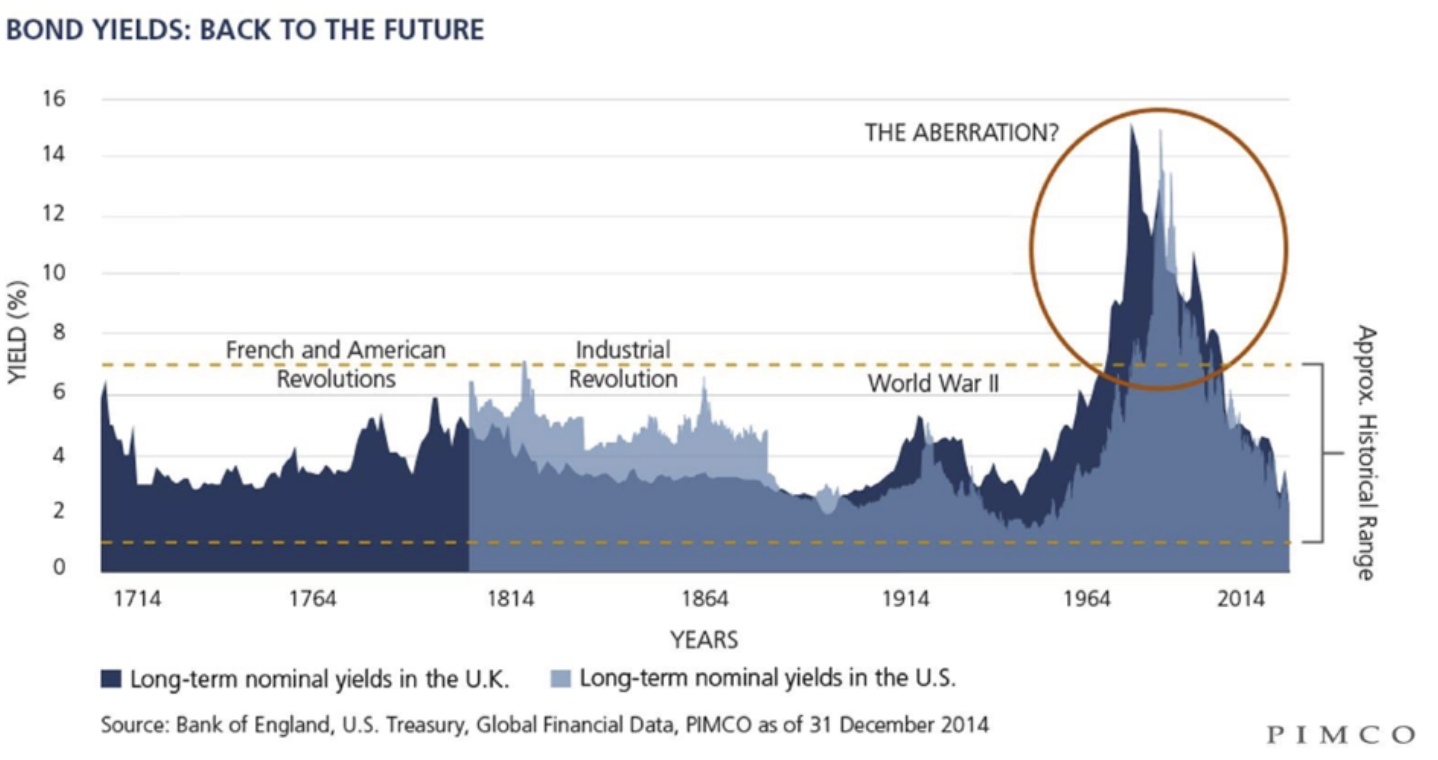

Here’s proof that low interest rates aren’t an aberration

If you’re a baby-boomer, you grew up with annual interest rates in the low teens. If you’re a millennial, interest rates above five percent are difficult to imagine. But what is the normal state of play, and what can we expect interest rates to do in the foreseeable future?

To answer this question, there is nothing like looking back over 300 years to get some perspective, as PIMCO recently did. Their research shows that during the 250 years before our baby-boomers were even conceived, nominal interest rates were fairly range-bound between about three and six percent. This is shown in the chart below.

This raises an interesting question: is it the millennials who are completely out of touch and have no idea how high interest rates could go? Or is it the baby-boomers who are the ones that experienced the aberration in the early 1980s and interest rates have simply normalized since then? The data would certainly suggest the latter.

This is probably good news for anyone that has significant borrowings to their names – and there is certainly no shortage of Australians who fit such a description. That being said, there are two things to keep in mind:

- No one really knows for sure where interest rates are going – even those who claim they do; and

- Global interest rates are roughly at their 300 year lows today – suggesting there is probably more upside potential than downside potential from current levels.

For borrowers, the prudent thing to do is to dial back borrowings to a level that can withstand a higher level of interest rate than where we are at today. And for investors in the equity markets, exposure to high-quality and undervalued financials will likely serve one’s portfolio well.

Montgomery Global’s offerings currently own two very high-quality global financials businesses which we believe remain undervalued:

- China Life Insurance (HKEx: 2628) – China’s largest life insurer in a large, growing and underpenetrated life insurance market; and

- Wells Fargo (NYSE: WFC) – a leading US bank and the country’s largest mortgage lender.

To the extent global interest rates normalize from current levels, these businesses stand to benefit and will make a meaningful positive contribution to Montgomery Global’s portfolios.