S&P 500 flat ahead of inflation data, IMF issues growth warning, ASX to rise

ASX 200 futures are trading 25 points higher, up 0.34% as of 8:45 am AEDT.

The S&P 500 gives up a 0.4% gain in the last thirty minutes as CPI jitters kick in, analysts expect first quarter US earnings to be a trough for earnings and return to record levels from the third quarter onwards, China inflation slows to lowest since September 2021 and the IMF issues a dire warning for the global economy.

Let's dive in.

S&P 500 SESSION CHART

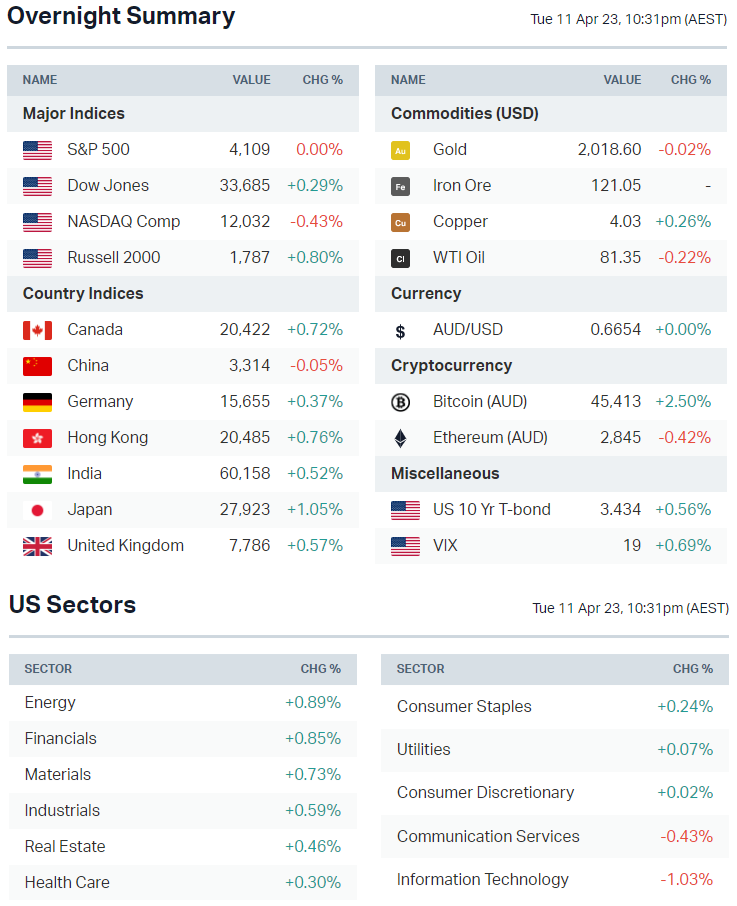

MARKETS

- S&P 500 closes breakeven after tumbling from 0.4% in the last thirty minutes of trade

- Breadth was still positive and equal-weight S&P 500 outperformed cap-weighted index by 60 bps, mega cap tech stocks weighed on benchmarks

- US Dollar Index down 0.4%, with commodities generally higher

- Market in wait-and-see mode ahead of inflation print and FOMC

- Bank of America clients pulled US$2.3bn from US equities last week, with real estate showing largest outflows since July 2021 (Bloomberg)

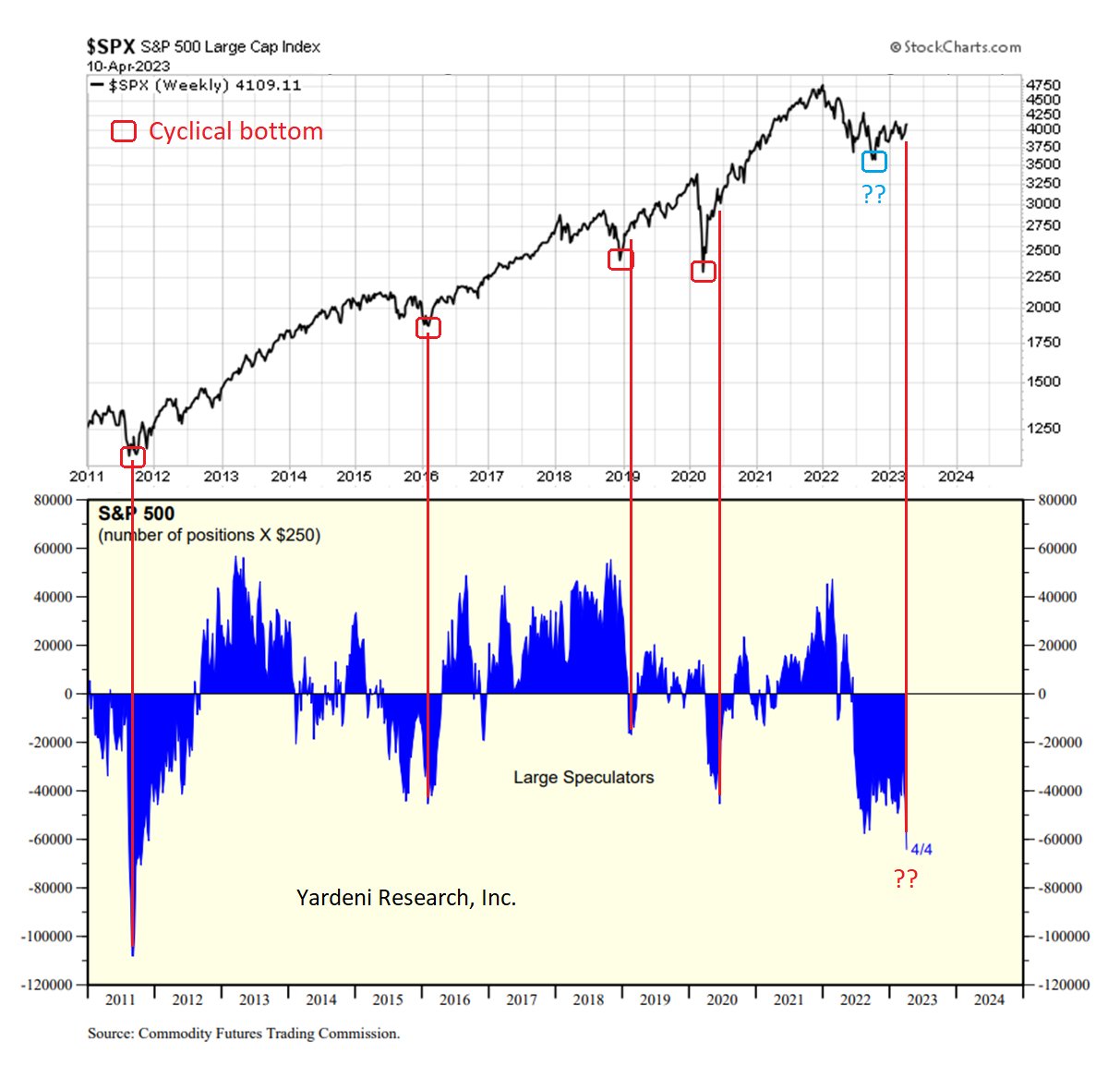

- CFTC data shows biggest net short S&P 500 positions since Nov 2011 (Bloomberg)

- CMBS spreads widen to highest since 2020 amid refinancing fears (Bloomberg)

STOCKS

- Newmont raises bid for Australian rival Newcrest to US$19.5bn (FT)

- Boeing tops Airbus in plane deliveries for first time since 2018 (Bloomberg)

- Glencore adds cash to offer for Teck US$23bn all-stock offer was rejected (Bloomberg)

Walmart to close several unprofitable Chicago locations (Bloomberg)

- "The simplest explanation is that collectively our Chicago stores have not been profitable since we opened the first one nearly 17 years ago – these stores lose tens of millions of dollars a year, and their annual losses nearly doubled in just the last 5 years," Walmart said in a statement

- WW International shares surge almost 60% after Goldman Sachs said the stock could almost triple as it pushes into the obesity medication market (Barron's)

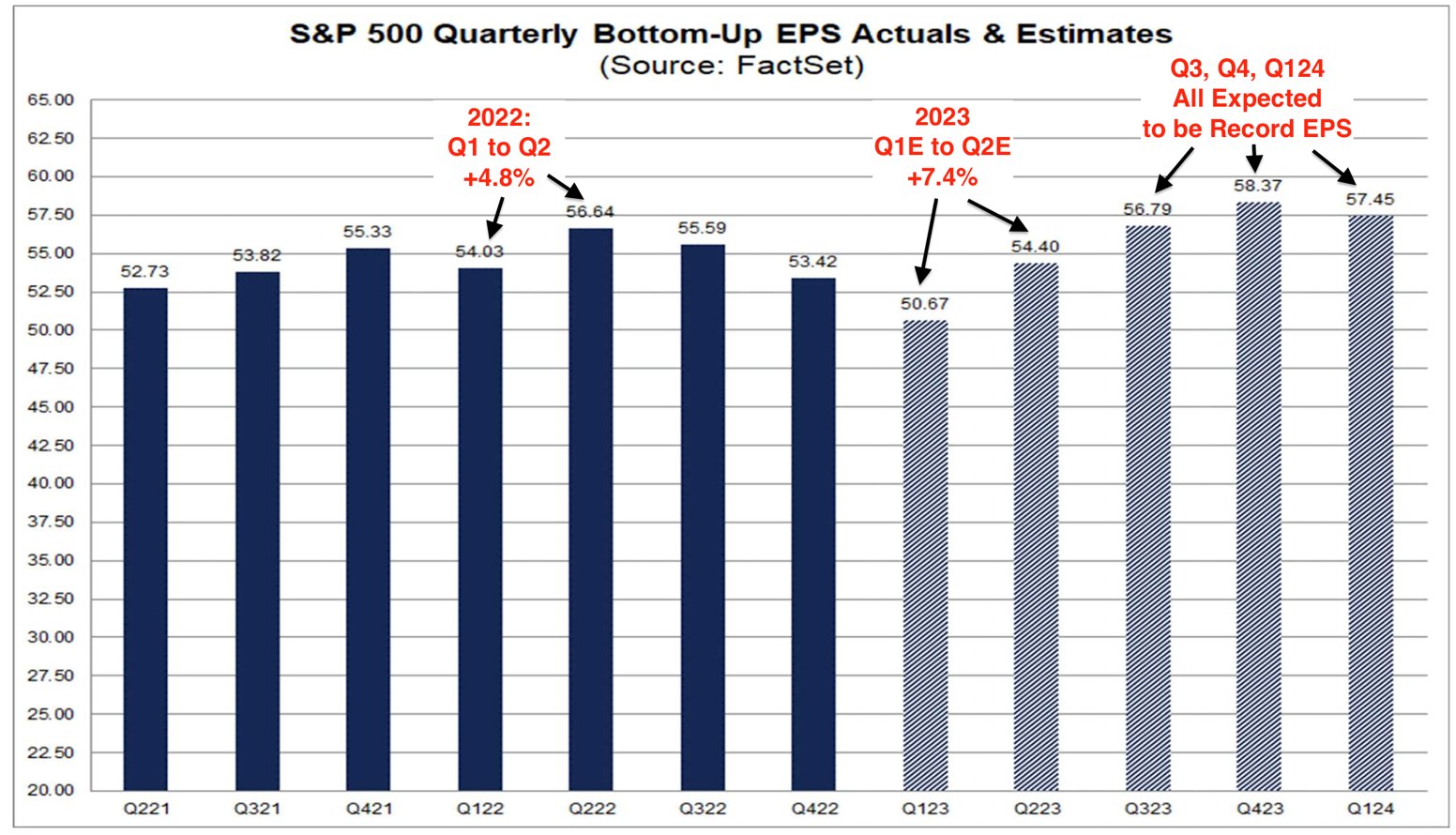

EARNINGS

- S&P 500 companies expected to show 6.8% YoY decline in Q1 earnings (FT)

- US banks likely to report weaker earnings following banking meltdown (FT)

- Analysts expect 1Q23 to be the trough for earnings and return to record levels from 3Q23 onwards

ECONOMY

- China consumer price inflation slows to lowest since September 2021 (Reuters)

- China new loans surprise to the upside for March, hit record for Q1 (Reuters)

- China plans to ramp up construction spending this year (Bloomberg)

- Australian consumer and business confidence bounces(Bloomberg)

- Bank of Korea leaves rates unchanged as expected (Reuters)

- IMF warns global economy could see hard landing under higher for longer scenario (FT)

- Available US office space hits an all-time high (Axios)

-

Collapsing money supply growth signalling recession (Bloomberg)

Deeper Dive

A closer look at China, IMF and the upcoming US inflation print. Sectors to Watch is taking a break (overnight was basically Resources higher thanks to China, weaker US dollar as well as M&A and Tech lower) ahead of the CPI print.

China: Inflation eases, loans jump and property sales bounce

There was plenty of bullish data and headlines out of China on Tuesday, which helped the ASX 200 Materials Index rally 2.2%.

- Inflation eased from 1.0% year-on-year in February to 0.7% in March

- Interestingly, the producer price index was very weak, latest -2.5% year-on-year for March from -1.4% in February

- Banks extended 3.89tn yuan (US$560bn) in new loans, more than double February and above analyst expectations of 3.24tn yuan

- 2nd-hand home transactions by floor area in China's 15 major cities rose 66% year-on-year for Jan-March, transactions jumped 98% year-on-year

- Several Chinese property developer shares rallied 10-20% on the news

In terms of economic outlook:

- IMF forecasts 2023 growth of 5.2% and 2024 growth at 4.5%, unchanged from January forecasts

- ING Economics said "data released so far do not point to a recovery that could lead to a 5% YoY GDP growth for the first quarter. As such, we think the government will announce fiscal stimulus measures after the GDP report is released next week."

- "There should be more infrastructure investment and some consumption stimulus. One such stimulus could be the resumption of subsidies for electric vehicles (EVs). However, this would increase the risk of over expansion of the EV industry."

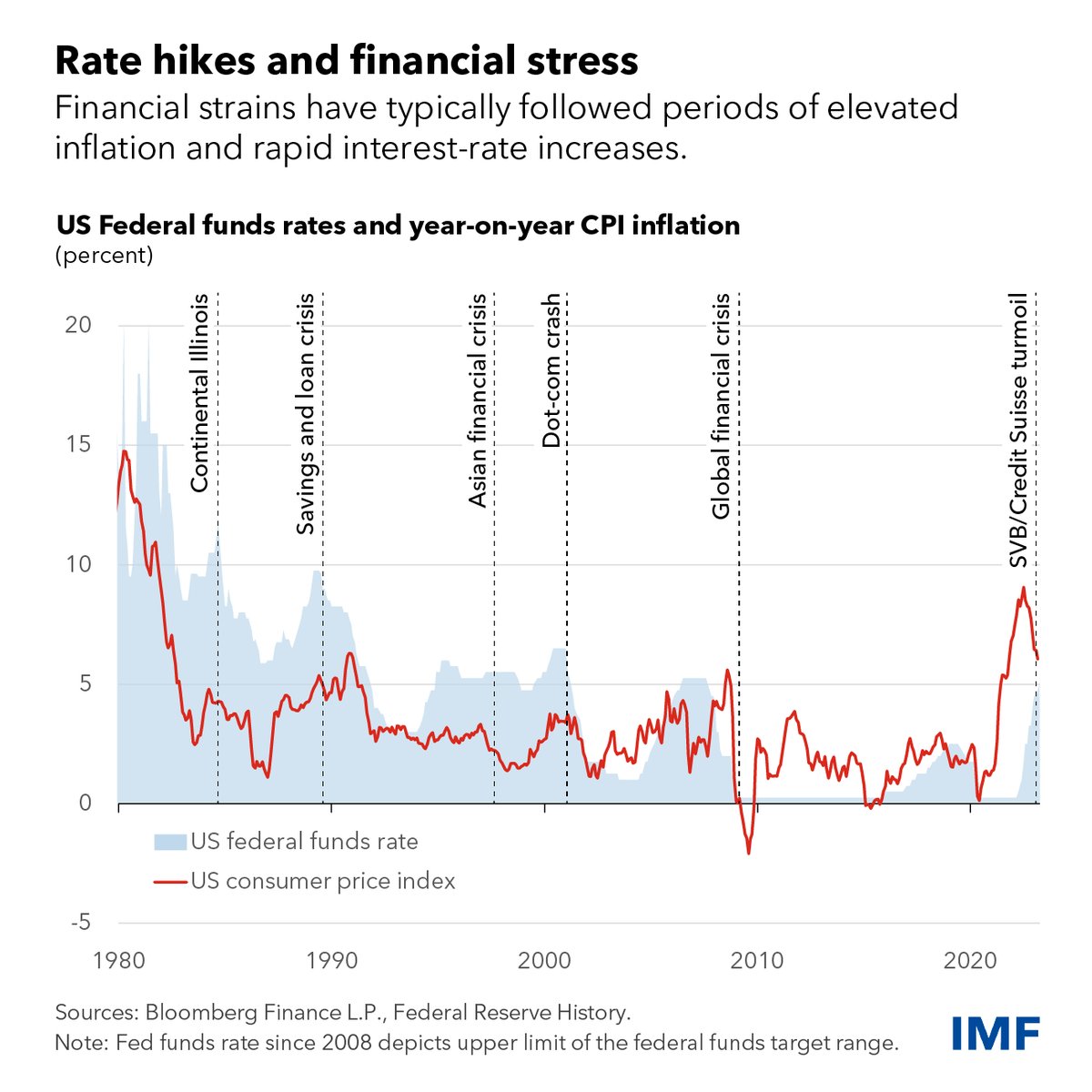

IMF: Warns of 'deteriorating' economy

A closer look the IMF note that warns of a "perilous combination of vulnerabilities" in financial markets.

- "On the surface, the global economy appears poised for a gradual recovery from the powerful blows of the pandemic and of Russia's unprovoked war on Ukraine."

- "Below the surface, however, turbulence is building, and the situation is quite fragile, as the recent bout of banking instability reminded us. Inflation is much stickier than anticipated even a few months ago ... Core inflation, excluding the volatile energy and food components, has not yet peaked in many countries."

- "More worrisome is that the sharp policy tightening of the past 12 months is starting to have serious side effects for the financial sector."

- "... risks to bank and non-bank financial intermediaries have increased as interest rates have been rapidly raised to contain inflation. Historically, such forceful rate increases by central banks are often followed by stresses that expose fault lines in the financial system."

US CPI: Headline to fall, core possibly higher

Brace yourself for another spicy CPI print tonight at 10:30 pm AEST.

- Headline inflation expected to ease to 5.2% in March from 6.0% in the previous month

- Core inflation expected to inch higher to 5.6% from 5.5%

As we noted from Tuesday's Evening Wrap, the market's been rather aggressive with short exposure in the lead up to this CPI print.

"Large speculators, mostly hedge funds, saw their net short positions in S&P 500 e-mini futures increase to roughly 321,000 contracts as of Tuesday, according to data from the Commodity Futures Trading Commission. That’s the most bearish reading since November 2011 following the downgrade of the US’s sovereign credit rating," Reuters reported.

Interestingly, large speculator positioning has typically coincided with S&P 500 cyclical bottoms. However, it's also wroth noting that we've had QE and zero-interest rate policy for most of the time series.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Wam Microcap (WMI) – $0.052, Future Generation Investment Co (FGX) – $0.033, Wam Global (WGB) – $0.058

- Dividends paid: Brambles (BXB) – $0.177, Pacific Current Group (PAC) – $0.15, IVE Group (IVE) – $0.095, TPG Telecom (TPG) – $0.09, Solvar (SVR) – $0.075, Qube (QUB) – $0.0375, Peet (PPC) – $0.035, Woolworths (WOW) – $0.46, Emeco (EHL) – $0.0125

- Listing: None

Economic calendar (AEST):

- 10:30 pm: US Inflation Rate

- 12:00 am: Canada Interest Rate Decision

- 4:00 am: FOMC Minutes

This Morning Wrap was first published for Market Index by Kerry Sun.

1 contributor mentioned