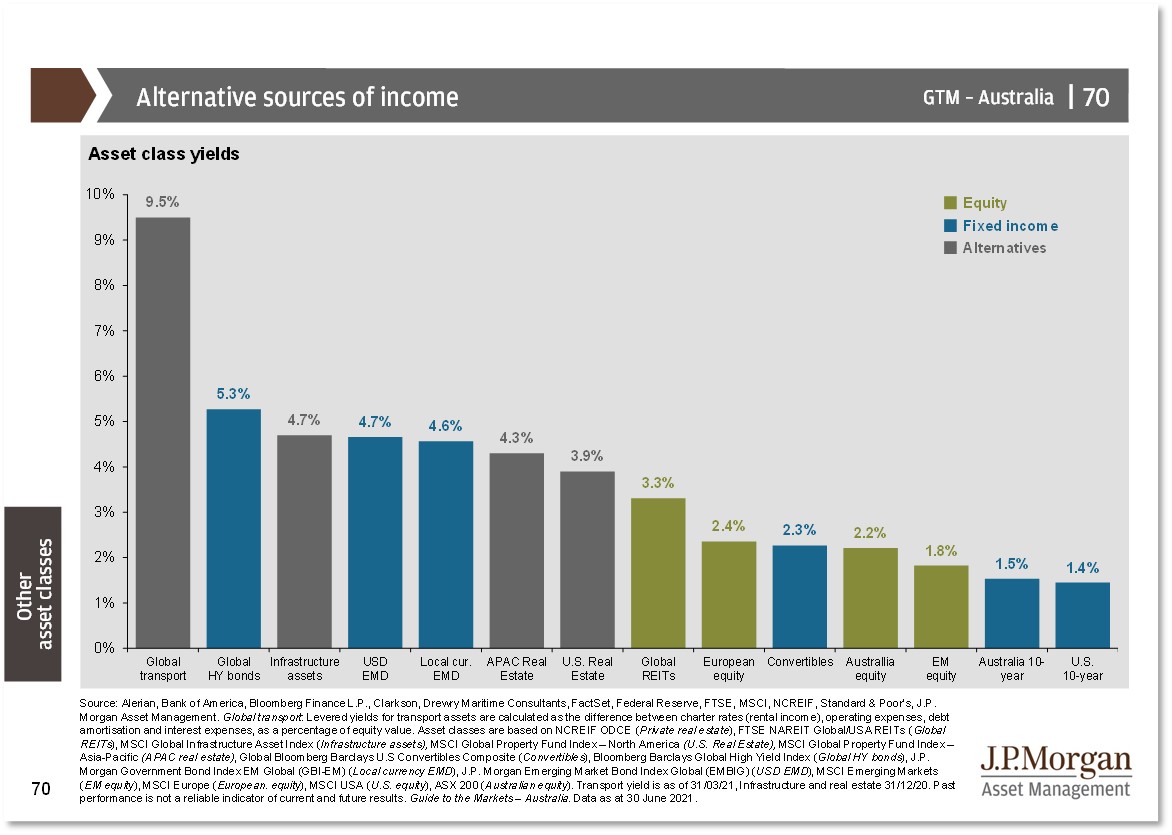

Income beyond fixed income

- The struggle to find income is not new, but is currently complicated by expectations of rising government bond yields and heightened inflation, creating risks for holders of core government bonds or longer duration assets.

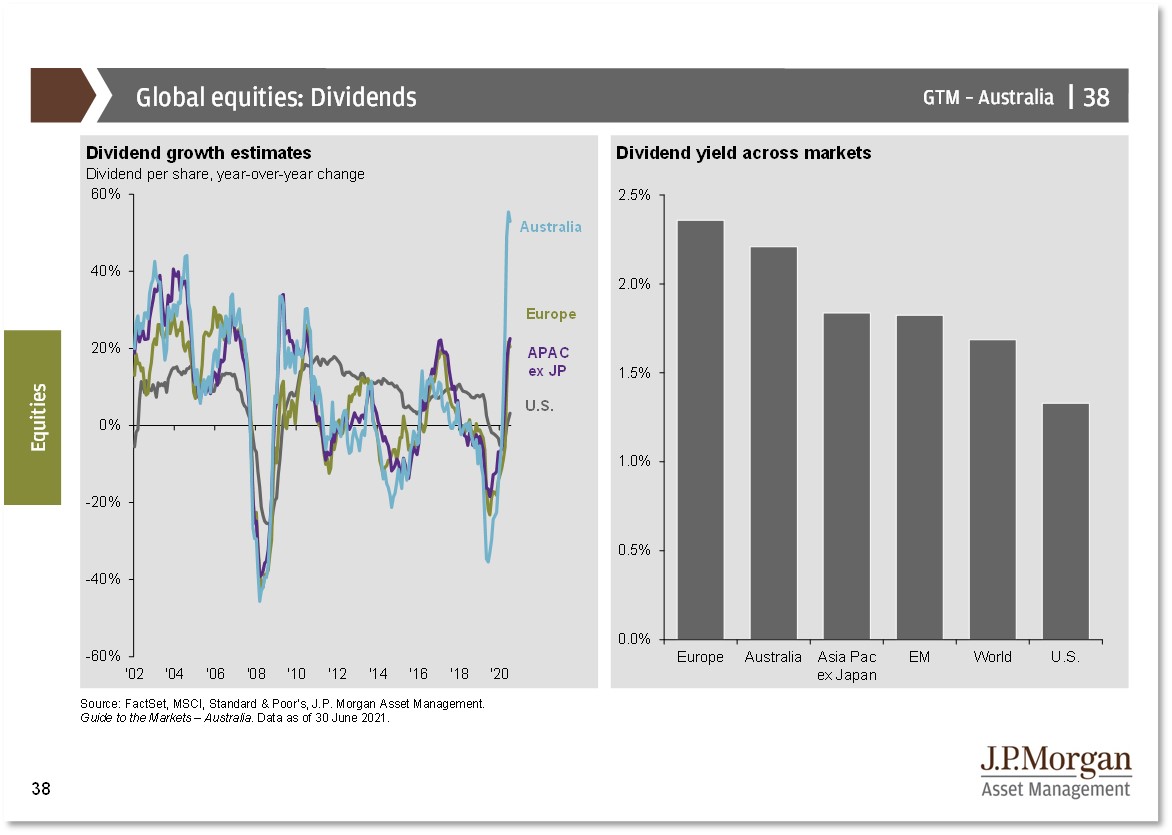

- The strengthening economic recovery has bolstered the earnings outlook. This should lead to a recovery in dividends as companies return capital through higher dividend payouts.

-

For

those

looking for potentially more stable income streams with a lower correlation to

equities, alternatives, such as real estate and infrastructure, present

predictable inflation-linked income options.

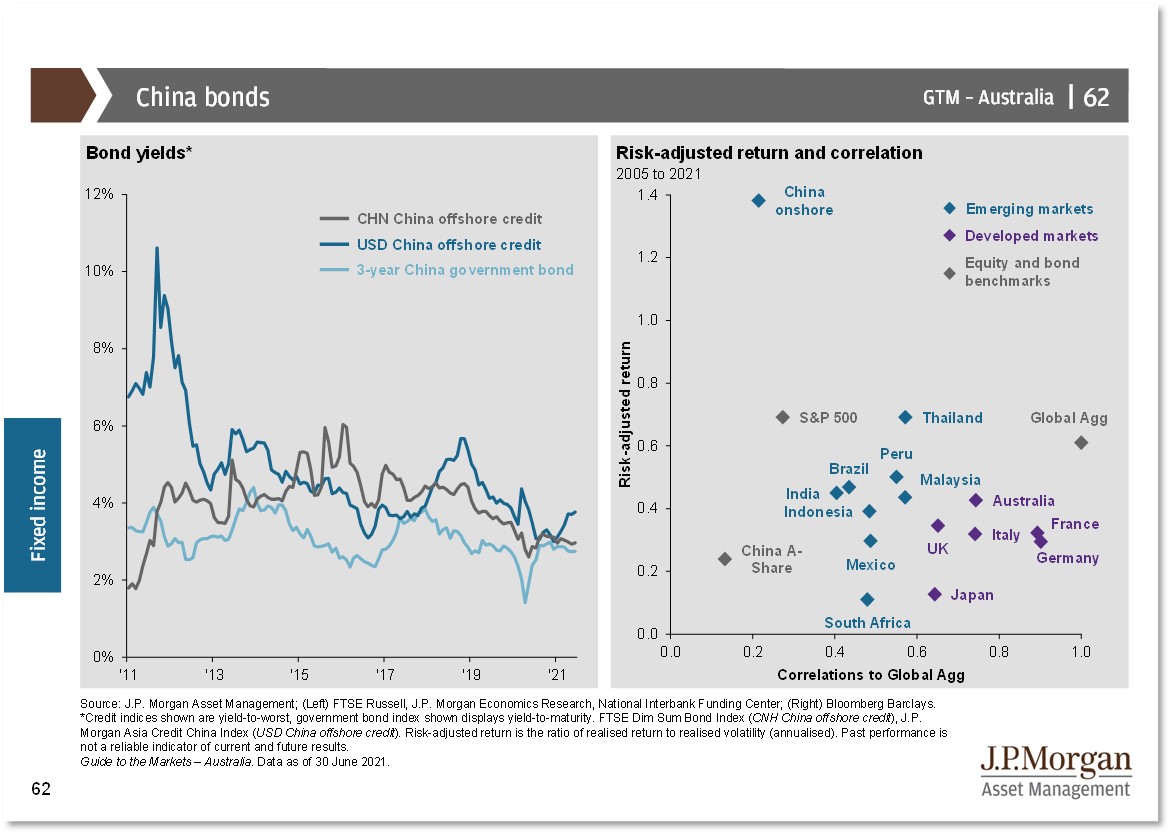

Fixed income to low income

Years of financial repression by central banks as well as longer-term secular forces have created a downdraft of income in the traditionally held parts of the fixed income market.

Divide(n)d we stand

The popularity of growth stocks, traditionally lower dividend payers, has reduced the dividend component of total shareholder return.

This trend may be starting to turn as elevated valuations in growth sectors greatly diminish return prospects and investors rotate towards value and higher dividend payers.

In

the

depths of the COVID-19 pandemic, dividend forecasts collapsed alongside

earnings expectations. Regulatory changes also prevented some companies from

paying or increasing dividends during the period. However, a V-shaped recovery

in many economies has led to a sharp increase in dividend forecasts, which are

noticeably stronger in Asian markets.

Alternative income

Looking beyond bonds for income means considering non-traditional assets. Alternative assets present their own challenges but offer similar characteristics for income and portfolio diversification.

In recent years, investors have been increasing their allocations to alternatives as such assets offer the prospect of increased returns, steady income and, in some cases, bond-like diversification.

These assets may also be an inflation hedge as the cash flows are indexed to rising inflation rather than having to absorb it.

Investment implications

The strength in earnings growth means companies can reward shareholders with higher dividends as well as reinvest for growth. Higher-yielding equity markets are trading at elevated valuations, and this is an option that should be considered.

4 topics