No - ETFs are not causing CommBank's "hated" rally

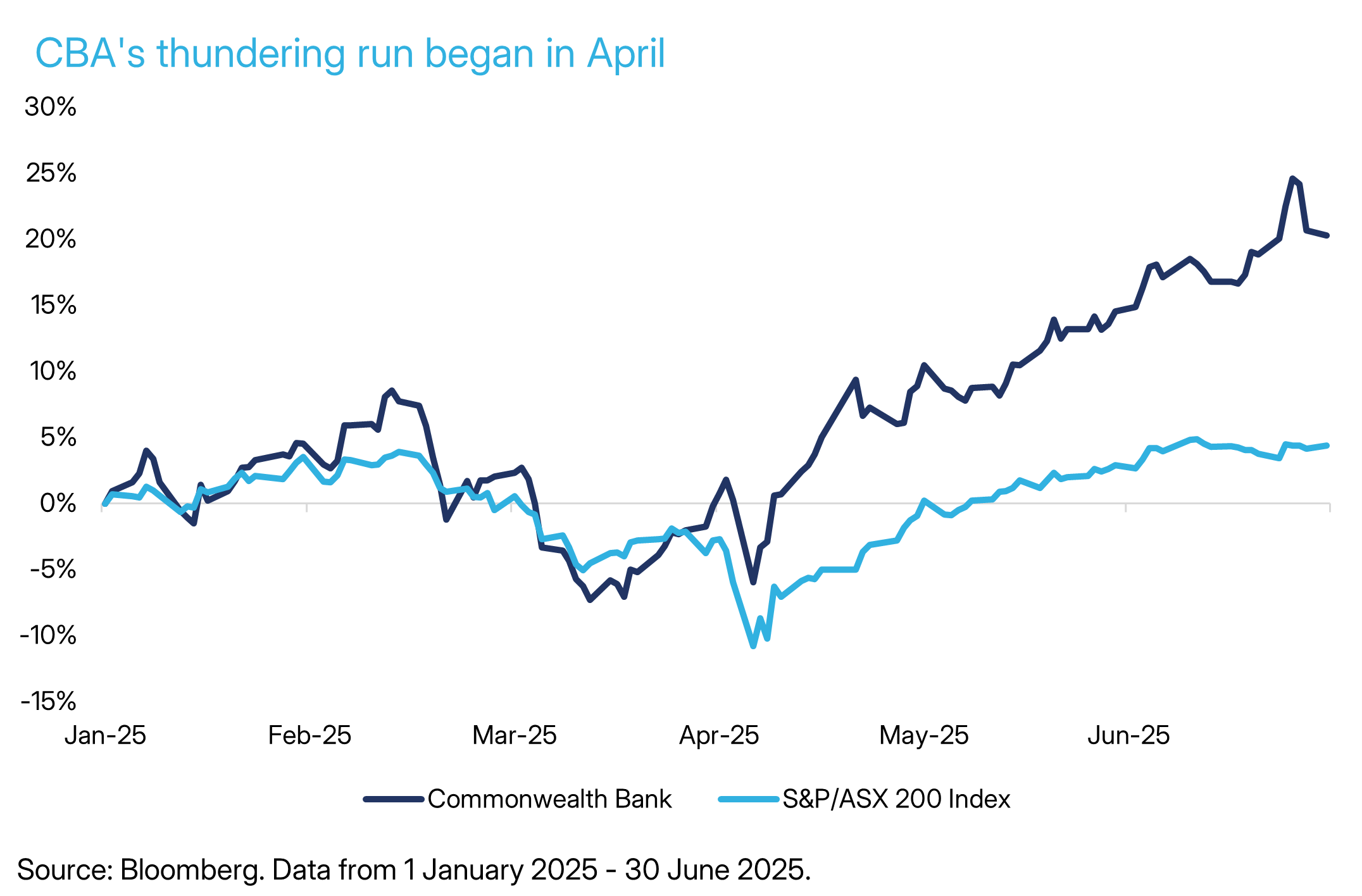

The Commonwealth Bank’s (ASX: CBA) large, and largely unexplained, share price surge is being blamed on ETFs.

The argument goes like this: CBA is the largest holding in the most popular Australian equity ETFs. These ETFs have seen strong inflows and have thus been forced to buy large amounts of CBA stock. The timing of these flows coincides with the bank’s unexpected rally.

Some even argue the effect is amplified by the fact that some major ASX 200 ETFs don’t engage in securities lending. This, on one interpretation, makes their buying resemble a corporate buyback: permanently removing shares from circulation.

We’ve heard this before. ETFs have been blamed for other market moves. But the CBA rally has rekindled the debate.

Did ETFs Send CBA to $180?

Not likely.

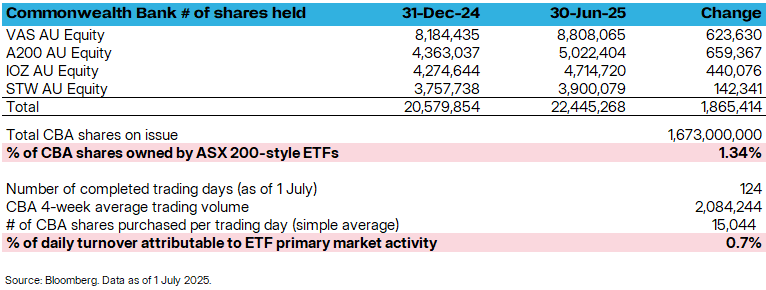

Let’s start with the numbers. ETFs tracking the ASX 200 and similar indexes - VAS, IOZ, A200, STW - own around 22.4 million CBA shares, according to Bloomberg. CBA has 1.7 billion shares on issue. That gives these ETFs a collective holding of just 1.34% of CBA’s float. (While ETFs listed on offshore exchanges also hold CBA, none hold as much as local ETFs).

Looking at the tape: since 1 January, these ETFs have bought about 1.8 million CBA shares over the 125 trading days this year. Assuming smooth flows, that works out to buying 15,000 shares a day. Now, CBA trades on average around 2.1 million shares a day. Meaning these ETFs are responsible for less than 1% of CBA’s average daily trading volume. That’s not enough to move the market on a company this large.

In sum: nothing in the numbers supports the idea that ETFs are driving the rally.

Then there’s the matter of source of funds. Historically, much of the money flowing into ASX 200 ETFs has come out of actively managed funds or direct shares. That is, money that was likely already exposed to CBA or otherwise in the market. So what we’ve often seen in ASX 200 ETF flows is money shifting sideways. It does not logically follow from the fact that ASX 200 ETFs experience inflows that aggregate demand for CBA’s stock is therefore increasing.

And what about the causal logic of the argument? If ETF buying is responsible for rallies in high-weight ASX 200 names, why has the effect been isolated to CBA? BHP (ASX: BHP) , the next-largest ASX stock, has an 8% index weight—yet it’s down 9% this year.

The Real Confusion: ETFs vs Index Inclusion

In my experience, much of the misunderstanding stems from a common conflation: ETF flows and index inclusion. While the two are linked, they’re not the same.

Index inclusion is well-known for sparking rallies. Arena REIT jumped 5–7% on joining the ASX 200 in 2022. Boss Energy soared 20% in December 2023 on the same news. Tesla’s 70% rally ahead of its S&P 500 inclusion in 2020 is perhaps the most dramatic recent example.

But index inclusion and subsequent rallies predate ETFs, and they’re not driven by passive vehicles alone. Active managers pile in too. Studies, such as the work of Professor Keith Cuthbertson at City University London, suggest up to 80% of active managers are closet indexers. They behave like index funds, just with higher fees.

So while index inclusion creates forced buying across the board - ETFs, passive mandates, and active funds alike - this is not the same thing as ETF-driven price setting.

Conclusion

Could ETFs one day become so large that they do set CBA’s price? Theoretically, yes. But we’re nowhere near there yet.

For now, ETF flows look more like a scapegoat. The search continues for the real driver of what’s fast becoming the most hated rally on the ASX.

4 topics

2 stocks mentioned