NAB’s ESG momentum: a positive

Rayner Road

Many quants and hedge fund managers are sceptical of the value of ESG (Environmental, Social and Corporate Governance) data. It certainly makes reasonable sense that traditional ESG data tends to be the domain of long-term investors.

So why are quants and hedge fund managers buying ESG data?

A: ESG momentum

ESG momentum has shown clear alpha signals, and investors are noting an increasingly positive feedback loop:

The more various stakeholders (investors, media and the general public) understand sustainability issues, the more companies are likely to report, the more the media will focus on the issues and the more material the issues become for a company.

Managers, especially those processing terabytes of alternative data, are well positioned to benefit from this trend.

As an example, let’s point the TruValue Lab’s Artificial Intelligence engine towards National Australia Bank (NAB):

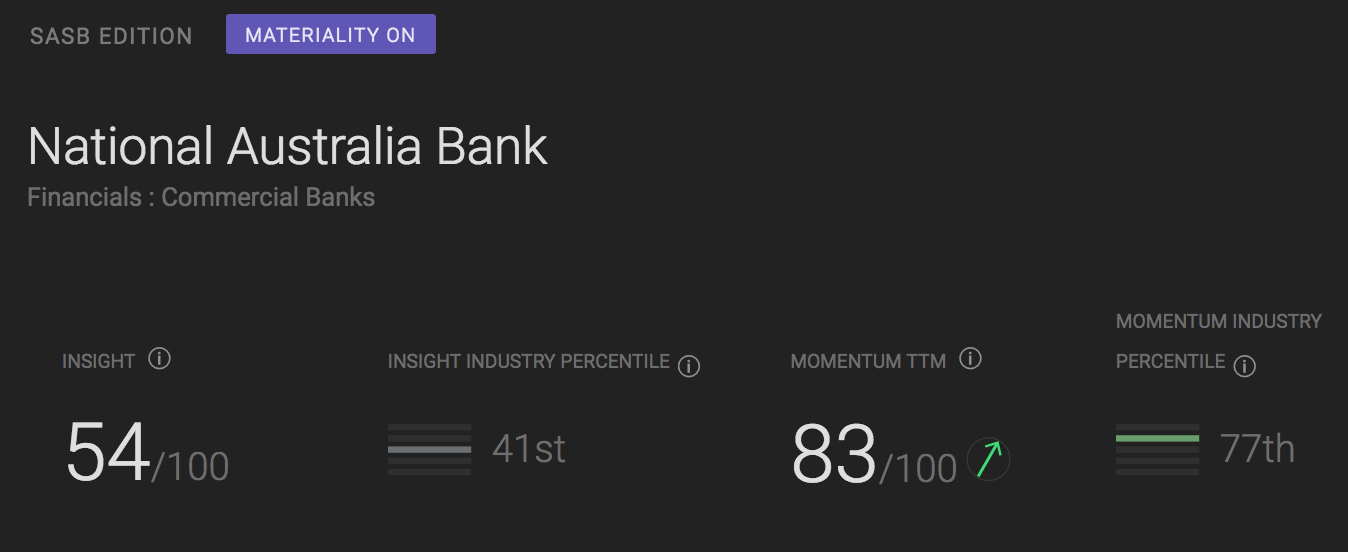

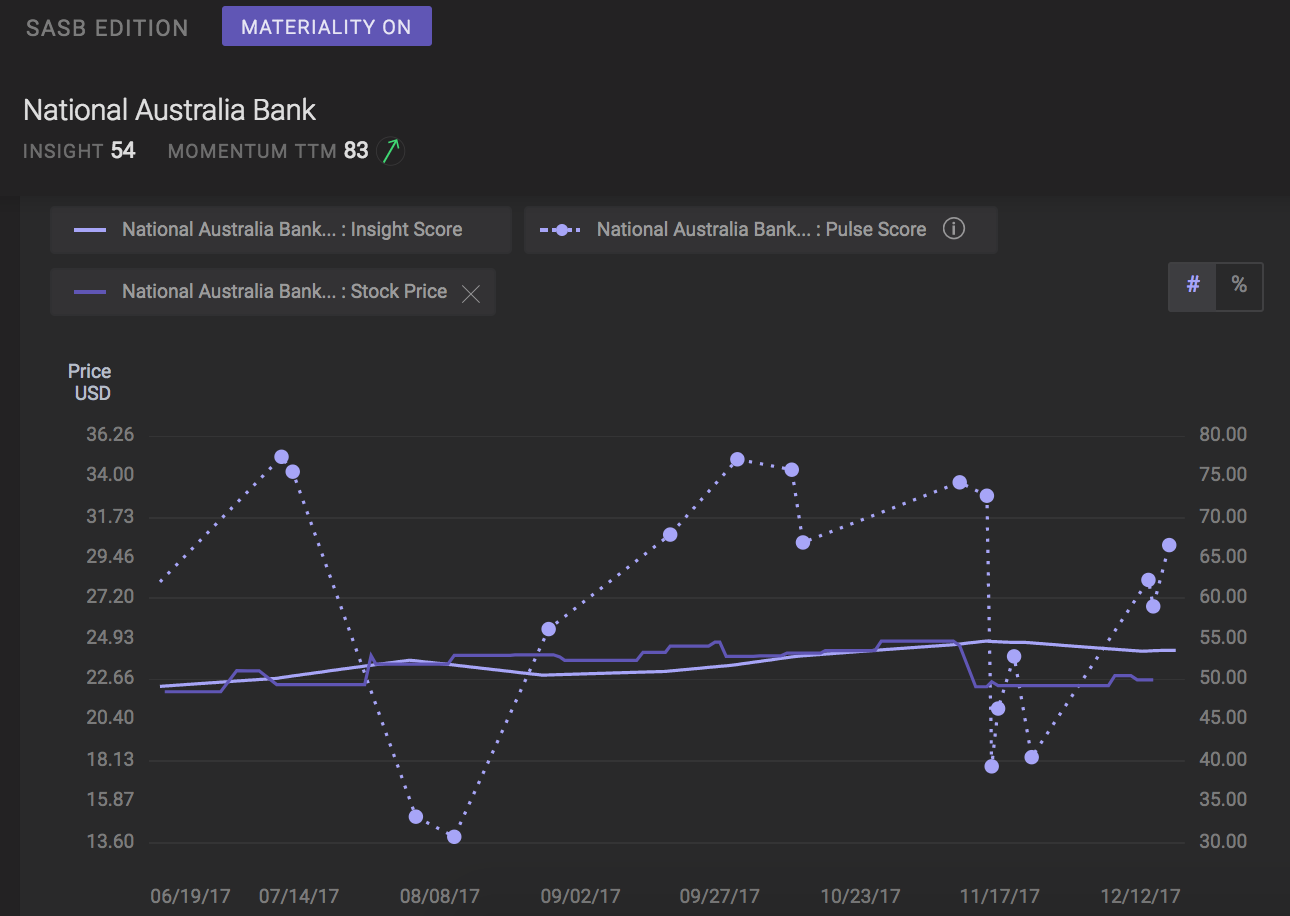

NAB’s Insight score (which is a weighted moving average of individual pieces of content scraped from over 75,000 data sources) is slightly above neutral at 54/100, which places NAB fairly low among peers - 41st percentile across the industry.

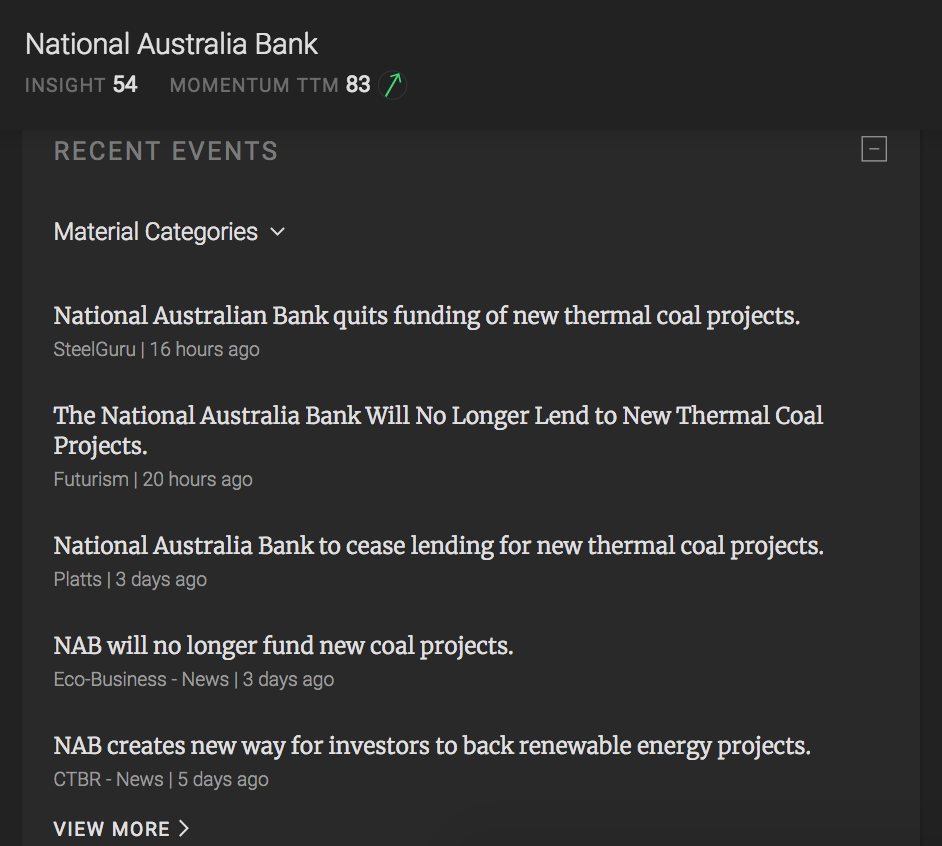

NAB’s ESG Momentum, however, is positive (83/100 or 77th percentile). This can be largely attributed to the positive reaction they have received for recently announcing an end to funding thermal coal as well as having created a new way for investors to back renewable energy projects, as shown in recent events below.

As with any piece of investable data, this signal may be outweighed by others and it may not translate to improved financial performance.

However, when an investor spreads this sort of real-time insight across an entire portfolio, there are proven performance benefits.

TruValue Labs is an alternative data provider from San Francisco that applies the Sustainable Accounting Standards Board’s (SASB’s) Materiality Framework to map millions of unstructured data points per month into comparable and consistent ESG data sets through their partnership.

Coverage = 8,500+ companies. Updated daily.

1 stock mentioned

Regional Director AsiaPac at TruValue Labs (big data and artificial intelligence meets ESG) based out of Sydney. Previously Executive Director UBS Zurich and Head of New Business at Regnan Governance Research and Engagement.

Regional Director AsiaPac at TruValue Labs (big data and artificial intelligence meets ESG) based out of Sydney. Previously Executive Director UBS Zurich and Head of New Business at Regnan Governance Research and Engagement.