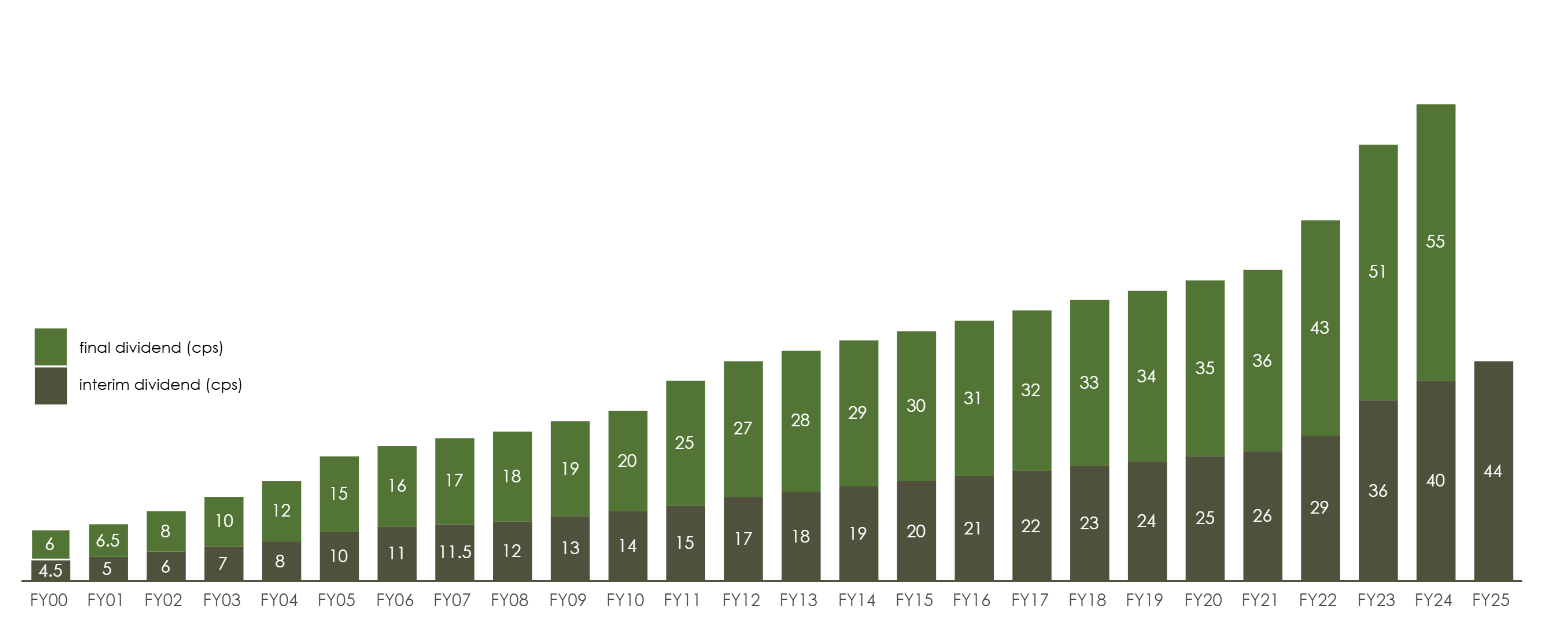

Meet the ASX’s first dividend aristocrat: Soul Patts records 27 years of growing payouts

Washington H. Soul Pattinson (ASX: SOL) achieved a historic milestone in becoming the market’s first ‘dividend aristocrat’ – a company that has increased its dividend annually for 25 years or more.

Last Friday, the company announced a final dividend of 59 cents per share, taking the total ordinary dividend for FY25 to 103 cents per share, up 8.4% year-on-year.

Soul Patts was widely expected to mark its 25th consecutive year of dividend growth this year. However, during preparations for its 125-year listing anniversary in 2028, a corporate historian discovered the company had actually been increasing its ordinary dividend every year since 1998 – extending the streak to 27 years alongside 122 years of uninterrupted dividend payments.

The quiet achievement reflects Soul Pattinson's understated approach to wealth creation, coinciding with its proposed merger with longtime holding Brickworks after a 56-year relationship.

Dividend durability

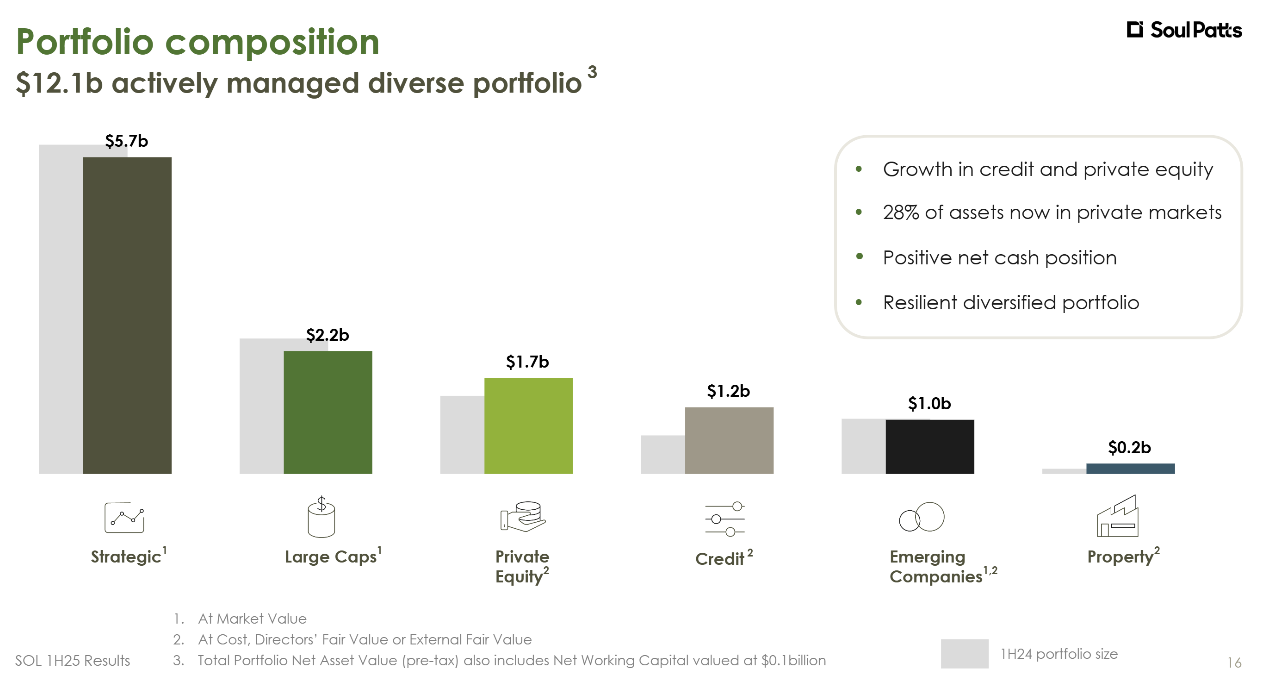

Soul Patts' dividend durability reflects strategic portfolio rebalancing over the past three years, with private equity, credit and other unlisted investments now comprising 28% of its total pre-tax net asset value.

This unconstrained investment mandate provides the flexibility to capitalise on opportunities across market cycles, supporting its ability to maintain dividend increases even during challenging periods.

Management expects the focus on private credit and private equity to deliver strong risk-adjusted returns and portfolio diversification benefits over the short-to-medium term.

The GFC and pandemic

The 2008 Global Financial Crisis and 2020 Pandemic represent two most challenging periods for corporate earnings in recent memory. Yet, Soul Patts managed to thrive thanks to strategic asset sales and corporate transactions within its portfolio:

- FY08: Net profit rose 14.1% to $113.1 million while the investment portfolio returned 34.6% versus the ASX 300's decline of 16.1%. This outperformance was largely driven by its 61.2% stake in New Hope during the coal boom. The dividend increased 5.2% to 30 cents per share.

- FY09: Net profit surged 98.6% driven by New Hope's $2.45 billion coal asset sale to BHP. The ordinary dividend rose 6.6% to 32 cents per share, and further bolstered by a 25-cent special dividend.

- FY20: Regular profit fell 44.7% to $169.8 million amid COVID challenges for key holdings like New Hope and Brickworks. Though statutory profits jumped 284% to $953 million due to the merger between TPG and Vodafone. Net assets still outperformed the All Ords with a -5.3% decline versus -12.2%, and the dividend increased 3.4% to 60 cents per share.

Soul Patts currently retains defensive portfolio positioning, reflecting management's view that investment markets remain volatile amid a complex geopolitical environment. However, the diversified asset base is expected to provide resilience should softer economic conditions emerge.

Brickworks merger maintains dividend philosophy

The key merger benefits include:

- Enlarged capital base with greater liquidity and expanded free float

- Stronger balance sheet supporting investment capacity

- Enhanced operational scale for pursuing new investments

- Unified management team led by Todd Barlow as Managing Director and CEO

- Board chaired by Robert Millner AO with nine members total

The proposed merger represents an evolution rather than revolution for Soul Pattinson, maintaining its core investment philosophy while creating additional scale and diversification opportunities.

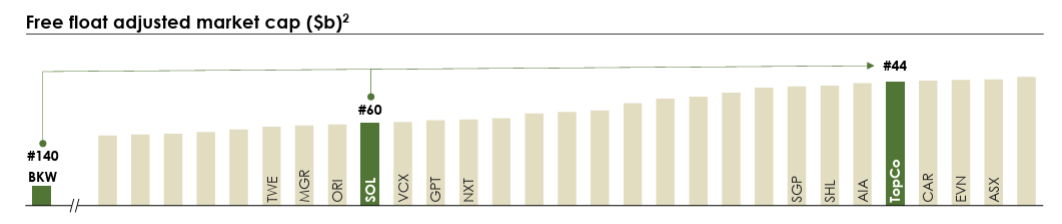

Interestingly, shares in Soul Patts rallied 16.4% on the day of the merger announcement, likely reflecting index-tracking funds and ETFs front-running the stock's potential inclusion in the ASX 200. The merger significantly increases shareholder liquidity, addressing one of the key barriers that has kept the company out of the benchmark index.

The next aristocrat

There are only three other S&P/ASX 200 companies that have maintained or increased nominal dividends for 14 consecutive years or more. That being:

- APA Group (ASX: APA) – An energy infrastructure business

- AUB Group (ASX: AUB) – An insurance broker and underwriting network operating across 450 locations in Australia and New Zealand

- Charter Hall Group (ASX: CHC) – One of Australia's leading fully integrated property investment and funds management groups

However, they all have many years to go before achieving dividend aristocrat status.

Interestingly, the S&P 500 boasts 69 dividend aristocrats, which is a rather extraordinary feat to have almost 15% of the index record such a dividend streak.

4 topics

4 stocks mentioned