Key takeouts from NAB's result

NAB's first-half results on Thursday marked the second stop in the banks' results season. This is giving management teams the platform to address the issues raised at the Royal Commission and give a boost to their sagging share prices by showing how their businesses are performing. NAB's results, similar to ANZ’s result on Tuesday, had the key theme of simplification. In NAB’s case this was the news that the bank is intending to exit their wealth management business MLC either via an IPO or a trade sale by the end of 2019.

Which metrics are jumping out at me?

Overall this was a result from NAB that had few surprises, with cash profit of $2.77 billion, in line with expectations and the company holding the dividend flat at 99 cents. This represents a 2% decline when excluding restructuring costs.

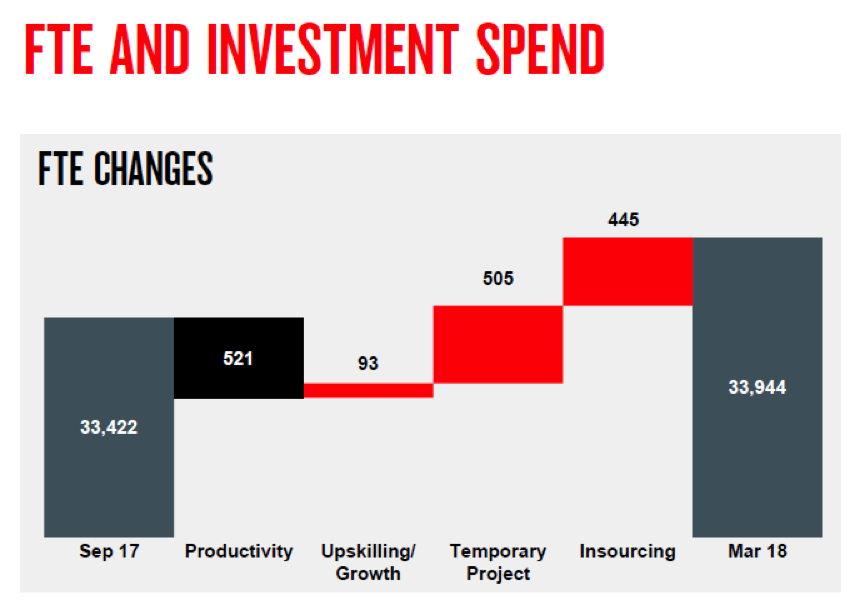

Restructuring costs and questions about when shareholders will see the benefits were a key feature of this result from NAB. In November 2017, NAB announced plans to cut their workforce by 6,000 over the next three years at a cost of between $500 and $800 million in a move to simplify the bank and deliver annual savings of $1 billion by 2020. This is based on plans for NAB to halve the number of products it sells and steer 60% of its business through digital channels.

Whilst shareholders were able to see $530 million of restructuring costs over the half; staff costs and numbers actually increased over the half and management guided to an increase in expenses in the second half of 2018. We were concerned to see that today management now expect that expense growth will be broadly flat in 2019 and 2020, which indicated that the timing of the savings from these cost initiatives is being pushed out. Not a good sign.

What are the bad debts telling you?

As we saw with ANZ on Tuesday, NAB reported a low bad debt charge of a mere 0.13% of average Gross Loans and Acceptances (GLA). This indicates that NAB is both managing risks in their lending book and benefiting from favourable conditions in the economy. Amongst the major banks, NAB has the largest exposure to corporate lending and over the last six months there have been no major corporate collapses which has kept this figure low.

What are the key takeouts with regard to the Royal Commission?

The Royal Commission is expected to cost NAB $40 million in 2018, primarily in legal fees; though one would have to imagine that the events of the last two months have contributed to NAB’s decision to divest its wealth management arm MLC.

This continues the theme of simplification that has been the main theme of the May 2018 banks reporting season so far, and will see MLC’s 1,200 financial advisers, super platform, and funds management business leave NAB.

Based on comparable listed companies, Atlas expects that NAB would receive around $2.8 billion for the MLC business based on the 1st half 2018 pro forma cash earnings of $102 million. The MLC business was originally bought from Lend Lease in 2000 for $4.5 billion and even when the proceeds from MLC Life Insurance to Nippon Life are removed, the MLC business has been a consistent drag on NAB’s return on equity (ROE) over this period.

The key risks ahead for NAB

NAB is trading on a forward PE ratio of 12.3x and a dividend yield of 6%, which is in line with the banking sector average.

However, looking forward the key risks that NAB faces are delivering on the cost savings from the heavy restructuring charges that shareholders are currently paying for and navigating the divestment of the MLC business.

1 stock mentioned