IML's top 5 picks from the ASX 100 most consistent dividends payers

Earlier in the Income Series, my colleague Carl Capolingua conducted a deep dive analysis of the ASX's top 100 stocks, aiming to identify the most consistent dividend payers.

In case you missed it, the link to the analysis is below:

.png)

It's one thing to look at the data, but we also wanted to hear from a seasoned income investor about which stocks from the list are making it into portfolios right now.

In that vein, we reached out to IML's Michael O'Neill, who makes it his business to know high-quality income stocks, co-managing the Investors Mutual All Industrials Share Fund and Investors Mutual Equity Income Fund.

The stocks and commentary below are from IML's Michael O'Neill. They should not be considered recommendations. Always do your own research before investing and remember, past performance is not a reliable indicator of future return.

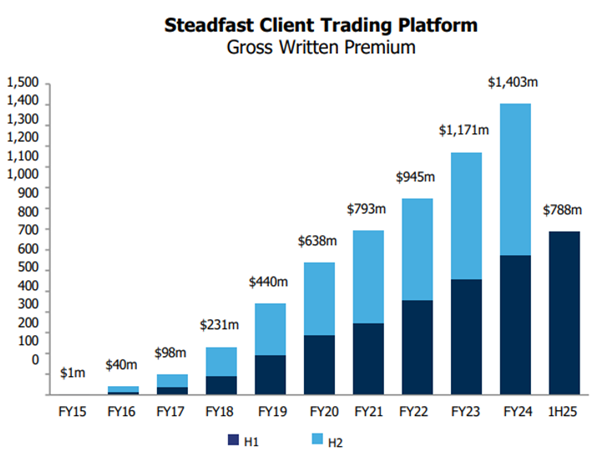

# 1 - Steadfast (ASX: SDF)

SDF ranked #12 on Carl's most consistent dividend payers, low-yield cohort list.

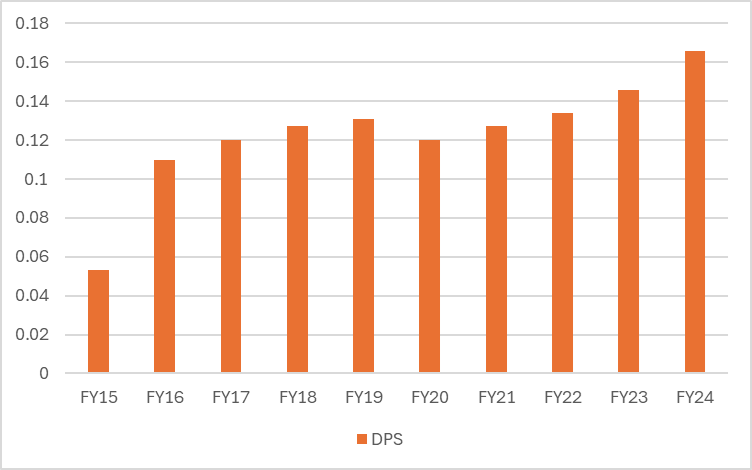

Steadfast is Australasia’s largest insurance broker and underwriting agency to SMEs, providing trusted advice on essential (non-discretionary) cover with 95% client retention. The company has consistently grown earnings and dividends 13.5% per annum since listing in 2013.

SME insurance premium growth tends to be steadier and reliable around mid-single-digit levels when compared to the peaks and troughs in larger commercial insurance lines like property.

SDF maintains technology leadership over peers through its client trading platform (SCTP), which gives brokers direct access to insurers for efficient quoting/binding. 23 insurers and underwriting agencies sit on this platform, placing >$1.5bn premium per annum.

Ongoing earnings growth should be driven by market share gains in the network, acquisitions of network brokers, growth in SDF’s specialised underwriting agencies which act under delegated authority from insurers (but don’t take on insurance risk), improving bargaining power with insurers, and scale efficiencies in SDF owned brokers.

Source: IML

#2 -Amcor (ASX: AMC)

AMC ranked #12 on Carl's most consistent dividend payers, high-yield cohort list.

Amcor is a leading global packaging company with ~95% of sales to defensive end markets, namely food, beverage and healthcare. Underlying volume growth has been relatively slow and steady over time ~1% per annum.

AMC has rapid pass-through of raw material costs to customers, ensuring margin stability over time. AMC has benefitted from acquisitions over time, which has meant greater buying power and cost efficiencies – underpinning consistent earnings and dividend growth of over 5% CAGR over the past 10 years.

AMC’s all-scrip merger with Berry Global, completed in April 2025, should be transformative like previous acquisitions of Alcan and Bemis, where realised synergies exceeded targets, and will enhance scale in North America, particularly in higher-growth segments (medical devices, pharmaceuticals and health & beauty).

With $590m cost and financial synergies and $60m revenue synergies targeted, AMC’s earnings could be 35% higher in FY29.

#3 - Medibank Private (ASX: MPL)

MPL ranked #26 on Carl's most consistent dividend payers, low-yield cohort list.

Medibank is one of Australia’s largest private health insurers. It made the cut last year and stands out once again as one of the most consistent dividend payers, due not only to the quality of the business but the capability of management and their strategies for reinvesting in the franchise.

Australia’s growing and ageing population, tax bracket creep and longer public hospital wait times all mean we will inevitably rely more on private health insurance in the future. MPL’s leading market position, strong brands, strong buying power and high customer satisfaction support strong customer retention and growth in recurring earnings.

As the scale player it has a low management expense ratio, allowing investments in IT and health services that competitors can’t match. These initiatives boost retention, reduce claims costs and also provide new revenue opportunities through the health services division, e.g. rehabilitation in the home.

Cashflows are further supported by improved returns on investments and a net cash balance sheet, which helps to support consistently high dividends.

Source: company reports.

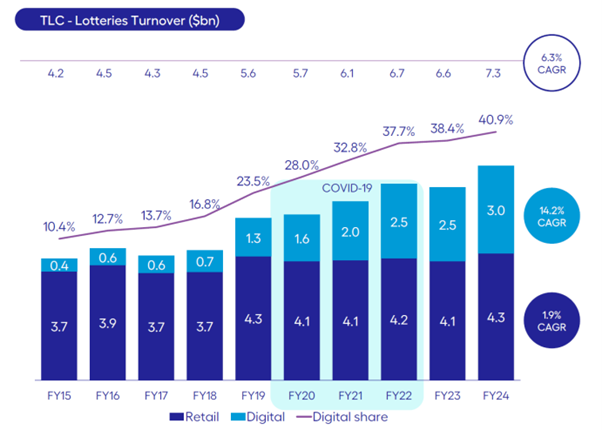

#4 - The Lottery Corporation (ASX: TLC)

TLC was rated #21 on Carl's most consistent dividend payers, high-yield cohort list.

TLC has made the cut for dividend consistency since its demerger from Tabcorp in May 2022. If you’re after consistent cash returns, don’t buy the lottery tickets, go to the source. TLC is Australia’s largest lottery operator, with operations in all states except Western Australia.

It holds long-term ~25 year monopoly licenses for Lotteries and Keno, has high customer loyalty, and delivers resilient, recurring revenues through the cycle. Growth is driven by population and price increases (Saturday Lotto in May 2025 with 10% price increase and larger prizes; Powerball in FY26).

Participation increases significantly when large jackpots occur with almost 1 in 2 adults entering the $200m Powerball. TLC is also migrating to digital channels, where it avoids retail commissions and can expand margins—digital penetration rose to 41% in FY24 (from ~15% a few years ago), with further increases expected over the next few years.

Renewal of the Victorian lotteries license could also be a catalyst for a share buyback.

#5 - Telstra (ASX: TLS)

TLS was rated #28 on Carl's most consistent dividend payers, high-yield cohort list.

Telstra maintains its market-leading position in Australian telecommunications, with superior brand, widest mobile coverage, and undervalued infrastructure assets within its InfraCo division.

In uncertain times, Telstra offers defensive income with revenue growth supported by population increases and rising data demand. Between 2016 and 2020, the industry went through a difficult period of intense mobile competition that led to a mutually damaging price war.

The industry has since stabilised with more rational competition. This has seen average revenue per user growth for post paid customers of over 3% for the past 3 years.

Management is now targeting mid-single digit cash earnings through revenue growth and cost efficiencies (assisted by AI adoption), which should support consistent and growing dividends.

5 topics

5 stocks mentioned

2 funds mentioned

2 contributors mentioned