More QE is coming

Jamieson Coote Bonds

In October, the Reserve Bank of Australia (RBA) communicated that it would consider lowering 10-year Australian government bonds yields and would not be surprised if wholesale cash in Australia would trade negative. We believe the RBA will most likely cut its policy rate to 10 basis points on 3 November and will announce further quantitative easing/yield curve policy in February or March 2021.

A recent paper by RBC Capital Markets noted that if the RBA did more QE further down the curve, it would be a shift in objective from lowering key borrowing rates for businesses and households, where 3-year rates are more relevant, to actively asserting downward pressure on the yield curve to assist the government’s borrowing cost, both the Commonwealth and potentially the states, as fiscal policy has to step in to help with the economic shock from the pandemic.

This is very bullish for Australian government bonds. The Reserve Bank of New Zealand and the Bank of England have been posturing to cut rates into negative territory, possibly in February 2021. The RBA and the US Federal Reserve (the Fed) will be the only two large central banks left standing by zero bound policy rates.

However, the central bank’s policy rate vs. the wholesale cash rate can differ. While the RBA sets the policy rate at 25 basis points, the wholesale cash rate has been trading at 8-10 basis points. So, it is plausible that wholesale cash will trade negative once the RBA cuts its policy rate to 10 basis points.

Imagine you are in charge of managing money on behalf of an institution, whereby your institution makes deposits with positive interest rates. Following the November rate cut, it may be possible that your deposits will actually cost you money to leave at the bank. This can be mitigated if the RBA decides to implement a lower corridor to where cash can trade, such as awarding zero return for excess cash.

Looking ahead from the perspective of institutional foreign investors, AUD wholesale deposit rates may not be positive in the future and Australian bonds are not going to yield more than other large liquid bond markets, which is the RBA’s goal. This will reduce foreign investor appetite to invest in AUD assets.

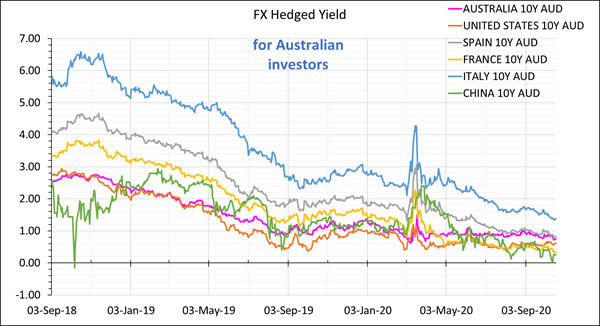

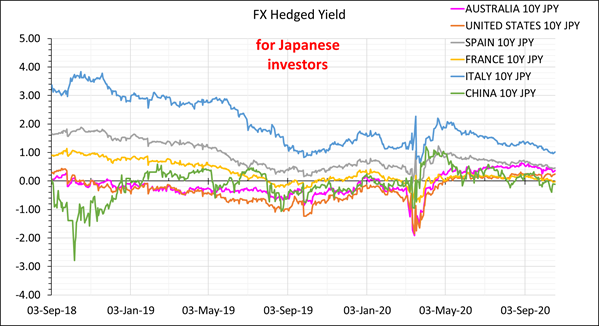

The charts below show government bond yields in each country over time for Australian investors, hedged back to AUD (left) and Japanese investors, hedged back to JPY (right). For Japanese investors, you can see that Australian government bond yields have been yielding higher than France over the past few months, hence we see Japanese investors switching out of France and into Australian bonds.

Source: JCB team analysis.

This presents a bit of a problem for the Australian Office of Financial Management (AOFM), which has been enjoying record demand for Australian bonds so far this year. If the yield on Australian government bonds is taken to a lower level than another substitutable markets, this can potentially see foreign demand for Australian bonds wane. In 2012, when Australian government bonds yielded 150-200 basis points over US Treasuries, foreign investors owned 76% of the Australian government bond market. Currently, the AOFM reports this number at 57%. As the RBA compresses yields lower, foreign demand may switch to net outflows.

A few things can adjust in order to meet record government bonds issuance. They include: 1) Bond yields can rise, relative to other countries. 2) Domestic demand will have to step up to buy Australian government bonds, either from domestic banks (switching out of Committed Liquidity Facility), the domestic private saving pool and superannuation industry allocating to government bonds as a truly liquid defence, or the RBA can buy more. Or finally, 3) the Australian Dollar would have to adjust lower to make Australian assets more attractive.

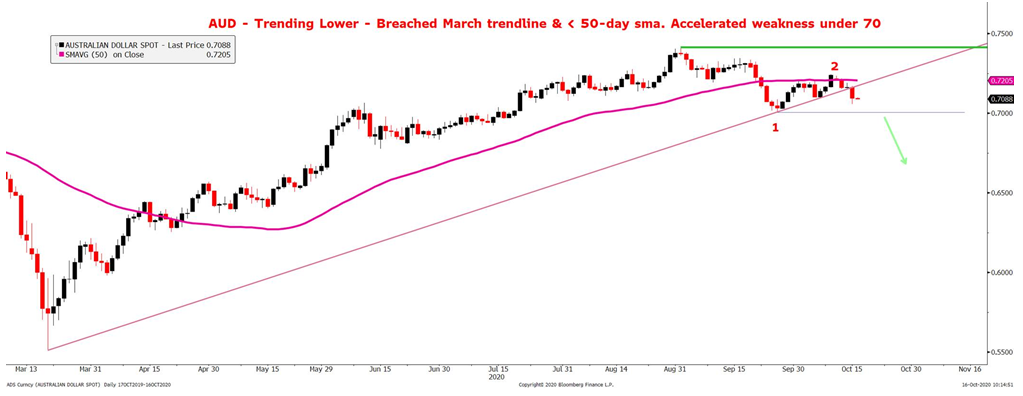

Given the above, this chart shows that technically there may be limited upside to how much the Australian Dollar can appreciate, while there is a lot of room to depreciate, if the exchange rate falls under 70 cents, if our view on the RBA’s policy is correct.

Source: JCB team analysis.

The exchange rate is of course a relative value between two currencies. The RBA may be keeping up with other central banks’ dovishness and the governments worldwide are issuing more bonds. At the end of the day, where the Australian dollar can adjust to next year will be a question of which government will out-spend, which central bank will out-dove. It is our view that Australian investors should stay bullish government bonds and be wary of the possible depreciation of Australian Dollar.

Strengthen your portfolio with global high-grade bonds

In times of economic stress, adding high-grade bonds to your portfolio alongside other risky assets can help offset and get the balance right between risk and return – this is absolutely crucial now as investors seek higher income. You can find out more by visiting our website.

2 topics

Kate oversees a range of investment strategies for JCB clients and is based in Singapore. She is a career fixed income portfolio manager, and specialises in High Grade Bond portfolio management across all major global regions.