Running the recovery gauntlet

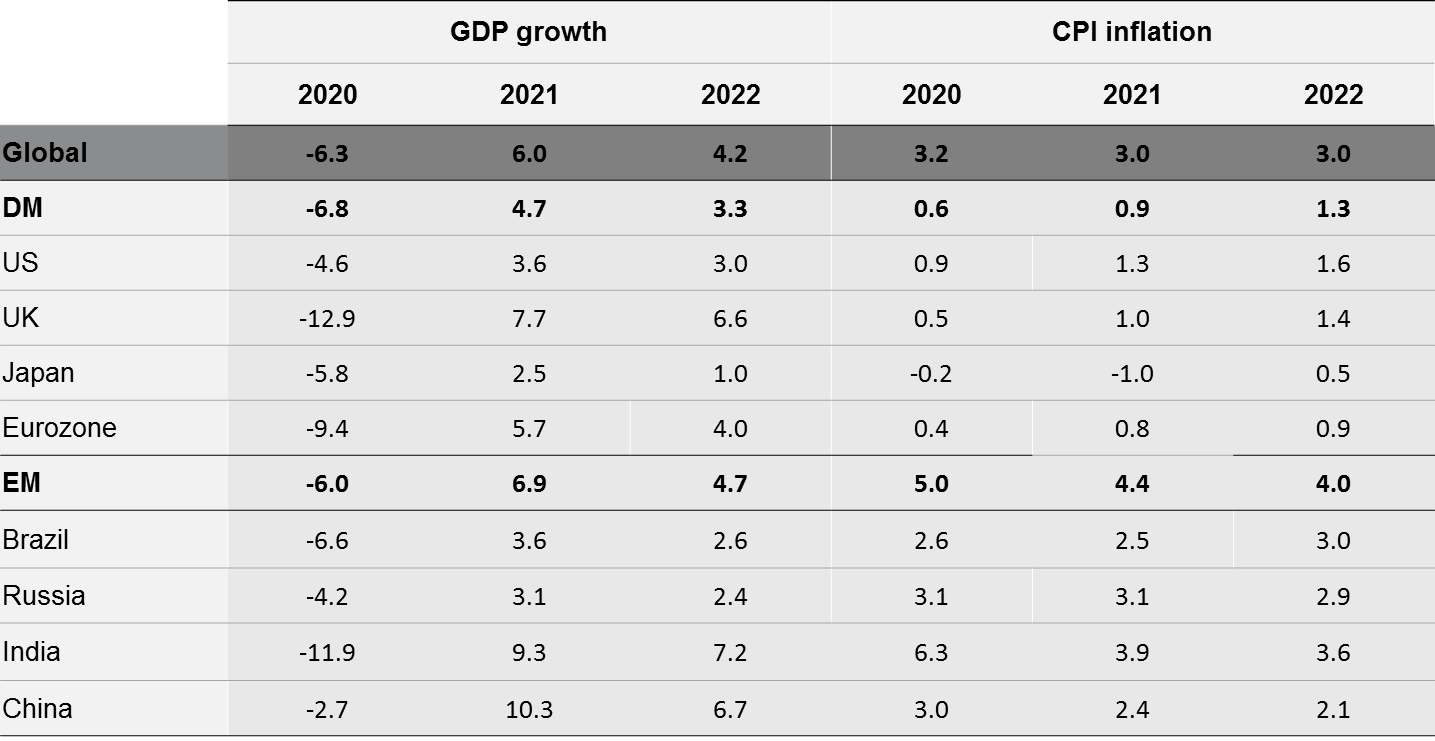

The global economy is springing back to life following an extraordinarily deep and synchronised contraction between February and April. Activity rebounded impressively in most countries between May and July as Covid related restrictions were eased, setting the stage for an annualised 20% rise in global GDP in the third quarter. The strength of this initial upswing has led us to revise up our forecast for global growth this year to -6.3%. While not as bad as previously feared, this contraction would still be the worst outcome since the 1940s.

However, there are signs that the speed of the recovery is already moderating. Mobility data and some other timely alternative indicators have flattened off at levels still well below their pre-Covid norms, while services PMI fell in a number of countries in August. The upshot is that while the global recovery has not petered out, it seems to be already losing steam, and we have lowered our forecast for the 2021 growth rebound to 6.0%. This would leave global activity well below its pre-crisis trend, with the recovery expected to be measured in years. It would also leave sizeable permanent scars across economies.

Renewed Covid outbreaks are one of the reasons we have seen some activity indicators falter. The US has been a high profile example, with a failure to contain the first wave of infections leading to severe outbreaks across states in the south and west, though case numbers have fallen more recently. Elsewhere, a number of large emerging markets, including Brazil and India, have struggled to lower community spread at all. Finally, some European and Asia-Pacific countries that had successfully supressed the virus are experiencing renewed outbreaks.

All this provides a timely reminder of the importance of a vaccine. A number of these are currently in stage-three trials and it is now our base case that at least one is approved by the end of this year, and almost certainly by the middle of 2021. Our best judgement around the manufacturing, administration, take-up and efficacy of vaccines is that over a billion people will immunised by the middle of next year. Inoculation is likely to be initially concentrated in developed markets and China, where this has the potential to provide effective coverage for a large portion of the vulnerable population and a step towards herd immunity.

While the outlook for a vaccine has improved, the broader policy environment is concerning, particularly on the fiscal side where the commitment to bold action at the height of crisis seems to be fading.

Again, the US provides an apt example, with deadlock over the Phase IV stimulus bill prompting sharp cuts in unemployment insurance benefits. Elsewhere, fiscal cliffs are approaching; with the UK seemingly willing to allow its wage subsidy scheme to expire; Australia having reduced the generosity of its schemes; and emergency support measures in the Eurozone scheduled to end from the turn of this year. While these cliffs may ultimately be made less sheer, the risk of a policy mistake is rising. And critically China’s policy response will not drive the global economy forward as it did after the financial crisis.

Central banks seem unlikely to scale back the support they have provided anytime soon, and many will look to ease further. However, they seem loath to consider sufficiently innovative policy reforms, which we consider crucial if they are to avoid repeating the mistakes made after the financial crisis. Take the Fed’s much hyped policy review, which culminated in a disappointingly vague commitment to “moderate” inflation overshoots. This cautious approach provides an example of institutional conservatism of central banks, which is limiting the degree of policy firepower they can bring to bear to fight this and future crises.

Renewed Covid outbreaks, encouraging vaccine progress and looming fiscal cliffs provide a reminder of the highly uncertain outlook. That is why our baseline forecasts represent just one of many plausible scenarios for the coming years. On balance we think that risks are slightly tilted to the upside, given the improving vaccine outlook and strength of the recent rebound. However, the risks of a renewed global downturn, or a more prolonged slump, are still material, and we continue to watch Covid trends and policy developments for signs that the outlook is darkening.

Scratching beneath the surface, it is clear that country divergences are set to become increasingly pronounced as we progress through the recovery.

This will reflect a range of dynamics including the relative success of managing the virus, the degree, efficacy and duration of policy support and the speed of rollout of vaccines domestically. While developed market economies would seem better placed on most of these fronts, success is not guaranteed. Indeed, the poorly managed US public health response and Congressional squabbling provide a warning around how these advantages can be squandered.

Current polling suggests that these and other missteps will probably cost the Republicans the White House and Senate in November. This would open the door to higher spending, only partly funded by taxes under Biden and the Democrats. But if the Republicans do hold the Senate this agenda will be blocked, and a partisan deadlock could lead to a painful policy tightening. Another term for Trump, alongside a split Congress, would most likely maintain the status quo seen over the past two years. Elsewhere on the political front, Brexit looms large in Europe. While we continue to expect agreement on a narrow FTA, the road to this will be bumpy and a No-Deal cannot be ruled out.

Finally, inflation has been grabbing headlines of late following some punchy price hikes in CPI reports. Our judgement is that these increases will prove to be transitory and should not be seen as the start of a shift to much higher underlying inflation. Indeed, we remain of the view that the Covid crisis will ultimately be mildly disinflationary. This reflects the large spare capacity generated by the recession alongside the continuation of many of the broader forces that have weighed on price growth for many years like aging populations, debt overhangs, weak labour bargaining power, technological change, as well the likelihood that aggressive policy responses will lack staying power.

Access original research from around the world

I lead a global team of economists and researchers providing projections and scenario analysis for the global economy, while also undertaking fundamental empirical research on topics at the intersection of economics, politics, policy and markets. Stay up date with all my latest insights by clicking the follow button below.