How to position for a choppy 2022

After a strong 2021 markets have been hit by a significant bout of risk aversion in January. Concern around the path of global inflation and interest rates has been the primary driver of the sell-off in both bonds and equities in January.

The twisting and drawn-out nature of the global pandemic alongside Russia-Ukraine tensions are also likely worrying investors, though US inflation and the US Fed’s reaction function seem to be the primary source of market angst.

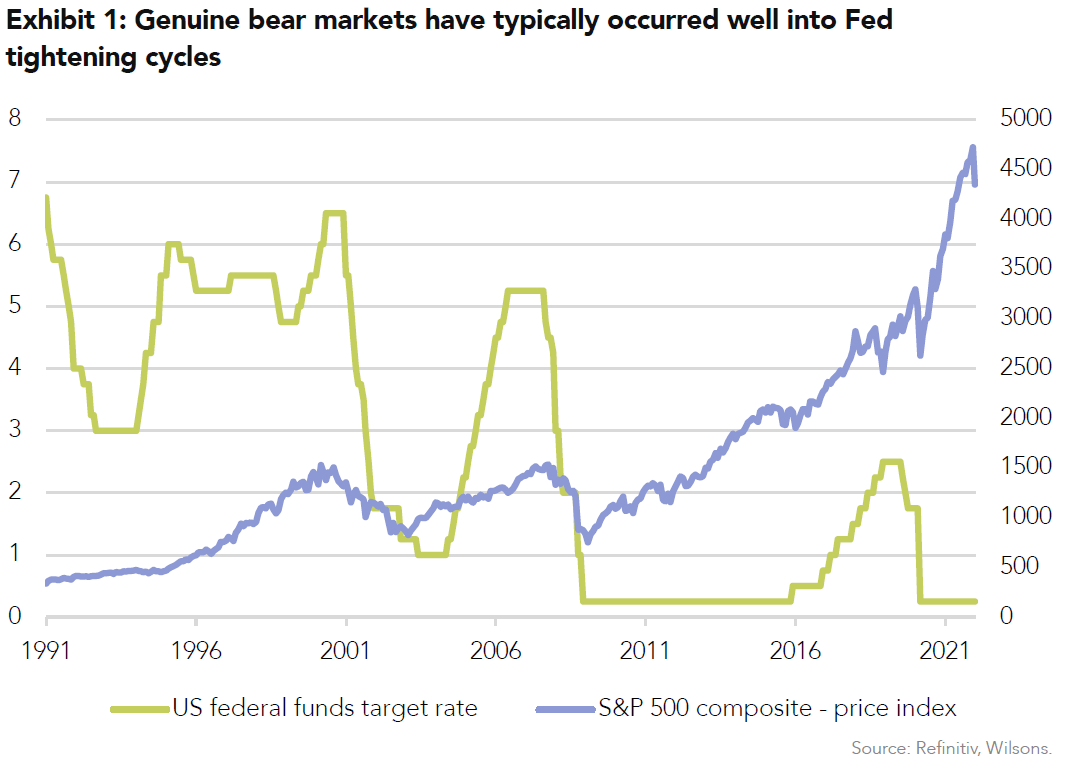

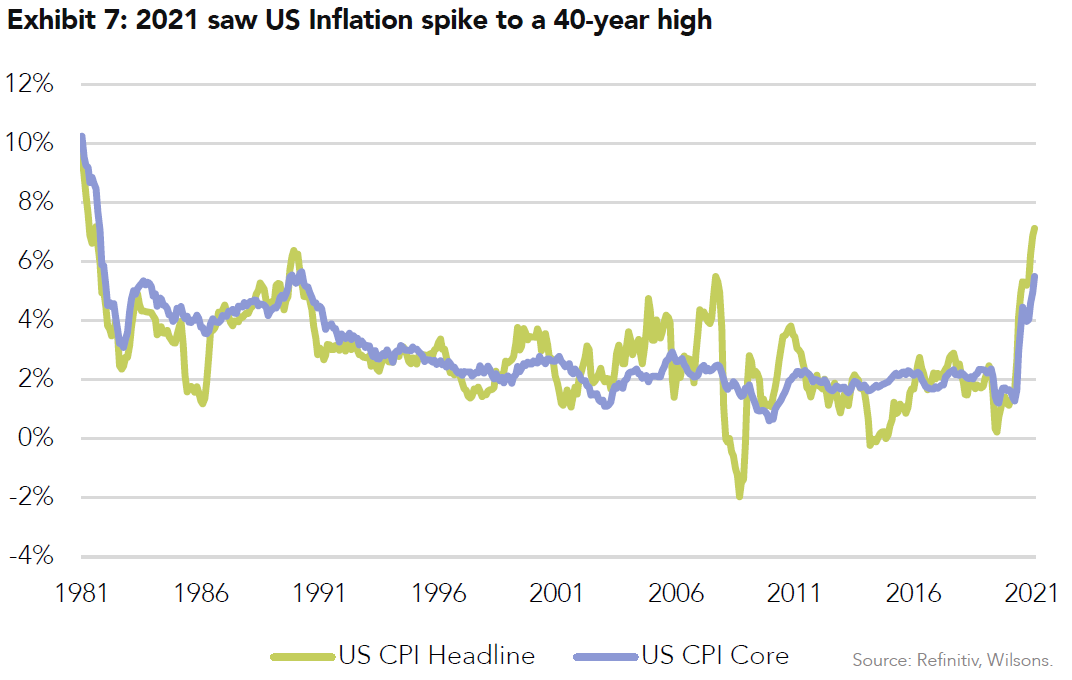

2021 witnessed a significant spike in global inflation with US headline CPI hitting 7% year-on-year (YoY) for the month of December (a 40-year high). After originally dismissing the inflation spike as “transitory” the US Federal Reserve shifted its rhetoric in December to move to a more hawkish stance. The Fed has flagged an accelerated pace of QE withdrawal and has flagged a faster pace of rate hikes with three planned for 2022 (the market has priced in four as at January 27th). This expected policy tightening, as well as the risk of a “policy error”, has weighed heavily on markets recently.

The Fed’s guidance, nor the market's pricing for rate hikes over 2022 and 2023, is not by any means a shift to a tight policy setting, but expectations are shifting and this is generating risk aversion. The market’s concern is that stubborn inflation may force the Fed to do more than it is indicating and indeed more than is currently priced by the interest rate markets. This concern has seen equities progressively drag lower in January.

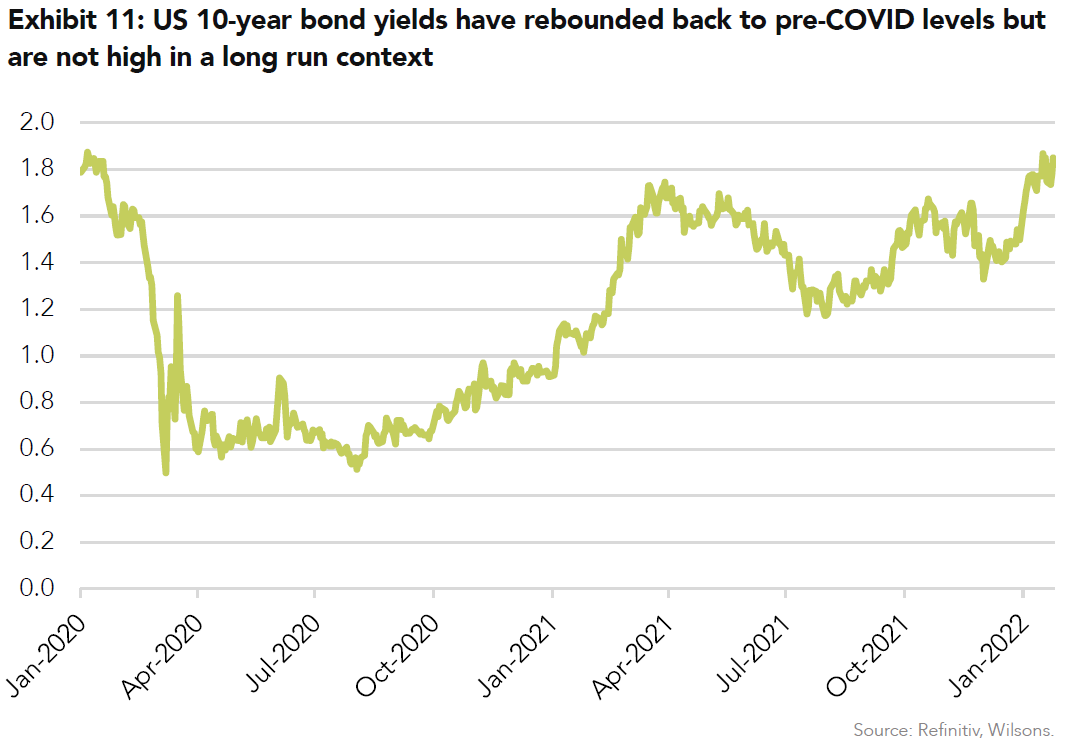

After being initially remarkably resilient to the step-up in inflation in 2021 the US 10-year bond yield has also begun to react to the inflation backdrop and the Fed’s recent policy pivot. 10-year yields have climbed from 1.4% to 1.85% over the space of the past month. Once again this in itself is not a restrictive rate for the real economy or an overly challenging relative valuation hurdle for stocks, but the recent pace of the move has unnerved markets somewhat.

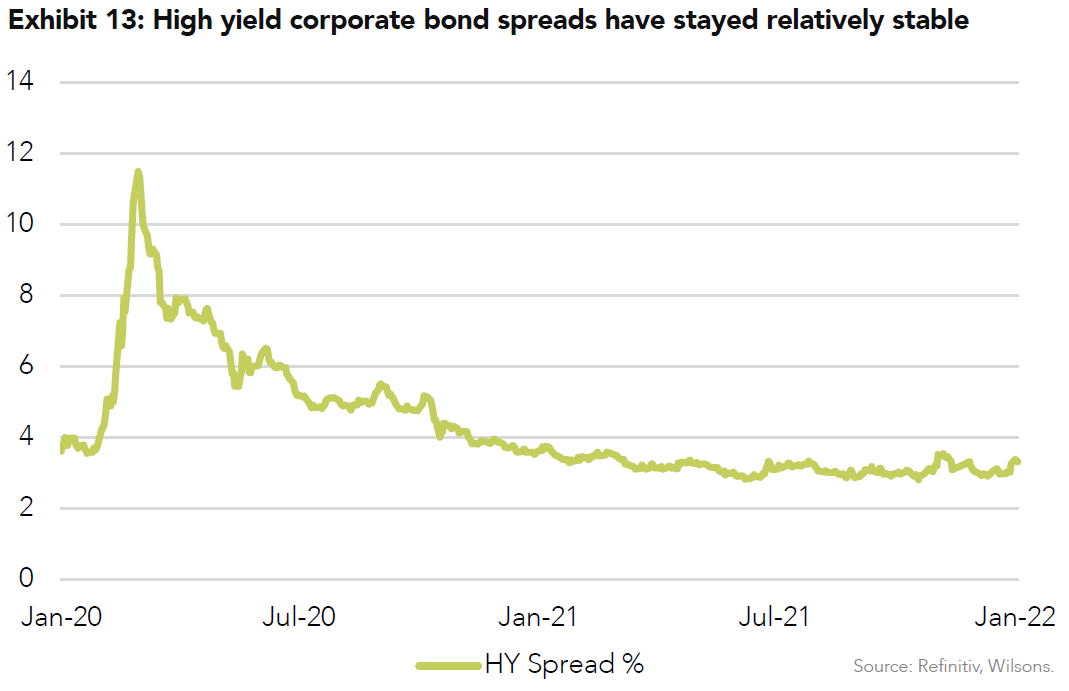

Yields have shown some tentative signs of stabilisation in recent sessions as risk-off sentiment in equities has encouraged some safe haven demand. Importantly, credit markets remain relatively calm.

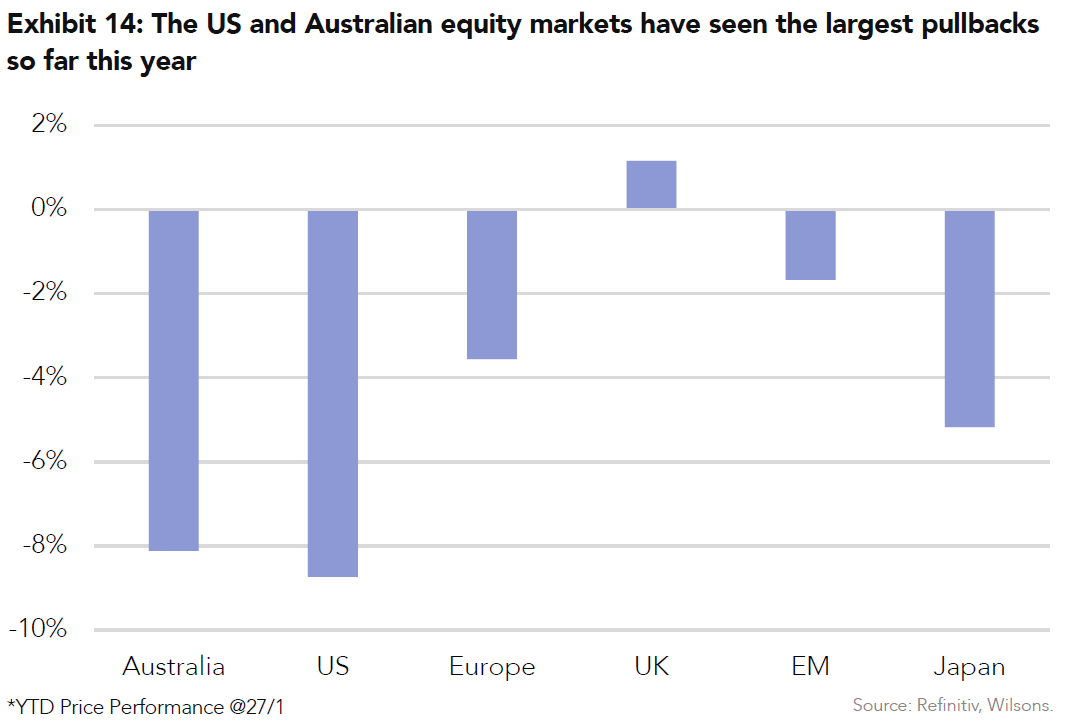

Equities market weakness has been particularly acute in high multiple (mostly tech) names. The US high multiple tech sell-off actually began in mid-November, around the time that QE tapering commenced. In contrast, broader indices such as S&P500 and the ASX200 actually hit new highs in early 2022, only to succumb to building risk aversion as January progressed. At the time of writing the US and Australian equity markets are both down around 9% from their early January peaks.

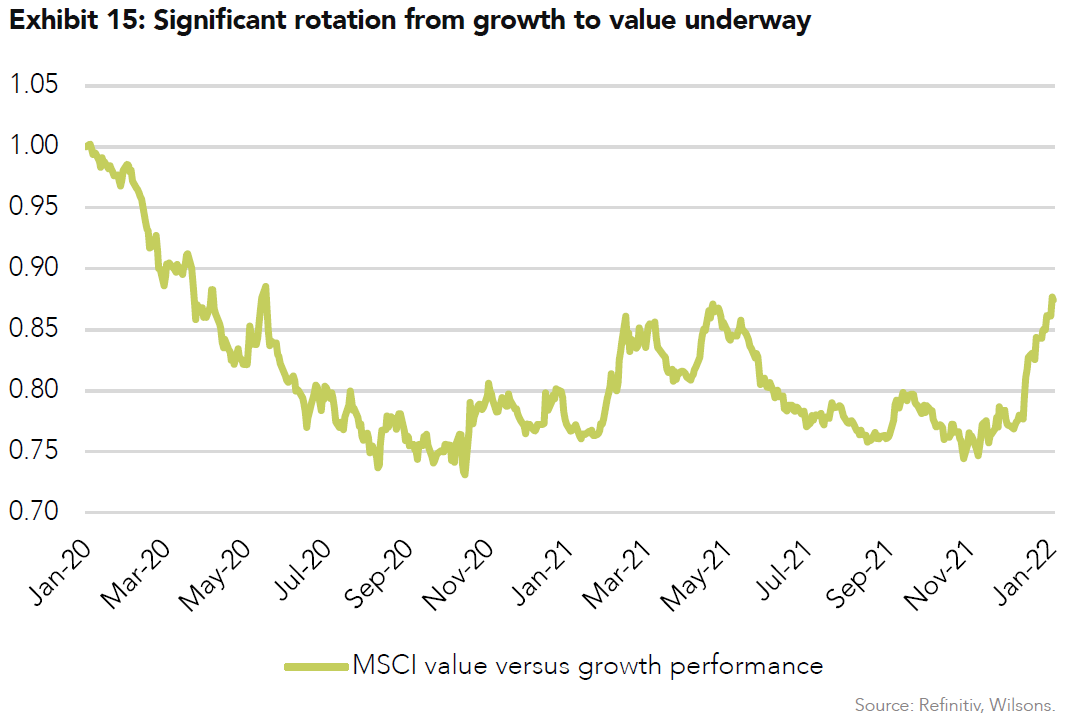

While weakness has become quite broad-based, the significant rotation has been evident so far this year with “value” sectors (e.g. energy, materials and financials) and “value” markets performing significantly better (the UK market is up year-to-date) than growth stocks and the growth stock heavy US market.

However, the value rotation has become somewhat overshadowed by a broad-based risk-off selldown in the latter stages of January.

We expect volatility could linger in coming weeks and indeed months as the global inflationary pulse will not dissipate quickly, though we believe we will start to see some ebbing of inflation pressures in the second quarter. This fade in inflation should extend through the second half of the year.

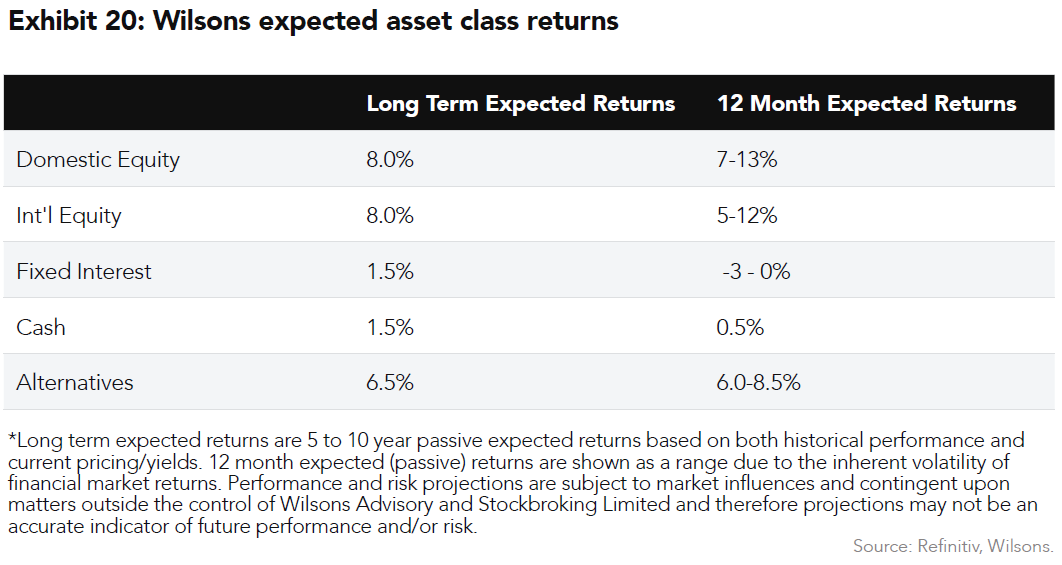

This should allow the Fed to keep to a measured pace of tightening which should ultimately provide support to stocks as we move through the year. This keeps us positive on equities on a 6-12 month horizon, albeit tactically cautious on a 3-4 month view. While corrections in the lead-in to Fed tightening cycles are fairly common, equity bull markets have not typically ended until policy becomes overtly tight.

Importantly, we continue to see the likelihood of above-average economic growth and earnings growth in 2022. Earnings estimates are in the mid to high single-digits and appear to be too low in our view. The potential for earnings upgrades is supportive for equities on a 6-12 month view, alongside the expected ebbing in the global inflation pulse.

We still think US 10-year bond yield will edge higher this year despite an eventual decline in inflation as resilient growth puts upward pressure on real rates.

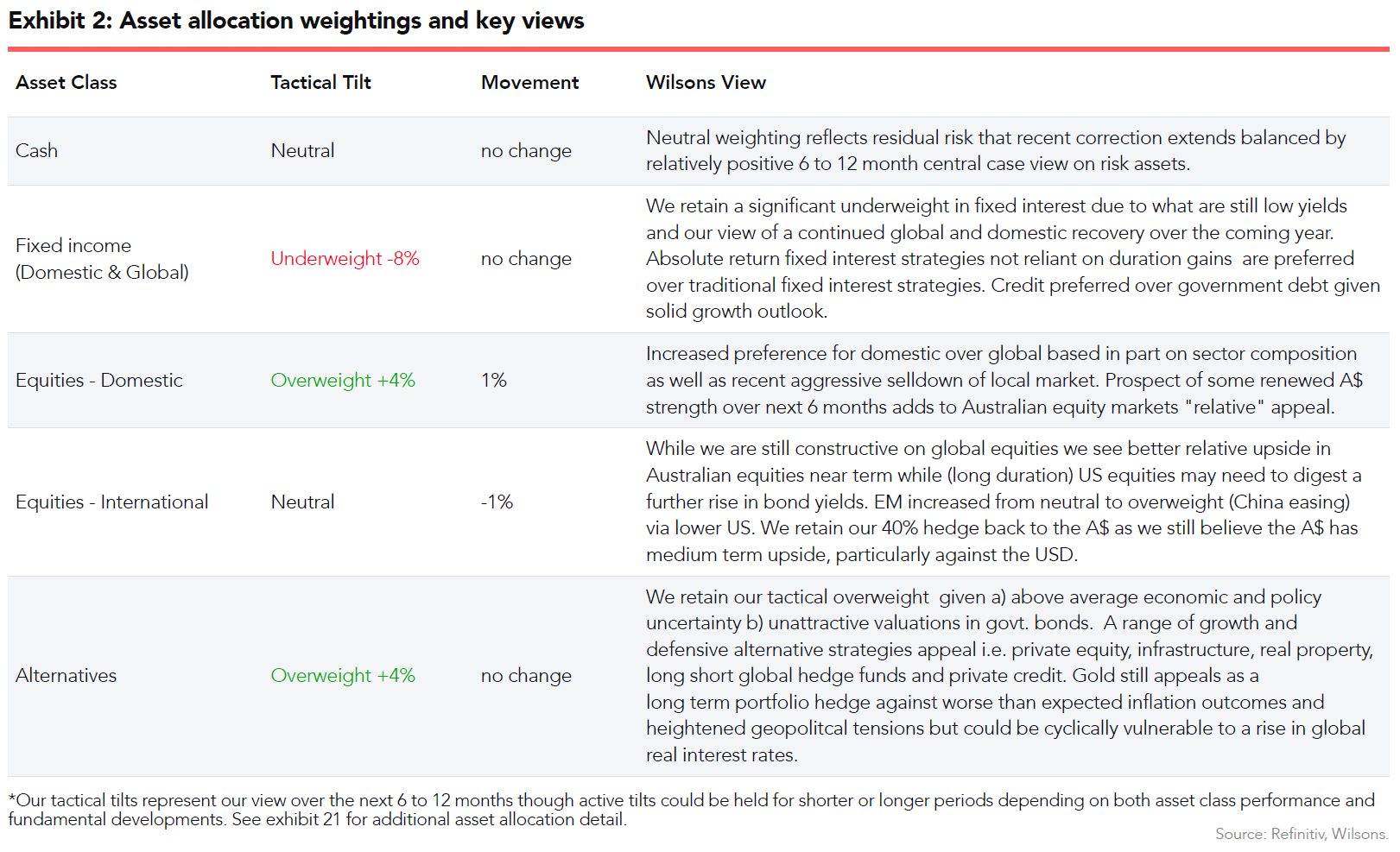

In summary, we continue with a moderate overweight to equities, an underweight allocation to fixed interest, and an over-weight to alternatives. We have increased our weighting in emerging markets (from neutral) by marginally increasing our US equity underweight. We have also edged up our Australian equity overweight given the size of the local pull-back in January.

Macro Backdrop

Above trend growth in 2022 but sticky near-term inflation

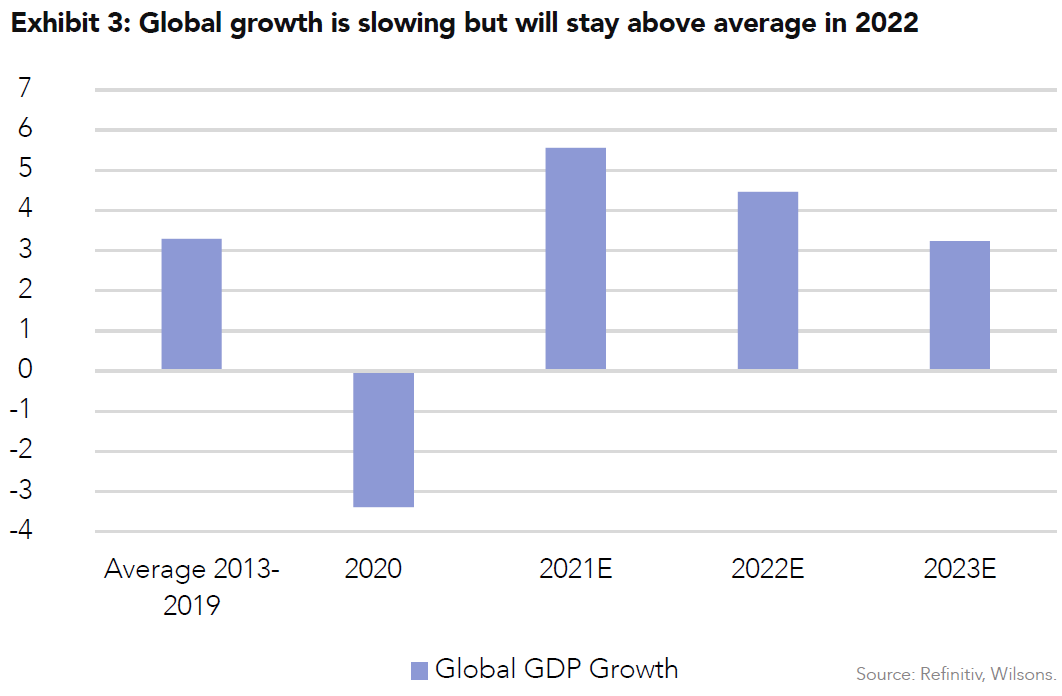

We expect the global growth recovery that began in mid-2020 to continue in 2022. While we have passed the fastest point of the growth cycle we expect 2022 will be another above-average year for global economic growth as the stop start process of economic normalisation continues and the huge stock of government stimulus continues to find its way into the global economy.

A moderate tightening of monetary policy in 2022 should have only minimal impact on the global growth cycle.

The release of pent up consumer demand as excess savings are spent is a key driver of our expectation of above-trend economic growth in 2022. US households have more than US$2 trillion in “excess” savings currently. Only a small portion of this needs to be spent in 2022 to drive a strong year of consumption. However, we will likely see a shift from goods spending to services which should also help ease inflationary pressures over the coming year.

We see the US economy posting another above-trend year of growth in the order of 4% real GDP. Our base case sees economic growth of a similar magnitude in Europe, which is way in excess of the long-term average growth rate, although the Russia Ukraine situation bears watching given Europe’s heavy reliance on Russian oil and gas.

China should do better in 2022 as policy is eased

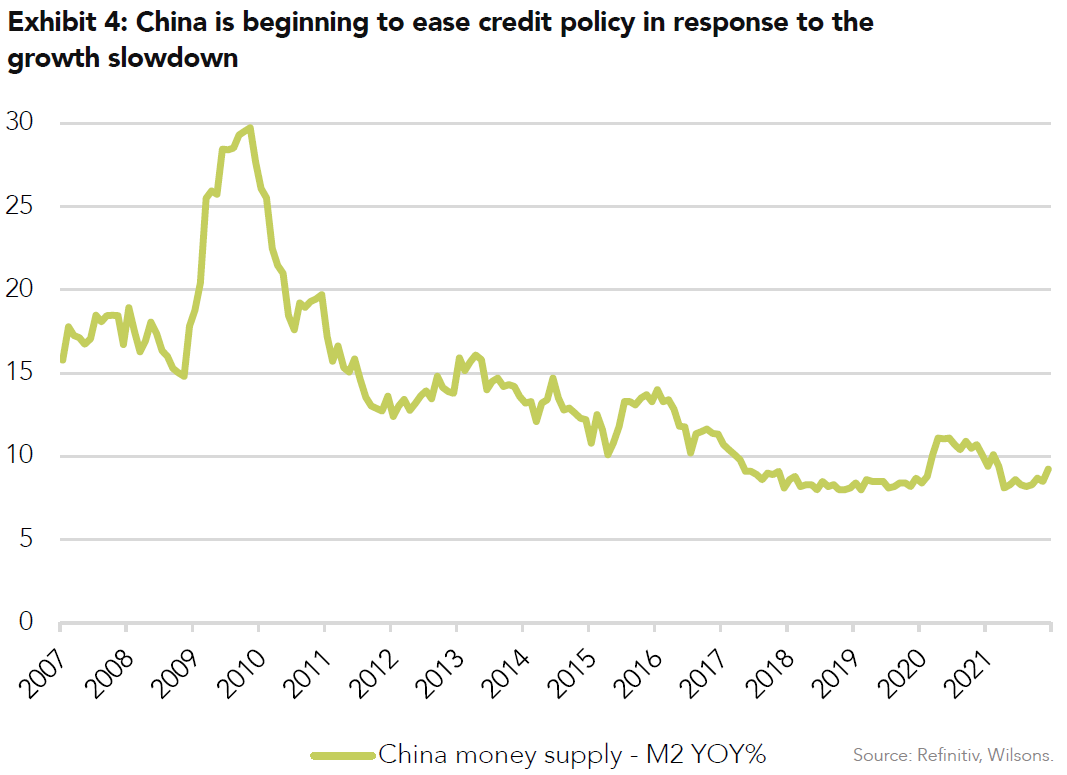

China’s credit policy is now clearly in easing mode, and we expect Chinese growth will re-accelerate on a quarterly sequential basis through 2022 (particularly post-winter Olympics).

The authorities are attempting to strike a balance between short-term growth targets and structural reform targets, but with the sharp slowdown in Chinese growth in the second half of 2021 short-term growth imperatives appear to be gaining the upper hand. The Chinese authorities are likely to still attempt to maintain a measured approach to stimulating the economy. As a result, any improvement in growth momentum is unlikely to be dramatic. However, the fact that the Chinese central bank is now in easing mode while the Fed is tightening should all things equal encourage support for Chinese equities, the broader EM universe and also commodities, particularly when risk aversion settles. We have begun to see evidence of this dynamic in January, with EM equities outperforming year-to-date.

The pandemic continues to throw up new twists with the Delta and Omicron waves presenting successive challenges to both the global health system and the global economy. While the twisting and drawdown nature of the pandemic has taken the edge off the global recovery, the recovery has none the less proceeded at a decent clip and we see above average growth in store for 2022 at least.

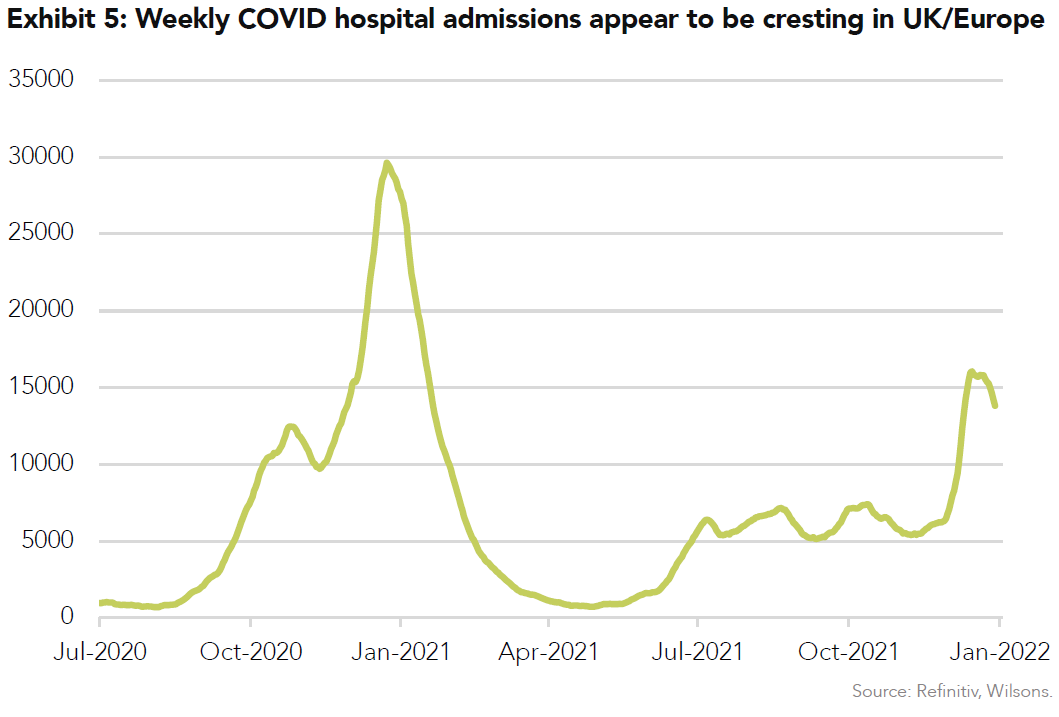

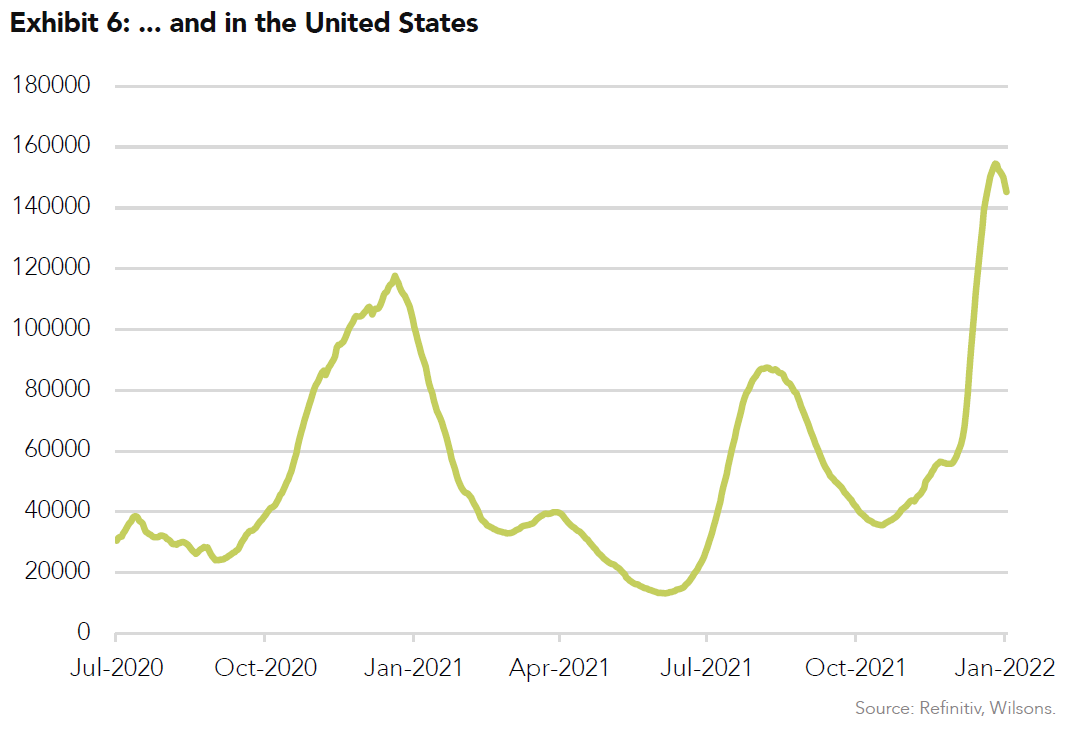

The Omicron wave now appears to be cresting in UK/Europe and the US. Whether this will finally give way to a more benign phase is impossible to say, but the ability of COVID to significantly disrupt the global growth cycle does appear to be gradually diminishing. While economic recovery is proceeding the pandemic is still disrupting the global supply chain with implications for the stickiness of the current global inflation pulse. While the growth backdrop remains supportive for equities, inflation is the focus (and key risk factor) for markets right now.

Inflation - Sticky but not a regime shift to high inflation

Inflation was undoubtedly the big macro surprise of 2021 and continues to be the key macro risk factor for 2022.

As is typical the US macro and policy situation continues to be the key focal point for markets. We think US inflation will ultimately come down significantly this year, though it will likely remain stubbornly high in the first quarter. US inflation should ease as we move through 2022 due to a combination of factors:

- A much higher inflation base in year-on-year terms (from Q2)

- A progressive easing in supply chain pressures as we move through 2022

- A likely deceleration in YoY oil price gains

- A rebalancing from overheated goods spending toward still depressed services spending

This easing in inflation pressure alongside decent economic growth is ultimately likely to provide a supportive backdrop for stocks on a 6-12 month view, but equities are currently having to digest an uncomfortable phase of stubbornly high inflation and uncertainty around the Fed’s policy response. This suggests some ongoing tactical caution over the next few months.

Domestic growth to rebound after yet another COVID speed hump

Australia’s economic growth path has been decidedly stop-start over the past year with strong growth momentum mid last year being disrupted by the Delta outbreak and associated lockdowns. More recently the December/January Omicron wave has had an impact on consumer behaviour and caused further disruption to the local supply chain. The growth impact of Omicron is likely to be visible but less significant than last year’s Delta impact. Our base case is that growth should rebound solidly over the balance of 2022 with 4-5% real GDP growth expected.

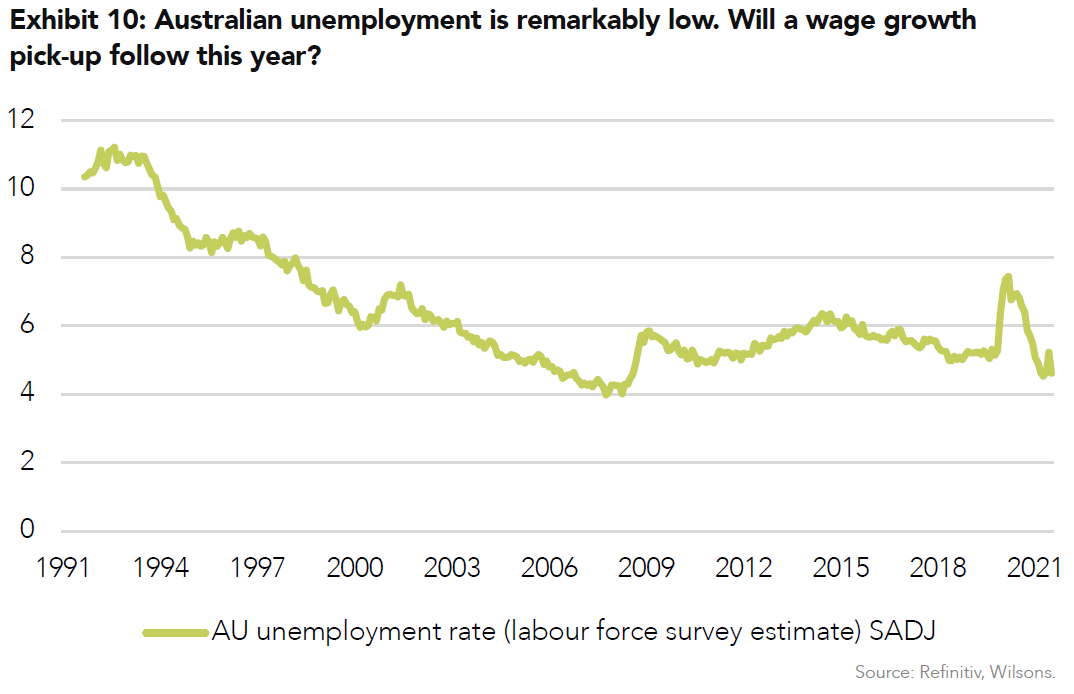

December employment data highlights the economy quickly rebuilt momentum post the Delta wave and we expect a similar pattern this year. There are tentative signs that Australia’s Omicron wave is also cresting although the return to school poses some risks.

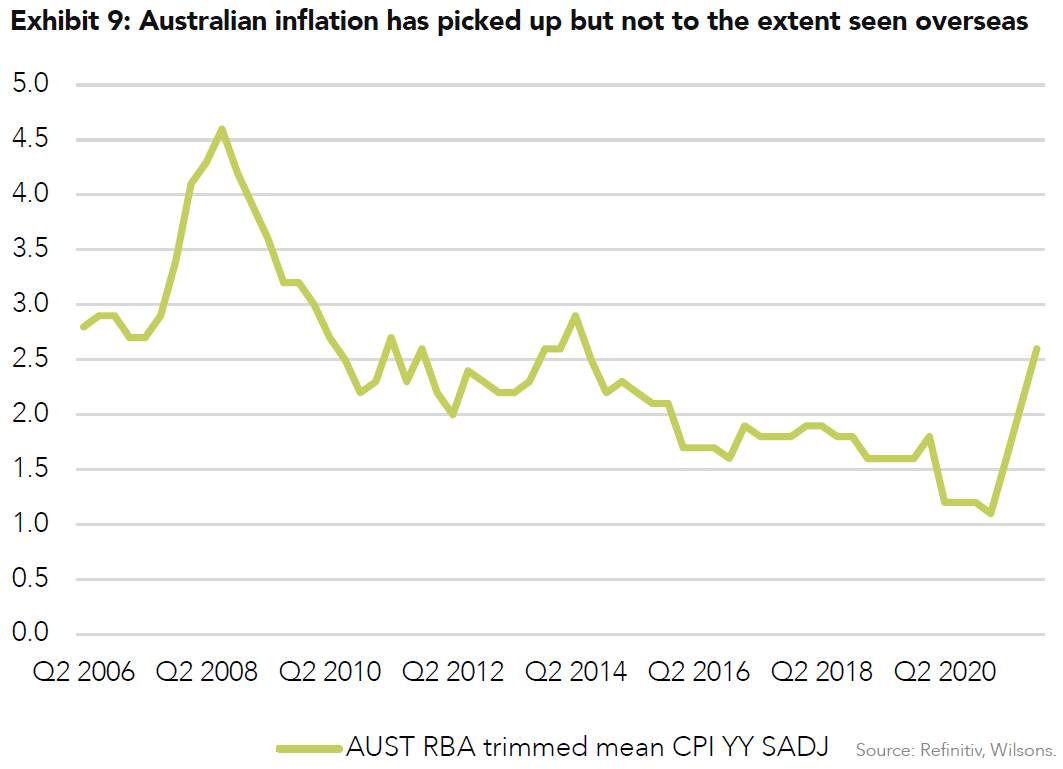

The recently released fourth-quarter 2021 inflation reading was higher than expectations but is still comparatively low in a global context. Q4 headline CPI accelerated to a higher than expected 1.3% QoQ & 3.5% YoY. Strong demand saw a much larger increase in goods prices (1.6%Q, 4.3% YoY) than services (0.7%Q, 2.3% YoY). The largest quarterly gains were seen in transport (2.8%, mainly fuel), clothing and footwear (2.6%), housing (1.8% mostly home building costs), and recreation (1.5%); while health fell (-0.3%).

The headline CPI at 3.5% is well above the RBA's forecast of 3.25% (consensus: 3.2%) and up from 3.0% in Q3. This marks three quarters at or above the RBA's 2- 3% target band, but follows ~7 years below the mid-point (averaging only 1½%). Indeed, Australian inflation is still far below the current experience in most major economies with inflation running at multi-decade highs of 5-7% YoY.

The RBA's preferred 'underlying' Trimmed Mean jumped to 1.0% QoQ (mkt: 0.7%).

The YoY lifted sharply to 2.6% (consensus: 2.3%) and well above the RBA’s forecast of ~2%. Omicron is disrupting labour and supply chains, adding to inflation pressure in the near term, though pressures should ease as we move into the second half of 2022.

The RBA's early February meeting will see raised inflation forecasts amid more hawkish global central banks and market pricing and reinforces the prospect of a likely hard-stop of local QE.

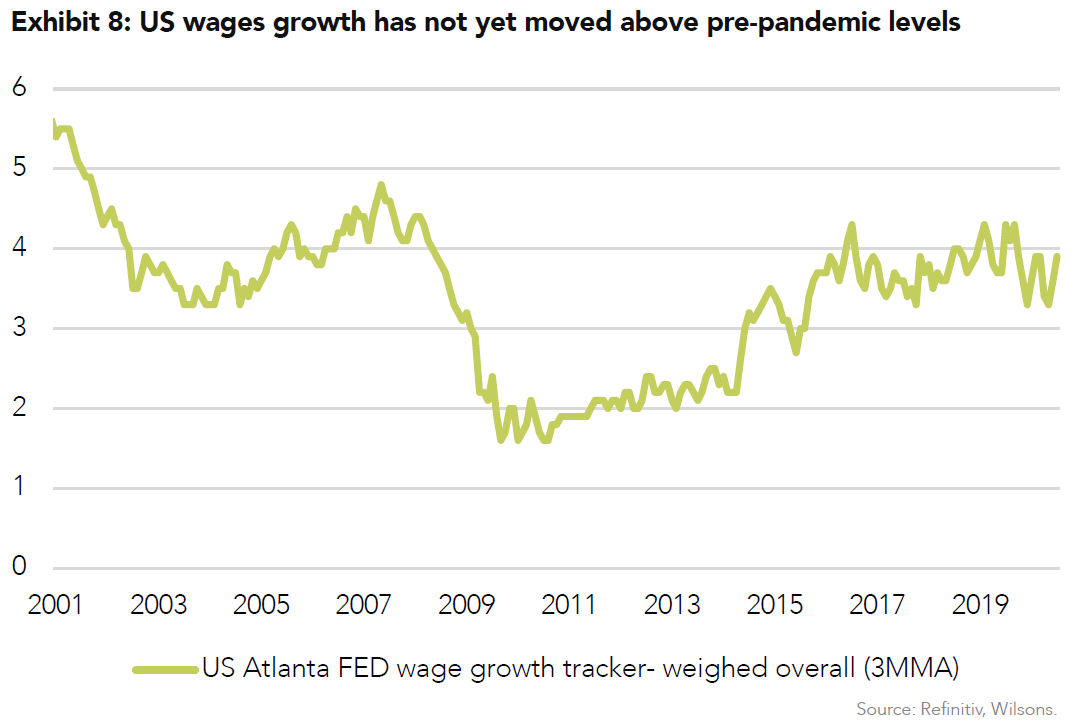

The recent drop in unemployment alongside the lift in CPI arguably already makes a case for the RBA to significantly adjust forward guidance, and signal a much earlier rate hike. However, Governor Lowe's dovish view is also prefaced on the need to see a material rise in wages (to around 3% versus the current 2.4%) for inflation to be deemed “sustainable”. The four rate hikes priced by the market for 2022 still looks too aggressive but the RBA, with its current guidance toward no hike until late 2023 or 2024, looks even further wide of the mark. We would expect there is enough of an inflation pulse this year to ultimately see a couple of RBA hikes in the second half of the year. This would still leave the cash rate at a very low 50-60bp by year-end, which is unlikely to have a significant impact on the growth outlook.

Fixed interest - Sell-off may pause but stay underweight

While US and domestic bond yields pushed higher in 2021 the reaction was relatively subdued in the face of a 40 year high in US inflation.

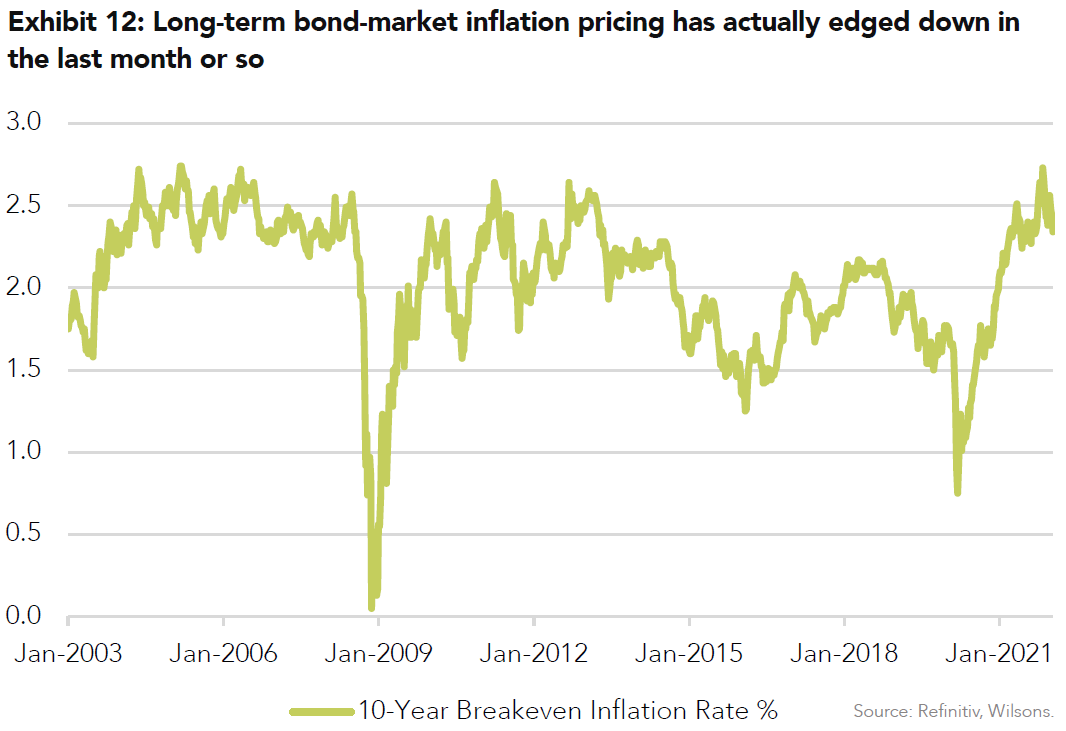

The bond market appears to have become a little more unnerved over the past month although closer inspection shows that the recent move has been driven by “real rates” rather than rising long term inflation expectations. The bond market still seems to believe that inflation is mostly temporary as evidenced by market measures of long-term inflation which have ebbed a little recently.

While this is the central case, the Feds pivot to a more hawkish stance in December alongside the imminent end to QE has ushered in significant selling pressure in fixed markets over the past month. There is a risk that the bond market sell-off becomes disorderly though this is not our core view. Bond yields are still low in the grand scheme of things and the sell-off is showing some signs of stabilising, at least in the short term. As we saw last year the rise in long term interest rates is likely to be a stop-start process.

While we see a significant drop in inflation over the course of this year as likely, we expect US yields to finish the year higher (in the 2.0% to 2.5% area) as resilient economic growth and an absence of Fed buying support (as QE ends) pushes up real rates.

Ultimately, we see current market pricing of a 1.75% terminal Fed Fund rate as too low. We think the Fed's 2.5% estimate is likely to be closer to the mark. We expect the markets estimate to rise over the medium-term and the ten-year bond yield to move up in line (perhaps with some additional modest term premium). Credit markets have remained fairly calm during the move up in government bond yields and the prospect of robust economic growth continues to suggest a preference for credit-based funds over government bonds.

Global Equities - Growth tailwinds vs interest rate headwinds

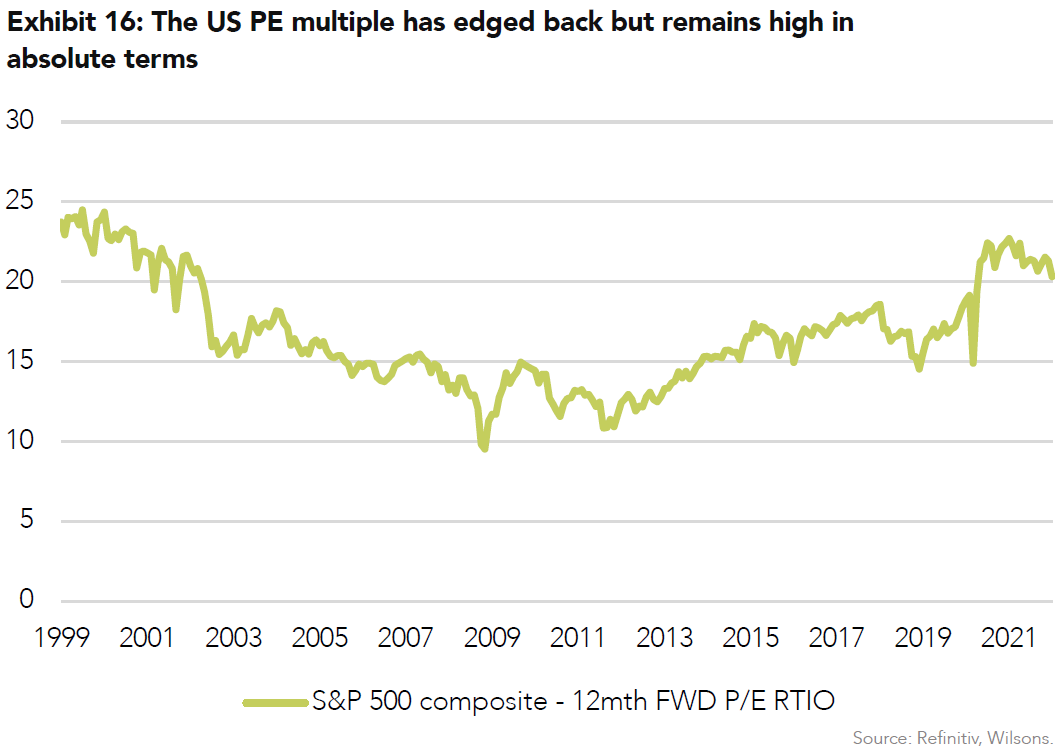

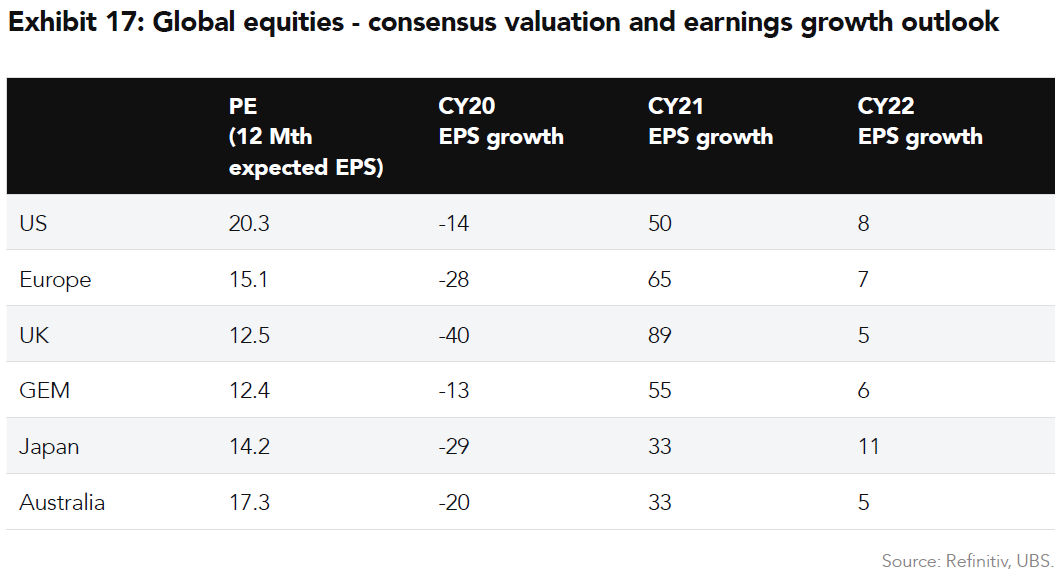

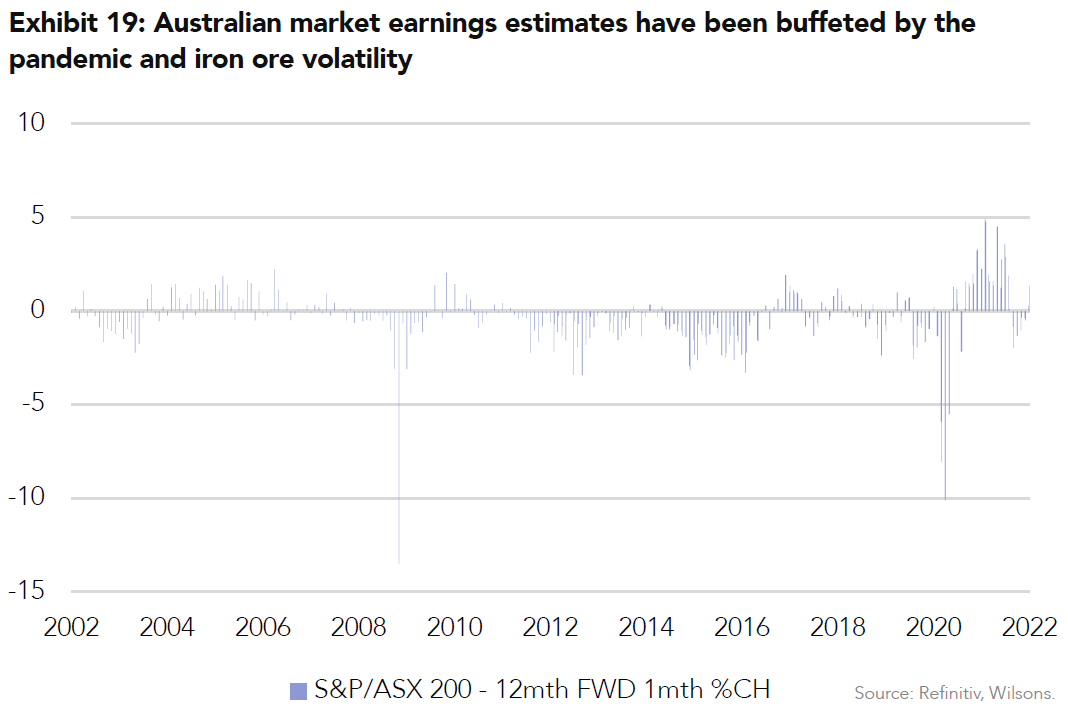

Inflation and a less friendly interest rate backdrop is the key risk for equities but above-trend economic growth should lay the foundations for an extension of the supportive earnings growth backdrop. While there has been much talk about excess liquidity and inflated valuations, the global earnings recovery has been impressive. Earnings growth will slow this year but we still see the potential for at least some moderate earnings upgrades in 2022.

Broadly we expect the global PE multiple to edge lower in 2022 as rates rise, but the prospect of high single-digit earnings growth (at least) should allow, at a minimum, average returns in 2022. We see some short-term risk that equities become oversold against the backdrop of macro uncertainty around the path of inflation and Fed policy. However, we expect this would be a decent buying opportunity if it was to transpire.

The growth stock skewed US market has outperformed the value skewed “rest of world” for some time now. Over the past month or two, as long-term interest rates rise there are signs that value is beginning to regain the ascendancy. We retain our call for the “rest of the world” to outperform the US in 2022, though the rapid selloff in “US high growth” may provide a tactical entry point in coming months we think investors will need to be more selective going forward.

Increasing EM based on valuation appeal and China easing

Emerging market equities (EM) struggled for much of 2021 being weighed down by deteriorating sentiment around the Chinese equity market. Non-Chinese equities performed considerably better, highlighting the advantage of an active approach to EM equities. EM equities should benefit from the nascent China policy easing cycle that is now underway. EM shares continue to look good value to us relative to their medium-term growth prospects. We edge back to overweight from neutral.

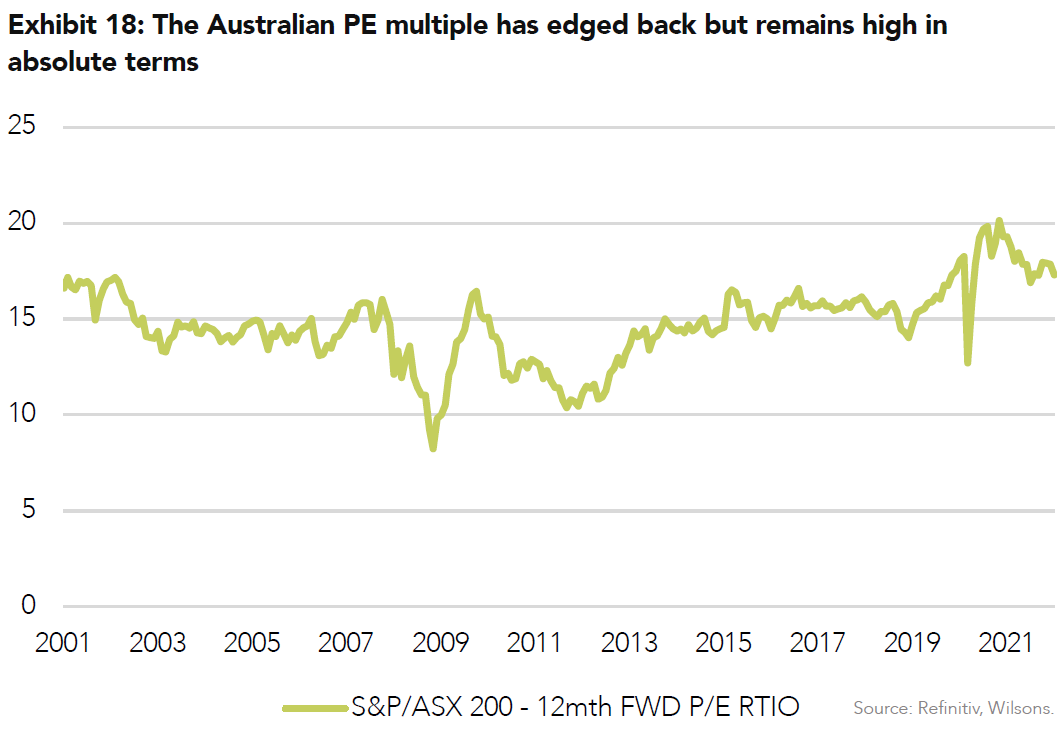

Australian Equities

We retain a preference for Australian over global equities on a 6-12 month view. We have edged our overweight up marginally as Australia’s recent sell-off is looking overdone in a relativity sense. Australia has a lower tech exposure and should offer more “valuation” protection from rising rates via its large financials and resources exposure.

A rebound in the Australian economy after the recent Omicron December slowdown should help the earnings cycle, though the upcoming February reporting season is likely to be a messy affair with the market struggling to disentangle short-term Omicron impacts versus underlying medium-term growth prospects.

The A$ has drifted lower in recent weeks as global risk aversion has lifted. We see some modest upside likely into the mid 70s on a 6-12 month view as global risk version falls, global growth and commodity price prove resilient, and the domestic economy rebounds. This also suggests retaining a modest preference for Australian over global shares in 2022.

Alternatives as a Diversifier – Retaining our overweight

Against a backdrop of higher-than-average macro-economic risk and an unattractive base case return expectation for fixed interest we maintain a solid overweight in alternatives (and a healthy strategic allocation). Our alternative allocations compromise four major subcategories:

- Private equity

- Private debt

- Real assets (infrastructure, real estate and commodities/agriculture)

- Hedge funds

It has been encouraging to see our alternatives portion of the portfolio hold up relatively well in recent market volatility. We still see good risk-adjusted return opportunities in growth alternatives such as private equity and inflation hedging “real assets” such as infrastructure and (active) property strategies. We also like the opportunity to earn attractive income streams in the order of 5-6% in relatively defensive alternatives such as (floating rate) private credit.

We retain some modest exposure to gold as a tail risk hedge – namely a hedge against unexpectantly stubborn inflation, or a significant incremental spike in market risk aversion. Gold has been creeping higher recently against a backdrop of higher bond yields and inflation nervousness. Our central case 6-12-month macro view of higher real rates and renewed positive sentiment toward risk assets may well act as a headwind for gold over the coming year. However, a re-emergence of a weaker US$ could offset this to some extent. While the outlook for gold is buffeted by a number of cross-currents, the tail-risk of a genuine inflation regime shift, as well as the potential for a spike in US-Russia-China geopolitical tensions suggest retaining some exposure. We remain sceptical of crypto-currencies as either a store of value or an effective portfolio hedge in risk-off environments. January has shown Cryptos are more of a “risk-on” liquidity play than a genuine portfolio diversifier.

Realise your ambition

At Wilsons, we think differently and delve deeper to uncover a broad range of interesting investment opportunities for our clients. To find out more, visit our website.

2 topics