Memo to Howard Marks: Government Debt is the New Subprime

Howard Marks is one of the greatest investors and investment strategists of the last 20 years. His firm, Oaktree Capital has delivered extraordinary returns for its investors since its inception in 1995. His investment thoughts and strategies are highly regarded by pension and sovereign wealth funds around the world with his memos widely read by both institutional and retail investors. In many ways Narrow Road Capital aims to grow to be an Australian focussed equivalent to Oaktree Capital, albeit with much, much lower fees.

Those who have followed Howard’s recent memos will have seen his warnings that markets were optimistic and overpriced. In my recent memos I’ve called this the season for weeding and pruning, as it gave investors the opportunity to sell weaker assets at high prices and be cashed up ready for a downturn. In Howard’s first January memo he reflected on the recent fall in asset prices and the rise in volatility. His conclusion is that yes, much of this sell-down is deserved, but that it probably won’t be as bad as 2008 as there isn’t a current equivalent to subprime in fragility and magnitude. This memo is a challenge to that assertion.

History is the Most Knowledgeable Guide for Credit

Mistakes in credit investing often come from ignoring the lessons of history. Assumptions like “this time is different” or this “borrower cannot default because…” have lead many investors astray. US subprime investors assumed that (a) borrowers with insufficient income would still be able to repay loans through sale of the property because (b) house prices never go down. Both assumptions were wrong and a simple review of history would have revealed that. For many mining and energy companies today, their debts were serviceable based on commodity prices not falling by more than 20-40%. Again, a review of long term prices for commodities reveals that much greater falls are possible.

In the realm of government borrowing I’ve often heard people say things like “this country cannot default because no one will ever lend money to them again”. The people making such claims ignore history as many countries have defaulted and returned to the capital markets within 5-10 years. Greece’s default in 2012 and return to the bond markets in 2014, without addressing the fundamental economic problems it faces, is proof that investors can have remarkably short memories for sovereign defaults. Reinhart and Rogoff have (see “This Time is Different”) and continue to remind us that sovereign defaults are neither unusual or unpredictable.

Another key lesson from history is that where debts have grown the most, particularly when measured against the ability to repay, is where the highest credit risk is. Rating agencies do a decent job on assessing this risk for corporates. If a company increases its debt by 20% but its earnings only increase by 5% that is very likely to lead to a downgrade in its credit rating. If this pattern continues over years, the credit rating will be downgraded substantially and eventually be at level that indicates default is highly likely in the near term. The track record of rating agencies with financial institutions, securitisation and governments is not nearly as strongly as with corporates, but there is still a high correlation between increasing debt and/or falling profits and rating downgrades.

The Current Situation for Government Debt

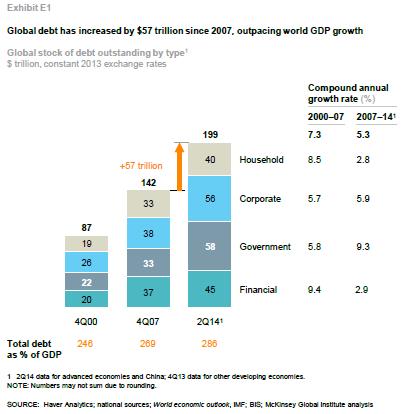

The 2015 McKinsey report Debt and not much Deleveraging highlighted that in 2000-2007 debt to consumers and financial institutions grew at 8.5% and 9.4% per annum respectively. Not surprisingly, defaults on US subprime housing and bailouts or collapse of banks around the world were key issues in the financial crisis. In the 2008-2014 period the largest growth has been in sovereign debt, up by 9.3% per annum. This rate of growth far exceeds global GDP growth, which is the easiest measure to track of government’s ability to source income to repay their debts.

Most forecasts have global GDP growth slowing this year and inflation levels for much of the world near zero. Together these factors mean that governments will have minimal tailwinds to help them service the increasing level of government debt. Quantitative easing and low reserve rates have made debt servicing easier, but those tools are subject to dramatic failures if citizens or lenders lose confidence in a government’s ability and commitment to repay debts. Venezuela is suffering runaway inflation and depletion of its foreign exchange reserves, again showing the perils of running a deficit and printing money. Whilst Japan has not yet experienced the hyper-inflation of Zimbabwe or Venezuela, it cannot endlessly print money and run budget deficits without dire consequences.

In making some general comments about government debt it is helpful to split the discussion into three groups; developed markets, China and emerging markets. I note at the outset that the problems amongst each group are not homogenous, but these groups help in identifying the key issues that many in that group face. For instance, some emerging markets are very focussed on exporting commodities whilst others primarily export manufactured goods. The relative quantum of debt within each, as measured by debt to GDP ratios can also vary wildly.

Lastly, I’m conscious that being early and being wrong are indistinguishable for many. I’m not predicting that 2016 will bring widespread sovereign defaults, but there’s a great risk that if austerity isn’t widely adopted some major countries will lose the confidence of lenders in the next five years. I’ve seen enough distressed situations to know that the inevitable doesn’t happen immediately and that unforeseen solutions can arise for seemingly hopeless situations.

Government Debt in Developed Markets

In developed markets the story is typically one of slow GDP growth but rapid growth in both explicit government debt and off-balance sheet liabilities. The off-balance sheet liabilities mostly relate to aging populations with the future holding a much greater demand for pension and welfare payments to older citizens as well as greater demands for healthcare. Under-investment in infrastructure is another way governments have been postponing expenditure. Bailouts of banks is another iceberg that can cause a shipwreck, with Ireland’s government debt to GDP ratio going from 44.5% to 121.7% in four years primarily as a result of poor lending and bank bailouts.

In the US, Federal, State and Local Governments have very large unfunded pension liabilities which will have worsened with the recent falls in equities and other risk assets. Disputes between Chicago teachers and the Governor of Illinois have resulted in a surge in borrowing and in the interest rate paid on new debt. The bankruptcy of Detroit in 2013 and the likely default for Puerto Rico this year are other examples. There’s no easy answer to these issues but the solution typically involves a combination of:

-

higher taxes (leading to more mobile citizens relocating to lower taxing cities),

-

reduced spending (which increases unemployment and perpetuates a cycle of further decline), and

-

defaults on existing obligations, with both retirees and lenders seeing their payments cut.

None of these options are painless. Governments that have their own currencies also have the option of printing money, a pathway the US, Europe and particularly Japan have used.

The US is the easiest developed market example to point to simply because there is greater reporting of the problems. In Europe, Italy has both terrible demographics and a very high government debt to GDP ratio as well as a banking system with imminent solvency issues that may require government bailouts. However, France, Germany and the UK have much higher debt ratios when off-balance sheet liabilities are included. On practically any measure, developed nations are becoming more indebted with no substantive plans to reduce their debts. Other than Greece, a crisis of confidence in developed market government debt is not yet on the radar for most investors. However, as the European crisis of 2012 showed a confidence crisis can quickly spread.

Government Debt in China

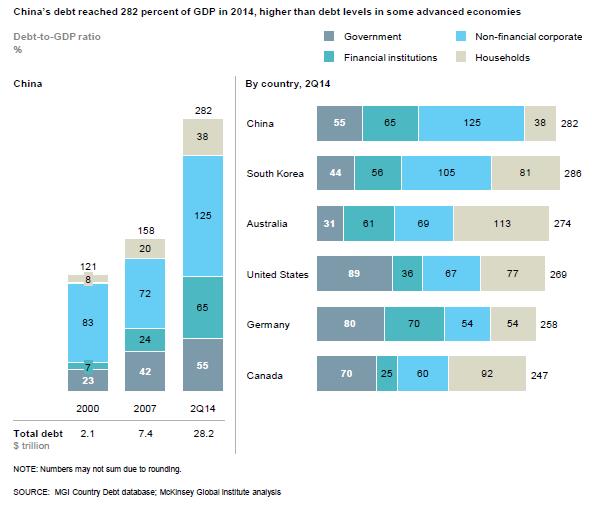

In October I highlighted that the biggest economic issue facing China is that growth in its debt levels has dramatically exceeded growth in GDP. Those bearish on China’s future will frequently call out this problem. Those who believe in strong growth or a soft landing for China ignore this. Simply put, historical examples of such rapid growth in debt levels have never ended well.

On the surface, government debt levels in China are contained and the most immediate concern is private debt. The McKinsey numbers below highlight corporate and financial institution debt as having growth rapidly and being larger than developed nation equivalents and far larger than other emerging markets. Digging deeper reveals two major issues that could see governments dealing with a fall in their income and an increase in their debt levels.

Firstly, Chinese local governments are heavily dependent on income from property development. Estimates vary but one report had 25% of all government income from land sales. This is an enormous concentration of revenue from a sector that is believed by many to be a bubble, creating the risk that local government revenues could collapse.

Secondly, local governments are substantial users of off-balance sheet lending, often via local government financing vehicles (LGFV). If the income from these activities is not sufficient to support the debt, there will be pressure to either bring the debt on-balance sheet or to provide financial assistance to prop up the ventures.

The bailout risks for Chinese governments at all levels stretch much further though. Many iron ore miners, steel producers, coal miners, property companies and state owned entities are known to be unprofitable and financially distressed. The pressure to support loss making sectors is already being played out with many local governments choosing stability of employment over financially responsible decision making. The biggest bailout risk is in the banking sector, with bad loans suspected of being 10-40% of all bank lending. If banks require bailouts then the national government could see its debt level escalate rapidly, as was the case with Ireland.

Government Debt in Emerging Markets

The reason for excluding China from other emerging markets and giving it its own section is simple – the vast majority of growth in emerging market debt levels since 2009 has come from China. Having said that, within emerging markets there is quite a dispersion. McKinsey’s research highlights Hungary, Malaysia and Thailand for having both high total debt to GDP ratios and high levels of debt growth since 2007. The credit default swaps for these countries aren’t showing substantial stress, with potential problems likely to be of the slow burn variety like in developed markets.

Using credit default swaps as a measuring stick, countries that derive much of their export income from oil are the standouts including Brazil, Nigeria, Russia, Saudi Arabia and Venezuela. All of these share downward pressure on their currencies (Saudi Arabia is widely tipped to break its US dollar peg) and surging budget deficits. Nigeria, Saudi Arabia and Venezuela can be somewhat dismissed as they have small external debt balances, but Brazil and Russia are the 7th and 10th largest economies and borrow heavily from other countries.

Some of the metrics for emerging market debt are reminiscent of the lead up to the Latin American Debt Crisis and the Asian Financial Crisis. The Wall Street Journal reported that foreign banks have lent US$3.6 trillion to companies in emerging markets with foreign investors holding 25% of local debt. Outflows from emerging market bonds are the highest on record with stressed and distressed debt higher than in the peak of the financial crisis at US$221 billion. Whilst most of this debt is to corporates, governments dealing with collapsing corporates and dwindling foreign exchange reserves can rapidly become unable to service their own debt. The IMF is likely to be very busy soon.

Conclusion

In making a call that government debt is the new subprime there’s a whole bunch of sectors that have been passed over for different reasons. US subprime auto has horrible lending standards, but the spread of the debt appears to be far less than subprime housing in 2007. US student loans are showing non-payment rates above 20% and many students are seeking to have their debts expunged. However, as much of the debt has government guarantees losses for the private sector should be limited.

The US high yield market has both banks (primarily leveraged loans) and bond markets (high yield bonds) exposed as earnings fall and the energy sector goes through a wave of restructurings and bankruptcies. The US$2.7 trillion that has been lent is larger than the US$1.3 trillion that the subprime housing market peaked at.

Emerging market debt exposures are far bigger than US subprime ever reached. The spread of debt across banks and bond markets means contagion through financial systems from this sector is a credible threat. An argument could be made for either emerging market debt or US high yield debt as the new subprime as both have had weak lending standards in some parts, rapid growth in debt levels and very large exposures spread across the financial system.

In picking out government debt as the worst, it’s a combination of the size and the flow on impacts that standout. Government debt in Japan is US$10.58 trillion, Italy $2.83 trillion, Brazil $1.55 trillion, Spain $1.35 trillion, Russia $333 billion and Portugal $299 billion. Any of these could make the €110 billion of losses on the 2012 Greek restructuring seem minor. At the smaller end there’s a swathe of South American and African nations which have dismal prospects of repaying their debts.

When defaults do occur they are typically a financial earthquake on the issuing country. Home country banks are amongst the largest holders of government debt so banks are often left insolvent after a government default – as was the case with Greece. Citizens receiving haircuts on their bank deposits have delivered a devastating negative wealth effect on Cyprus, with similar problems in Greece as citizens are partially blocked from withdrawing their deposits. In some countries, notably Japan, retail investors are one of the largest owners of government debt. A reduction in principal and interest payments will have an immediate impact on spending by the typically elderly owners.

Home country pension funds are often large investors in government bonds, with the flow on impacts showing up over the longer term as citizens are far more reliant upon government welfare in their retirement. If the debt default is accompanied by a currency collapse corporates are often dragged down by foreign currency loans and contracts. A government debt default will always spill-over to the home economy.

Just as many subprime investors assumed that house prices never fall, few investors currently consider the possibility that government debt defaults could become commonplace. Yet like subprime in 2006, the fundamentals of the sector are poor. Debt levels have grown far more rapidly than ability to repay, little credit research is done, rating agencies and governments are somewhat complicit in maintaining confidence and there is often political gain to be had by defaulting on the debt rather than repaying when things get tough. If governments were assessed like corporates or personal borrowers, many would be laughed out of the bank when they applied for additional loans.

Thus far it has been easy for investors to dismiss the defaults as isolated and unusual cases. Detroit, Puerto Rico, Ukraine and Greece are relatively small and are considered to be governments with particularly poor management. The European debt crisis of 2012 has been long forgotten, but the migrant issues and the continuing inability to fix Greece are tearing at the unity of the European Union and could see an attitude of every man for himself emerge. It’s not a stretch to think that a future global recession could see a global version of the 2012 European debt crisis, but without anyone willing to bail others out.

Written by Jonathan Rochford for Narrow Road Capital on February 2, 2016. Comments and criticisms are welcomed and can be sent to info@narrowroadcapital.com

2 topics