Inflation – What it really means for equities

Inflation has been an especially hot topic in recent quarters. A range of factors have come together to see inflationary expectations increase and the core Consumer Price Index (CPI) in the United States print the highest level in almost 30 years. As shown in figure 1 below, the latest 12 month percentage change in the core U.S. CPI hit 4.5% in June 2021, a number not seen since November of 1991. Much debate has focused on the degree to which inflation will prove transitory or more permanent and how central banks will respond. Will they let it run more this time or might they tighten sooner than previously expected? In this monthly note we take a closer look at equities through the lens of various inflation environments.

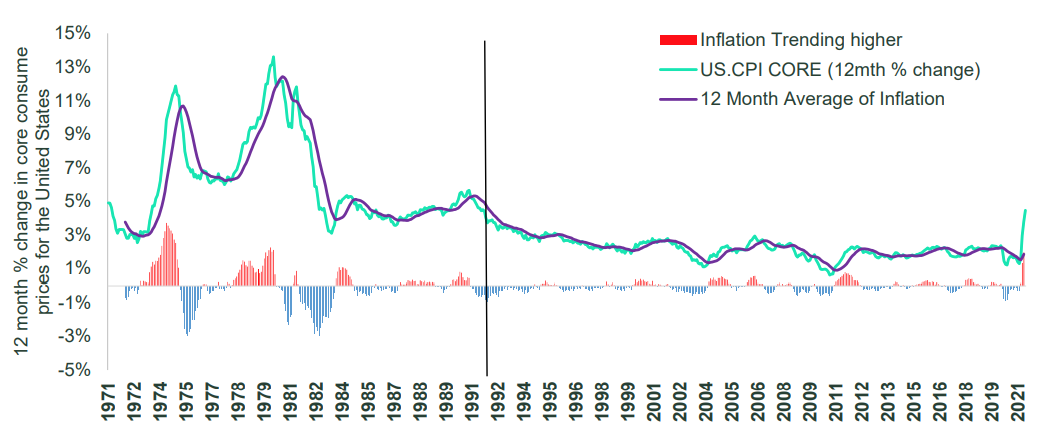

Figure 1 - U.S. Core Inflation – Over the Last 50 Years

Source: State Street Global Advisors, Factset as of 30 June 2021. The 12 month % change in the U.S. CPI. All Items Less Food and Energy, US City Average, 1982-84=100, SA, Index: MSCI World Index USD.

Figure 1 highlights the range of inflation outcomes over the last 50 years. The green line represents the core inflation rate for the United States back to 1971. Since June 1992 inflation has remained in a tight range with an average of 2.2% and 90% of the time between 1.2% and 3.2%. In contrast during the 1970 to 1992 period inflation averaged 6.1% and spent 90% of the time between 3.1% and 11.8%. The oil shocks of the 1970’s had a big impact on inflation and equally central banks have more successfully used monetary policy to control inflation in the last 30 years.

Inflation Trending up or Down?

The purple line in figure 1 shows the 12 month average of the inflation rate. When the green line is above the purple line the inflation rate is above the average and is defined as trending up. When the green line is below the purple line it is defined as trending down. The red bars highlight when inflation is trending up, blue when trending down. We have highlighted the inflation trend as this is more relevant to inflation expectations and also to the likely central bank’s response in monetary policy. We would expect market participants to anticipate a monetary tightening response if inflation continues to trend higher and especially if it is already above target levels.

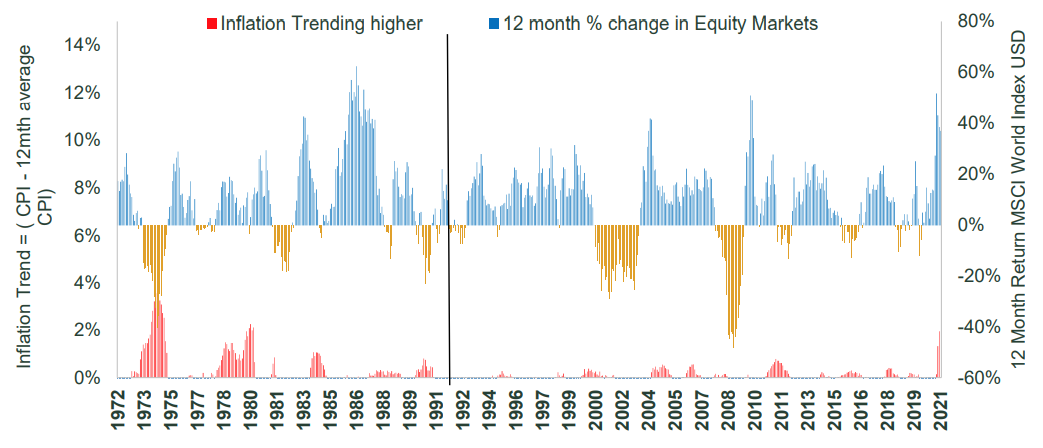

Figure 2 - Equity Market Returns when Inflation is Trending Higher

Source: State Street Global Advisors, Factset as of 30 June 2021. The 12 month % change in the CPI-U, All Items Less Food and Energy, US City Average, 1982-84=100, SA, Index: MSCI World Index USD. Equity market returns are calculated using the rolling 12month % change in the MSCI world index in USD.

As inflation trends higher central banks are often forced to tighten and this often flows into a more volatile equity markets with lower returns and we see this in the chart in figure 2. In the last 50 years the average rolling 12 month return for equities during periods of rising inflation was only 5.3%, compared to 10.4% return when inflation was trending down. A reminder that inflation trending up is a major risk factor for equity market returns.

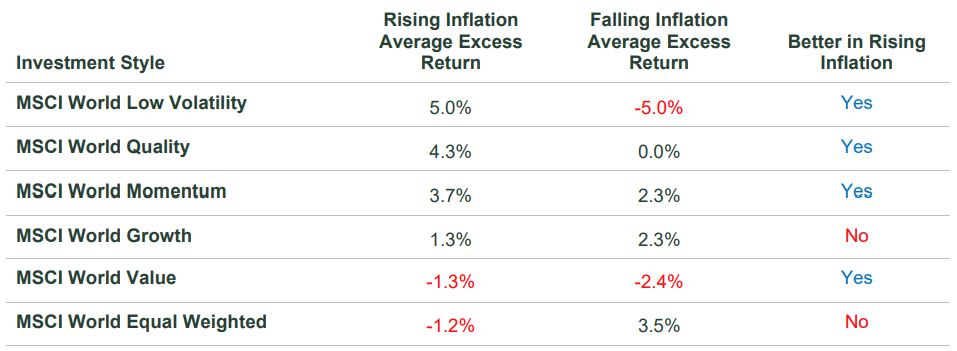

Thematic Performance in Rising Inflation and Falling Inflation Environments

Figure 3 highlights which strategies perform better in rising and falling inflation environments. We find most strategies have generated excess returns in a rising inflation environment. The exception has been Growth, and Small Companies. In the last 20 years Growth and Smaller Companies have generated higher average excess returns when we have been in a falling inflation environment. In our current state of inflation trending higher we find in the last 20 years the greatest outperformance has come from Low Volatility, Quality, Momentum and Value (1).

Why Might These Styles Outperform in a Rising Inflation Environment?

We know that inflation is a lagging indicator and by the time we see actual inflation trending higher (as we do today) the markets will anticipate an ever increasing chance of tighter monetary conditions. This is now one of the major debates within markets and so far this year we have already seen interest rate markets price an increased chance of some monetary tightening. The themes of Low Volatility, Quality, and Momentum are better placed if financial conditions tighten from here.

Figure 3 - Excess Returns Associated with Rising and Falling Inflation

Source: State Street Global Advisors, Factset. Covers the period from 30 June 2001 to 30 June 2021. The table compares the returns to different themes under two inflation states. State 1: Rising inflation is equal to months when the 12 month inflation rate is greater than the rolling 12 month average inflation rate (105 months) State 2: Falling inflation is equal to months when the 12 month inflation rate is lower than the rolling 12 month average inflation rate (124 months). The table calculates the average monthly excess return multiplied by 12 for each of the investment styles. Past performance is not a reliable indicator of future performance.

The Bottom Line

The market environment is ever changing and it is prudent to diversify across a broad range of themes. As inflation continues to trend higher the balance of risks move to less accommodative monetary policy and a more volatile equity market. In the last 20 years the themes that have generated the most excess returns in this rising inflation environment include Low Volatility, Quality, and Momentum.

Never miss an insight

Stay up to date with our latest thoughts by clicking follow below and you'll be notified every time we post content on Livewire.

Footnotes

(1) Value has had negative performance in both rising and falling inflation states but has done less worse in a rising inflation environment. The measure of excess return for Value is based on the outperformance of the MSCI world index in USD.

1 topic

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.