Insider Trades: Directors are buying shares in these 16 ASX companies

Welcome back to the Insider Trades Series – A summary of on-market director trades valued at more than $10,000 between 21 July and 1 August 2023.

The volume of director transactions continues to be relatively slow, potentially reflecting blackout periods ahead of August reporting season. We typically separate large and small cap trades but given the lack of volume, we’re merging the data into one table.

Top insider trades

Code |

Company |

Date |

Director |

Type |

Price |

Value |

|---|---|---|---|---|---|---|

Besra Gold |

26/07/23 |

Jocelyn Bennett |

Sell |

$0.31 |

$750,022 |

|

BKI Investment |

25/07/23 |

Robert Millner |

Buy |

$1.79 |

$302,350 |

|

BKI Investment |

27/07/23 |

Robert Millner |

Buy |

$1.83 |

$148,293 |

|

Macquarie Group |

28/07/23 |

Mike Roche |

Buy |

$176.12 |

$123,283 |

|

Frontier Energy |

26/07/23 |

Grant Davey |

Buy |

$0.37 |

$98,548 |

|

ROX Resources |

27/07/23 |

Robert Ryan |

Buy |

$0.24 |

$97,600 |

|

Ryder Capital |

24/07/23 |

David Bottomley |

Buy |

$1.00 |

$89,541 |

|

Metcash Ltd |

01/08/23 |

Mark Johnson |

Buy |

$3.629 |

$72,570 |

|

Polymetals Resources |

27/07/23 |

David Sproule |

Buy |

$0.32 |

$64,444 |

|

Jervois Global |

28/07/23 |

Peter Johnston |

Buy |

$0.06 |

$49,999 |

|

Aurelia Metals |

26/07/23 |

Bryan Quinn |

Buy |

$0.09 |

$40,050 |

|

Latrobe Magnesium |

31/07/23 |

John Lee |

Buy |

$0.06 |

$29,000 |

|

Galena Mining |

26/07/23 |

Alexander Molyneux |

Buy |

$0.09 |

$27,148 |

|

Iltani Resources |

24/07/23 |

Anthony Reilly |

Buy |

$0.22 |

$26,400 |

|

Marmota |

24/07/23 |

Colin Rose |

Buy |

$0.04 |

$24,327 |

|

Warriedar Resources |

28/07/23 |

Amanda Buckingham |

Buy |

$0.08 |

$20,000 |

|

Iltani Resources |

28/07/23 |

Anthony Reilly |

Buy |

$0.24 |

$18,000 |

|

Iltani Resources |

24/07/23 |

Justin Mouchacca |

Buy |

$0.23 |

$16,875 |

|

Cadence Capital |

26/7/23 |

Karl Siegling |

Buy |

$0.79 |

$14,201 |

|

Ryder Capital |

21/7/23 |

Peter Constable |

Buy |

$1.00 |

$12,528 |

|

Ryder Capital |

24/7/23 |

Peter Constable |

Buy |

$1.00 |

$12,526 |

|

New Talisman Gold Mines |

24/7/23 |

Samantha Sharif |

Sell |

$0.02 |

$10,971 |

|

QX Resources |

28/7/23 |

Maurice Feilich |

Buy |

$0.03 |

$10,860 |

|

Laramide Resources |

25/7/23 |

Raffi Babikian |

Sell |

$0.40 |

$10,000 |

Taking a closer look

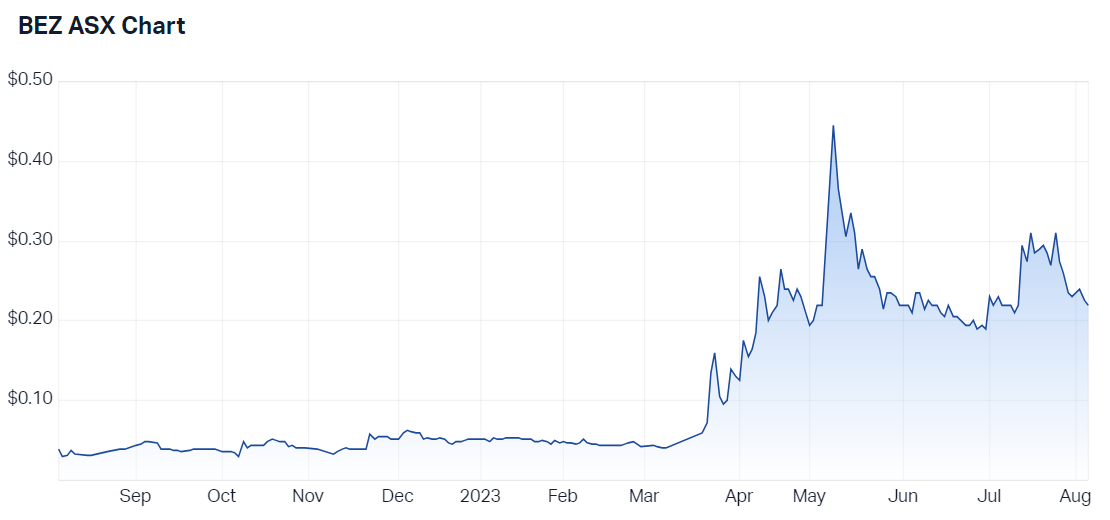

Besra Gold (ASX: BEZ): Director Jocelyn Bennett sold $750,022 shares just six days before her resignation. The company said she has been “instrumental in injecting significant new finance into the company, enabling the company to restructure and refocus its efforts on rebuilding shareholder value based on the world class Bau Gold Project in East Malaysia and re-list in 2021.” The stock is down around 27% from her exit price at 31 cents per share.

%20Share%20Price%20-%20Market%20Index.png)

Macquarie (ASX: MQG): Shares in the investment bank fell 4.4% on 27 July after it reported 1Q24 was substantially down year-on-year and reduced its FY24 outlook for three divisions. Morgan Stanley said “we think the lowered outlook factors in weaker conditions in the first third of FY24E and expect FY24E consensus downgrades,” but expects the business to be “well placed to resume earnings growth in FY25.” We’ve seen a few non-executive and independent directors over the past 3 months, buying around the mid $170 per share mark.

%20Share%20Price%20-%20Market%20Index.png)

Frontier Energy (ASX: FHE): The green hydrogen company is progressing the Bristol Springs Renewable Energy Project in WA, which is set to become one of Australia’s first and lowest cost producers of the fuel source. The stock has had a relatively muted performance this year, down 16% year-to-date. Upcoming catalysts include offtake agreements and funding discussions prior to a final investment decision that is currently anticipated for ‘later this year.’

Metcash (ASX: MTS): Metcash shares rallied 4.7% on 26 June, following the release of its better-than-expected FY23 results. The company also reported 6.8% growth in its Food segment for the first seven weeks of trading in FY24, also ahead of market expectations.

“We continue to prefer Staples over Discretionary names as consumer spending slows. Metcash is well placed with its IGA network and its liquor stores to participate although we note that Hardware is a cyclical business that might face a slowdown in coming months,” Macquarie said in a note.

%20Share%20Price%20-%20Market%20Index.png)

Polymetals (ASX: POL): Is a $45m market cap explorer operating the Endeavour Lead-Zinc-Silver Mine and two gold projects in Guinea. On 17 April, the stock rallied 61% after announcing high-grade mineralisation of up to 13.9g/t gold, 2,020 g/t silver, 12% zinc and 17% lead at Endeavour. Though, the stock has been trading sideways ever since. We’re now starting to see insiders nibble, with three buys valued at $14,232, $46,840 and $64,444 taking place in the second half of July.

%20Share%20Price%20-%20Market%20Index.png)

This article was first published for Market Index on Friday, 4 August 2023.

1 topic

12 stocks mentioned