PayPal closing in on Afterpay

One of my first jobs at university was in retail, working at Surf Dive ‘n’ Ski. In 1995 I was amazed by the number of people who used ‘lay-by’ to purchase goods, one of the earliest forms of instalment plan payment systems. We would ring the sale up, place the product in the bag, staple the receipt to the bag and hang it in the back room. Customers would then trickle in over time, making payments until the item had been paid off, at which point they could finally take it home. (Larger stores had entire lay-by departments, staffed by dozens.)

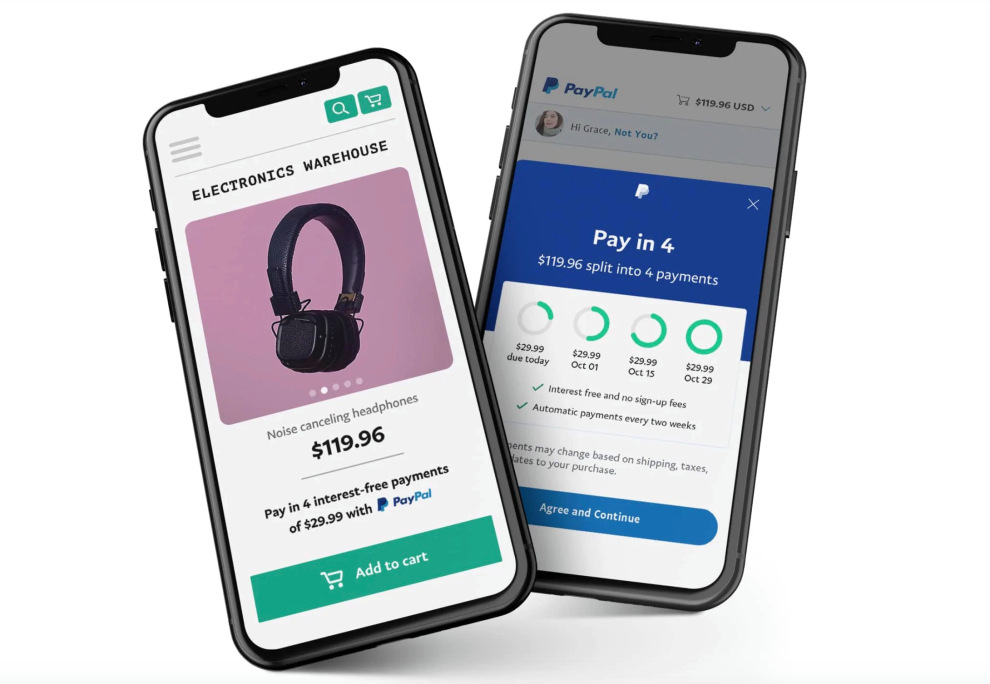

Today, the lay-by has been replaced by Buy Now Pay Later (BNPL) service providers. The benefit is clear, you can take the product and use it while making instalment payments over weeks or months. It has become enormously popular with the millennial generation, many of whom possibly remember their parents struggling to meet exorbitant interest charges on credit card purchases.

Globally 3.8 billion people are under the age of 30, a larger number than at any time in history. So I guess, it comes as no surprise that BNPL companies are booming. In fact the ASX now lists seven, the largest of which is Afterpay, the industry leader with 11.2 million active customers and 63,800 active merchants globally. By comparison, PayPal has 377 million active customers and 29 million merchant accounts.

Less than 1% of PayPal’s customers and merchants have opted into its BNPL product, offering significant potential growth. Despite this, PayPal reports its BNPL product has had the fastest start to any product ever launched in its history. Within a few short months of activating the service, it surpassed Afterpay’s merchant base in the US by a factor of 18x and acquired 2.8 million active users, a feat that took Afterpay more than a year.

“I would also highlight the rapid growth of our Buy Now Pay Later functionality we saw tremendous and growing demand throughout the quarter and witnessed the fastest start to any product we have ever launched. Millions of consumers transacted at hundreds of thousands of merchants in Q4 alone”Dan Schulman, PayPal CEO, 4Q20

Pay Pal has three clear advantages over its BNPL peers:

- It has the largest user base of consumers and merchants;

- It can enable each merchant with very light integration work;

- It does not charge the merchants any additional fee for BNPL beyond PayPal’s standard transaction fee.

We look forward to seeing PayPal prosper over the next five years as it successfully competes with fintech companies unleashing new waves of innovation disrupting incumbent financial institutions.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

7 stocks mentioned