'Knock-down buy': This is a rare stock market opportunity

Every once in a while, an opportunity comes along to buy a great company at a fair price. Even rarer, is the opportunity to buy a great company at a knock-down price.

We believe that BMW (ETR: BMW), trading at just six and a half times earnings, is such an opportunity.

For context, the long-term average price earnings ratio of BMW is twelve times.

In the US, Macy’s is trading at a similar multiple to BMW despite the department store being in secular decline, shuttering almost 200 stores.

In Australia, you would have to fork out 27 times earnings to pick up a slice of Domino’s Pizza.

The anaemic valuation makes even less sense when you consider the giant strides BMW is making in the EV space.

BMW increased the number of EVs it sold by 100% in the last twelve months. It now sells more EVs than Ford, GM, and Rivian combined. Tesla meanwhile is only growing EVs by 35% per year (albeit from a higher base) despite slashing prices and compressing margins from 17.2% to 7.9% over the last year.

The 20% price cuts were not enough however to prevent Chinese upstart BYD from dethroning Tesla as the top seller of EVs globally.

Despite this, Tesla still trades at a startup-like valuation of 55 times earnings. Not bad going in a low growth, highly regulated, and labour- and capital-intensive industry!

Uncertainty surrounding the EV transition?

The truth is that the speed of the EV transition is uncertain, particularly in sparsely populated countries like Australia (and rural America for that matter).

After being a strident early adopter, Hertz has sold 20,000 (40%) of their EVs citing poor resale values and high repair costs, replacing them with internal combustion models.

A recent study of 6.9 million cars found that the three-year depreciation rate for EVs was 52% versus 39.1% for internal combustion engine cars.

We like BMW’s pragmatic strategy of retaining traditional internal combustion engines in the line-up and leaving the powertrain choice to consumers. This wait and see strategy will allow BMW to evolve their offering as charging infrastructure and technology evolves.

Compare the pair

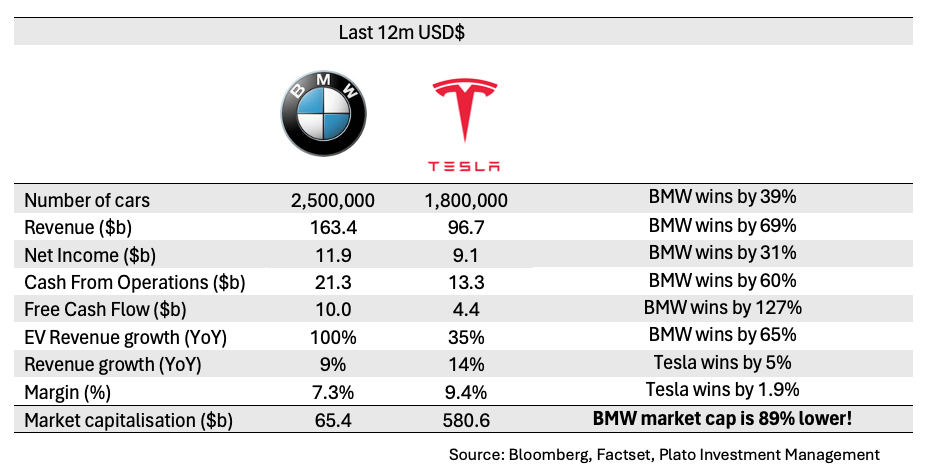

A quick line by line comparison of BMW and Tesla makes the absurdity of the BMW valuation crystal clear.

Despite dominating Tesla on almost every metric, the storied Bavarian automaker has a market value that is almost 90% less.

That is not to say that over the next month or quarter BMW stock will outperform Tesla. Mr Musk is certainly capable of rebooting his reality distortion field recently arguing that Tesla do not produce cars, they produce “robots on wheels”.

Over the medium term however, the fundamentals will assert themselves and we are confident that BMW represents far better value for shareholders.

That said I think Tesla is an incredible company and Musk is an extraordinary visionary.

If Tesla delivers on the long promised fully autonomous driving before anyone else, then the valuation may well be justified. For this reason, Tesla is not a stock, despite the lofty valuation that we would ever short.

Value, growth... Or both?

BMW is a top holding in the Plato Global Alpha Fund. In this recent presentation, Dr David Allen discusses BMW and some of the other key holdings in the Fund across value, growth and quality names.

1 topic

1 fund mentioned