Market volatility is here - and it's good news for value investors

Rising inflation, rising interest rates, ongoing supply-chain disruption, and high volatility. Just a few issues troubling investors and central banks at the moment. While global stock markets may be gyrating, it may just be a case of who dares, wins when it comes to staying in the market and investing. In fact, the market volatility could be a value investor’s friend according to Sumanta Biswas, CFA, Vice-President and Portfolio Manager for Polaris Capital Management.

“When stocks come down, we get a lot of opportunities to buy. When those same stocks rebound, we could see opportunities to sell at a premium.”

He believes now is the time for value investments and focuses on good management, good valuation and sustainable cash flows, with the Polaris screens identifying undervalued, attractively priced companies across emerging and developed market countries.

In this wire, Biswas shares his views on:

- The economic outlook through the end of 2022

- Where to find value opportunities in energy and technology

- How to best ride out the current market

How do you see the current economic environment evolving over the next 6 months?

We recently met with around 16-17 companies in New York over two days. The general feeling was that business is getting better, though many of the companies expect a protracted economic recovery. In our opinion, the next 6 to 12 months will be unchartered territory due to inflation, energy inflation in Europe, supply chain issues, geopolitical risks and a slowdown in GDP growth.

One thing you can be assured of is volatility. We expect to see a lot of volatility, and that is a real advantage for investors like us. When stocks come down, we get a lot of opportunities to buy. When those same stocks rebound, we could see opportunities to sell at a premium – as a result, volatility is our friend.

As value investors, we have a lot of flexibility in investing in any geography, industry or market cap. This opens up a world of options, especially in tumultuous times. Take energy – in general energy exporters will benefit, but energy importers will not. The same dichotomy holds of materials, industrials and even consumer discretionary stocks. We found that some geographies re-opened up more quickly post-COVID, while others have not.

Is now the right time for value investments?

Growth investors have benefitted from a strong run over the past 13 years but we are starting to see a reversion to value.

Typically, value performs well when there is inflation and GDP growth. We have a lot of the former, we don’t have the latter.

Don’t get me wrong, worldwide GDP will likely grow. We expect it will grow at better rates than during the pandemic years, but not at the 3% rates seen prior to the pandemic. And the higher inflation rates disproportionately hurt growth and tech stocks, as analysts start revising down estimates.

Conversely, value stocks should start to run up on higher inflation and renewed pricing power, along with new infrastructure spending and early stages of economic expansion. Cyclical value sectors, like materials and financials, are primed for success. Commodities, in particular copper, or iron ore, have done well; as prices rise, companies selling these materials are in a perfect position.

How do you go about identifying value opportunities?

We have a front-end screen of 40,000 companies to produce a list of approximately 500 companies that appear to be the most undervalued in the world. From this point, we do fundamental research to determine if a company is worthy of investment. The bottom-up research process is 90% of our time, digging into the company, conducting due diligence and traveling to facilities. We do extremely intensive research, and then roundtable each stock proposition with the entire investment team, before determining if a company is a good value fit for our portfolio.

To give you a few examples, we bought a U.S. company that’s one of the largest DIY hair colouring companies. They have a huge market share, with a loyal customer base who consistently use the same hair dye products, getting salon quality results at a fraction of the price. The company is branching out into omni-channel and Amazon sales, which should only increase their market share.

We purchased a U.S. private student loan company that funds college tuition; this company has 60-70% of market share and isn’t subject to the government’s loan forgiveness scheme.

We also bought a copper company that has done very well, especially in light of the commodity scarcity. Additionally, with copper going into green electrification, there’s increased supply-demand constraints likely to help boost prices.

Where do you see unique pockets of opportunity geographically?

From a geographic perspective, the large majority, almost three-quarters, of attractive investment ideas are in the U.S., Asia and emerging markets. While many investors may shy away from emerging markets fearing a rising U.S. dollar, we believe that many companies based in these countries are exporters and will benefit from higher prices.

Today, I would say that approximately 10% of our portfolio is invested in emerging markets.

Investors often lump all relevant countries into one category for emerging markets. This generalisation does a disservice to the countries involved, each of which has different investment cycles, GDP, interest margins and credit structures. The one commonality is that many of the countries are sitting on stronger balance sheets than they were in the financial crisis, and ran up less debt during the pandemic. Other than that, China, Brazil, South Africa, Thailand, Singapore and Korea are all very different from one another.

A lot of the Southeast Asian countries are energy export powerhouses; the stronger U.S. dollar benefits them. There will be pockets of opportunity in this market for keen stock pickers like us.

Where do you see unique pockets of opportunity on an industry basis?

In the current market, we see opportunities in financials, industrials, materials, consumer discretionary and information technology sectors. Diving deeper into sub-sectors, we are seeing good value in auto suppliers, housing, construction, chemicals, retail and real estate.

We are looking at sectors and stocks that irrational investors often shun; fundamentally strong companies unfairly punished that are ripe for a rebound. That is where we believe we can make money as contrarian investors.

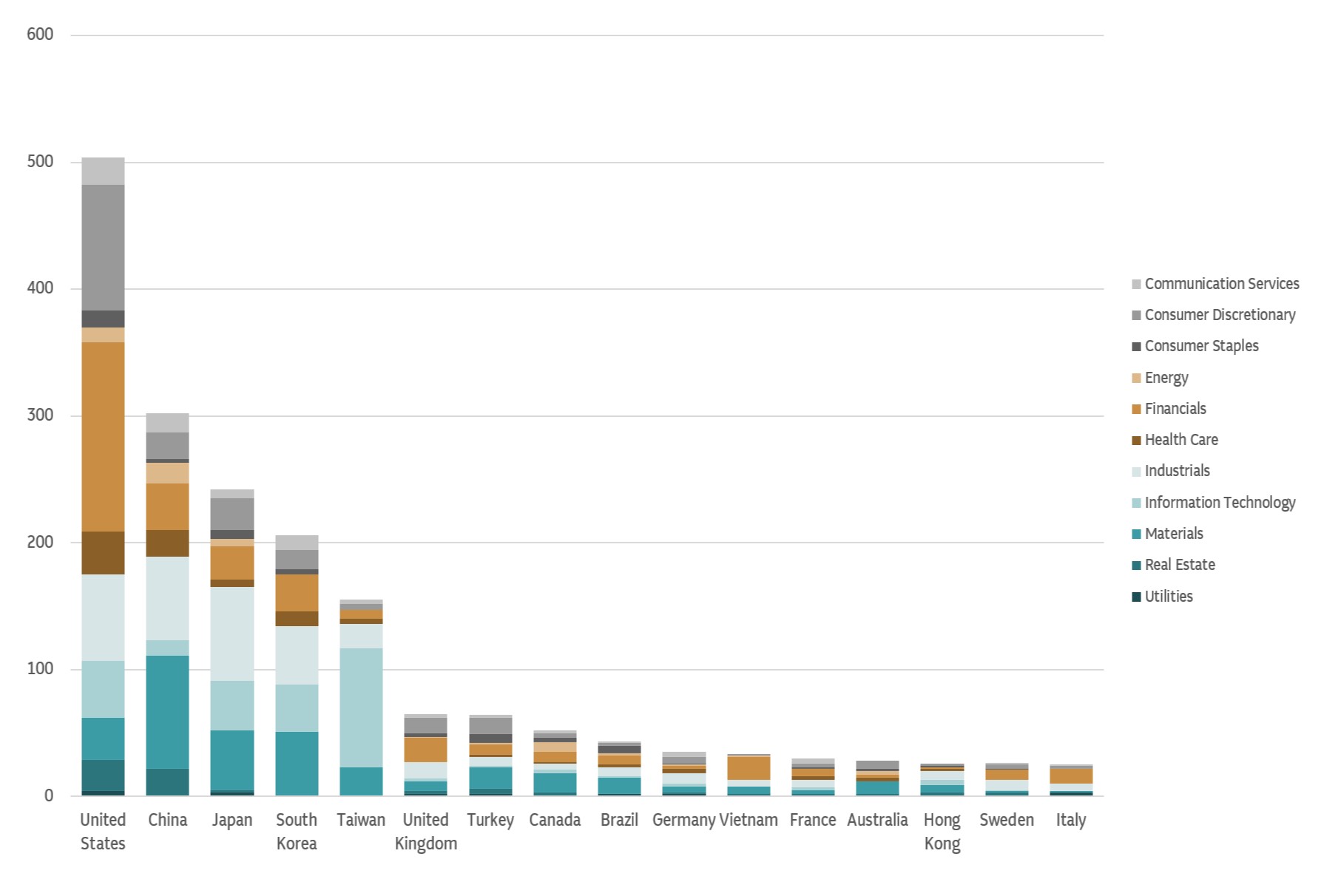

Valuation screens by country

Are there value opportunities in technology now that prices are coming down?

When we talk of tech, most people think of platform companies like Facebook, Spotify and the like. They have still not come down to our valuation standards. If you look at the next layer, hardware and software companies are a busy industry. The IBMs and Intels of the world are a much more exciting space for us. We have a few of those types of companies in our portfolio and we’re looking to add more in that space.

How should investors approach energy markets given the volatility?

It depends on which part of the energy value chain you're looking at because they are very different. If you look at oil exploration, there have been multiple years of under-investment and a natural decline of around 6% in the largest oil fields. So the supply is dwindling while demand is rising in a post-COVID environment. Being conservative and focused on downside risk, we are not comfortable with the very high oil prices built into the valuation of most of the major oil conglomerates.

Conversely, we have plenty of gas in the world and the world will need lots in the form of LNG (liquified natural gas). We expect to see a lot of LNG going to Europe in the coming decades. Israel, Japan and China are already consuming tonnes of LNG. It’s a very good space up and down the value chain from gas to LNG.

Other energy sources, like nuclear, are not on the radar for most developed countries; while emerging markets (China & India specifically) are developing nuclear projects very aggressively. And finally there are renewables. There is a lot of supply coming on from both wind and solar energy, however there are still many areas in the world where renewables have not reached grid parity without subsidies. Even after it does reach grid parity we still need to solve the problem of energy storage. Without this, we believe fossil fuels and nuclear will continue to have an important role to play.

What tips do you have for value investors going forward?

First: Value has historically outperformed growth over long periods of time.

There is plenty of historical proof to that effect. The data covering nearly a century in the U.S. and 50 years in non-U.S. markets supports the notion that value stocks can have higher expected returns.

We believe the current growth trajectory is simply unsustainable, with one of the longest bull runs in decades. What led to this growth momentum: low interest rates, yield curve inversion, stronger earnings, COVID-19 disruption and the ensuing excess liquidity to stabilise economies worldwide.

All of this caused stock prices to jump to untenable levels; where once the mean price-to-cash flow was around 8-9 times, more recently the mean price-to-cash flow jumped as high as 13. Basically, growth assumptions for these companies have been extremely high off of a very high base; and we don’t think this can last. We are already seeing signs of the tech high flyers and FAANGs starting to crumble.

Second: Investors should have patience.

You’ve got to think long-term, 3-5+ years and use these negative reactions of the market as buying opportunities.

We capitalise on irrational market behaviour; we dig through the noise and pessimism to look at a company’s fundamentals, cash flows, balance sheet and management. And often times we find strong, well-managed companies trading at attractive valuations during these market corrections. In each cycle the reason or reasons for the correction may differ but every correction finally ends. We believe that trying to keep emotion out of investing and sticking to a strict value discipline even in volatile times should provide an edge.