Quant investing: What is Monte Carlo Simulation, and how do you use it to improve a strategy?

What is Monte Carlo Simulation?

Monte Carlo simulation is a statistical technique that uses random sampling to model possible outcomes of a complex system. It is named after the famous Monte Carlo Casino in Monaco, where gambling games involve a lot of randomnesses. Monte Carlo simulation has become a widely used tool in many fields, including finance, physics, and engineering.

In the context of finance, Monte Carlo simulation can be used to model the performance of investment portfolios under different market scenarios. It is particularly useful for quantitative investing strategies, where investors use mathematical models and algorithms to identify and exploit market inefficiencies.

To understand how Monte Carlo simulation can improve the robustness of a quantitative investing strategy, let us first look at the basic idea behind the technique. Monte Carlo simulation involves generating a large number of random scenarios that reflect different market conditions. Each scenario is based on a set of assumptions about the behavior of different market variables, such as stock prices, interest rates, and exchange rates.

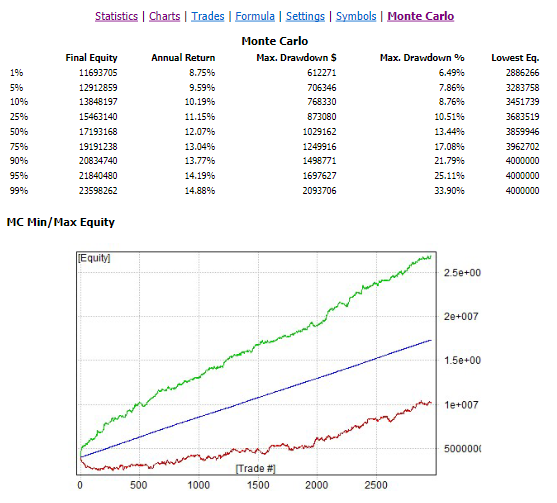

Once a set of scenarios has been generated, the investor can then use them to model the performance of their investment portfolio under each scenario. This can be done by running the portfolio through a simulation engine that calculates the returns and risk metrics of the portfolio under each scenario. By analyzing the distribution of returns across the different scenarios, the investor can gain insights into the performance of their portfolio in different market conditions.

How do you use it to improve a strategy?

The beauty of Monte Carlo simulation is that it allows investors to test the robustness of their investment strategies under a wide range of market scenarios. By generating a large number of scenarios, investors can identify potential risks and opportunities that they might have missed otherwise. For example, they can test how their portfolio would perform in a recession, a bull market, or a sudden market shock.

Parameter optimisation

Monte Carlo simulation can be used to optimize the parameters of an investment strategy. For instance, investors can use it to find the optimal allocation of assets, the best combination of risk factors, or the most effective hedging strategies. By simulating different scenarios and testing different combinations of parameters, investors can refine their investment strategies and make them more robust.

Summary

In conclusion, Monte Carlo simulation is a powerful tool for quantitative investors who want to test and optimize their investment strategies. By generating a large number of random scenarios and analyzing the distribution of returns across them, investors can identify potential risks and opportunities and make their strategies more robust. With the help of modern computing technology and software tools, Monte Carlo simulation has become an essential part of the toolkit for many quantitative investors.

5 topics