Imdex: What the market missed

Perennial Value Management

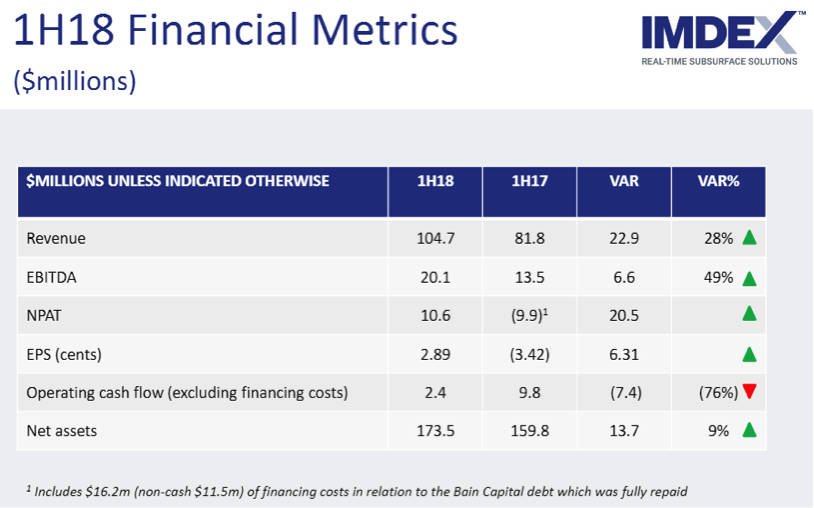

Starting with quality of the earnings, the data was encouraging. Revenue growth continues to be strong reflecting the recovery in the mining cycle. More encouraging was the expansion in EBITDA margins (from 16.5% to 19.2%) and this was despite the disclosure of an additional $5 million invested in technology development over FY18 which will be all expensed (about $1.75 million of which hit the 1H).

The resulting EBITDA growth of 49% (as seen below) was a few percent ahead of consensus expectations and clearly shows the operational leverage which Imdex can deliver.

Source: Imdex, 1H18 Results Presentation

Drilling into the results further (excuse the pun) the higher EBITDA margins were mainly driven by higher gross margins (from 64.8% in the pcp to 65.9% just reported).

In our view such high margins are testament to the technology leadership which Imdex continues to invest in. These higher gross margins have allowed the further investment in technology without damaging the margins at the EBITDA line.

The only weak part of the IMD result was the conversion of EBITDA to cash with gross cashflow of only $6.5m compared to EBITDA of $20.1m (or 32% conversion). $12m of the difference is easily explained and relates to working capital with higher inventories (+$6m) given contract wins as well as lower payables ($6m lower). Given the strong growth experienced by Imdex this working capital drag is less concerning however we will be expecting a better effort by management in the second half (they have averaged a much healthier cash conversion of 89% over the last three years).

We also believe it was the stronger outlook statements which the market has reacted positively to, and with good reason.

4 things the market is missing

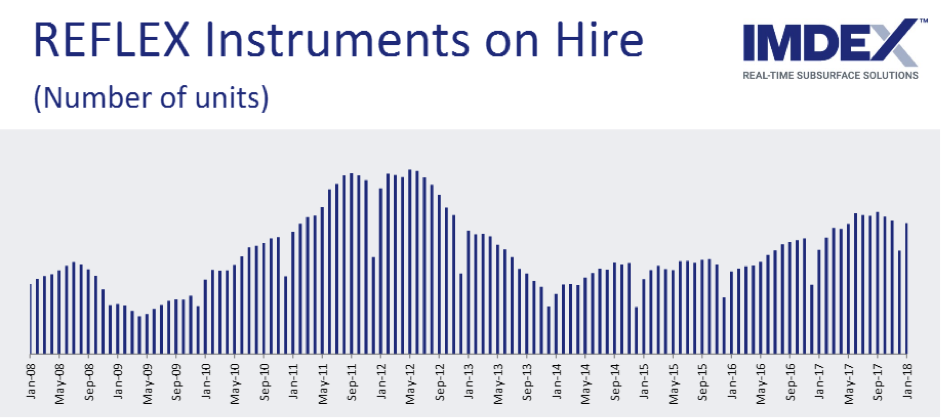

The chart below has always been a reliable forward indicator for Imdex, and in this vain 2018 is off to a good start with tools on hire up 25% in January - the positive implications for continued revenue growth in the 2H18 are obvious.

Source: Imdex, 1H18 Results Presentation

Commentary on the call also indicated that Dec 17 was the highest December on record for the company – in our view this indicates how desperate mining companies are to begin growing their reserves again, even in a tough Northern Hemisphere winter, after years of underinvestment in drilling.

Another encouraging aspect was the comments in the presentation that margins in the 2H18 are expected to grow again despite the larger impact from costs associated with the technology investment.

Finally Imdex also discussed in detail the rationale for the potential acquisition of CoreVIBE (TM) and MagHAMMER (TM). While this remains uncertain it is a good reminder to investors of the optionality to earnings of having a strong balance sheet.

Whether or not the acquisition proceeds post the current due-diligence period investors should take comfort from the disciplined and risk-averse nature with which it has been constructed – the lack of such discipline in past acquisitions has been a constant criticism of Imdex so it is pleasing to see progress in this area.

Disclaimer: Please note that these are the views of the writer and not necessarily the view of Perennial.

Read next

For more insights from our contributors on what the market missed in other company results including Telstra, CSL, Challenger and JB Hi-Fi, please click here: (VIEW LINK)

1 topic

1 stock mentioned

Andrew commenced with Perennial Value in July 2008. Prior to joining Perennial Value, Andrew was Head of Research at Linwar Securities, a boutique broker specialising in smaller company research. Andrew joined Linwar in 2003 and during this...

Expertise

Andrew commenced with Perennial Value in July 2008. Prior to joining Perennial Value, Andrew was Head of Research at Linwar Securities, a boutique broker specialising in smaller company research. Andrew joined Linwar in 2003 and during this...