Markets on high alert

Nothing good results from panic. History has reinforced this point time and time again. It is our response to the crisis that is critical. Global central bank intervention has been swift, coordinated and innovative. They have a good track record since the 2008 global financial crisis and they have shown they can adapt. This will continue. Government response over the past week has seen some of the most aggressive fiscal policy announcements for some time. More is needed. This is the time for bold and large fiscal stimulus to complement the very stimulatory monetary policy.

Equity markets, and risk assets in general, have always been driven by both fear and greed. There are significant uncertainties in the current market turmoil and the dislocation in markets is the result of these uncertainties. The human and health impact of the Coronavirus (COVID-19) has amplified our fears. Our privileged lifestyles have been impacted and the lack of resilience is notable. However, as difficult as it sounds, there will eventually be an end to the current severe crisis, there will be a health solution, and societies and economies will slowly begin to recover. Get comfortable being uncomfortable for now.

Market pricing in global recession

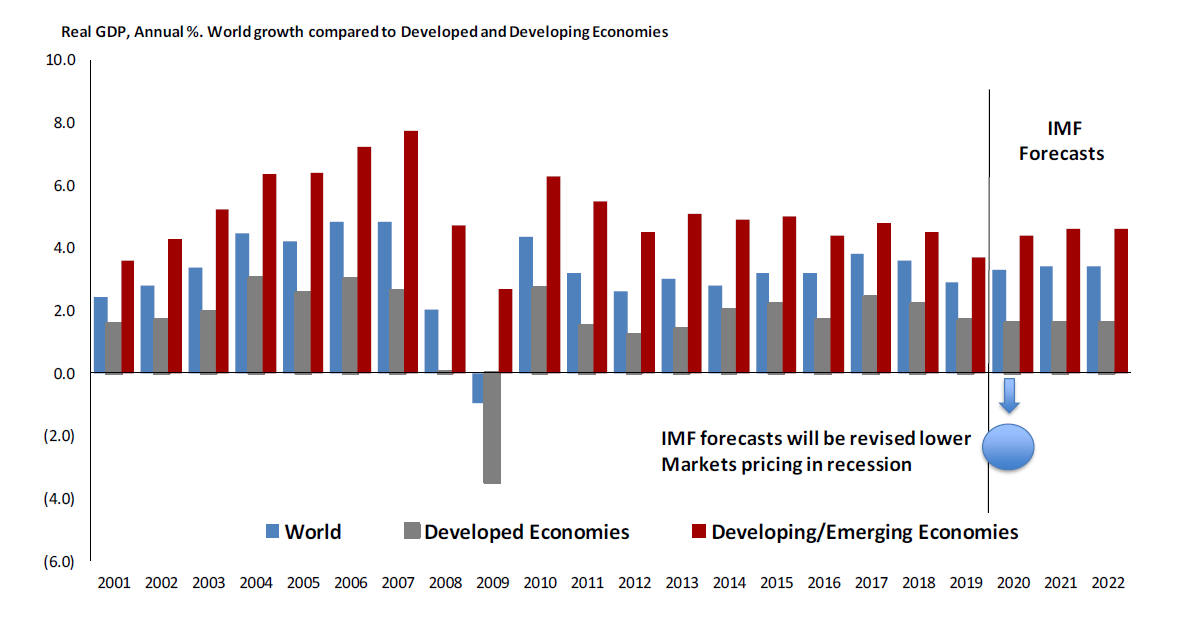

Global growth forecasts from the International Monetary Fund (IMF) in January 2020 were for a 3.3% and 3.4% growth outlook for 2020 and 2021 respectively. These were already revised downward earlier this year, however, it is clearly obvious that the 2020 forecasts will be revised significantly lower as the marketprices in a global recession. Global recessions are rare events. Chart 1 shows global GDP by developed,emerging economies. As economies go into the current self-imposed quarantine, the degree of thedownturn will be a function of how long it takes for economies to get back online. This will be a function ofthe COVID-19 case trajectory across major economies.

Chart 1: IMF Global Economic Growth Outlook

Market beginning to price in a global recession as economies go offline to self-quarantine. Global recessions are rare with the 2008 global recession the most severe for over 50 years. The policy response today has become more adaptive and flexible, unlike the 1930s where the wrong fiscal and monetary policy amplified the depression. Interestingly, GDP per capita since 1950 has also increased with the average person 4.4 times richer today. Economies do rebound quickly following periods of severe disruption.

Source: IMF, K2 Asset Management

Given the significant challenges ahead, there has been a swift, aggressive, coordinated and innovative global central bank (CB) intervention. The Fed, BoJ, ECB, BoE, PBoC and RBA all delivered aggressive monetary policy solutions. Many other central banks have followed. More is expected to be delivered and the central banks continue to step up.

The fiscal stimulus is only just getting started globally and more will be needed.

The invisible hand requires more aggressive government assistance.

Fiscal policy must be bold and adaptive for the times. This will vary but should also include part equity ownership in key industries and sectors from governments. A similar program was used in the US through the 2008/09 global financial crisis. There is good precedent from the worlds largest economy.

Underpinning the global economy for the eventual turn around needs to include the employment outlook as this underpins the fragile household confidence. In addition to more aggressive, targeted and innovative fiscal response by governments, there will also need to be a partnership with key global pension and sovereign funds, private equity and venture capital firms. The cash balances are in the trillions and they all have a vested interest to assist the economic recovery once we get through the uncertainties of the current COVID-19 health challenges.

Lower rates critical part of the solution

Part of the solution will be historic low rates and central backs participating in targeted quantitative easing to keep the yields of the risk-free swap curve as low as possible. Given that governments will need to accelerate their respective fiscal stimulus, they will need to issue greater supply of long dated bonds to fund the program. It is noted that heading into the previous 2008 severe global correction that rates were higher and therefore the ability to apply monetary stimulus was at a better starting point. However, that does not remove the critical importance of keeping rates near zero for as long as it will take. This time, there will be more aggressive and sustained fiscal policy to complement global central bank efforts.

The official cash rate in Australia will remain at historical lows near zero for the foreseeable future. Chart 2 illustrates the Australian official overnight cash rate setting for nearly 50 years. When the economy comes back online, the recovery period can be relatively swift given the current interest rate settings.

Chart 2: Official RBA cash rate over the long run

Cash rates now at new historic lows as Australia has caught up with many developed economies with near zero cash rates

Source: RBA, K2 Asset Management

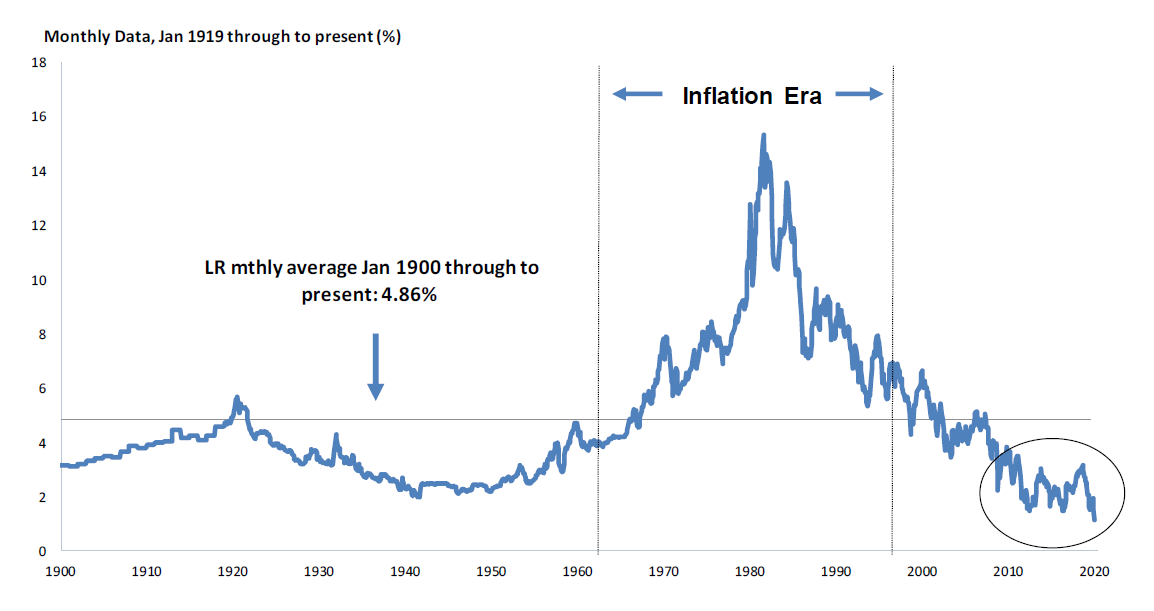

Long bond yields will remain one of the key drivers for the recovery, particularly US treasuries. Chart 3 illustrates the US nominal long bond yield over the past 120 years. The worlds largest economy has started to roll out a USD $1 trillion emergency stimulus program. This will only be the start and one would expect this to more than double. Importantly, this will be followed with additional stimulus from the worlds second largest economy, China. Given prices of iron ore, met coal and thermal coal have been holding up, they are clearly stock piling and are preparing a fiscal stimulus package that may exceed the US.

The combination of these two massive competing and different economies rolling out such aggressive fiscal stimulus, will lead to a global recovery when there is the eventual return to normal as economies go back online following the inevitable health solution.

Chart 3: US 10 year bond yield over the long run

US nominal bond yields currently near record lows. The ongoing central bank buying will assist in keeping the yield as low as possible. Therefore the equity earnings yield (despite the uncertainty) will remain compelling vs both cash and bond yields for the foreseeable future.

Source: Bloomberg, K2 Asset Management

Market valuations and outlook

Equity markets are clearly finding it difficult to price future earnings when they have no ability to get a grasp of the earnings outlook as parts of the economy go into temporary shut-down. This is partly why the current sell off in equity markets is now the quickest in history (number of days from the peak to a greater than 20% sell-off). Previously the quickest market correction (of greater than 20%) was 1929 and 1931-32. Markets fear uncertainty and while they know earning will bounce back eventually, they are consumed with the 2020 outlook of collapsing corporate earnings on a aggregate level.

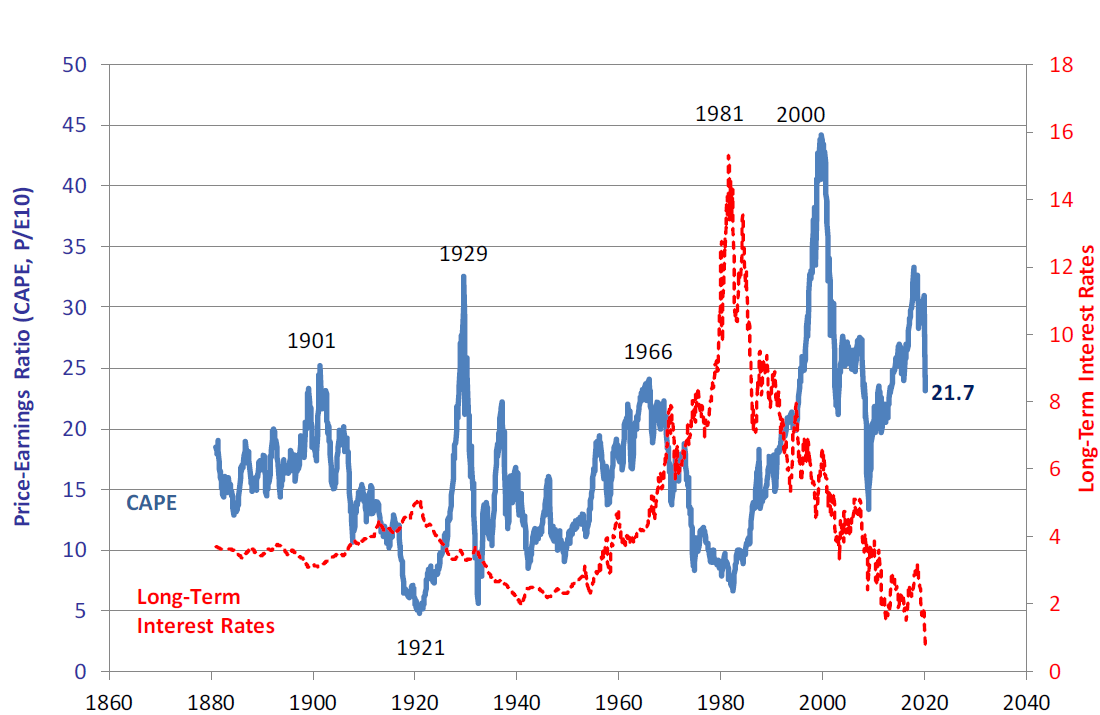

So what is a practical measure to use in the time of such excessive market dislocation? We know from behavioural finance that while volatility will remain very elevated for now, investors will find it difficult to interpret valuations. Using the standard P/E multiple is of less use when the denominator (EPS) one year forward means so little for the years ahead. The cyclically adjusted price to earnings ratio (CAPE) effectively looks at the rolling 10-year EPS outlook at the current (spot) price. Chart 4 illustrates the CAPE plus long bond yields for the US market over the past 150 years. This is a more stable way to review valuations given it will be unreasonable to assume earnings do not grow in the future. EPS outlook will once again turn positive on a one year outlook as soon as economies begin to come back online and approach full capacity.

Chart 4: The Robert J Shiller cyclically adjusted real P/E (CAPE) since 1871

The well know Prof Robert J Shiller (refer “Irrational Exuberance”, Princeton University Press) illustrates 150 years of the CAPE and long bond yields. There is already a sharp correction when using rolling 10 year average real EPS data. Note the historically low long bond yields combined with targeted, coordinated monetary and fiscal policy imply equity valuations are compelling.

Source: Robert J Shiller, Yale University

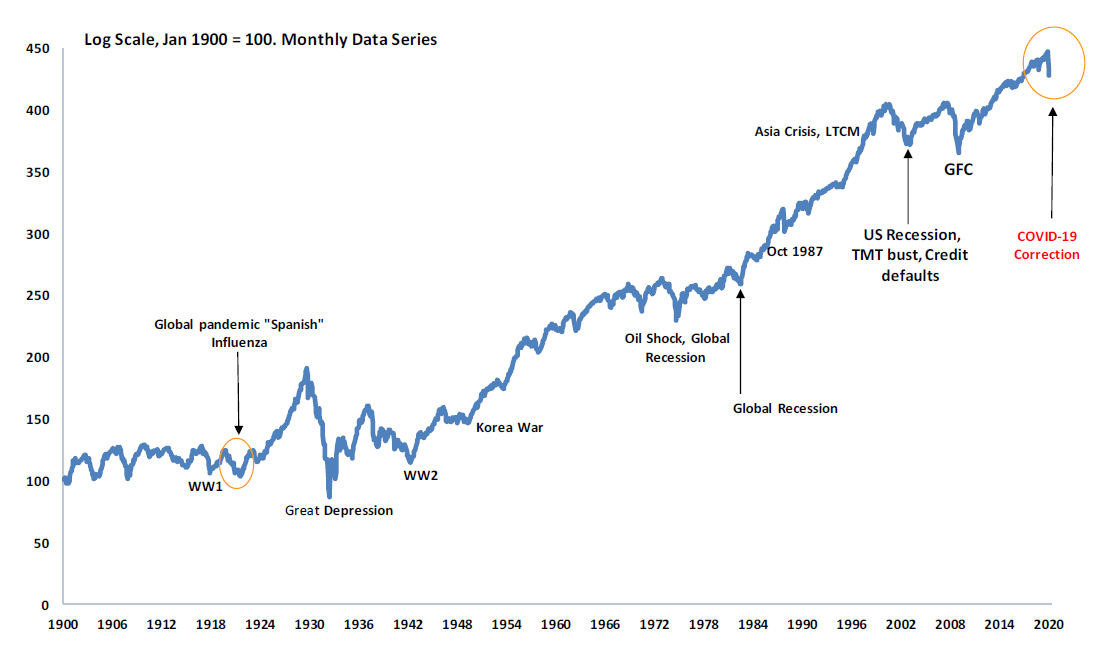

In times of excessive market volatility that exhibit significant dislocation across the asset classes, such as the current period of uncertainty, it is useful to reflect on the long run performance data. It is always good for perspective as many investors react emotionally which can negatively impact their wealth creation.

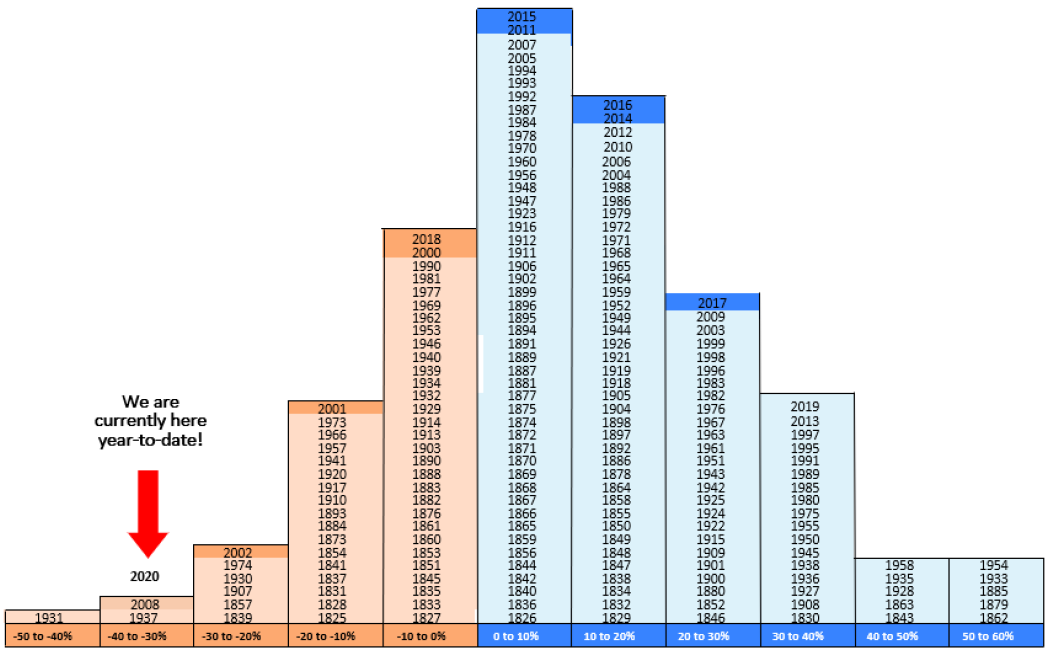

Chart 5 illustrates the long run annual equity performance data for US equities since 1825. There have been more than enough significant global events over this period and economies and markets have always recovered. The annual performance over the past 195 years is a conventional normal distribution but with a skew to the right. This should not be surprising as there have been 71% positive annual returns (139 positive annual years) compared to 29% negative (56 negative years inclusive of 2020). This reflects that economies expand more than contract and therefore earnings expand more than contract. Selling equities today will not be the solution for those looking to create wealth over the longer term.

Refer to Chart 6 for a timely reminder that equities as an asset class delivers strong returns over time however it is a volatile asset class. Predicting future prices is not always an easy task, however economies and therefore earnings, expand more than contract over time.

Chart 5: Annual performance of the S&P500 since 1825

There have been 139 positive years (71%) and 56 negative years (29%) in the US equity market over the past 195 years (inclusive of current year-to-date). Economies expand more than contract over time, therefore earnings expand more than contract.

Source: Global Financial Data, Bloomberg, K2 Asset Management

Chart 6: Long run perspective. S&P 500 equity returns following many challenging global events

Source: Global Financial Data, Bloomberg, K2 Asset Management

Outlook summary

As we look towards the year ahead the market is pricing in a severe global recession, which is a rare event. The COVID-19 event has taken large economies offline in an effort to minimise the contagion rate. Earnings have been impacted. There are significant challenges ahead as economies deal with the current health pandemic crisis. However, the policy response is critical. It will impact how investors behave.

Globally, central bank intervention has been swift, coordinated and always innovative for the times. They have continually stepped up to deal with the many market challenges since the mid 1990s. The complimentary global fiscal response from governments has started. This now needs to be very large, bold, coordinated and innovative for the times. Don’t hold back. The invisible hand requires some assistance.

Investors do not like uncertainty and history has shown this.

History has also illustrated time and again, that there will be a solution and the eventual recovery. Nothing good comes when you panic. Holding your diversified investments with a long-term view at current valuations is a very reasonable position.

There will be investors that will not deal well with the excessive volatility. There will be fear and desperation that will lead to capitulation. Those investors who capitulate will experience regret in the future. There will eventually be a health solution. Economies will bounce back following the excessive coordinated stimulus and they will get back to full capacity as employment and earnings rebound.

Learn more

In addition to identifying undervalued stocks, K2 has the ability to actively manage equity market exposure and currency exposure as well as having the ability to short sell. To find out more, hit the contact button below or visit their website for more information.