Investment Perspectives: In global real estate, does size matter?

Small companies are an interesting asset class. Almost every leading company today was once a small company. And getting the call right can be extremely rewarding (like buying Amazon in 2001).

However, one can argue that buying small companies comes with greater than normal risk. It can be hard to displace an incumbent, and lack of scale or adequate human or financial capital can result in even the best ideas failing. Clearly it takes a specialist to navigate such risks successfully.

But what about listed real estate? Do small / medium sized REITs have the same risks?

With regard to access to human and financial capital, the answer is maybe. However, asset-backed mortgages often look past the entity and more to the asset, mitigating the argument that small REITs do not have access to capital.

Moreover, does a building really lose its competitive advantage if it is housed in a smaller listed REIT compared to a larger one? Does a property care if one CEO is replaced by another? Business models can become obsolete, but can a building become obsolete just because it is owned by a smaller company?

The benefits of owning a small / mid cap REIT

While one can argue there are some additional risks of small cap REITs, there are also some very clear advantages.

- Smaller REITs are more ‘digestible’ from an acquirer’s perspective (as they are easier to fund) and are therefore more likely to be an M&A target.

- Incremental cashflow or valuation gains are more likely to ‘move the needle’ for small REITs.

- Smaller REITs tend to have oversized administration expenses relative to income, which means they benefit from scale economies as they grow.

- Incremental acquisitions (if sensible) are more likely to add to earnings / cashflow / value.

At Quay, we have no qualms owning smaller REITs as long as they pass our liquidity filter and valuation and risk screens. But are we missing potential return opportunities presented by the large REITs, or taking on additional risk? To answer these questions, we turn to the data.

Does size matter for long-term REIT performance?

To quantify the performance of REITs by size, we back-tested three global real estate portfolios. Using Quay’s proprietary screening model, which targets listed real estate companies in developed markets with limited development income and adequate liquidity, we identified a universe of 389 listed real estate opportunities today.

From this opportunity set we sliced the data into small, mid, and large cap sectors, defined as:

- small cap < US$2.0bn market capitalisation

- medium cap between US$2.0bn and US$5.0bn market capitalisation

- large cap > US$5.0bn market capitalisation

By these definitions we arrive at an investment pool of 108 securities for large cap, 113 securities for mid cap and 168 for small cap.

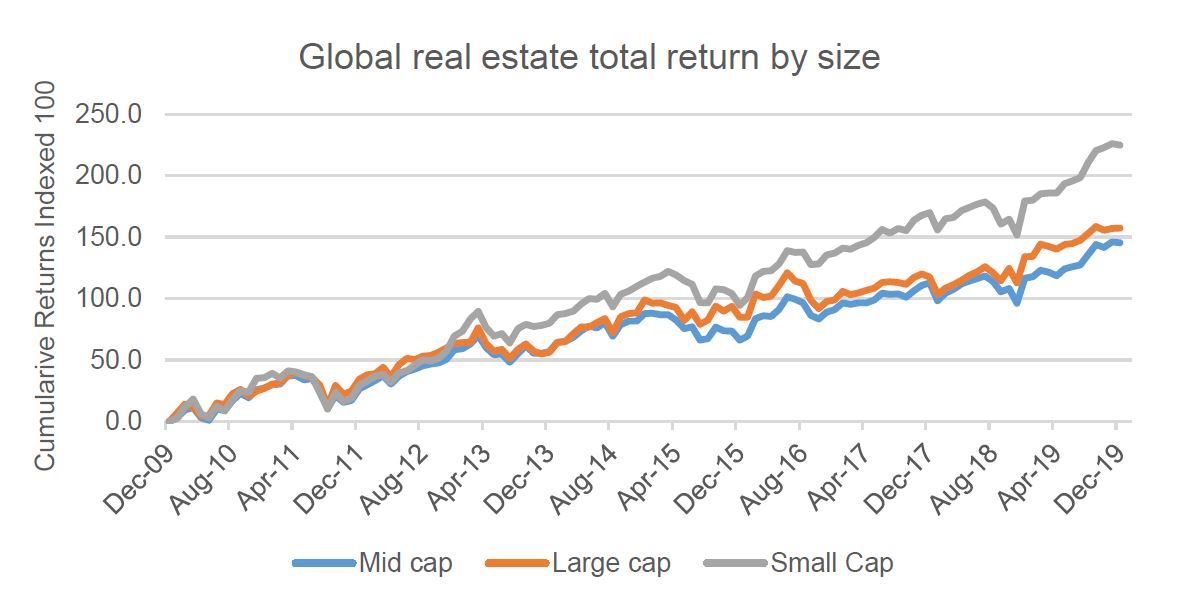

To test the returns we back-tested each portfolio, reweighting each month (market cap weighted) over 10 years. The cumulative total returns (measured in USD) are shown below.

Source: Bloomberg, Quay Global Investors

The data clearly shows smaller REITs have meaningfully outperformed large REITs over the past 10 years, while mid-caps have underperformed (albeit only marginally).

But what about risk?

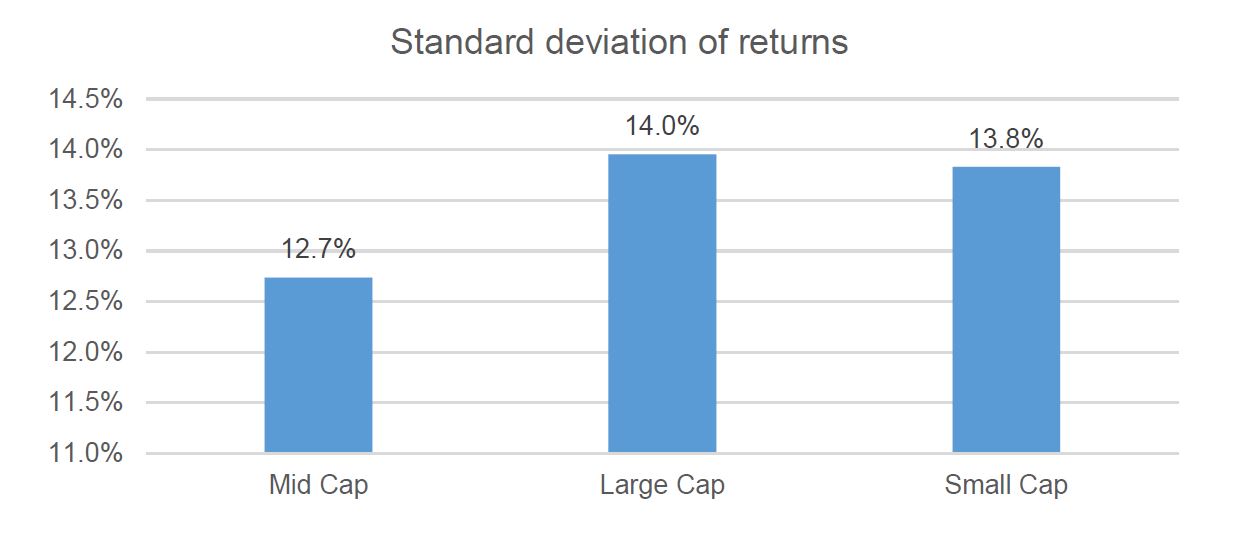

At Quay, we tend to define risk differently to most. However, if we are to use a very simple statistical measure, like standard deviation of returns, we can see smaller and mid cap REITs have displayed lower risk compared to the large caps.

Source: Bloomberg, Quay Global Investors

By this analysis, portfolios of large and mid cap REITs have historically delivered lower returns relative to smaller REITs, but in both cases with higher standard deviation.

Looking beyond the data

While it may be true that a building doesn’t know if it is in a small REIT, we fundamentally believe in some sectors, scale (and therefore size) does matter.

For example, we believe the owner of a single shopping mall – even if it was one of the most productive malls in the country – is at a material disadvantage compared to an owner of a large number of high-quality malls. This is because malls are extremely capital- and people-intensive. Unlike office or industrial property, malls require continued redevelopment (which is difficulty with asset-backed funding), remixing and specialist leasing skills. Further, larger owners have significant information advantages versus smaller owners. For example, larger owners tend to have comprehensive data base on retailer sales and profitability by location and category – information useful for leasing negotiations and redevelopment feasibilities.

To some extent, scale is also important in the area self-storage – especially over the past five years where demand and pricing algorithms have become important for revenue management and search.

It is clearly a sector by sector proposition.

Shortcomings of the analysis

One of the shortcomings of our analysis is that the back-testing available (via Bloomberg) is limited to 10 years, so it does not include the global financial crisis – indeed it only includes the (so far) 10-year bull market since 2010.

However, we can test the performance of the portfolios in ‘worst case markets’. The chart below shows the largest monthly loss for each portfolio since 2010. Again, smaller companies tend to do better under this scenario.

Source: Bloomberg, Quay Global Investors

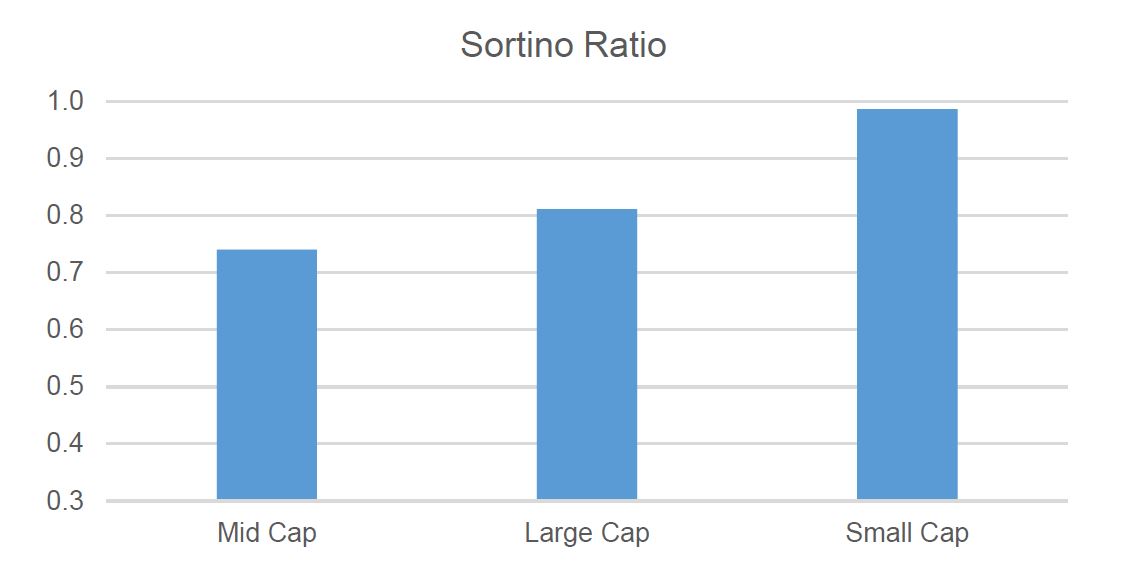

And for the more statistically minded, the Sortino ratio (risk premium returns divided by standard deviation of negative returns) again favours small caps[1].

Source: Bloomberg, Quay Global Investors

How does this affect Quay?

At Quay, we seek to identify and own the best real estate opportunities listed globally. At times, this may point us to small or mid-sized real estate companies.

We are not afraid to own smaller companies if we believe the risk return metrics are in our favour. As a result, some of our larger positions in the Quay Global Real Estate Fund would be mid-cap under this definition and in the past we have owned REITs that would be defined as small-cap. As the data above suggests, we do not believe this means we are necessarily taking on more risk – especially considering we target companies with low leverage and high dividend cover, with undervalued assets backed by strong secular themes.

Finally, this analysis suggests that fund size can affect the overall performance of a manager. The larger the fund, the more likely it is that the fund will miss opportunities in the smaller REIT world. This is why we will remain disciplined on our overall investment capacity – so we can continue to invest into the future as we invest today, and not miss the opportunities presented by smaller companies.

2 topics