Is it really 1987 all over again?

Forgive me for stating the obvious, but 1987 was a long time ago.

The Bangles were at the top of the Billboard Hot 100 with Walk Like an Egyptian, Oliver Stone's Platoon won the Best Picture gong at the Oscars, and the original Broadway run of Les Misérables swept that year's Tony Awards. It was also 11 years before this author was born - but let's not dwell on that.

But why the focus on 1987, you ask?

1987 was the big one in financial markets up until that point. And by 'big one', I mean crash. Black Monday saw $1.7 trillion in value wiped out and there were concerns of a reprise of the Great Depression.

More importantly, however, there are some in the market today that are seeing echoes of the '87 crash. Just recently, respected Bloomberg (and formerly, Financial Times) markets commentator John Authers labelled his markets note "No one wants to remember 1987. Then there's 1916."

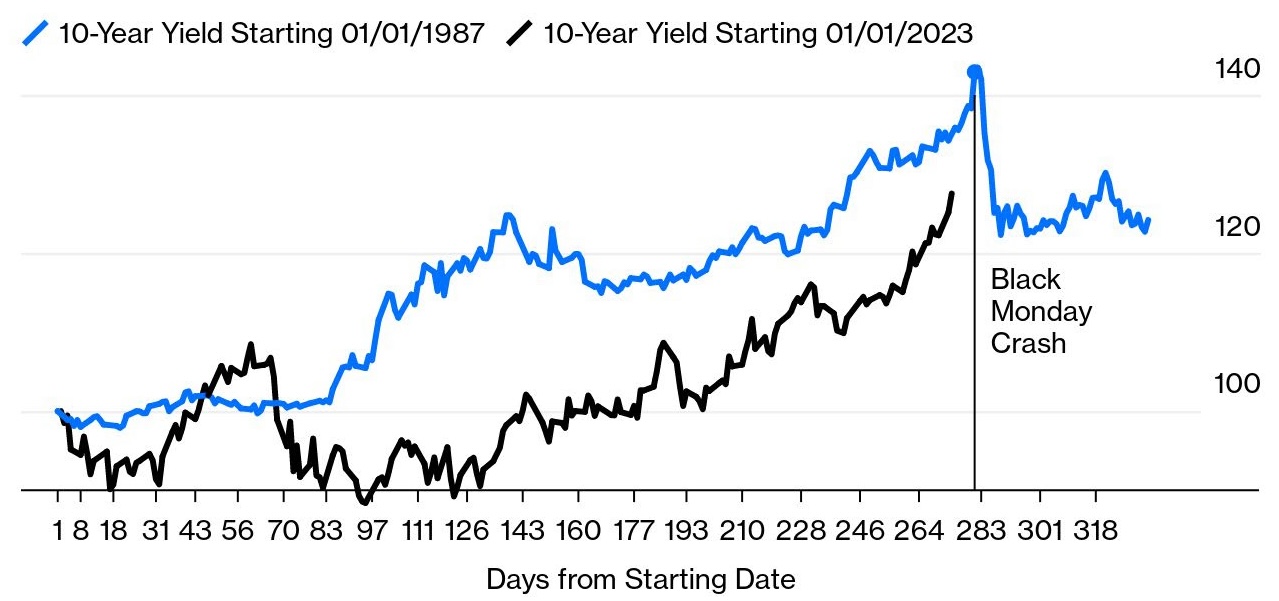

In the note, Authers argues that the surge in bond yields and the year-to-date moves in the NASDAQ look a lot like the financial crisis of 36 years ago. And while the causes of the 1987 crash are very different to the causes of the market pricing in 2023, the parallels can't be ignored. We'll explain more in this wire.

Authers' argument summarised

To illustrate his argument, Authers uses a range of charts that show stark parallels between 1987 and 2023. Consider his bond market charts first - nominal yields have spiked sharply since mid-2023. While the surge was more in basis points terms in 1987, the pace and the steep nature of 2023's climb makes this line more worrying.

.jpg)

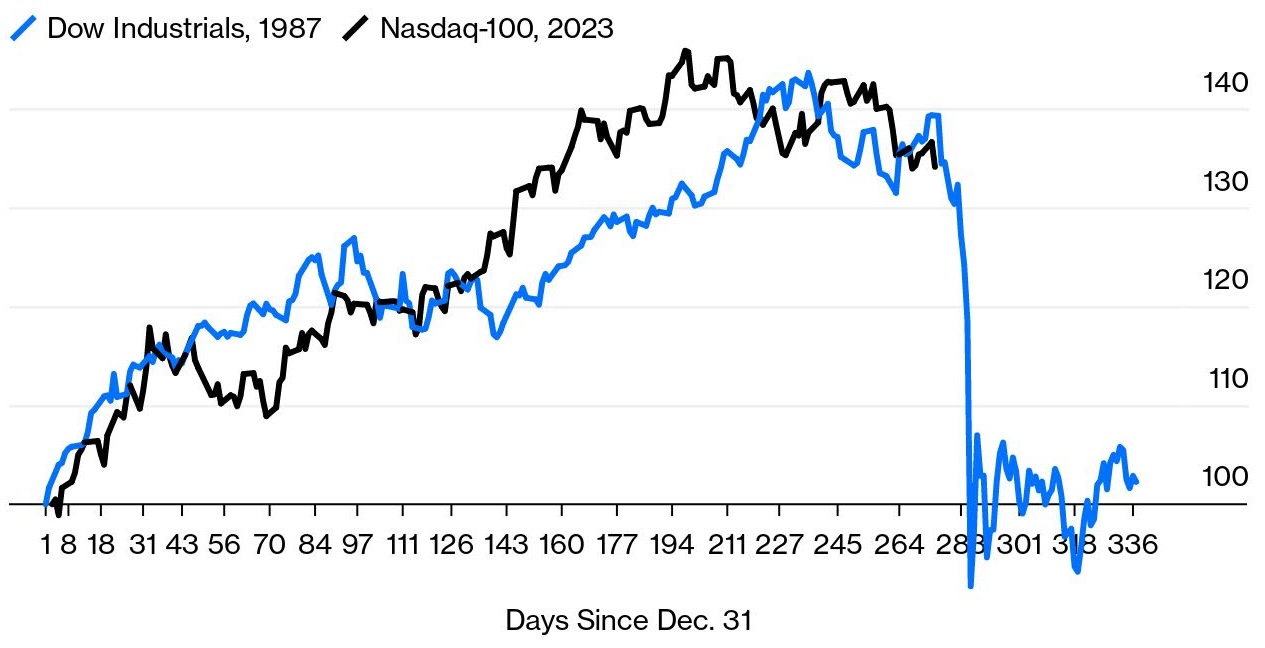

There was no NASDAQ 100 in 1987 (the index as we know it didn't exist until March 1995). But in 1987, there was certainly a Dow Jones Industrial Average. And again, the peaks, rises, and troughs are remarkably similar. If this pattern were to play out exactly as planned, we could see another Black Monday in the next few weeks.

.jpg)

The point of these two charts was to demonstrate that the last 15 years have been very unusual, especially when "risk" assets are performing in a way that "safe" assets are not. And when the pattern has been unusual, there is precedence in the grind higher in yields and the sudden drop in risk assets.

"It’s reasonable to expect that something will give soon. It doesn’t necessarily have to involve a stock market crash," Authers wrote.

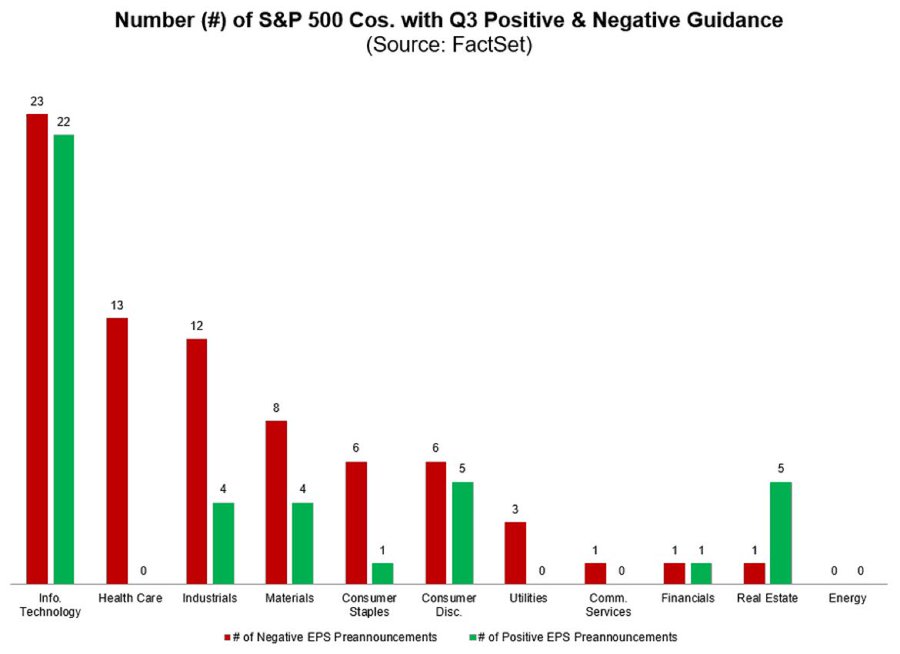

The counterargument tends to revolve around earnings. US corporate earnings forecasts are back at highs not seen since 15 months ago. The only problem is that these rosy forecasts are being mostly upheld by a few stocks. Of the 116 companies which have issued earnings guidance so far, 64% of them are issuing negative guidance - the highest on record.

What's missing from these charts

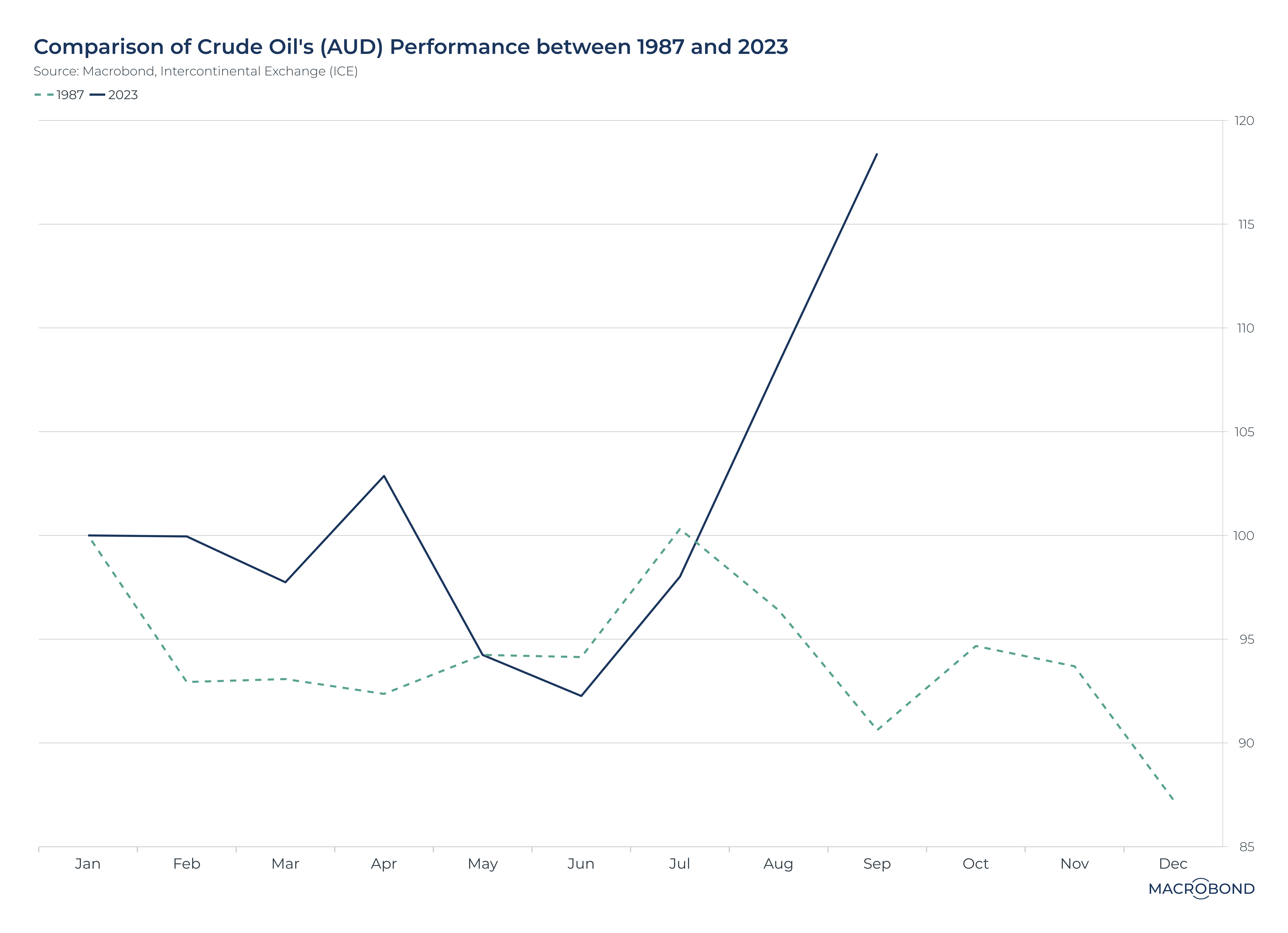

There are some asset classes noticeably missing. For instance, commodities in 1987 didn't spike in a way that you would expect would lead to a market crash.

According to Macro Trends, the WTI crude oil price finished 1987 lower by 6.6%. So far this year (so far being the operative word), the same asset is up nearly 9%. And depending on who you ask, that figure is about to go even higher:

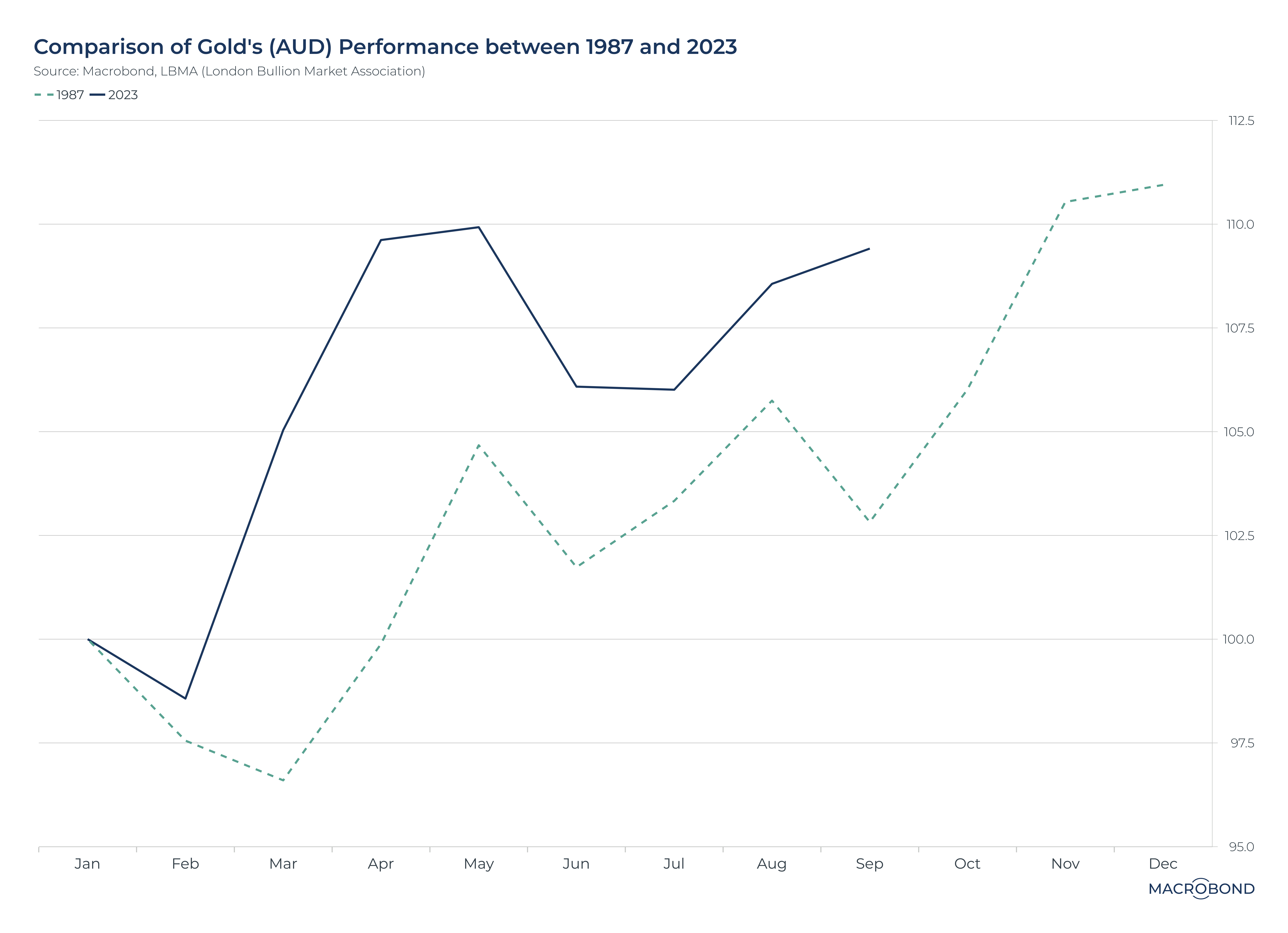

The gold price soared by nearly 25% in 1987. But this year, the gold price is down by nearly 4%. That's because traders are shifting their safety bets into the US Dollar Index instead.

The Australian experience

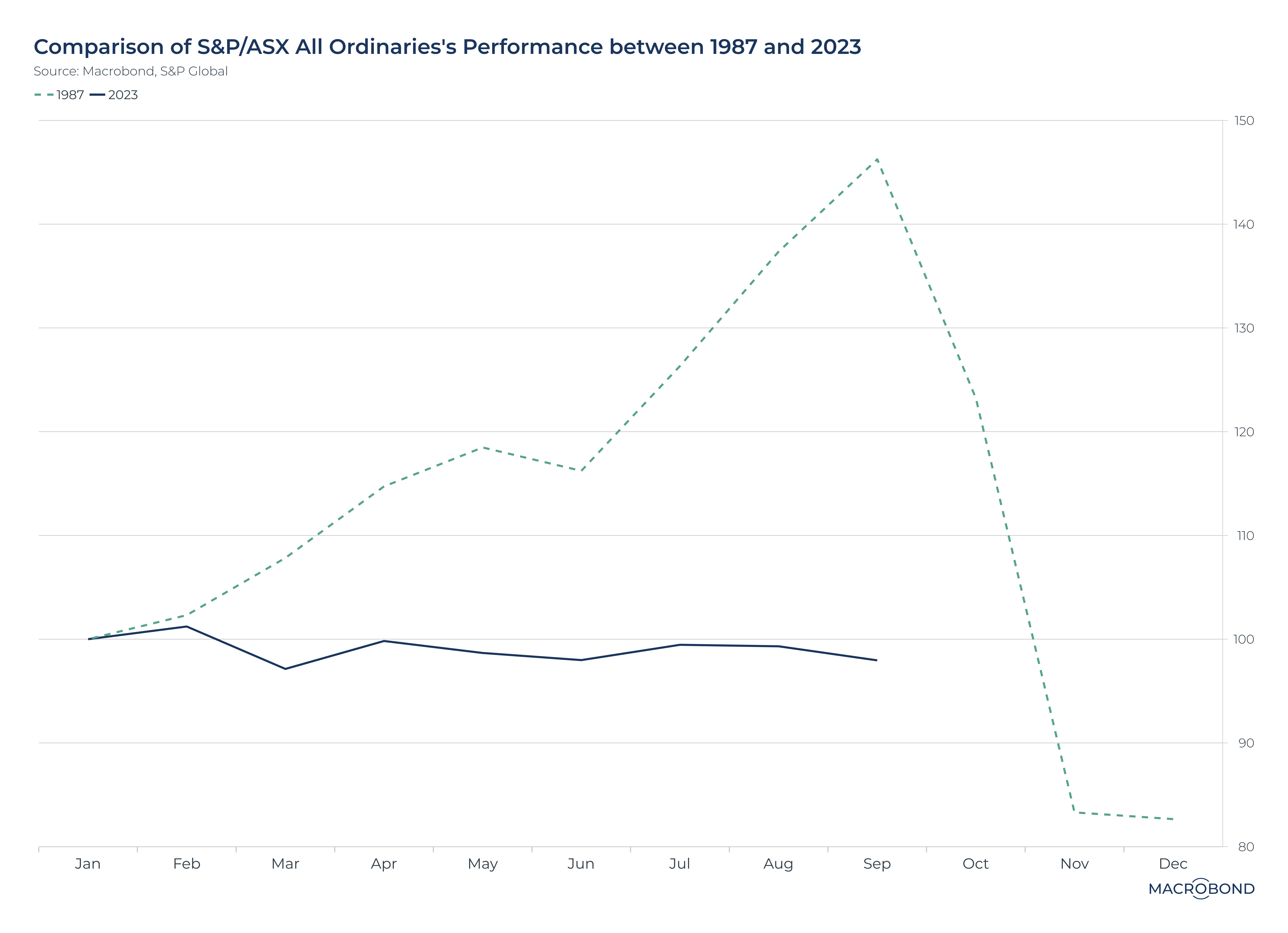

Let's now translate these asset classes into the Australian story. First, here is the All Ordinaries in 1987 then 2023 until today. As the chart shows, the All Ords rose sharply until September when it began to crater. From there, it erased all its year-to-date gains in under two months. In contrast, 2023 has been a more-or-less flat year for the local stock market index. Any falls month-to-month have been tempered by the fact we haven't gone anywhere so far this year.

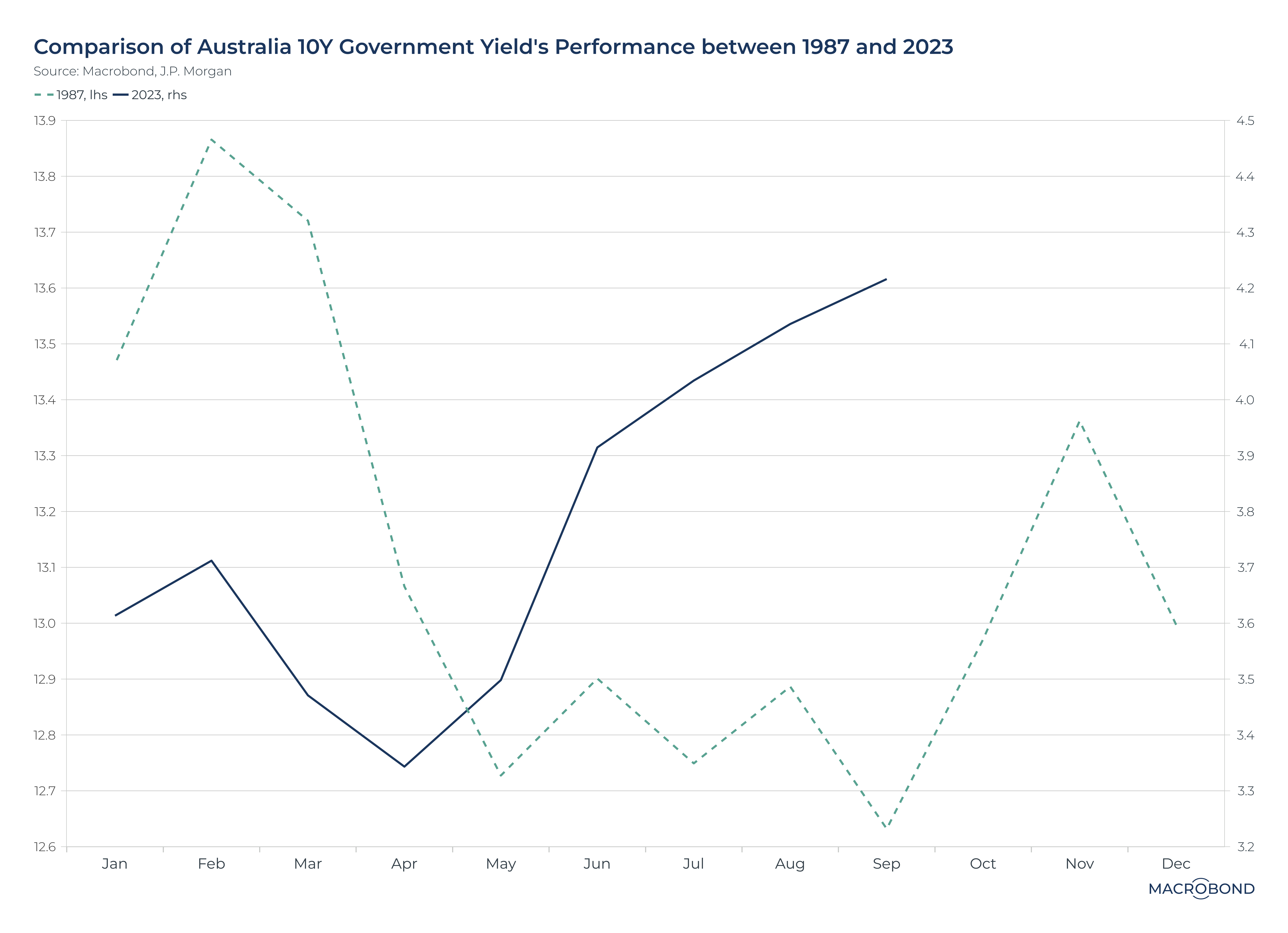

Next, the Australian 10-year bond yield. First line is 1987 and the second line is 2023 so far. Once again, we see something very different to the US. In 1987, yields were incredibly choppy hovering between 12.6% and 13.9% (or 130 basis points)! But in 2023, yields bottomed in April and from there, it's been one-way traffic.

.png)

And finally, gold and crude oil in Australian dollar terms. Again, the first dashed line is 1987 and the second line is 2023 YTD. Crude oil prices fell slowly for most of 1987 (especially after the middle of the year) while 2023 has seen a steep rise year-to-date.

.png)

In the case of gold, the safe haven is being bid once again just as it was in 1987. But the difference between the two is the value of the Australian dollar.

.png)

Conclusion? 2023 (at least in some respects) does smell a lot like 1987 but mainly for US investors. In Australia, the story is a little more complex - especially in the case of the equity market where the run-up was present in 1987 but has not manifested in 2023.

Of course, the other big difference today is the impact of the COVID-19 pandemic. There is far more liquidity in the system, even if central banks are unwinding at a pace of billions per month. There are also, thanks to the Global Financial Crisis, many more safeguards than there were pre-2008.

But, in many ways, things are also the same. Prices are high, valuations in parts of the market are extreme, earnings expectations are lofty, investors were seeking safety, and central banks desperately need inflation back at 2%. I wonder if that sounds familiar to anyone.

What is the remedy?

This is where the rubber meets the road. No one really knows.

On one hand, Barclays strategists believe it is a stock market crash that will rescue the bond market's savage sell-off. Again, a lot like 1987.

"There is no magic level of yields that, when reached, will automatically draw in enough buyers to spark a sustained bond rally," they wrote. "In the short term, we can think of one scenario where bonds rally materially. If risk assets fall sharply in the coming weeks."

AXA's Chris Iggo has yet a different view. He thinks we can solve this carnage by... cutting interest rates.

"There is a case for central banks acting soon – by cutting rates - to avoid what might be a negative outcome at the end of this cycle. The pushback against that approach is, of course, that inflation remains too high. Central banks can’t fine tune, but they can risk manage, and markets are suggesting that current policy settings are not optimal," Iggo wrote.

One final view comes from arguably the most bearish of all the permabears - Societe Generale's Albert Edwards. Edwards had this to say recently in a client note (another part of that note is quoted in John's piece):

"As U.S. bond yields surge ever higher, do you feel like you are in a car you just know is about to crash but are powerless to stop?," Edwards wrote before adding "Never in my career have I witnessed such uncertainty about where we are in the economic cycle."

You can read John's full note in the attached PDF.

2 topics