S&P 500 higher, Bank of Canada holds rates at 4.5%, ASX 200 set to bounce

ASX 200 futures are trading 32 points higher, up 0.44% as of 8:45 am AEDT.

US stocks mostly higher after the broad-based selloff on Wednesday, Powell makes a dovish tweak to his remarks - suggesting the Fed is prepared to upshift only if the data warrants so, US job openings come in stronger than expected, the yield curve continues to scream a recession, the Bank of Canada becomes the first major central bank to hit pause on interest rates and UBS' take on gold.

Let's dive in.

S&P 500 SESSION CHART

MARKETS

- Wall Street fears big Fed rate hike after Powell's speech (Bloomberg)

- Global investors contemplate fallout from US rate reaching 6%, driving the dollar higher and equities lower (Bloomberg)

- Deepest bond yield inversion since Volcker suggests a hard landing (Bloomberg)

- Powell prepared to speed up pace of rate hikes (Bloomberg)

- RBA Lowe opens door to an April rate pause (Bloomberg)

STOCKS

- WeWork (+4.4%) tries to short up financial footing with $3bn debt restructure (NY Times)

- CrowdStrike (+3.2%) eyes strong FY revenue as cybersecurity spending holds up (Reuters)

- Occidental Petroleum (+2.1%) pops as Buffett bumps ownership to 22.2% (CNBC)

- Tesla (-3.0%) shares hit by US probe into reports steering wheels fall off (Reuters)

ECONOMY

- US job openings stay elevated as labour market remains tight (Reuters)

- German retail sales fall 0.3% month-on-month in January (Reuters)

- Canada leaves rates unchanged, sees inflation falling as forecast (Reuters)

- US economy could lose a million jobs and fall into recession if debt ceiling is not raised (NY Times)

Deeper Dive

Economy: Bank of Canada bets on disinflation

The Bank of Canada kept interest rates unchanged at 4.5%, arguing that economic data points to inflation sharply decelerating this year towards its 2% target. It forecasts CPI inflation to be "around 3% by the middle of this year."

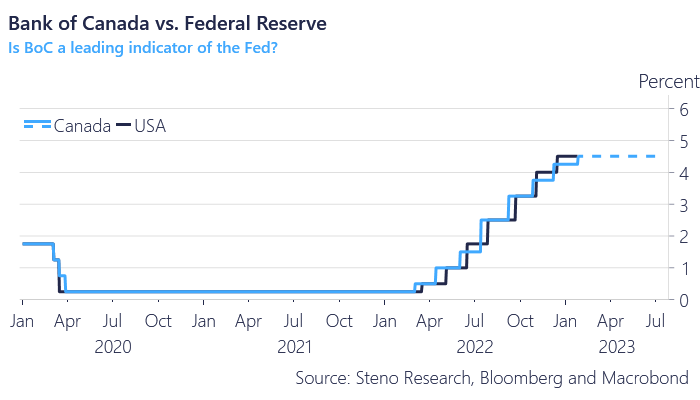

This marks the first major central bank to pause interest rate hikes. Oh and the Bank of Canada often precedes the Fed.

Beyond that, we also received the ADP Employment Report overnight. 242,000 jobs were created but its status as a precursor to the major non-farm payrolls report has dislocated in recent months.

JOLTS job openings were also released last night, with the 10.8 million figure beating expectations of 10.58 million. There are still about two jobs available for every one unemployed person seeking work. It's clear this labour market tightness is going nowhere.

Powell speech: The aftermath

Now that Powell's speech is done and dusted, let's assess the damage:

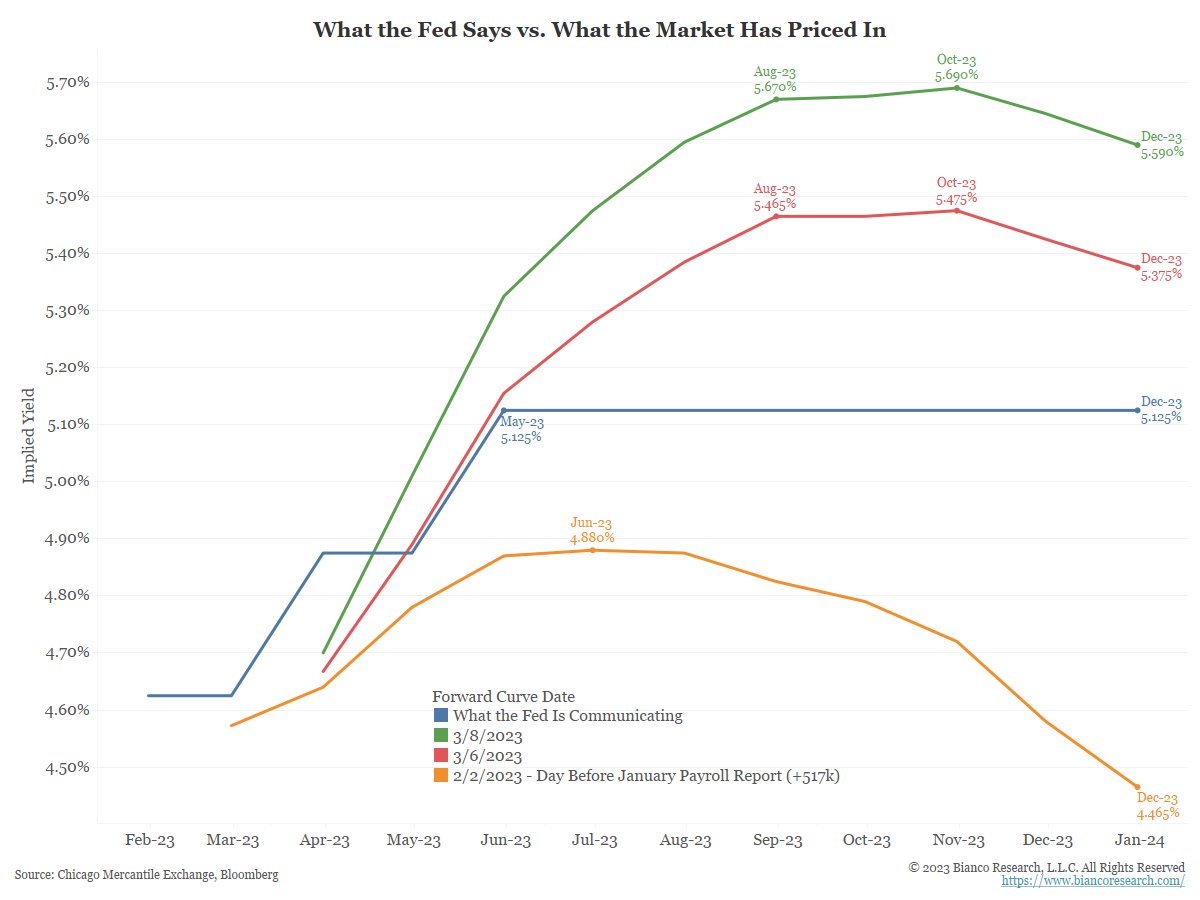

- Probability of a 50 bp hike in March was 31% on Monday and 81% right after he finished his testimony

- The probability of 6.0% funds rate at the September FOMC meeting was 16% on Monday, now 60%

- The terminal rate was 5.48% on Monday, now 5.69%

- The forward curve has shifted aggressively but remains adamant of a rate cut in December 2023

Powell also flagged the JOLTS survey, the NFP report Friday and next week's inflation report as key inputs for the Fed's interest rate outlook:

- "They're going to be important in our assessment."

- "We'll be carefully analysing them."

- "We have not made any decision about the March meeting."

- "We're not on a preset path."

Gold, Gold, Gold

Two differing views on gold are featured in our broker watch today. UBS still believes spot gold can clock US$1,900/oz by Q4 and it's placing its hopes on a Federal Reserve pivot by the end of the year, which in turn could be fueled by poor jobs data. If you're looking for gold exposure, Northern Star (ASX: NST) is their top pick in the large end of town while smaller players SSR Mining (ASX: SSR) and Gold Road (ASX: GOR) are also looking good.

At Morgan Stanley, they've been taking a look at the traditional relationship between spot gold prices and real Treasury yields (nominal + inflation). 2022 was an aberration by their standards. Gold would have fallen further if not for increased central bank demand. Their bull case is for gold to be at US$2,160/oz by the end of the year despite a deterioration in that argument over the first few months of 2023.

Key Events

ASX corporate actions occurring today:

- Trading ex-div (larger cap only): Monadelphous (MND) – $0.24, APM Human Services (APM) – $0.05, ASX (ASX) – $1.162, CSL (CSL) – $1.549, Vulcan Steel (VSL) – $0.224, South 32 (S32) – $0.071, IDP Education (IEL) – $0.21, Perpetual (PPT) – $0.55, BHP (BHP) – $1.306, Rio Tinto (RIO) – $3.265, McMillian Shakespeare (MMS) – $0.58, MinRes (MIN) – $1.20

- Dividends paid: Accent Group (AX1) – $0.12, SG Fleet (SGF) – $0.089, Ansell (ANN) – $0.2915

- Listing: None

Economic calendar (AEDT):

12:30 pm: China inflation rate

3 stocks mentioned