Implications of a changing world

Key points:

- In the decade ahead, we think markets will be influenced by deteriorating geopolitics, increased protectionism, unsustainable fiscal deficits and poor demographics.

- On the encouraging side of the ledger, the outlook for artificial intelligence is bright and could lead to a positive productivity shock, perhaps of a similar magnitude to the personal computer revolution.

- As part of our annual Strategic Asset Allocation Review process, we incorporate these thematics into scenario-based capital market assumptions to build long term portfolios which are robust to a variety of future outcomes.

We are currently in the process of developing our 2024 Strategic Asset Allocation Review. In this month’s Market Insight, we review some of the major themes which help us frame scenarios for the decade ahead. The decade of low growth, low inflation and low interest rates following the Financial Crisis feels long behind us. The global economy is becoming more fragmented as divisions between strategic competitors grow and countries turn inward. The consensus in favour of market liberalisation has faded as Governments seek to prop up preferred industries. All of these factors will influence markets to some degree in the period ahead, generally for the worse in our estimation. However, there are some bright spots, particularly with respect to the potential for artificial intelligence to have a measurable positive impact on economic growth.

Geopolitics

From a tactical asset allocation perspective, the golden rule has been to buy market selloffs related to geopolitical crises. Almost always, geopolitical “events” have very limited implications for markets. Most of these events since World War Two have been limited in scope, limited in size or have generally involved countries who matter little for investment markets. Indeed, since the fall of the Soviet Union, geopolitical trends have been a positive driver of markets. The risk of widespread conflict was low and the tendency toward globalisation lifted trade, productivity and therefore overall economic growth. Capital markets have deepened, and investment opportunities have increased.

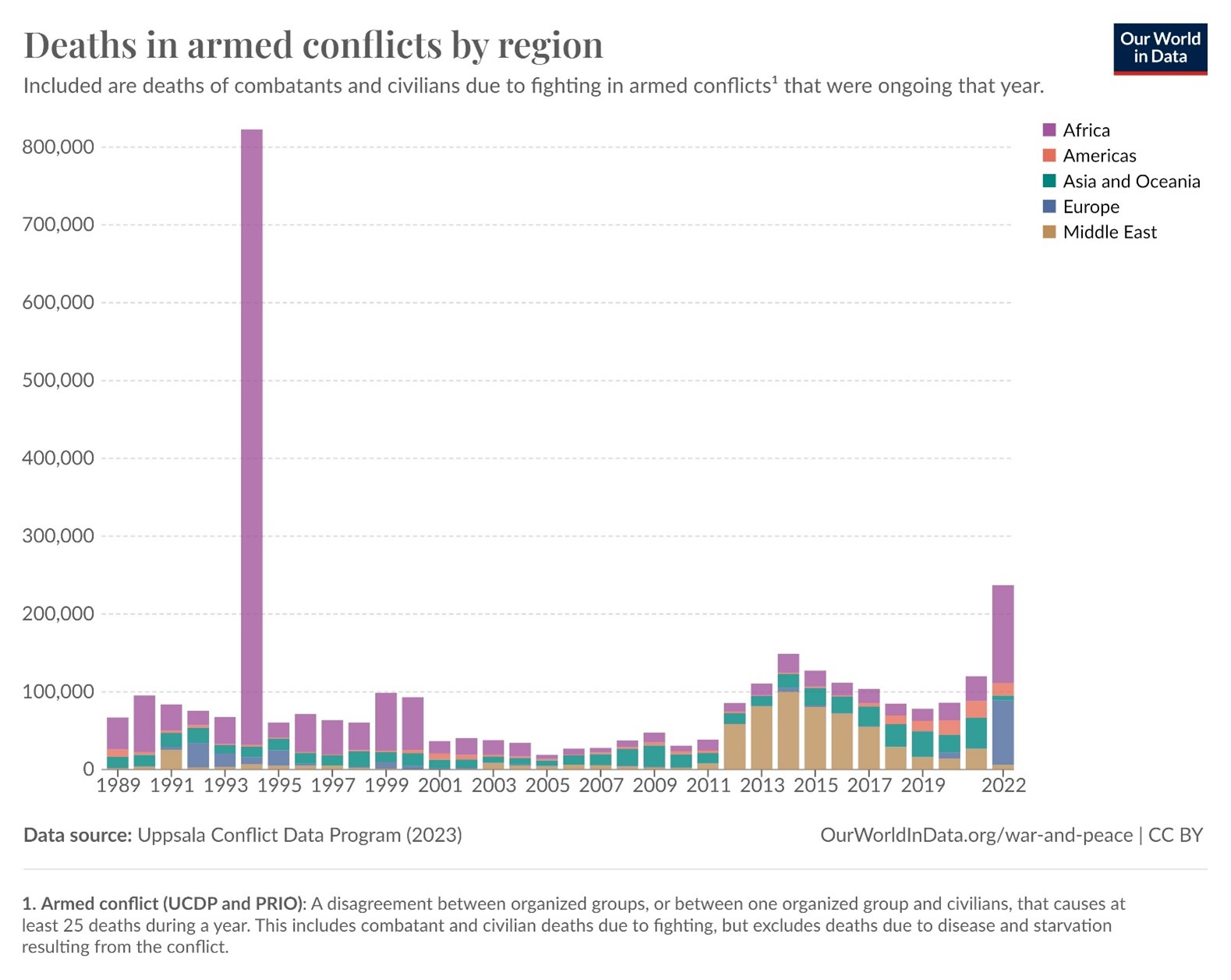

The key question is whether this trend is reversing. The rise of China as a strategic adversary of the United States in particular and liberal democracies in general increases the probability of a conflict which would matter for markets. We can’t dismiss the risk that China will invade Taiwan and the US will become directly involved. That would not be a dip to buy. Alongside the risk of a great power conflict, the World has become a more dangerous place. Instances of conflict have risen in the past decade. To the extent that these conflicts have occurred in commodity producing regions there have been second round impacts for markets, but we expect these to continue to be generally short lived and limited in scale.

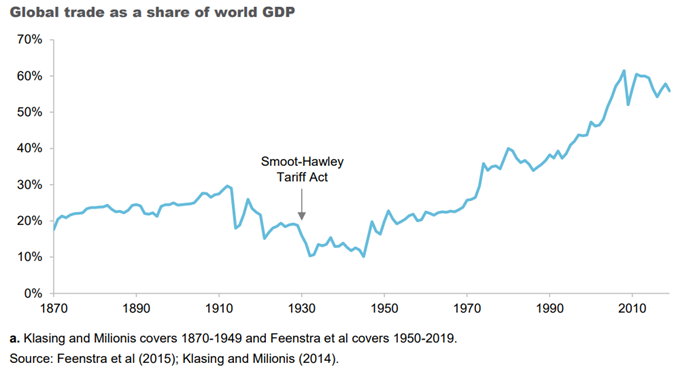

The other side of geopolitics is the trend towards deglobalisation. We think this will more clearly weigh on markets. While global merchandise trade is still rising, there has been a trend towards trade protectionism and activist industry assistance in recent years, driven in part by competitive pressures between countries.

Protectionism and industry assistance

There has always been protectionism and policies to subsidise domestic industries. While free trade is unambiguously beneficial to the wealth of nations on average, there are winners and losers. When the losers are politically important, governments intervene. They also intervene to support national champions or to simply buy votes. Sometimes, governments intervene because they think it is a good idea, but evidence that their ideas are actually helpful is lacking. Instances of these government actions had been falling globally for many decades as the benefits of free trade became more widely accepted and institutions such as the World Trade Organisation offered a forum to manage trade disputes.

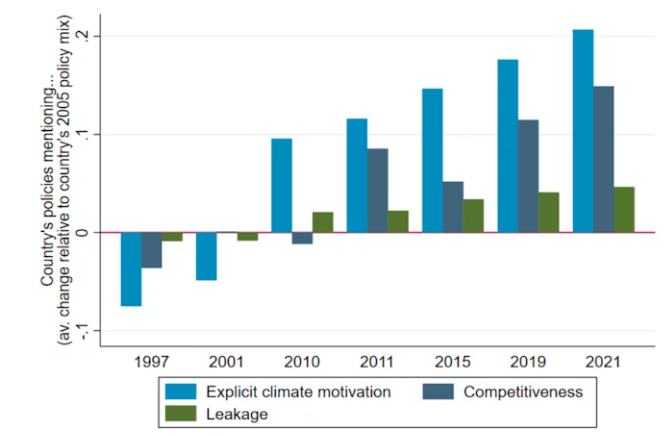

However, in the past decade, protectionism and industry assistance has come back in vogue. Some of this reflects strictly anti-competitive policy driven by great power competition - Trump’s trade war with China and China’s tariffs on Australian wine being prime examples of this. However, a significant amount of industry support has more recently fallen under the guise of climate change policy and supply chain resilience (see below).

The recent Australian Government announcement to commit one billion dollars to subsidise Australian solar panel manufacturing is a “good” example of this. China builds solar panels so cheaply that Europeans are using them as fences. The policy to support Australian panel manufacturing is stupid, but sounds good, and will be popular with some voters. The United States’ Inflation Reduction Act and the Chips and Science Act follow the same theme. Combined, they provide around US$400 billion in industry support for domestic climate change adaptation technology and semiconductor production. Rather than taxing carbon or implementing a market-based emissions reduction framework, government ministers get to announce important sounding policies in marginal electorates wearing high-vis gear.

Likely reflecting all of the above, global trade as a share of GDP peaked in the late 2000s and has been trending lower since. Increases in outright protectionism and industry assistance will likely continue to weigh on trade in the decade ahead. The net effect of this from a macroeconomic perspective is higher inflation, lower economic growth and more government debt. The latter is particularly important given the rise in interest rates since 2020 and the global lack of concern by developed economy governments about the trajectory of their finances.

Fiscal dominance and interdependence

"Under current policy and based on this report’s assumptions, [government debt relative to GDP] is projected to reach 566 percent by 2097. The projected continuous rise of the debt-to-GDP ratio indicates that current policy is unsustainable. "

—Financial Report of the United States Government, February 16, 2023

Fiscal dominance refers to the possibility that governments can dominate central bank policy. Arguably, this has been a feature of global economic policy since 2020. The fiscal stimulus from governments deployed in an attempt to offset the impact of Covid lockdowns was gargantuan, and (alongside the supply chain impact of lockdowns) drove inflation to the highest rates since the 1980s. One of the primary reasons that economic growth in the US has beaten consensus expectations over the past couple of years has been the deterioration in the fiscal position of the Government. The US federal budget deficit has widened significantly since mid-2022, by around 3% of GDP. We think fiscal dominance will continue to be driving force for global markets in the decades ahead.

In aggregate, there appears to be much less concern globally with government debt levels than immediately following the Financial Crisis despite the trajectory of debt almost everywhere being on a clearly unsustainable path.

These mechanics are worsened by the key themes mentioned in the beginning of this Insight. The heightened risk of conflict is translating into materially higher defence spending in major economies. Industry support policies designed to combat climate change or secure supply chains are also a drag on government budgets. We can foresee a World where the biggest swings in economic conditions are driven by the governments of the day, rather than central banks. Given spending money is popular with voters and increasing taxes loses elections, the consequence of this should be higher interest rates and higher inflation. Eventually, this path risks creating true fiscal unsustainability, where investors refuse to finance debts at an interest rate which can be absorbed by government revenues, leading to fiscal crisis and financial repression.

Demographics

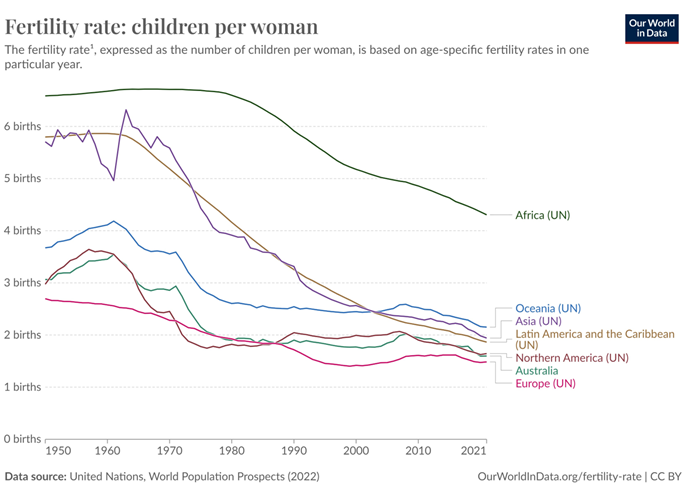

Population growth across much of the World has fallen over the past 30 years and is projected to fall further from here. Most developed economies now have fertility rates below replacement rates, meaning they rely on immigration for continued population growth.

No one actually knows what the consequences of this are for global capital markets. At first glance, a shrinking population should put pressure on government deficits as there are fewer young people contributing tax receipts to finance entitlements for the elderly. For developed countries, there is an ample supply of young people from developing countries willing to migrate in order to improve their standard of living, which could act as an offset. For developing countries with populations projected to shrink, the situation is more challenging.

Ageing populations also have an unclear impact on inflation. One would expect that retirement should be inflationary. Supply is removed from the economy as people stop working, while demand continues as retirees continue to spend (albeit at a reduced rate). However, the empirical experience of Japan and Western Europe is the opposite. Both appeared to be mired in deflation prior to 2021.

Ageing populations will weigh on overall economic growth (due to lower labour supply growth) and also due to lower productivity growth. Individuals experience the most uplift in their labour productivity in their 20s and 30s. With these cohorts a lower proportion of the overall population, compositionally, productivity growth should be lower going forward. Lower economic growth generally means weaker equity market returns. In addition, to the extent that retirees sell accumulated assets to fund their lifestyle, the price of assets should fall. However, there could also be an aggregate switch away from growth assets towards defensive assets as retirees de-risk their portfolios.

Artificial intelligence

The only real shining light on the thematic horizon is the potential positive benefits from artificial intelligence (AI). We first wrote about the potential impact of AI in early 2023, shortly following the wide release of Chat GPT. Since then, models have improved significantly, and commercial adoption of AI tools has accelerated.

We think there is a very good chance that this widespread adoption leads to an increase in productivity growth of a similar magnitude to that seen during the adoption of personal computers in the 1990s. This could be somewhere in the order of 1.5 percentage points higher productivity growth per annum in developed markets, which would nearly double potential economic growth in developed economies.

This should deliver robust equity market returns. Note that this is alongside the already stellar returns that have been delivered by AI beneficiary stocks. Market returns should broaden as most corporates would benefit from enhanced productivity. To the extent that AI models continue to improve in the decade ahead with better input data and more processing power, the impact could be even greater.

Some scenarios for the future

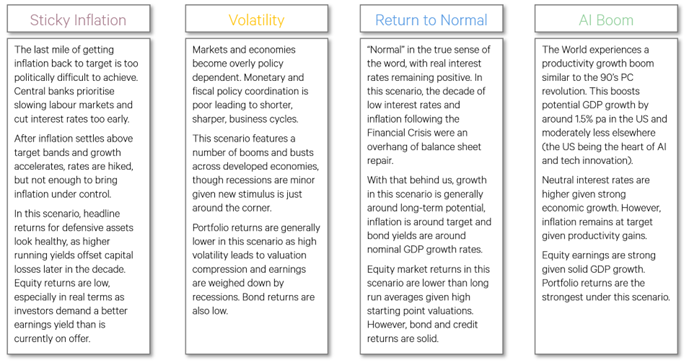

The themes above are useful in framing the scenarios used in the development of our capital market assumptions. This year, we are modelling four distinct scenarios (outlined below).

Generally, and as can be guessed from reading the above, the scenarios lead towards higher inflation and higher volatility in macroeconomic and market outcomes. Ideally, framing the future in this way allows us to build long-term portfolios that are robust to a variety of outcomes.

1 topic