Latest Virus Forecasts: US and Australia Peak in April

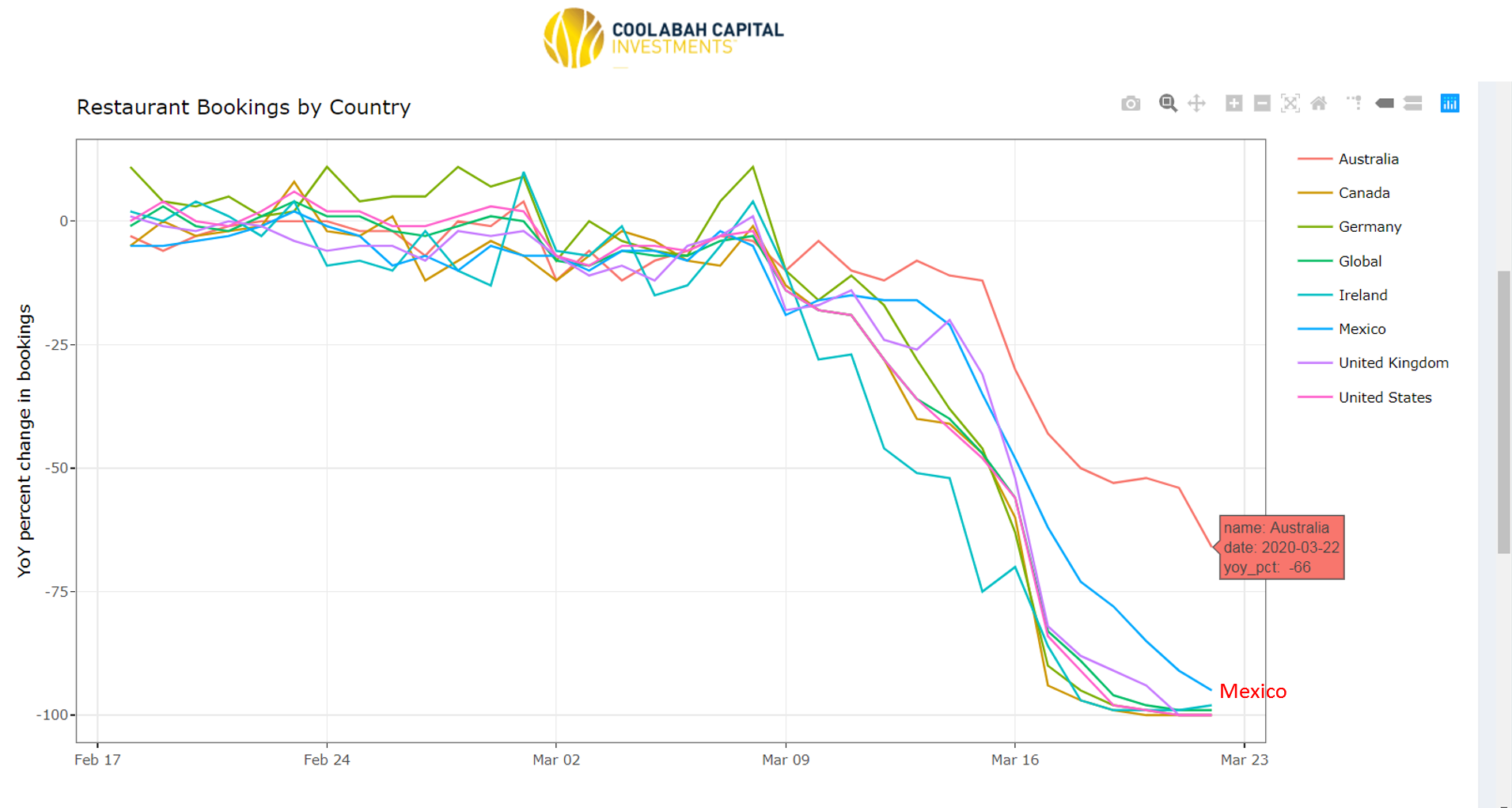

Enclosed are the latest forecast and infection/fatality data from our real-time COVID-19 tracking systems. We've also included some new analytics, such as benchmarking the change in restaurant bookings around the world to proxy for the intensity of the containment strategy. If you have not read our methodology paper on this forecasting model, you can find it here.

Key results as at 29 March 2020:

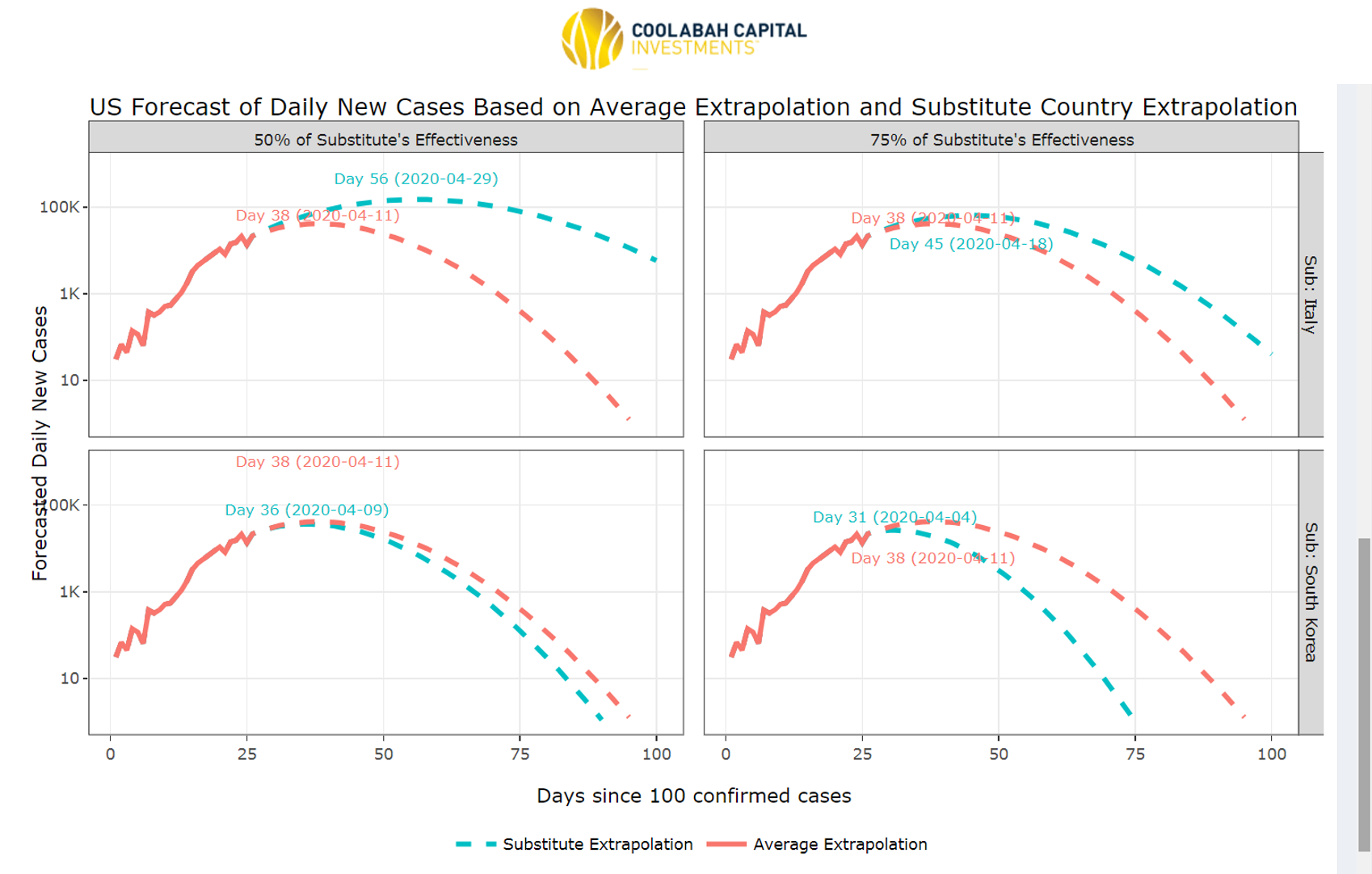

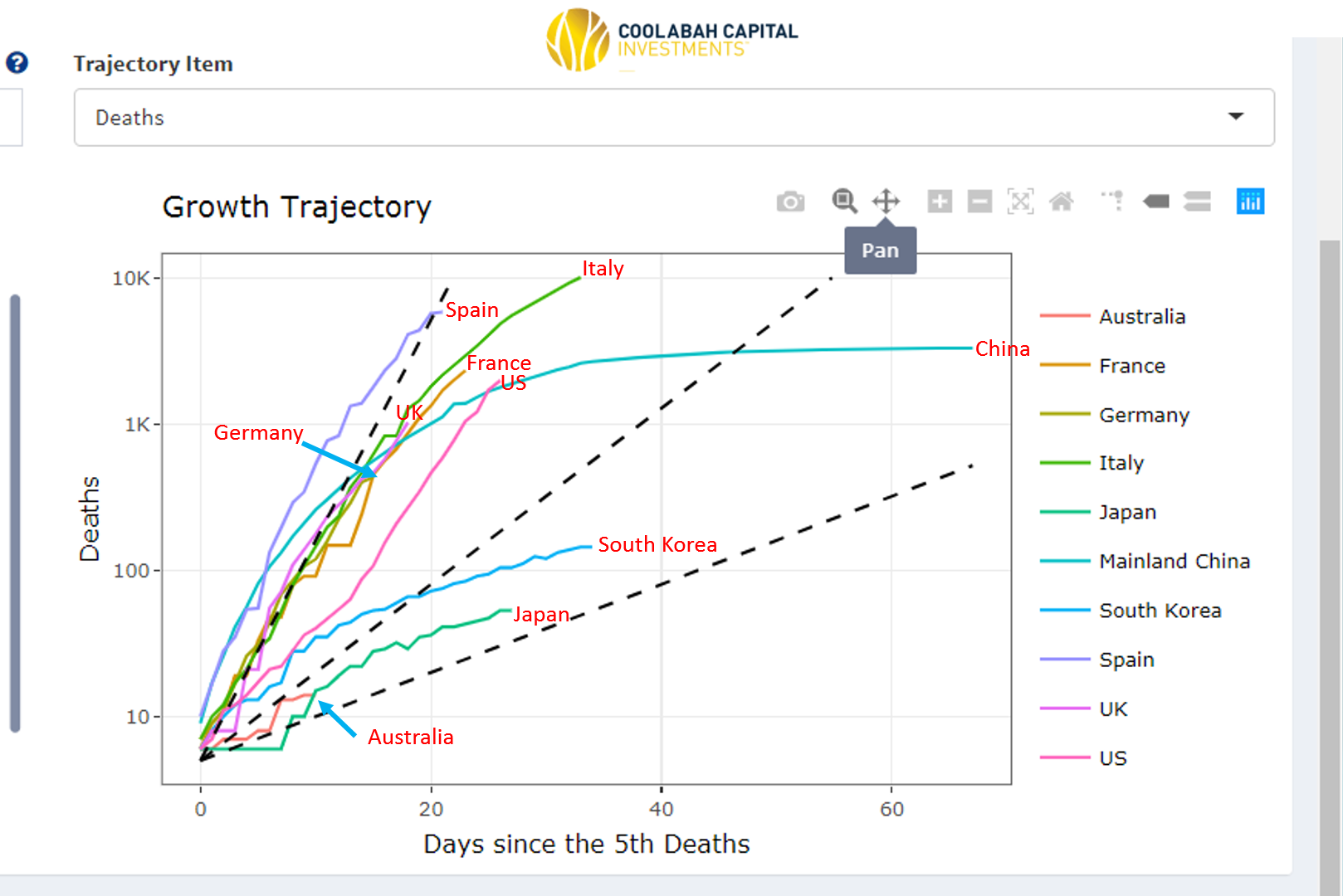

- The peak in America's new infection numbers will be realised between April 9 and April 18 assuming it is 50% as effective at containment as South Korea and 75% as effective as Italy. In a more gloomy scenario where the US is only half as effective at containment as Italy, the peak new infection numbers materialise around April 29 (see first screenshot). For the time being, America's fatality rate is growing at a slower pace than the UK, the major European nations, and China's original path (see third screenshot);

-

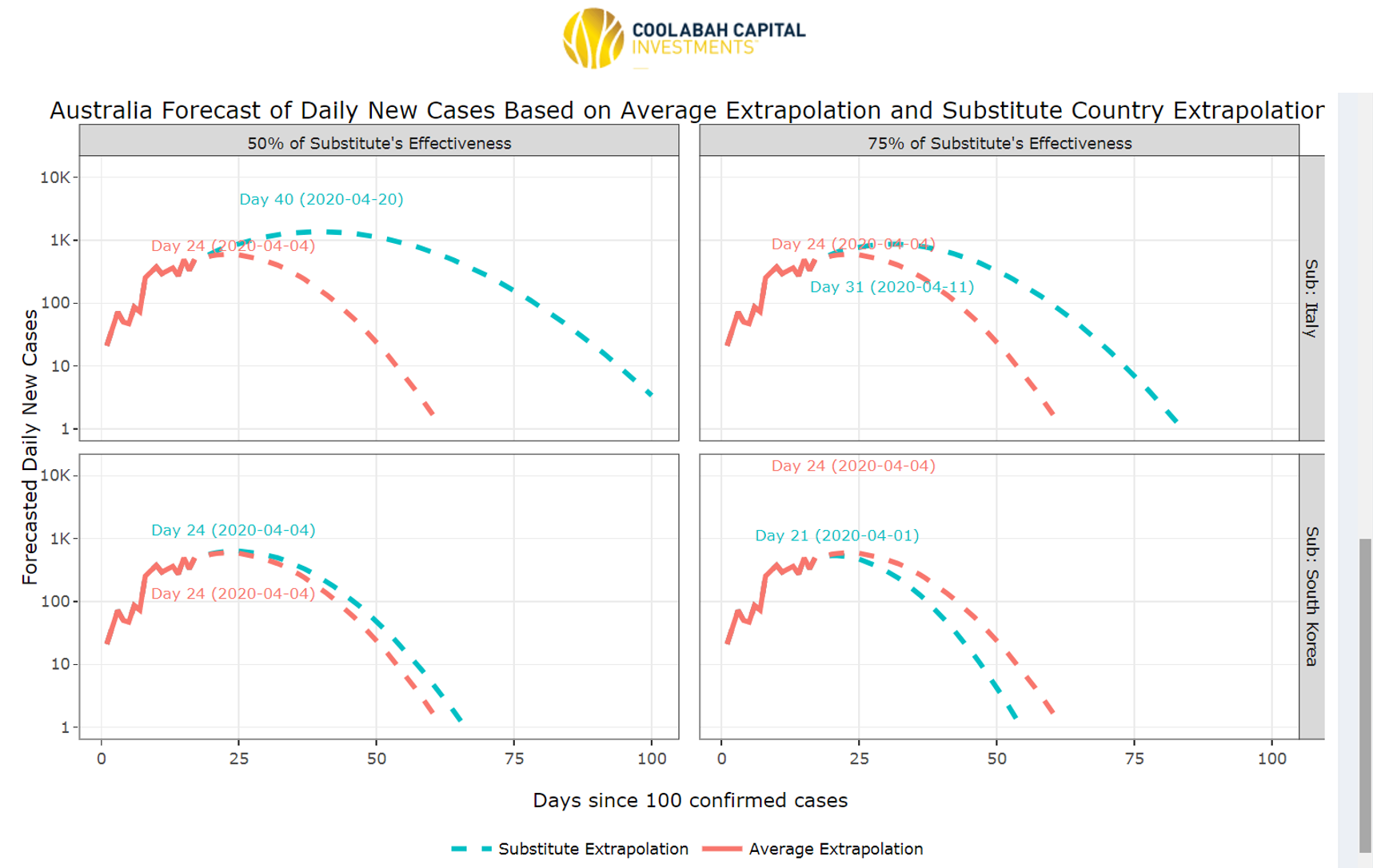

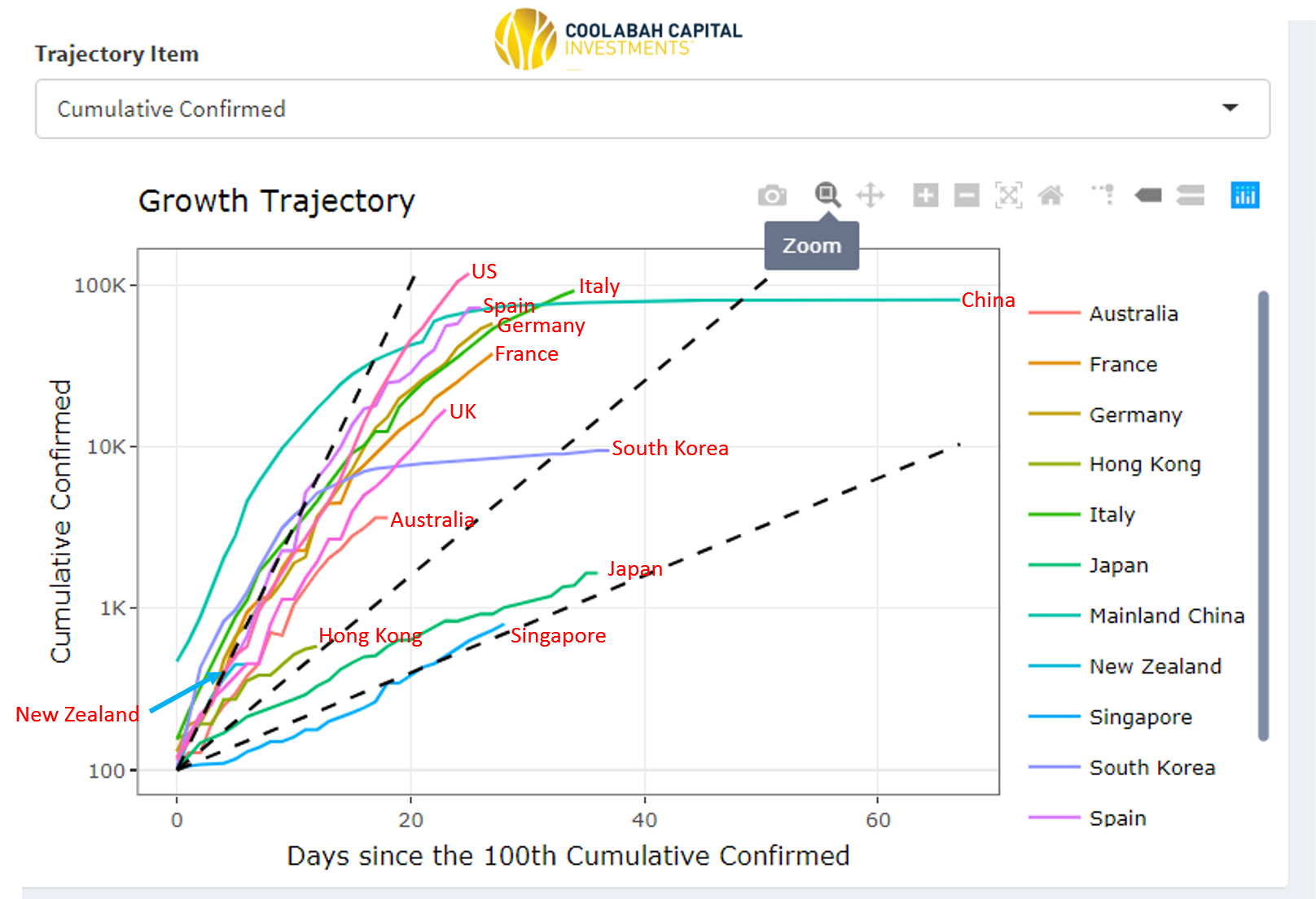

Australia's peak new infection numbers are realised between April 4 and April 11 assuming it is 50% as effective at containment as South Korea and 75% as effective as Italy (see second screenshot). If Australia is only half as good as Italy at containment, the peak in new infections is observed around April 20. Interestingly, Australia's infection rate (fourth screenshot) and, in particular, its fatality rate (third screenshot) are tracking better than North Atlantic nations with Australia's fatality rate sitting somewhere between South Korea and Japan.

- In key countries around the world, the change in restaurant bookings is broadly similar, although Australia has noticeably lagged, presumably because of slower convergence to hard containment. This does not, however, appear to have impacted Australia's relative infection/fatality performance as yet, which is slower than most global peers. (The bookings data is sourced from Open Table.)

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Chris co-founded Coolabah in 2011, which today runs over $8 billion with a team of 40 executives focussed on generating credit alpha from mispricings across fixed-income markets. In 2019, Chris was selected as one of FE fundinfo’s Top 10 “Alpha Managers” based on his risk-adjusted performance throughout his career across. He previously worked for Goldman Sachs in London and Sydney, the Reserve Bank of Australia, and founded the award‐winning research/investment group, Rismark. He has regularly advised governments, developing unique policy proposals. Chris graduated with the University Medal (Economics & Finance) from Sydney University. He studied in the PhD program at Cambridge University in 2002/03, leaving to set up his funds business.

........

Disclaimer: This information has been prepared by Smarter Money Investments Pty Ltd. It is general information only and is not intended to provide you with financial advice. You should not rely on any information herein in making any investment decisions. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Past performance is not an indicator of nor assures any future returns or risks. Smarter Money Investments Pty Limited (ACN 153 555 867) is authorised representative #000414337 of Coolabah Capital Institutional Investments Pty Ltd, which holds Australian Financial Services Licence No. 482238 and authorised representative #001277030 of EQT Responsible Entity Services Ltd that holds Australian Financial Services Licence No. 223271.

1 topic

Comments

Comments

Sign In or Join Free to comment