One of the most compelling opportunities today

Nufarm is an Australian company that specialises in chemical crop protection globally. It produces products to help farmers protect their crops against damage caused by weeds, pests and disease.

There are two key reasons we believe Nufarm is one of the most compelling opportunities in the Australian equity market today:

- Industry consolidation

- Omega 3 opportunity

This article explains why Nufarm is undervalued today and why we believe it will be a future winner for our investors over the medium term.

Why Nufarm is undervalued

If you invested in Nufarm at the start of the year it has been a tough investment. The share price has fallen almost 30% and Nufarm is trading at a substantial discount to its global peers.

The underperformance has been driven by two key issues:

- Australian drought - The Australian drought in 2018 significantly impacted Nufarm’s Australian earnings (~15% of total company earnings). The drought was a one in fifty year event. But investors need to remind themselves that droughts are cyclical in nature. They are not structural issues and whilst we do not know when it will rain, we like to take the contrarian approach of buying in drought and selling in rain.

-

Glyphosate concerns - Glyphosate is the world’s most commonly used herbicide. It has come under controversy this year following a US law suit against Monsanto, which ruled that ‘RoundUp’ (which contains glyphosate) caused a former school gardener’s cancer. Glyphosate products currently account for almost 20% of Nufarm’s earnings so this is an issue we are monitoring closely. To date there are no glyphosate cases against Nufarm.

Whilst controversial, we don’t believe there is any reasonable scenario where chemical crop protection is banned globally. Doing so could reduce global crop yields by 40% which would result in a global food shortage. The issue is multi-faceted, but we believe Nufarm is well-placed in any reasonable outcome from the controversy.

The Australian drought and glyphosate concerns have created a buying opportunity for medium to long term investors. Below we explain why we believe Nufarm will be a future winner for our investors.

Industry consolidation

The Global crop protection market is a US$50bn industry. The industry has traditionally been dominated by six large players including multinational brands such as Bayer, Syngenta, Monsanto and BASF. However, the crop protection industry has been going through a major period of consolidation over the past two years. Since 2016, the six largest players have consolidated to four.

Nufarm is a big beneficiary from industry consolidation. Less competition means a better pricing environment across the market. In addition, the frenzy of mergers and acquisitions across the industry has resulted in forced asset sales, giving Nufarm a once in a lifetime opportunity to buy high quality assets directly from competitors at great prices. With competitors distracted and internally focused, we believe Nufarm has an opportunity to gain market share as a focused, independent alternative supplier of crop protection to its customers.

Omega-3 opportunity

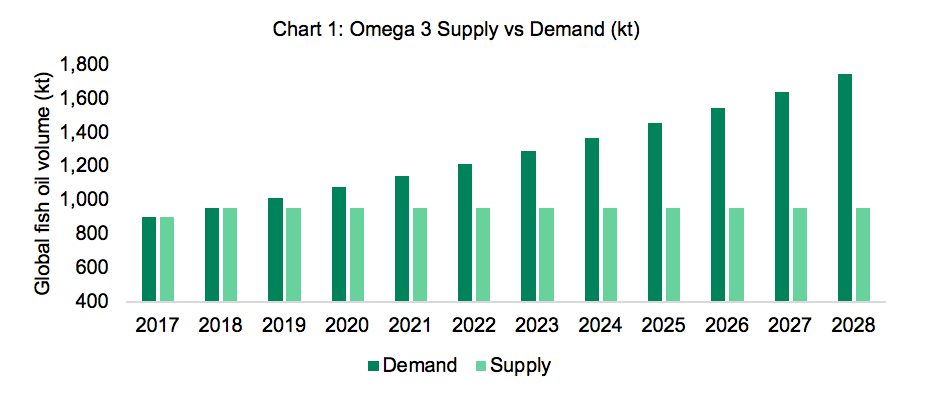

Fish oil is a rich source of Omega-3 fatty acids. It is derived from sustainably caught unpalatable fish such as anchovies and other fish by-products and used predominantly as aquaculture feed in fish farms. Omega-3 is required to meet the world’s growing appetite for fish. However, as Chart 1 highlights, the world is short natural sources of Omega-3.

Nufarm has developed the World’s first plant-based source of Omega-3 in partnership with the CSIRO. Whilst there are competitive technologies being developed, Nufarm will be first to market, with patents beyond 2030 and regulatory approval for commercialisation expected in 2019.

In our view, the Omega-3 opportunity represents 40% additional upside to the current share price despite earning nothing today.

Conclusion

Nufarm has fallen over 30% this year and is currently undervalued versus its global peers. Whilst there are issues regarding the Australian drought and glyphosate concerns, we believe there is material upside to today’s share price. In our view, industry consolidation and the Omega-3 opportunity will provide significant earnings growth for the company. We believe Nufarm is one of the most compelling investment opportunities in the share market today.

Want to learn more?

For further insights from the team at website.

1 stock mentioned