Livewire readers' most-tipped small caps: First-half 2021 results

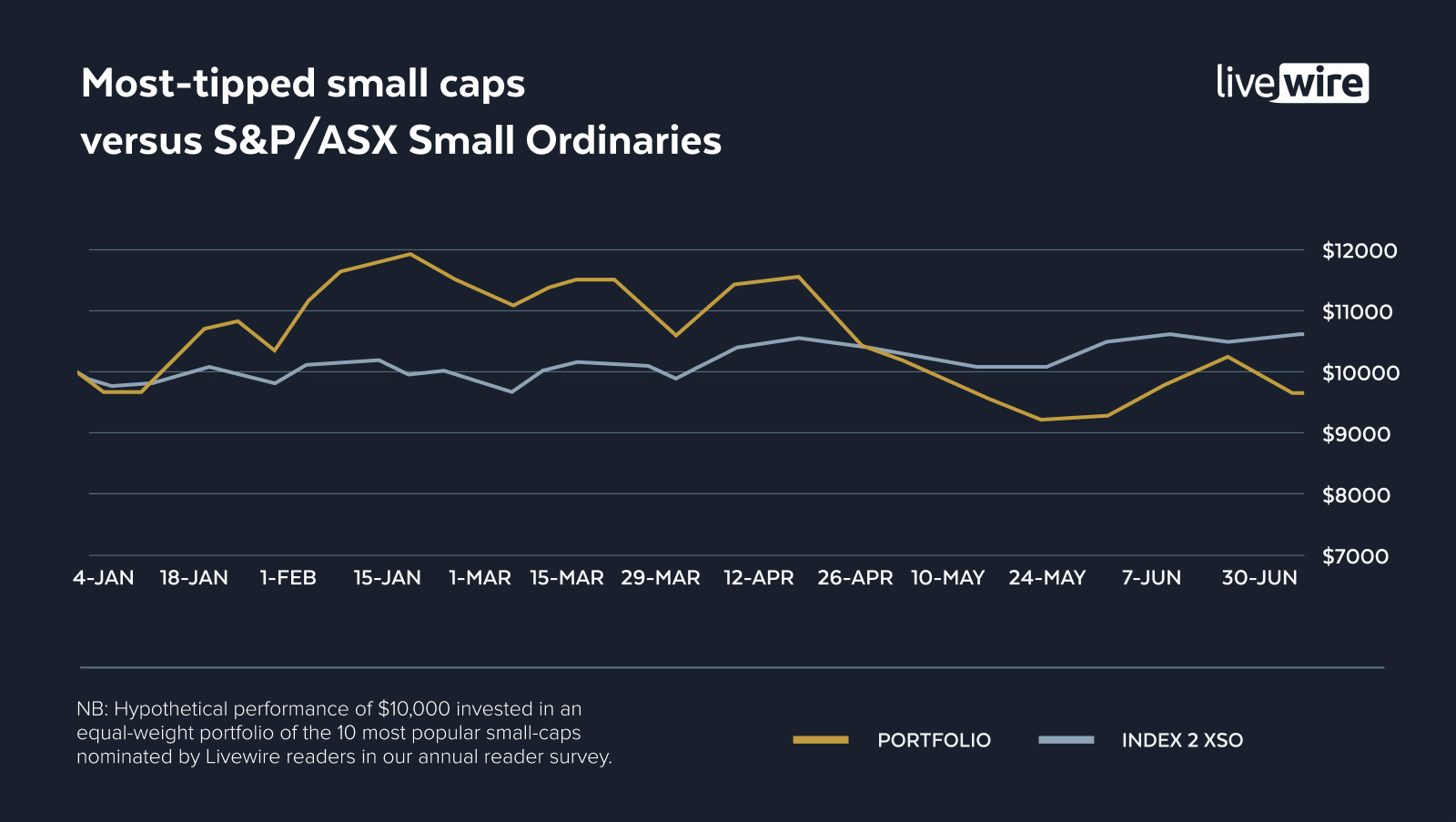

It was a tale of two quarters for your most-tipped small-cap stocks in the first half of this year, which overall returned -2% for the six months to 30 June.

Much of the damage was done in the second half, when the portfolio of stocks delivered a loss of around 7% versus a gain of around 6% from the small ords between 1 April and 30 June. This contrasts sharply with the first quarter when your most-tipped small caps delivered a benchmark-beating return of 6.9% - versus a small ords return of just over 1.3%.

This same pattern is evident in many of the individual stock performances, too. Some of the best performers from Q1 were the worst in Q2. For example, take Lynas Rare Earths (ASX: LYC). The top-tier producer of materials core to the manufacture of electric vehicles, renewables and defence materiel delivered a -7.5% for the second quarter – despite topping the chart in Q1 with a stellar 47.6% return.

Similarly, local fintech firm EML Payments (ASX: EML) was the list’s third-best performer for the first quarter, delivering an almost 16% return. But the prepaid cards and gift cards specialist blotted its copybook badly in the second quarter, backing up with a -32% return.

Local drug firm Paradigm Biopharmaceuticals (ASX: PAR) also turned an about-face. The company turned a positive first-quarter performance of just over 5% into a negative in the back-end of the half, returning -22.6% in Q2 and an overall -18.6% for the first half of 2021.

It worked the other way around for medical device manufacturer Polynovo (ASX: PNV), which returned 4.2% in Q2 after delivering a -31% in Q1 – but still ended the half with a return deep in the red.

Keep reading to find out what caused this see-saw effect in some of your favourite Aussie small-caps over the first six months of 2021 and what it could mean for the second.

The data on the stocks below was sourced from Sharesight.

EML Payments (ASX: EML)

YTD return: -16.3%

Q2 return: -29%

Market cap: $1.26 billion

An absolute shocker of a quarter for EML Payments, with a series of major events and announcements. So what happened?

In early April, the company announced the acquisition of European fintech, Sentenial Group. EML agreed to pay a total of 110 million Euros for Sentenial, which specialises in user-to-user payments, offering a platform that services major banks, blue-chip companies, and SMEs. The acquisition was well received by the market, with the stock rallying as high as $5.89 in the days following the announcement.

But that’s the end of the good news for EML. In mid-May, the company went into a trading halt for a couple of days, before announcing “significant concerns” that had been raised by the Central Bank of Ireland (CBI) against the company’s Irish subsidiary, PFS Card Services (Ireland). The concerns relate to changes the company made as a result of Brexit, and “could materially impact the European operations of the Prepaid Financial Services business.” This news sent the share price tumbling from $5.15 before the trading halt, to as low as $2.47 on the day of the announcement. This issue has not yet been resolved, and CBI has no statutory timeframe in which to complete any action, and the company has been unable to provide guidance on the impact on FY22 earnings.

The share price has recovered significantly from its low, though remains far below its pre-announcement highs, sitting at around $3.60 at the time of writing.

Lynas Rare Earths (ASX: LYC)

YTD return: 36.4%

Q2 return: -7.5%

Market cap: $5.24 billion

Lynas shareholders had a wild ride during the last quarter. The stock climbed nicely heading into April amid strong demand for its neodymium-praseodymium (NdPr) oxide, dysprosium and terbium rare earth elements – used widely in electric vehicles, renewables and defence materiel.

Having hit more than $6.60 in the prior quarter, two major share price dips occurred between the start of April and the end of June. The first saw LYC stock drop to $5.31 from $6.38 – around 16% - following its 19 April quarterly activities report. Management announced record sales revenue of $110 million for the March quarter and said customer demand had regained or surpassed pre-COVID levels. But this coincided with news that China, the world’s biggest rare earths producer, was significantly boosting production in line with rising demand for EVs, renewable energy components and defence equipment.

After paring some of these losses to reach just under $6 a share on 11 May, Lynas stock dipped again as a severe third pandemic wave swept Malaysia, where one of the company’s four operating sites is located. As nationwide lockdowns took effect from 12 May, Lynas shares again fell below $5.30. The share price has since regained some ground, closing at $5.70 on 30 June, but remains around 4% below where it started the quarter.

Avita Medical (ASX: AVH)

YTD return: 5.5%

Q2 return: 3.2%

Market cap: $0.71 billion

The big news for Avita this quarter was the US Food and Drug Administration’s approval of the company’s RECELL product for a larger patient population. RECELL is a regenerative skin treatment used on patients with severe burns. Previously, it was only approved for use in the US on patients over 18 years old, and who were suffering from "full-thickness" burns on less than 50% of their body. The treatment is now indicated for use on children as young as one month old, and with burns on more than 50% of their bodies. The share price rallied by more than 10% on the announcement and is now up 21% from the pre-announcement price.

For a more detailed discussion of the topic as it affects Avita and its shareholders, read this recent Livewire article by Montgomery Investment Management.

Electro Optic Systems (ASX: EOS)

YTD return: -26.8%

Q2 return: -17.1%

Market cap: $0.65 billion

The second quarter looked a lot like the first for EOS, and that’s not good news. The big falls followed the laser guidance manufacturer’s quarterly update at the end of April. It appears to have been a case of over-promising and under-delivering, with high corporate expenses, sluggish revenue growth, and high cash burn unsettling investors. The company burned $12.5 million through operating activities and invested another $11 million. This resulted in a $24 million drop in cash balance, which now stands at around $40 million. Unless cash burn improves soon, further capital will be required.

But some good news came on 12 May as EOS management announced an acceleration of cash receipts, with $41.5 million in cash inflows in the first six weeks of the quarter.

Management has since indicated the delivery issues and delays overhang from 2020 has now been resolved, and now has “over $100 million of finished product positioned near specified customer delivery sites.”

Paradigm Biopharmaceuticals (ASX: PAR)

YTD return: -18.7%

Q2 return: -18.3%

Market cap: $0.48m

It was a big quarter for Paradigm for many reasons, but unfortunately for shareholders, a rising share price is not among them. On the positive front, the company achieved its first revenue – a huge milestone for any drug developer. But the news failed to excite the share price.

Now for the negatives. The stock fell 6.3% on 26th April after announcing that the FDA has asked additional questions regarding their Investigational New Drug application. This might not sound like a big deal, but in an industry where FDA approval can make or break a company, any uncertainty attracts a risk premium.

May brought another seemingly innocuous announcement about the FDA’s “feedback”, “position”, and “recommendations”. But investors smelled blood in the water. The stock fell 9% on the day and hasn’t recovered since.

More updates

That's it for Livewire Readers' Most-Tipped small caps for the first half of the year. We'll be back after the third quarter with another update when we'll also bring you the FY20 results. This should give us a good indication of how companies are performing.

In the meantime, my colleagues Bella Kidman and Mia Kwok will be providing updates on the Most-Tipped global stocks and Fundies' Top Picks in the days ahead. You can read Patrick Poke's coverage of Most-Tipped large caps here. Follow their profiles to be notified when they post.

Not an existing Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors. And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

1 topic

10 stocks mentioned

2 contributors mentioned