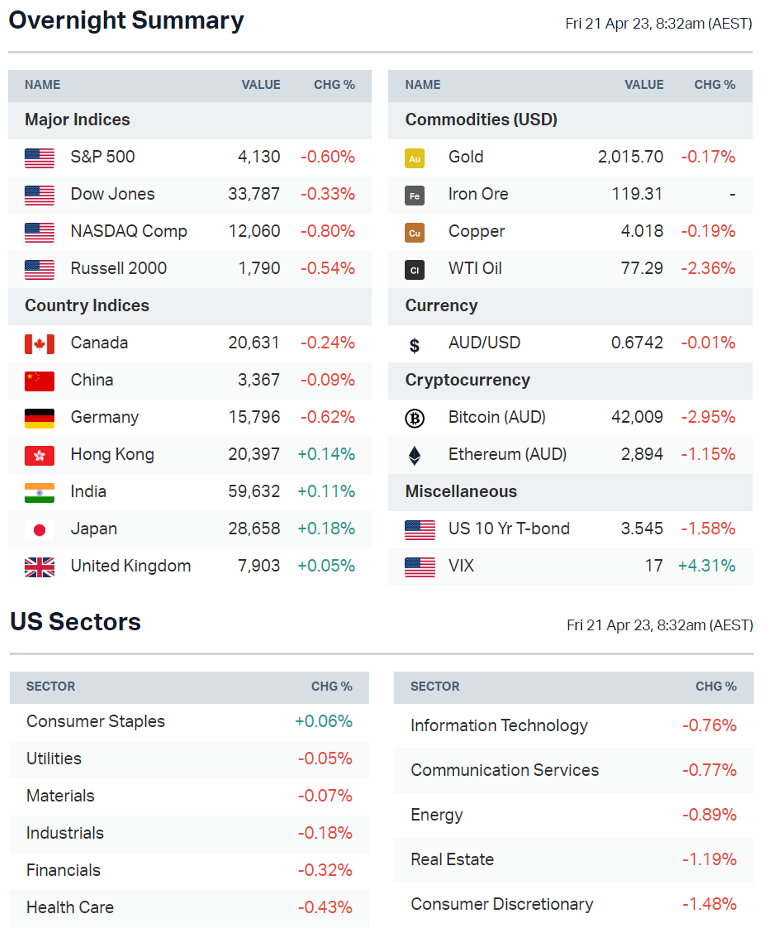

S&P 500 lower, Tesla shares tank 10%, iron ore hits year-to-date low, ASX to fall

ASX 200 futures are trading 38 points lower, down -0.52% as of 8:20 am AEDT.

US stocks fall amid disappointing earnings and soft economic data, oil prices give back all of its OPEC production cut gains, iron ore prices return to negative year-to-date territory, Tesla shares tumble as EV price cuts chip away at margins, the US Philly Fed manufacturing index unexpectedly falls even further in April and the RBA's review in three dot points.

Let's dive in

S&P 500 SESSION CHART

MARKETS

- S&P 500 and Nasdaq finished lower amid the underperformance of automakers, regional banks, energy and airline stocks

- Tesla price cuts and margin miss was the big drag on tech stocks, regional bank results also underwhelmed

- Treasury yields and the US dollar eased, sending gold back above US$2,000

- Oil prices fall ~2.4% to the lowest level since 31 March – when OPEC announced unexpected production cuts

- Iron ore futures fall almost 4% in the last two sessions, bringing year-to-date performance to -2.4% from a peak of 20% on 21 February

- NY Fed Williams says inflation is still too high, Fed will act to lower it (Reuters)

STOCKS

- TSMC flags weaker chip demand and higher inventory (Bloomberg)

- Google to introduce generative artificial intelligence into advertising business (FT)

- Deutsche Bank to cut jobs at executive board, infrastructure and private banking (Reuters)

EARNINGS

American Express (-1.0%): Revenue beat but EPS miss, US consumer credit delinquencies were unchanged month-on-month in March at 1.1%, provisions for loan losses totaled US$1.1 billion – above market expectations of US$890 million, full-year guidance was reaffirmed.

"I think a lot of people describe the current economic environment as mixed. And so March was our strongest month ever across the globe in terms of volumes as a company.” – CFO Jeff Cambell

Tesla (-9.75%): Revenue rose 24% year-on-year to US$23.3bn, net income fell -24% to US$2.5bn, EPS and revenue broadly in-line with analyst expectations, gross margins hit a two-year low of 19.3% from 21.%.

"We expect that our product pricing will continue to evolve, upwards or downwards, depending on a number of factors ... although we implemented price reductions on many vehicle models across regions in the first quarter, our operating margins reduced at a manageable rate.”

AT&T (-10.4%): Revenue and earnings broadly in-line, free cash flow was only US$1bn compared to estimates to expectations of US$3bn. The telco is struggling with higher costs of phone inventory, network construction and lower income from Direct TV.

ECONOMY

- US Philly Fed manufacturing index flags steepening contraction (Reuters)

- New Zealand inflation moderates by more than forecast (Bloomberg)

-

RBA to get new rate-setting board under review recommendations (Reuters)

Deeper Dive

Economic Data: Beginning to Falter

The S&P 500 has never bottomed before a recession. Data going back almost 100 years suggests that there is more downside if the economy falters, according to Bloomberg.

Overnight, the US Philadelphia Fed fell 8 points to -31.3 in April compared to expectations of a -19.3 reading. Here are some of the key takeaways:

- Eighth consecutive negative reading and lowest since May 2020

- Indexes for new orders and shipments remain negative but increased this month

- Prices paid and received declined to their lowest readings since mid-2020

- The Philly Fed manufacturing index below -25% has a 100% hit rate for recessions since the 1970s

There was also an interesting comment from JPMorgan about the US jobless claims market where “a rising trajectory in [jobless claims] took hold last month ... A sustained move well above 250,000 in the coming months would send a signal that the economy is sliding into recession.”

The disinflation narrative might be gathering momentum, which provided an initial kick for markets, but now we have to ask ourselves, why are prices starting to fall?

RBA Review: The TLDR Version

Yesterday, the most important institution in Australian economics received a near-300 page paper that has been 30 years in the making. Here's the TLDR version:

- Monetary policy should now be set by an independent and separate board to those dealing in regulation and bank operations.

- A new framework will be built for policy and tools, which will be reviewed every five years.

- Meetings will move to every six weeks and post-meeting press conferences will become standard.

Corporate members will remain on the RBA monetary policy-setting board, highlighted by two new appointments (Afterpay's Elana Rubin and former Fair Work Commission President Iain Ross).What the Review did not make clear is whether Governor Phil Lowe should keep his job. That decision will likely be made later this year.

Charts of the Week

This segment of the morning wrap brings you weekly technical commentary on the ASX 200 and some of the more interesting charts in the market. These are not meant as recommendations. They are for illustrative purposes only. Any discussion of past performance is for educational purposes only. Past performance is not a reliable indicator of future return. Always do your own research.

ASX 200 – Patience, young grasshopper

Last week I wrote of the big test the bulls would face at the 7400 level – the underside of the uptrend support line and a prior swing high. Since then, the index has traded in a very tight range and continues to hover just short of 7400. For all intents and purposes, nothing has changed. Having been involved in markets for some time however, one gets the sense that some sizable moves are on the way – let’s hope it’ not sell in May and go away. Either way, some patience is required here whilst the market figures out what happens next.

Altium (ALU) – About to ascend?

When I was a trader, Altium was one of my favourite stocks to look at. Long trends, interesting chart patterns, and typically plenty of interest from the market. Currently, the chart is showing a wedge pattern, which is a type of continuation pattern. The textbooks will tell us that continuation patterns typically break in the direction from which they came (if the stock was going up on the way in, it will break higher on the way out), and that the moves can be explosive. And it makes sense practically. Since January the distance between the bulls and bears has become narrower and narrower and right now, neither party has a clear advantage. That creates tension and, when that tension snaps, the move can be significant. One for the watchlist.

Bluescope Steel (BSL) – Beautiful Bluescope

From a trend perspective, BSL has one of the best looking charts in the market right now. Accelerating, well supported uptrend since September, rising average volume through the most recent part of the rally, not yet overcooked on the RSI, a clear move through $20 recently so no round number resistance, and a break of the prior swing high yesterday. There is plenty of bullish technical evidence for this one and the momentum is strong.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: MFF Capital (MFF) – $0.045

- Dividends paid: Horizon Oil (HZN) – $0.015, Gowing Brother (GOW) – $0.03, ARB Corp (ARB) – $0.32, Charter Hall (CQE) – $0.043, CI Resources (CII) – $0.025

- Listing: None

Economic calendar (AEST):

- 9:00 am: UK Consumer Confidence

- 9:00 am: Australia Manufacturing and Services PMI

- 9:30 am: Japan Inflation

- 4:00 pm: UK Retail Sales

This Morning Wrap was first published for Market Index by Chris Conway, Hans Lee and Kerry Sun.

3 contributors mentioned