One year on - what did we learn?

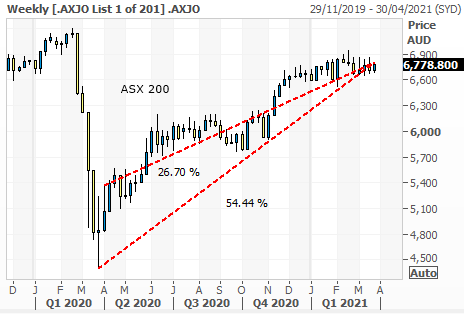

It is a year since the bottom of the market on March 23, 2020. Since then, the ASX 200 is up 54.44% if you bought at the absolute low and sold today.

What a year of opportunity.

The 54% is a fantasy of course - no-one bought at the bottom, or could be expected to have bought at the bottom and amazingly, if you bought just a week after the bottom, the market is up 26.7%, less than half the 54% - what a difference a week makes in volatile times.

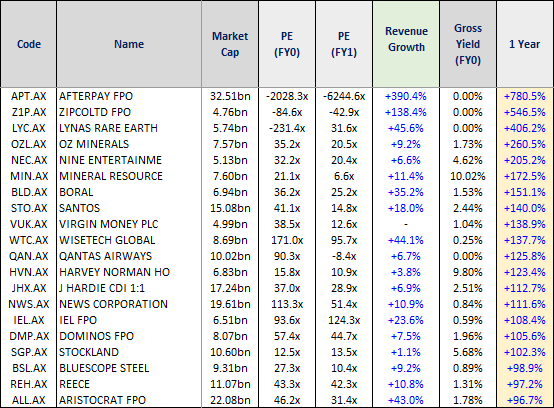

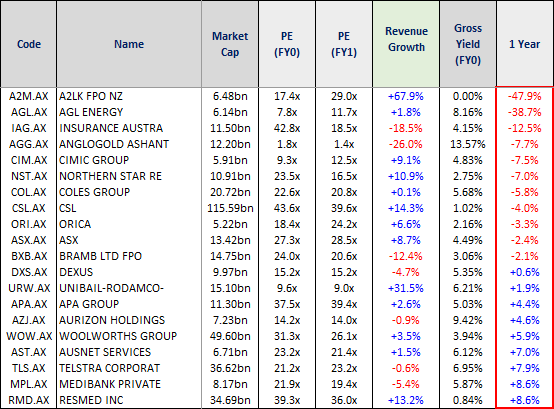

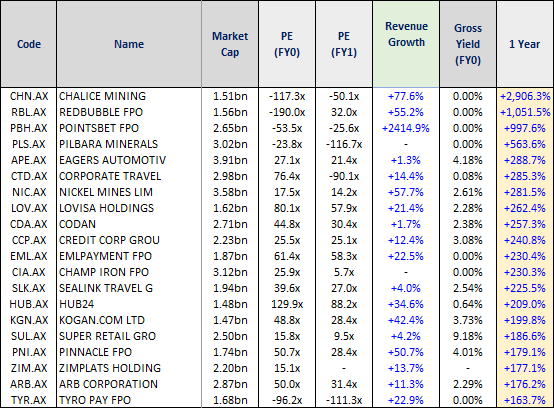

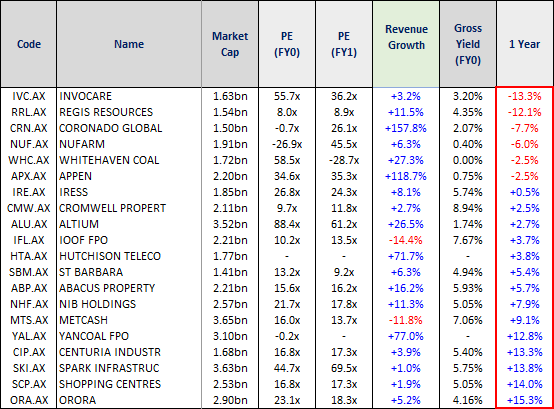

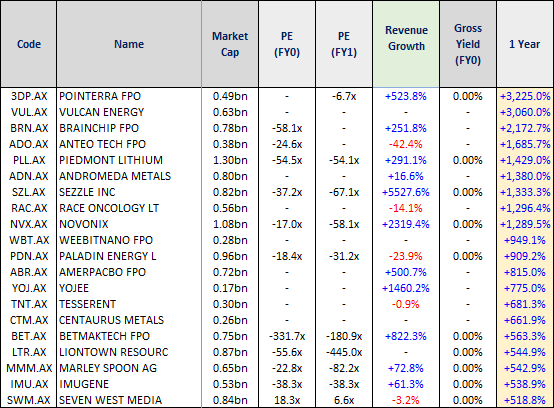

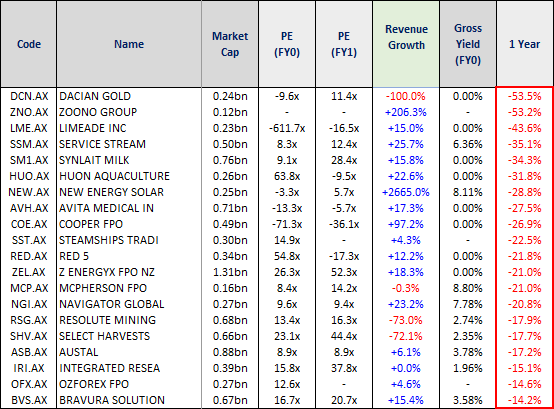

Here are some of the best and worst performers over the last year. Lets see if we can learn something from a year of pandemic hindsight. All these tables have been derived from our Marcus Today All Ordinaries spreadsheet.

I have included the one-year performance column and a few other columns as you can see, in particular the PE, Yield and Revenue Growth. The reason for including those is to highlight how you simply would not have picked these stocks on basic fundamentals - the best performers are not necessarily profitable or cheap, and most of them offer no yield at all.

TOP 100 - Top 20 performers in the biggest 100 stocks:

TOP 100 - Worst 20 performers in the biggest 100 stocks:

NEXT 100 - Top 20 performers in the next biggest 100 stocks:

NEXT 100 - Worst 20 performers in the next biggest 100 stocks:

ALL ORDINARIES - Best 20 performers in the All Ordinaries index:

ALL ORDINARIES - Worst 20 performers in the All Ordinaries index:

15 GOLDEN RULES FROM THE PANDEMIC - Here are some of the lessons from these lists. Observations about sharp market corrections and the recovery.

- Some of the best bits of the market are the exponential bits ahead of a correction. You have to participate in those exuberant moments or you’ll never get the averages, not be too fearful or cautious. Enjoy the exuberant bits. Play the game when its “on”. Laugh all the way to the top. Let the finger-waggers wag, they always do when people make a fortune with little effort.

- Corrections are inevitable and regular. Expect a big one every ten years (50%), and a tradeable one every three years (10-20%).

- Corrections come quickly. You don’t have much time to react. You have to be decisive.

- Recoveries come slowly. It’s a year from the correction and what we lost in 23 trading days we still haven’t recovered. You have plenty of time in the recovery, plenty of time to decide when and what to buy. There’s no rush. You never have to catch the knife. The market never crashes up. You do not have to catch the bottom.

- If you ever say “I can’t buy it, it's gone up 10% in a week” you will fail at investment. If you are the sort of investor who says "it's up 100%, I've missed it", you doom yourself to conservatism. Chickens don't make money. You will never buy a ten bagger. Forget APT up 780% in a year. Eleven stocks in the All Ordinaries have been ten baggers (up over 1,000%) in the last year. 180 stocks (36% of the All Ordinaries index) have doubled, 290 (58%) are up more than 50%. Percentages are big in a correction and a recovery. Do not be scared of big percentages. You can buy stocks that have gone up, but in a recovery you have to buy stocks that have gone up.

-

No-one knows when corrections are coming and those that did, didn’t know for sure, they just made a fuss when they discover (in hindsight) that they made the right noises at the right time.

- Do not think you will be so clever as to predict the end before it happens. You can't predict the big sell-offs, just be aware (as now) when some of the ingredients are in place (money printing, excessive debt, rising rates, overvaluation) but don’t do anything about the signs of a market correction until the correction begins. We are in the reaction game not the prediction game. Yes, become more sensitive to the signs the more stupid it gets, but still….wait. And when the precipitous signals turn into a precipitous market, you'll be ready to be decisive.

- Corrections are great! They are to be welcomed as an opportunity. Do not fear them, welcome them.Best moments in the market, but not if you pull out, stay out, or deny its happening.

- No-one will ever tell you to sell. No-one in the industry wants you in cash. They want you in their fund, in their product; trading, speculating, active. To go to cash through a professional will require you to be assertive. To go to cash as an individual seems like a big decision, but really, its not.

- Cash is always king. There is nothing wrong with cash, ever. Even if you get the timing terribly wrong all you miss is “not making money”. You can wear that whilst you think. Being in cash is riskless. You have all the power. You can buy tomorrow. Do not be fearful of going to cash. It's no biggie. It's actually very cathartic, especially when things get wild.

-

Catching the bottom of a correction is all about sentiment. When everyone has lost faith in/sight of fundamentals, you need skills reading the herd not the numbers. Watch the herd, don’t join the herd. Look at the tables above, at the best recovery stocks and their PEs and Yields. Warren Buffett could not have picked those stocks on the numbers. Most of the best stocks combined zero yields and were loss-making. Read the herd not the numbers. Fundamentals are useless when it comes to timing the market. Its why value investors always emphasise the long term, because they are useless at the short term. "Its a weighing machine not a voting machine" is just an excuse for giving up on timing the market.

-

At extreme moments the market drives all, sinks all boats, lifts all boats. Focus all your attention on identifying the “Pivot Point” in the market. In corrections the woods are on the move, forget the trees until the forest is going up again.

- Stock selection comes second to the market. After the market pivot point, stock selection is about where you will make the most money, but you have to get the market right first. If you get that right you’ll make money in everything.

- The recovery will come fastest and hardest in the stocks that have suffered the most extreme sentiment swings. In the last year Qantas, Stockland, EDP Education and Virgin were not the stocks with the best fundamentals (far from it), they were stocks that got the most oversold, so rebounded the most. The money is in identifying and timing the extremes of sentiment in stocks as well.

- Don’t bother to buy defensive stocks when the correction starts. Do you remember A2M, FPH, TLS and WOW performing better than the rest of the market when the market fell over. They had a “moment” of outperformance. But in the recovery they have been some of the worst performers. Defensive stocks will not serve you well at any time. Leave them to the fund managers that concern themselves with their own relative, not actual, performance. For an individual investor there is almost no point at which you would want to buy a “defensive” stock. They make less money in the recovery and there is no point holding the stock that loses you less money in a correction.

At the end of the day the pandemic year has been great for us as investors. It has been a year of fabulous opportunities. Hopefully you played the game. Look forward to the next great correction. Hopefully we'll all have the vigilance, experience and courage to exploit it, not run from it.

To stay up to date with our latest stock ideas and strategy updates sign-up for a 14-day free trial to Marcus Today - CLICK HERE to get started