Modelling Russia/Ukraine conflict risks (+ NSW dumps Russian loans, as we recommended last year)...

In October last year, we published new academic research on modelling global conflict risks using advanced statistical methods, including artificial intelligence techniques. Leveraging 160 years of conflict, demographic, political and economic data, this research offered the first estimates of the empirical probability of future military conflicts occurring between different nation states (at least, to the best of our knowledge based on a review of the extant literature). Note that the data-set used for the research ended in 2020, and our models were released in 2021 (ie, the models do not include any new data after 2020, as our systems highlight).

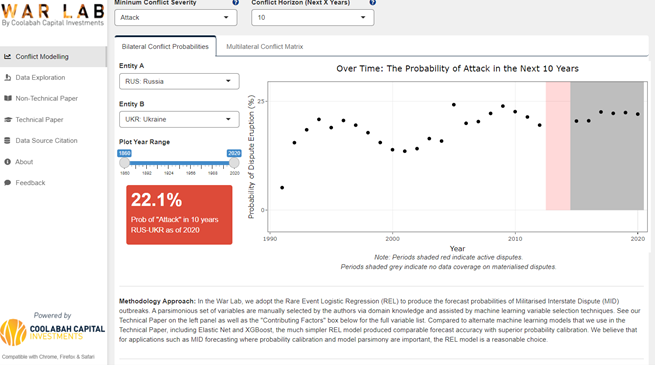

Based on the information available to the models up to 2020, they estimated that there was a significant 1-in-4 to 1-in-5 probability of a full kinetic military conflict, or "attack", including the declaration of war, occurring between Russia and the Ukraine over the next 10 years (the probability of an attack arising in the 5-years---as opposed to 10-years---after 2020 was estimated to be 1-in-6 to 1-in-7). Sadly, this risk has now materialised. (For what it is worth, our models only had a 4.8% probability of a Russia/Ukraine attack emerging in the 12 months following 2020, which proved accurate.)

The chief goal of this research was to educate investors and the public on the fact that a rigorous, scientific approach to estimating global conflict probabilities resulted in assessed risks of interstate militarised disputes that were likely much higher than what most people otherwise assumed. I had, in fact, written about the need for this research a decade ago in the AFR in a column entitled "War Risks Need to be Analysed". At the time, the Department of Defence actually came and met with me to discuss how they could do this research. Back in 2012 I wrote:

The most profound hazard Australians face is the risk of war. We invest vast taxpayer resources – more than $30 billion each year – nominally insuring against it. Yet despite more than 200 conflicts since 1900, causing 35 million deaths, there is a startling dearth of quantitative research on forecasting the frequency and severity of wars. Here I am talking about projecting the “probability distribution" of future conflicts...

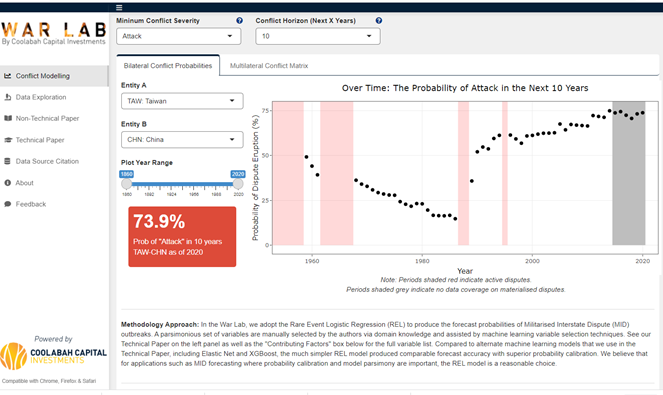

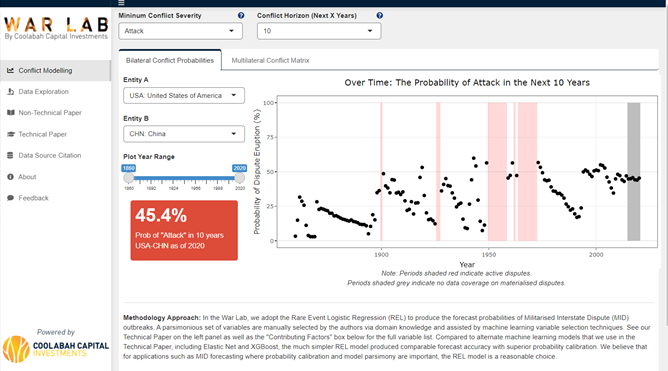

The media on our research last year focussed on our estimated probabilities of conflict breaking out between China and the US, and China and Taiwain, over the decade following 2020, which were handicapped at 45% and 74%, respectively (see second screenshot below). (These screenshots are from our interactive site showcasing this research at predictingwar.com.)

Interestingly, in the same month we released the conflict modelling (ie, October last year), we also argued that NSW should stop lending money to non-democratic states, including Russia, via its TCorp-managed investment funds. On 22 October 2021, I wrote in the AFR:

The second drama of interest is The Guardian’s report that NSW’s $26 billion Debt Retirement Fund, which is managed by NSW’s investment arm, TCorp, has been providing debt and equity finance to dictatorships and tax havens, including Russia ($75 million), Saudi Arabia ($45 million), China ($225 million), UAE ($15 million), Cayman Islands ($30 million) and Angola ($15 million)...In our portfolios, we require all investments to be domiciled in democratic, rather than authoritarian, states where there are minimum safeguards regarding the rule of law, property rights, freedom of individual and religious expression, human rights and so on. Without this democratic criterion, it is easy to end up lending money to the likes of Vladimir Putin and the Saudi royal family.

The big news today is that NSW has belatedly embraced this idea, with media reporting that it will dump its Russian government bonds:

The NSW government will dump $75 million worth of Russian assets from a state investment fund to protest against President Vladimir Putin’s brutal invasion of Ukraine. Treasurer Matt Kean said NSW will sell all holdings of Russian assets from its NSW Generations Fund, acknowledging the plight of Ukraine and the Russian people protesting the violence. At the same time, the government is reviewing all state-managed funds, worth $112 billion, to ensure environmental, social and governance (ESG) principles...Analysts last year warned the fund could place taxpayer dollars at risk after the government borrowed more than $10 billion to bolster the fund despite the state’s rising deficit, which was set at $19.5 billion in December.

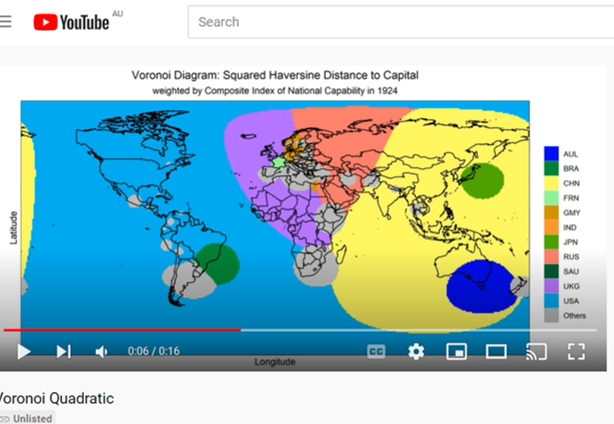

Our global conflict modelling was released via a 26 page academic paper published over at SSRN, which we summarised in a short article for Australia's top defence think-tank, the Australian Strategic Policy Institute. The Australian newspaper's Foreign Editor, Greg Sheridan, also authored a detailed review of this analysis, which he discussed in an interview with Sky News's Peta Credlin. All of the research was made publicly available via the abovementioned predictingwar.com site, which provides many analytical tools, including this animated visualisation of different countries' power projection capabilities over time (known as a Voronoi diagram). To watch this visualisation, click here.

Our models adopt a very precise definition of what an "attack" encompasses under the data-set supplied by the University of Michigan's Correlates of War project. An attack involves "the use of regular armed forces of a state to fire upon the armed forces, population, or territory of another state", "the outbreak of sustained military hostilities between the regular armed forces of two or more states", and/or a "declaration of war" involving "an official statement by one state that a state of war exists between itself and another state".

There is another conflict threshold, described as "war", which is distinguished from an "attack" simply by the number of battle deaths sustained. This is, however, much more challenging to accurately model because there are only 95 events defined as "wars" in the Correlates of War data-set in contrast to the 1,158 "attacks". Accordingly, our models default to predicting kinetic military attacks.

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income and over $7 billion in FUM, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 14 analysts and 5 portfolio managers. Click the ‘CONTACT’ button below to get in touch.

2 topics