S&P 500 and Nasdaq fall as bond yields rally, EV makers post steep losses, ASX 200 futures flat

ASX 200 futures are trading 1 point lower, down -0.01% as of 8:45 am AEDT.

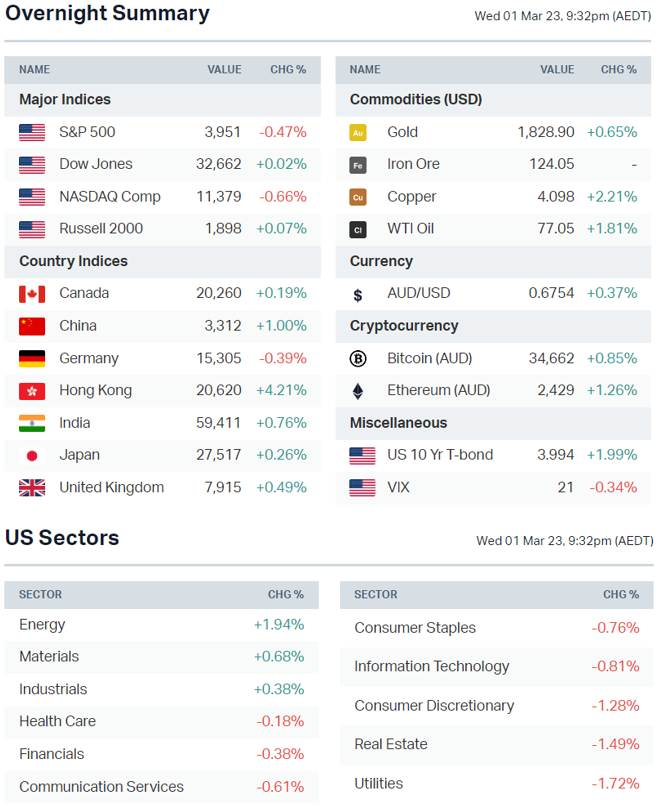

The Nasdaq and S&P 500 struggled against rising bond yields and hawkish Fedspeak, short-term Treasury bills are now paying more than the classic 60/04 portfolio for the first time since 2001, EV makers Nio and Rivian posted large losses for the December quarter, Germany's inflation unexpectedly accelerates in February and Australian home prices fall at the slowest pace since last May.

Let's dive in.

S&P 500 SESSION CHART

MARKETS

- S&P 500 and Nasdaq traded around breakeven in early trade but closed in negative territory, towards session lows

- Swaps market now expecting an additional four rate hikes through July to bring peak rates to 5.50% to 5.75%

- Cash is paying more than the classic 60/40 portfolio of stocks and bonds for the first time since 2001 (Bloomberg)

- Investors dumped almost every financial asset in February (Bloomberg)

- Minneapolis Fed's Kashkari says he's open to either a 25 or 50 bp hike this month but rates may ultimately need to go higher than 5.4% (Reuters)

- Atlanta Fed's Bostic urges 5% to 5.25% rates into 2024 to avoid new flare-ups in price growth (Bloomberg)

STOCKS

- Tesla's Musk to outline more affordable EVs and new Master Plan (Reuters)

- GM cutting hundreds of salaried positions (CNBC)

EARNINGS

Nio (-5.9%): Chinese EV maker posted a wider-than-expected operating loss of US$976m for the December quarter. Revenue was up 62% to US$2.3bn and vehicle deliveries for the full-year rose 34% to 122,486.

Rivian (-19.3%): The EV maker posted an adjusted net loss before tax of US$5.2bn for 2022, narrower than its guidance of US$5.4bn. Rivian guided to 50,000 vehicles for 2023, double last year’s amount but below market expectations of 60,000. The stock is down more than 90% from its peak in November 2021.

ECONOMY

- Germany inflation unexpectedly accelerates in February (Reuters)

- US manufacturing contracts for a fourth straight month (Reuters)

- China manufacturing expands at fastest pace in 10 years (Bloomberg)

- Australian GDP and inflation both below forecasts (Bloomberg)

- South Korea exports fall for fifth consecutive month (Reuters)

- Eurozone manufacturing PMIs show output stabilising in February (Reuters)

Deeper Dive

US ISM Manufacturing: An unexpected uptick in inflation

The US ISM Manufacturing Index surveys purchasing managers across different industries to gauge their level of activity and provides insight into the overall health of the manufacturing sector. The 50-point mark separates expansion from contraction.

February ISM manufacturing was 47.7, marginally missing consensus expectations of 47.8 but above January's 47.4.

The prices-paid component moved back into expansionary territory, rising to 51.3 from 44.5 in January, indicating raw materials prices increased in February. The reading ended a four-month streak of falling prices.

Eight industries reported increased prices for raw materials compared to six industries that noted falling prices.

Talking Technicals: Yields and ASX 200

After a slow start to the week, US bond yields are back. The 2-year is chasing that 5 handle, up another 6 bps overnight to 4.88%. As yields continue to climb, does this spell a slow and painful death for equities?

The ASX 200 is trying to hold the trendline that its established from October lows. Can it continue to respect it or will it eventually break towards the downside?

Aussie property: Slowing pain

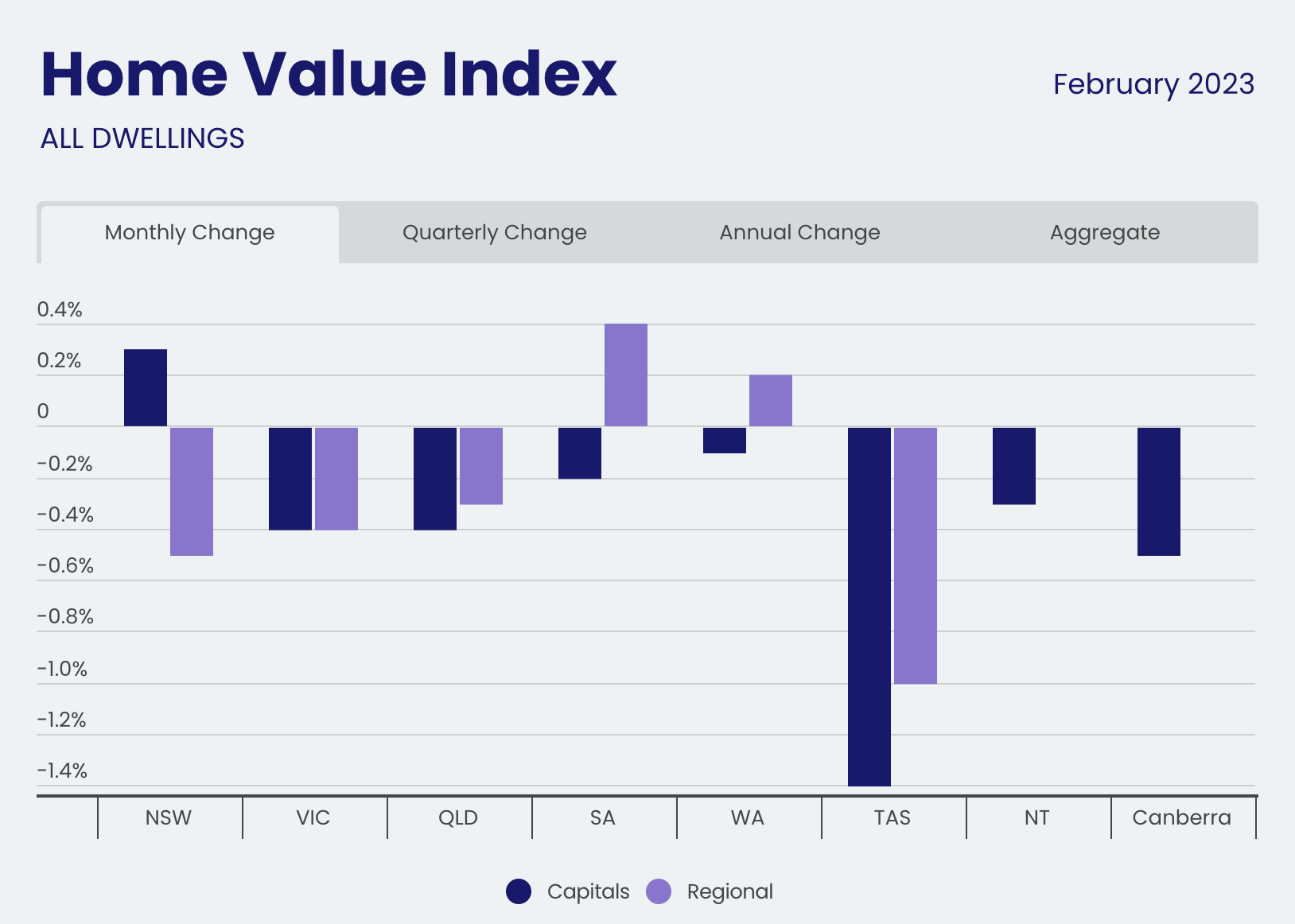

Inflation was not the only thing that piqued the market's interest yesterday. CoreLogic's latest home value index recorded the smallest monthly fall since May last year but it's the Sydney print that really got people's attention.

So is this the bottom of the housing plunge? More than likely not, given the RBA's new and revived hawkish stance as well as the consensus expectation of a weaker economy. Don't worry though, the median house price in Sydney is still above $1 million. They really should just rename "Who Wants to be a Millionaire" to "Who Wants to Buy a House".

On a related note, private credit growth has experienced its third consecutive monthly slowdown. Housing credit growth is also down, making the profitability challenge for banks that bit tougher.

That's something Macquarie analysts have gotten a hold of:"We expect customers to be more price sensitive than in the past. This will likely result in ongoing reduction in banks’ back book mortgage profitability."

They see downside risk for all the Big Bank earnings. But if you had to own one, they still say you should own ANZ or NAB over CBA and Westpac. And definitely a major bank over a regional one.

Chart of the Week

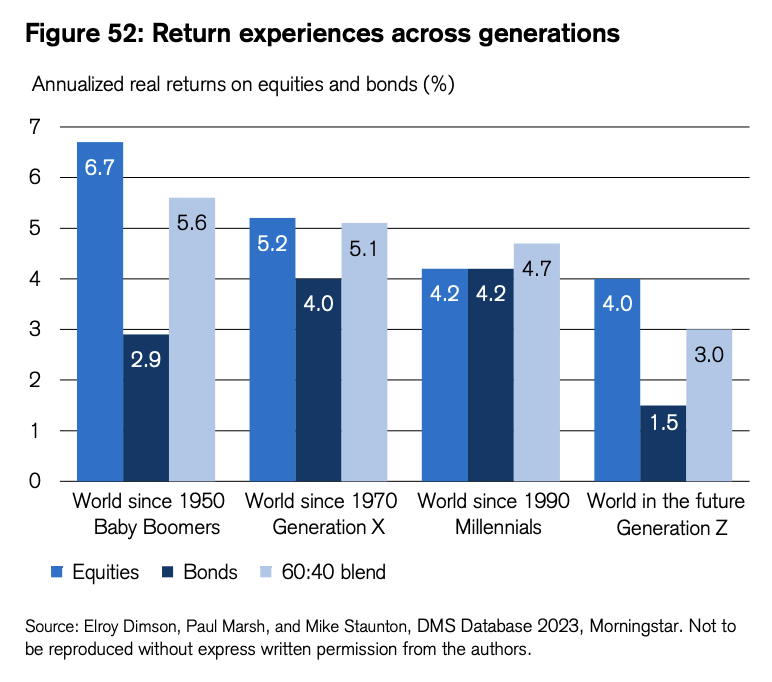

This week's top chart comes from Credit Suisse's Investment Outlook for 2023. If you like equities, you'll really like this chart. Investors’ views of the future are conditioned by past experience. These past experiences differ across generational cohorts that are loosely defined by birth year, not by current age.

In the first three columns of this chart, we report the returns they may have observed. In each block, we show the investment performance of world equities, world bonds, and a balanced portfolio (a 60:40 blend of the two). All three generations enjoy good returns from equities but that bond return is not looking so crash hot as it once used to be.

Key Events

ASX corporate actions occurring today (lots of companies trading ex-div so here are the main ones):

- Trading ex-div: Integral Diagnostics (IDX) – $0.025, Baby Bunting (BBN) – $0.027, Woolworths (WOW) – $0.46, Platinum Asset Management (PTM) – $0.07, Coles (COL) – $0.36, Kelsian (KLS) – $0.075, SSR Mining (SSR) – $0.077, Pro Medicus (PME) – $0.13, Medibank (MPL) – $0.063, Nib Holdings (NHF) – $0.13, Pilbara Minerals (PLS) – $0.11

- Dividends paid: None

- Listing: None

Economic calendar (AEDT):

- 9:00 pm: Eurozone Unemployment

- 9:00 pm: Eurozone Inflation Rate

2 contributors mentioned