India isn’t tough for all

Common perception, particularly in Australia, is that doing business in India is difficult, unfruitful and has many challenges ranging from sovereign, cultural and execution risks. Quite often perceptions are shaped by prior experiences and travel to India in prior decades.

However, if you turn the clock back, there are several businesses which have been successfully operating in India for numerous years. Companies like Unilever, Nestle, Pepsico and Suzuki would list India as one of their most profitable regions. In fact, Suzuki generates around half of its sales from India and its 56% owned Indian business Maruti Suzuki which amazingly has a market cap of US$30bn compared to Suzuki’s $21bn. This is a case of a strong partnership where Japan’s technology and India’s demographics have been brought together to leverage on Maruti’s strong distribution and understanding of local consumer behaviour.

Parent company Unilever owns 67% of Hindustan Unilever (HUL). This subsidiary produces 10% of the revenues and profit of a global giant like Unilever. HUL is now the market leader in over 20 categories and has over 700 million Indians using its products. However, it’s not just large global conglomerates having success in India.

The model for success revolves around the same principles:

- Partnering with an Indian company with immediate access to domestic market knowledge and understanding of the local business environment (including marketing and distribution in Tier 2 and 3 cities);

- Leveraging brand and building brand recognition through domestic experts;

- Building manufacturing hubs in India to lower import duties;

- Bring global technology expertise to Indian soil

- Understand aspirational and value characteristics of Indian consumers – meeting demand at the right price

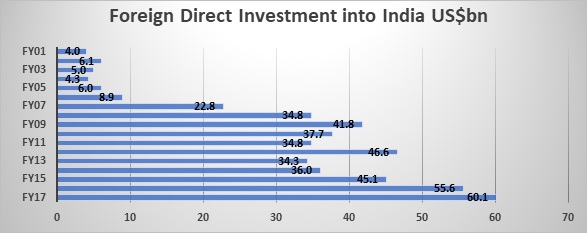

To discount India from investment would be to leave out a rapidly growing economy, turbo charged with positive demographics that have an increasing appetite for western products and brands. In fact, India today is one of the hottest places in term of foreign investment (FDI). In the FY17 (March year end in India) foreign direct investments increased to just over $60bn for the year in wide ranging sectors like Services, Telecommunications, Computer Hardware / Software. Impact investments also continue to grow as the rest of the world increasingly participates in providing for India’s infrastructure needs.

India’s Prime Minister, Narendra Modi, major reforms include easing foreign ownership restrictions on over 85 counts, across over 20 sectors in three years since his party, the BJP came to power. Modi is keen to act as an advertising magnate for India’s need for foreign capital from the likes of Apple, Google, Amazon, WalMart etc. In fact, one of the party’s reform initiatives has been a Make in India campaign, which focuses on bringing manufacturing to India, particularly given a vibrant and youthful population which is actively seeking employment.

The best way for Australian investors to create wealth from this opportunity is to recognise India as a growth market of significant opportunity, which global corporates are recognising. The best way to play the thematic is through investing in local businesses which understand their client base through an actively managed India focused fund – just like the Suzuki’s and Unilever’s of the world!

5 topics