India paves the way for sustainable growth

Mirae Asset Management

The Indian Stimulus package has been dubbed the largest stimulus plan seen among developing countries post COVID-19. The roll out is expected to create a self-reliant Indian economy by leveraging the nation’s demographic advantages, technological skills and boost domestic demand through robust supply chains as well as building infrastructure; further cementing the 'Make in India' campaign.

Stimulus package with a focus on self-reliance

The initial fiscal measure of Rs1.9tn (US$25bn) was intended to buffer the impact of the lockdown through a series of income support measures including cash transfers, free food grain and gas cylinders and interest-free loans to help low-income households through the lockdown. On the monetary front, RBI liquidity measures amounted to Rs8tn (US$105bn).

In our view the immediate net fiscal impact from the overall economic package will be limited at 0.7% of GDP. The room for further fiscal measures is low, given the increasing fiscal deficit.

The promised stimulus package is expected to address 15 measures, of which 6 for Micro, Small, and Medium Enterprises MSME’s, 2 relating to employee provident funds, 2 for the financial sector, 1 for real estate, 1 for power distribution companies and the other 3 will be tax-related measures.

We are positive with the government’s efforts in providing ample liquidity into the market as a liquidity crunch was a big overhang on investor’s minds. The government guarantee and partial credit guarantee scheme should provide the confidence needed and the expectation is for flows to slowly start returning once sentiment grows positive again.

In line with the adage that a crisis should never go to waste, Indian government has taken the opportunity to push through much needed Structural Reforms.

In line with the adage that a crisis should never go to waste, Indian government has taken the opportunity to push through much needed Structural Reforms.

Agricultural reform

The agriculture marketing reform includes amendment of laws at a central and state level to allow farmers to sell their produce anywhere they want, including to other states. Previously, farmers were barred from selling inter-state even if a product price in that state was higher. With the relaxation of this law we see an increased benefit for consumers as well as farmers. Another reform announced was removal of agricultural products from the ambit of the Essential Commodities Act. This will allow stock limits to be applied only during emergencies or removed altogether for food processors. This move will free up the industry for farmers and large scale corporate investments, allowing the agricultural market to trade at equilibrium.

Labor law reforms

Several states like Uttar Pradesh, Madhya Pradesh and Gujarat announced suspension of

key labor laws around collective bargaining rights, attaining government approval for dismissals, and factory labor inspection visits for a period of 3+ years. In the past, archaic labor laws and frequent harassment by inspectors were cited by the industry as key deterrents to expand rapidly in India.

Opening up of State Controlled sectors and Privatisation

Reforms for the coal, defence and power distribution sector was announced. In terms of coal, the government stated liberalisation where any party can now bid for coal blocks, the change comes from the previous monopolised market where only captive mines with end-use ownership could bid.

Defence sector push

The government will raise the automatic foreign direct investment (FDI) limit to 74 per cent from the current 49 per cent. There is a push toward domestic manufacturing.

State incentives for implementing reforms

While the central government has allowed 200bps additional borrowing for states in FY21, it is important to note that 150bps of this is linked to 10 specific targets, including One- Nation-One-Ration Card, ease of doing business, power sector reforms, urban local body reforms, and allowing inter- state use of food subsidies. In the past measures announced from New Delhi was not always followed through with the same zeal on a state level when local oversight and implementation was key for their success.

The reforms largely seen around labor, agriculture and privatisation in our opinion will create a stronger more sustainable long-term growth story for India. Although consensus expectation was for there to be more fiscal stimulus, we recognise that the room for higher fiscal deficit is limited and measures were designed with a longer- term outlook.

Focus on 'Make in India' Campaign

Make in India was gaining momentum pre-COVID. The expectation post-COVID is with realignment in global manufacturing; India could potentially benefit from the shift in manufacturing and supply chains by offering comparable or better terms than other competing regional countries in South/South-East Asia. With the anticipation for global companies to diversify away from Chinese manufacturing bases due to heightened concerns around deterioration of trade talks with the US as well as refraining from over-reliance on a particular country.

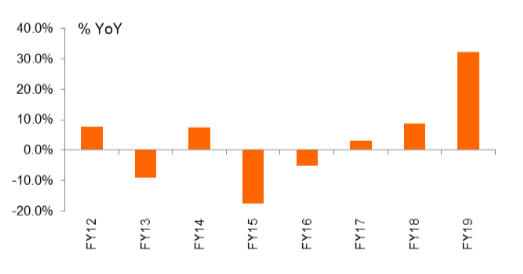

India’s electronic exports, mainly smartphones have increased significantly in recent years

Source: CMIE, UBS, July 2019

On the supply-side reforms in ‘Ease of Doing Business’, there has been significant progress with India gaining 71 places higher in the World Bank’s annual ‘Ease of Doing Business’ survey. This owes to the past six years of central government’s progress in moving forward reforms.

A competitive edge the country has is in the new corporate tax rate of 15% for new manufacturing companies. This rate is lower than that of China and other regional countries.

Focusing on the long-term benefits

With the combination of fiscal stimulus along with major policy reforms, we believe the long-term structural growth story for India is laying down a strong foundation for the future. We draw comfort in seeing the necessary measures taken by government to solidify the 'Make in India' program and believe as the recovery story comes underway the potential for returns in India remain largely untapped. Positioning ourselves to capture this wave before it is realised is our priority; we need to ensure we see past short-term volatility to reap the long-term benefits.

Since early March 2020, we have seen sharp selloff and high risk aversion in Indian markets as investors doubted the ability of the country to handle COVID outbreak. As the lockdown ends and with no significant second wave of infections, we believe consumers will gradually resume their normal livelihoods, as seen in Korea, Taiwan and Hong Kong. Thus the market would focus back on business models, growth opportunity and valuation led risk reward resulting in outperformance by our portfolio exposures which are sector leading companies in financials, insurance, consumer discretionary, real estate and hospitals. These companies are down nearly 30-50% from February-end and should outperform as they enjoy benefits of growth recovery and market share gains.

Invest in sector leading companies

Mirae Asset focuses on identifying ‘Sector Leaders’ that will benefit from competitive advantages and deliver sustainable growth over the long-term. Click the 'FOLLOW' button below for more insights

1 topic

Rahul is CIO & Portfolio Manager with over 19 years investing in Asia ex-Japan Equities. Based in HK & a regular in Asian financial services media, Rahul embodies Mirae's ethos of " We Live Our Investments."

Expertise

Rahul is CIO & Portfolio Manager with over 19 years investing in Asia ex-Japan Equities. Based in HK & a regular in Asian financial services media, Rahul embodies Mirae's ethos of " We Live Our Investments."