Is another CSL hiding on the ASX?

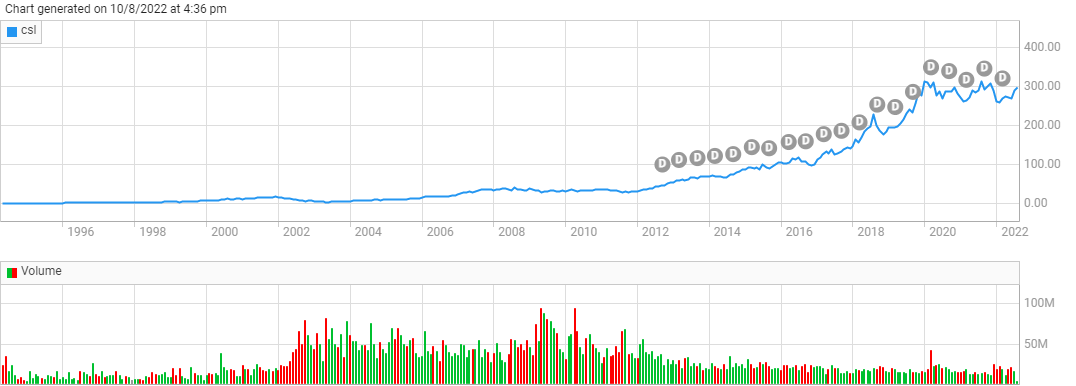

Remember when CSL shares were $40 each? That was 10 years ago. If only we had known at the time...

The unicorn of Australian biotech has had a phenomenal run with good reason. It's got a great product base in plasma, proteins and vaccines. It invests heavily in research and development. It draws a revenue in more than 100 countries. And this has translated to its financials.

Here's some quick numbers...

- Market capitalisation of $A142bn

- Trading at ~$296 per share

- FY21 annual return was $US10.3bn

- Return on invested capital (ROIC) above 19% for each of the last eight years

- Five year average total yield 1.23%

CSL share prices

CSL might be the star, but our small Australian industry holds a lot of promise. Could there be another CSL ready to emerge on the ASX? I spoke to two experts about the healthcare sector and which companies might have what it takes.

Victor Windeyer is the Portfolio Manager for the Future of Healthcare Fund at Australian Unity. He still views promise in big players like CSL but has his eye on the future.

Shane Ponraj is an Equity Analyst at Morningstar. His top pick for the industry is a familiar name which might surprise you.

The tall poppies of Australian healthcare

The US might be the heartland of biotech, but Australia holds its own. Our list of global players includes:

- CSL (ASX:CSL)

- ResMed (ASX: RMD)

- Sonic Healthcare (ASX: SHL)

- Ramsay (ASX: RHC)

- Cochlear (ASX: COH), and

- Fisher & Paykel (ASX: FPH)

Going global has been key to growth for these companies.

“Typically, Australian sales for a large global healthcare company is ~2-3% of global sales,” says Windeyer.

In fact, this is why you probably won't get fully franked dividends from these companies. You can't offer franking on international revenue streams.

The global approach continues to look lucrative. Particularly when you consider the projected growth. The global healthcare market is tipped to grow to $US665.37bn by 2026 (Source: Verified Market Research). This is approximately double its value in 2020. What is behind this growth? Aside from population growth, government spending continues to rise. Plus there's changing technology and a range of trends like aging populations fuelling growth. There's opportunities for companies with the right patents to make the international leap.

Diving back into the local index Windeyer groups some of the emerging companies into three distinct buckets.

- Service providers with efforts focused on Australia. Some examples include Monash IVF (ASX: MVF), Healius Pathology (ASX: HLS) or Estia Health Ltd (ASX: EHE).

- High growth, high multiple companies with products sold internationally but low profitability. Examples are Medical Developments International Ltd (ASX: MVP) or Somnomed Ltd (ASX: SOM).

- Early-stage companies seeking to develop new products for the global market. Examples are Botanix Pharmaceuticals (ASX: BOT) or the privately held Vaxxas.

How to identify a leading healthcare business

The next CSL need not be a carbon copy of the current market leader... but it should probably share some common traits.

“Leaders in healthcare generally have a moat of some capacity and often that is derived from intangible assets, cost advantages or switching costs," says Ponraj.

CSL has an extraordinary patented product base. So that's an intangible asset. Plus it invests heavily in research and development to keep ahead of the trends. CSL is also a global leader in terms of plasma collection and fractionation. What this means is that it's been able to develop scale, which in turn delivers a cost advantage.

However, finding a great healthcare company is about more than just financial metrics.

"Investors also need to ask whether a company's products or services will deliver a great clinical outcome for people," says Windeyer.

The feel-good stuff has a commercial upside. Good outcomes = demand. You can justify higher prices to account for costs if you have demand. If you have demand, you can also consider increased scale which turns into better margins and profitability. Then you can cycle profitability back into research and development to keep ahead of the competition.

Windeyer argues that good clinical outcomes and ongoing research and development are significant factors for success. CSL and Cochlear are cases in point. Looking for companies with similar attributes is an obvious starting point.

Four emerging healthcare stocks

Is there a clear cut candidate to be the next CSL? Unfortunately not and CSL is a rare success story in the healthcare sector of the local market. The outcomes for many emerging biotech companies are binary, and today's hot tip could be tomorrow's dog.

The next CSL could be a long-established name with the chance to grow again. Or it could be a start-up about to run clinical trials.

Windeyer has his eye on a few lesser-known names:

- Clarity Pharmaceuticals (ASX: CU6) is a radiopharmaceuticals company in clinical trials focused on cancer treatments.

- Neuren (ASX: NEU) is in clinical trials for drugs associated with neurological disorders (without any current treatments). It has just submitted an application for Trofinitide (drug therapy for Rett Syndrome and Fragile X Syndrome) to the FDA.

- ProMedicus (ASX: PME) which is an imaging IT provider.

By contrast, you've probably heard of Ponraj's current pick.

Ansell Holdings (ASX: ANN) is not the cheeky holding you remember. It sold off that lifestyle component in 2017 to Humanwell Healthcare (SHA: 600079) and CITIC Capital (0267.HK). But its key focus is a close cousin. Protective industrial and medical gloves. I don't think it will surprise people to appreciate this became critical during the pandemic.

Ponraj suggests the market has overreacted to Ansell's near-term margin pressures. Prices have declined in single use exam gloves. Ansell has an excess of supplies (inventory). Inventory costs aren't matching with the price drops, which is creating short-term pain. He expects the situation to normalise.

The company itself is looking in good shape.

“Ansell’s industrial segment held a 15% EBIT margin in first-half fiscal 2022, while group revenue rose 8% on a record prior period. Aside from single-use gloves, Ansell is still guiding to half-on-half revenue growth in all its businesses in second-half fiscal 2022," says Ponraj.

Ansell could also benefit from the growth market for glove use in emerging markets.

Is now really a good time to buy healthcare?

Everyone jumped on the healthcare bandwagon during the COVID-19 pandemic. So the sector became expensive. There was huge government fiscal support and investors loved the idea of buying into vaccines and cures. It has suffered since from ongoing supply chain issues and geopolitical risks.

Valuations are now looking better. Windeyer has seen particular improvement in growth stocks in biotech, life sciences and medtech subsectors.

Simultaneously, the big pharmaceutical stocks are still priced relatively attractively, are resilient and have historically outperformed during US recessions”.

On top of better valuations, Ponraj says the sector has been fairly resilient. It has defensive characteristics against rising inflation and recessions due to providing essential products and services. To put it in perspective, if you need insulin for diabetes, you can't suddenly stop. This means they have pricing power and many don't have much debt.

That's not to say all things are rosy for healthcare. The sector is still working through its COVID hangover on supply chains and labour. Ponraj thinks things will look better in the medium and longer term as those issues start to ease.

“The sector is poised for continued strong growth, the forward demand profile is extremely strong and technology innovation will generate incredible value over time,” says Windeyer.

So improved valuations, good growth prospects? Now could be a good time to take a closer look at Aussie healthcare.

Interesting in hearing more about healthcare investing? Follow Victor Windeyer by selecting his profile.

3 topics

16 stocks mentioned

1 contributor mentioned