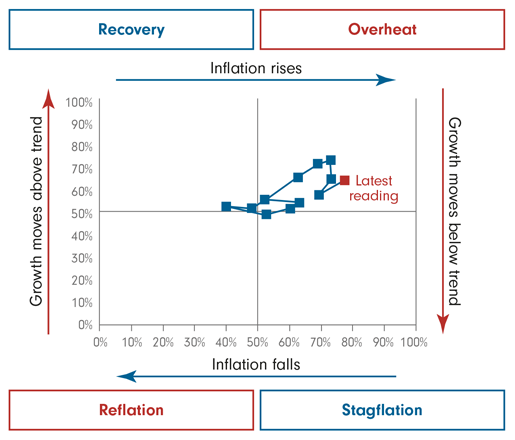

Investment clock in overheat

Our global growth reading improved slightly over the month. This was driven by a rise in the pace of growth, as the leading indicator was unchanged. Business confidence in all regions remains at elevated levels. The trend of unemployment was softer, with the US slightly negative. Our global inflation score also increased over the month, with the trend improving across all regions. The leading component was also stronger, led by improvement in Japan where the prices paid survey rose strongly.

Positioning: Overweight commodities, underweight bonds

The Overheat phase of the Investment Clock typically favours commodities over other asset classes and it remains our preferred asset class. With upward pressure on bond yields from both real yields and inflation expectations, we maintain our underweight positions in bonds and REITs. Within equity regions, we prefer the UK over Europe and Australia over Hong Kong. In currencies, we continue to have a negative stance on sterling and favour the Norwegian krone over the Canadian dollar. In equity sectors we prefer Energy to Materials and Consumer Discretionary.

1 topic