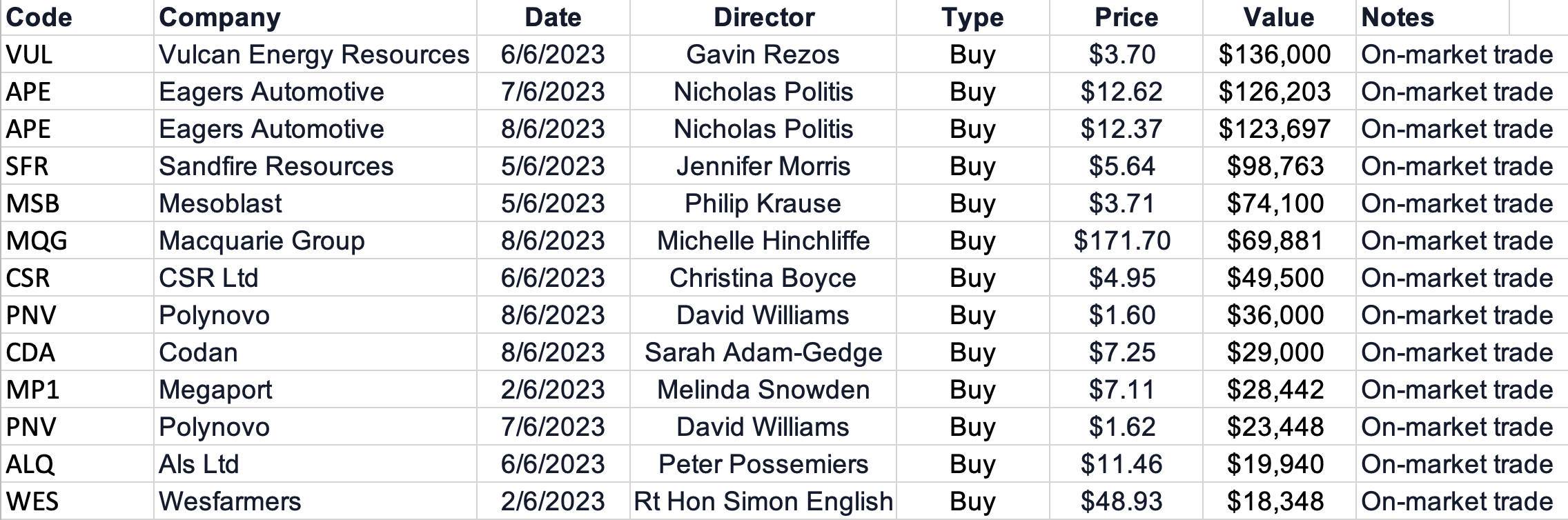

Insider Trades: Aussie rich-lister continues his spree (and 12 other director buys)

Welcome back to the Insider Trades series, a summary of director transactions – those on-market trades valued above $10,000 – that have taken place between 2 June and 9 June 2023.

Among the larger end of ASX companies, this time around we’ve found 13 transactions meeting the above criteria – and none of them were “sells”.

Eagers Automotive director Nick Politis again features strongly, having scooped another quarter of a million dollars worth of APE’s stock last week.

The other company that saw multiple stock buys (of more than $10,000) from inside its ranks was mid-cap medical technology firm Polynovo.

Top insider buys

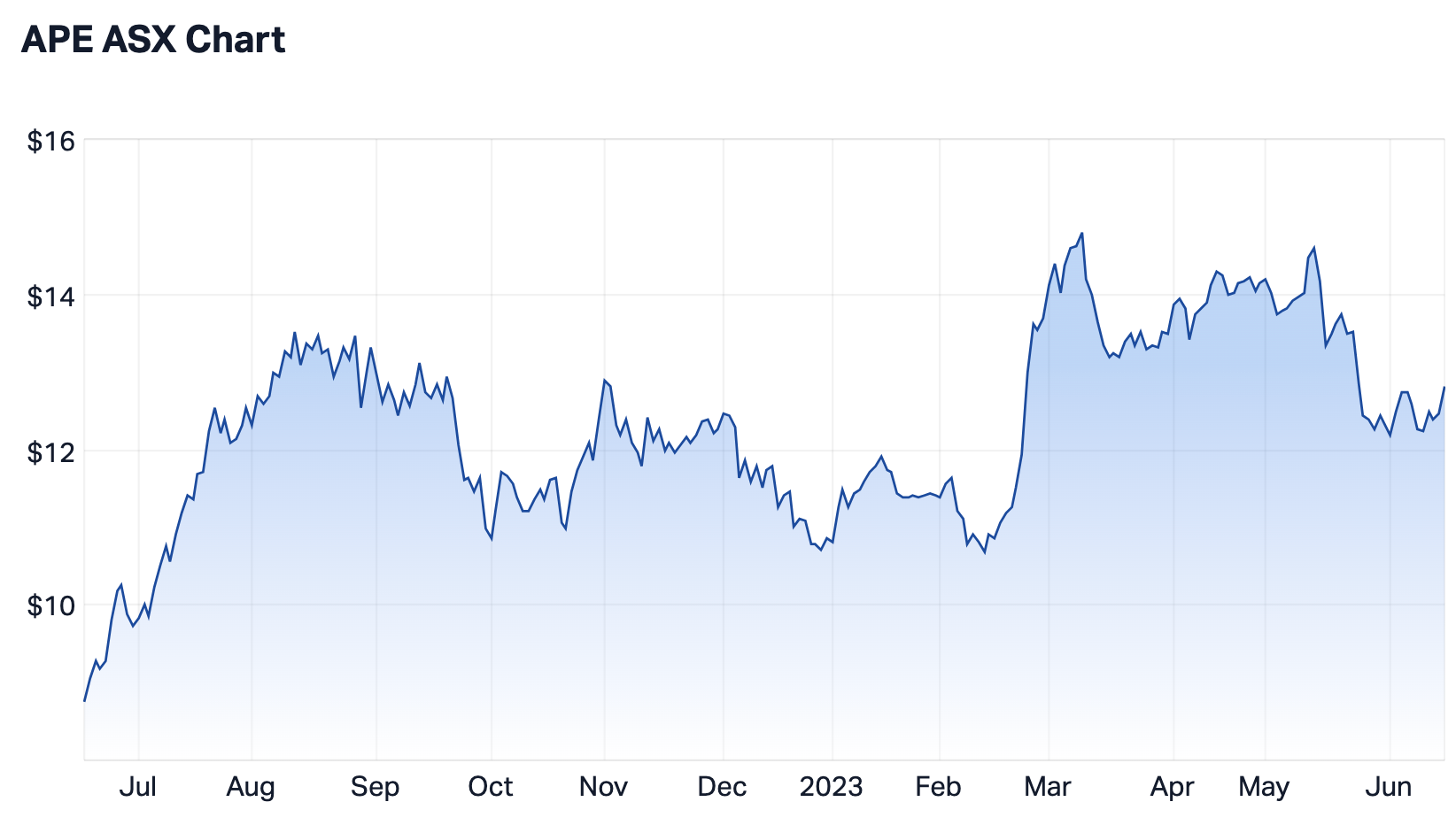

Eagers Automotive (ASX: APE)

The latest stock purchases from Politis – an AFR rich-lister who ranked 58 in 2023’s iteration – mean he’s purchased just under $1.5 million worth of APE’s stock in eight months. Aside from being among the local automotive sector’s biggest movers and shakers, Politis is the chairman of top-tier rugby league team the Sydney Roosters and a part-owner of the Brisbane Broncos.

Adding the transactions of other APE directors Michelle Prater, Daniel Ryan, Sophie Moore and David Blackhall to those Politis has bought lifts the total value of stock purchased by insiders since October to $26.9 million.

In recent months, Eagers has also received favourable mentions from several professional investors on the pages of Livewiremarkets.com – including top-performing fund managers Chris Stott and Tim Carleton of 1851 Capital and Auscap Asset Management.

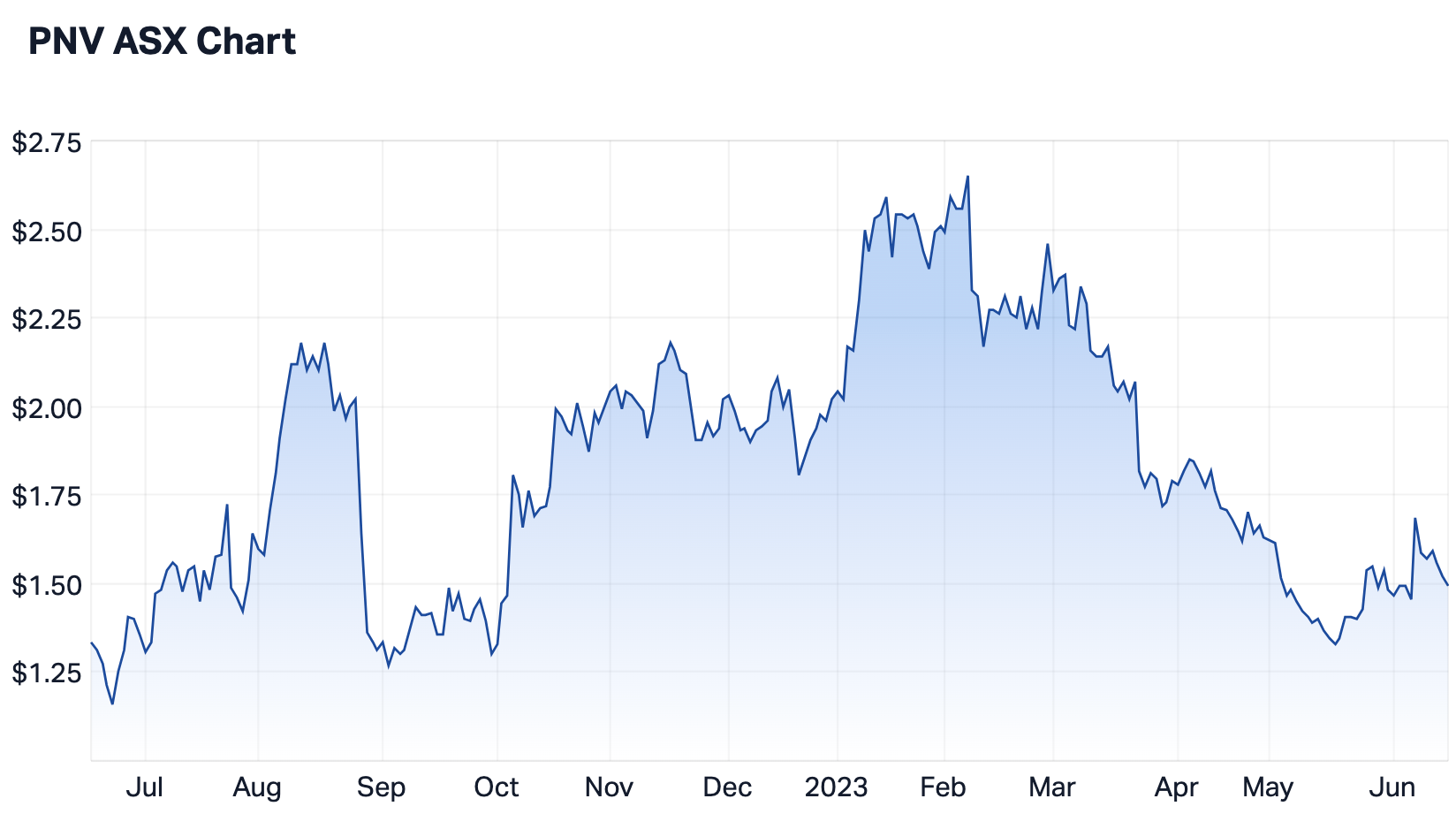

Polynovo (ASX: PNV)

David Williams’ acquisitions this week are the Polynovo chairman’s first for the year – back in March, he sold $9.7 million worth of the stock.

The firm’s share price rallied around 15% between 6 and 7 June, on the back of a record $7.2 million in sales during May 2023. “There is a lot to like about our growth,” said Williams a couple of weeks ago, pointing specifically at year-to-date sales in Canada and Hong Kong and a first-ever sale to the Middle East.

Much of the company’s recent positive momentum is attributed to Polynovo’s NovoSorb MTX, a synthetic polymer artificial skin product that received US FDA approval last September.

Vulcan Energy Resources (ASX: VUL)

The largest insider transaction last week was made by Vulcan Energy’s non-executive chairman Gavin Rezos. The small-cap company is in the mid-development stages of what management claims is a zero-fossil fuels lithium processing technology.

Sandfire Resources (ASX: SFR)

Another resources company, copper-gold producer Sandfire Resources, rounded out the three largest insider transactions last week, alongside Eagers Automotive.

The firm’s share price is up around 15% year to date but the company’s not without its challenges – as highlighted recently by Market Index’s Kerry Sun. But as one of only a handful of Australian copper producers it remains appealing – and not just to Jennifer Morris, a non-executive director of not only Sandfire but also iron ore and lithium producers Fortescue Metals and Liontown Resources.

This article was originally published on Market Index on Friday 16 June 2023.

3 topics

4 stocks mentioned

2 contributors mentioned