S&P 500 rallies on cool producer prices, Nasdaq up 17% year-to-date, ASX 200 futures higher

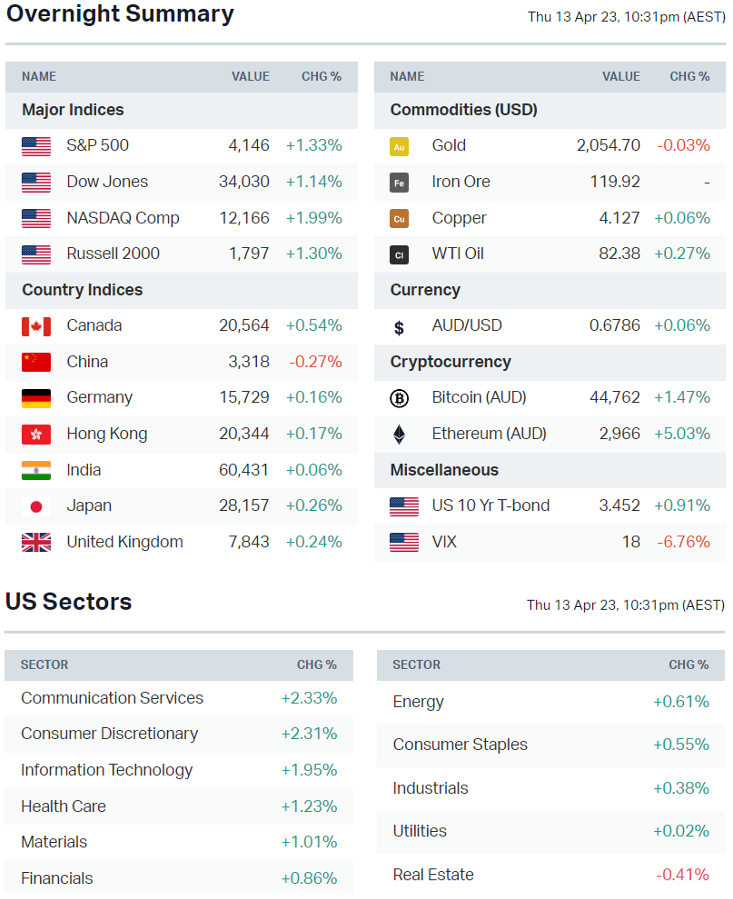

ASX 200 futures are trading 15 points higher, up 0.20% as of 8:45 am AEDT.

The S&P 500 and Nasdaq rally back up to a 2-month high, US producer prices unexpectedly fall in March while jobless claims rise more than expected, the Fed is still likely to opt for a 25 bp rate hike at its May meeting, the disinflation narrative helps gold shoot close to US$2,050 an ounce and Charts of the Week is back!

Let's dive in

S&P 500 SESSION CHART

MARKETS

- S&P 500 opens 0.2% higher and rallies intraday on cooler-than-expected core and headline producer price data and higher-than-expected jobless claims

- Year-to-date benchmark performances: Dow +2.7%, S&P 500 +8.4%, Nasdaq +17.1%

- VIX closes at almost the lowest level since January 2022

- Fed target rate probabilities still favour a 25 bp hike in May

- Fed minutes reiterate need for data dependence, policy flexibility (Bloomberg)

STOCKS

- Goldman Sachs downplays slowdown in US lending in late March (Bloomberg)

- Apple triples iPhone production in India to US$7bn in major China pivot (Bloomberg)

- Amazon CEO says consumers are much more cautious about what they spend on, increasingly trading down, noted AWS faces short-term headwinds (CNBC)

ECONOMY

- US producer prices unexpectedly fall in March (Reuters)

- US jobs market eases; unemployment benefit claims rise above expectations (Reuters)

- China exports unexpectedly surge in March (Reuters)

- South Korea's import prices fell at fastest pace in 27 months in March (Reuters)

- India core inflation drops to below 6% target for first time in 18 months (Bloomberg)

-

ECB officials said to favour a 25bp hike in May (Reuters)

Deeper Dive

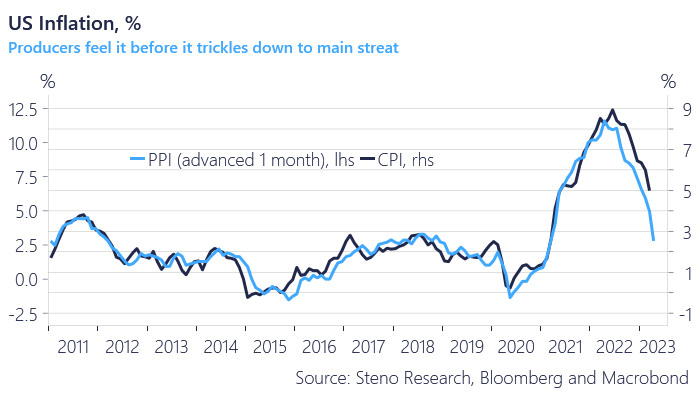

Inflation cools, PPI unexpectedly falls and jobless claims rise

The disinflation narrative makes a return to headlines after a favourable March inflation print and cooler-than-expected producer price data.

Some key takeaways from the PPI print include:

- Headline PPI unexpectedly fell 0.5% MoM in March vs. expectations of no change

- Headline PPI was 2.7% YoY vs expectations of 3.0%

- Headline PPI fell from 4.9% in the previous month or 220 bps

- Energy was a big drag and services was the weakest since March 2020

- Core PPI was 3.4%, in-line with expectations

- "On usual correlations, the current PPI suggests that headline inflation prints below 3.0% already in May." - Steno Research

US jobless claims for the week ending April 8 increased to 239,000 from 228,000 and above expectations of 232,000. This signals that the labour market is beginning to show signs of weakness. Does this mean the tightness we've seen is likely to fade soon?

Sectors to Watch

I'm not going to lie. Things feel a little frothy. CNN's Fear & Greed Index measures what emotion is driving the market from a scale of 0 to 100 (extreme fear to extreme greed). It's currently sitting at 65 from 26 a month ago. Anyway. Today's sector to watch will be pretty short n sharp.

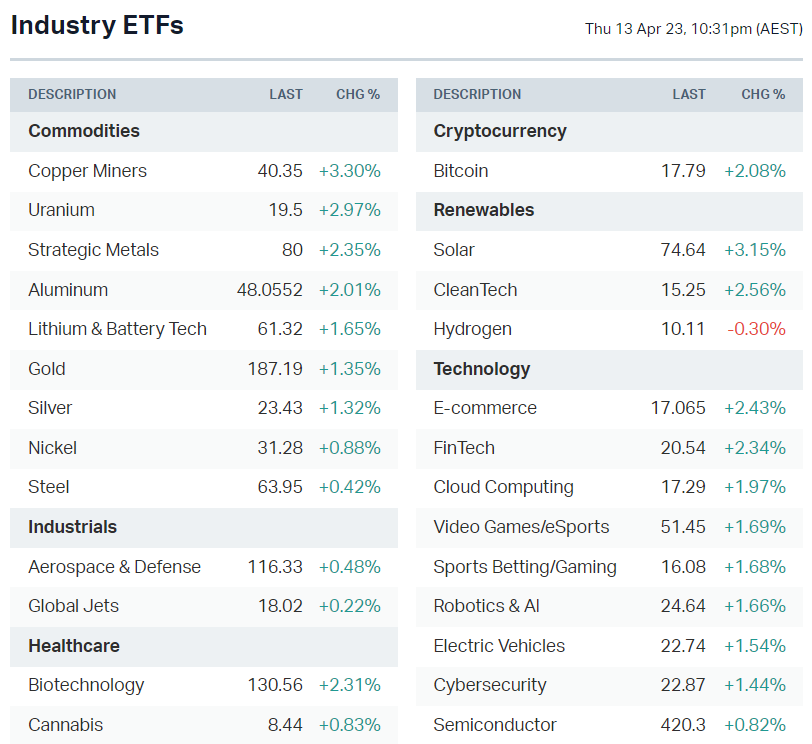

- Gold: Will high inflation soon be a thing of the past? The PPI print and trend says so, which helped gold push through US$2,000 with ease. It's currently trading at US$2,040 and making a run for that March 2022 high of US$2,070.

- Copper: Dr Copper rose 1.05% overnight. The Global X Copper Miners ETF rallied an outsized 3.3%. A little more and it'll be trading at levels not seen since June 2022.

- Uranium: Arguably one of the most frustrating sectors due to the lack of spot and share price upside vs. compelling narrative about decarbonisation and energy security. The Global X Uranium ETF bounced 2.97% overnight ,which could see some strength follow through for local names.

- Tech: Nasdaq rallied 2% overnight. Local tech stocks were surprisingly strong on Thursday (despite the ASX 200 falling 0.27%). The strength yesterday was led by names like Wisetech (+1.5%), NextDC (+1.7%) and Altium (+2.0%). Do we see this trend continue?

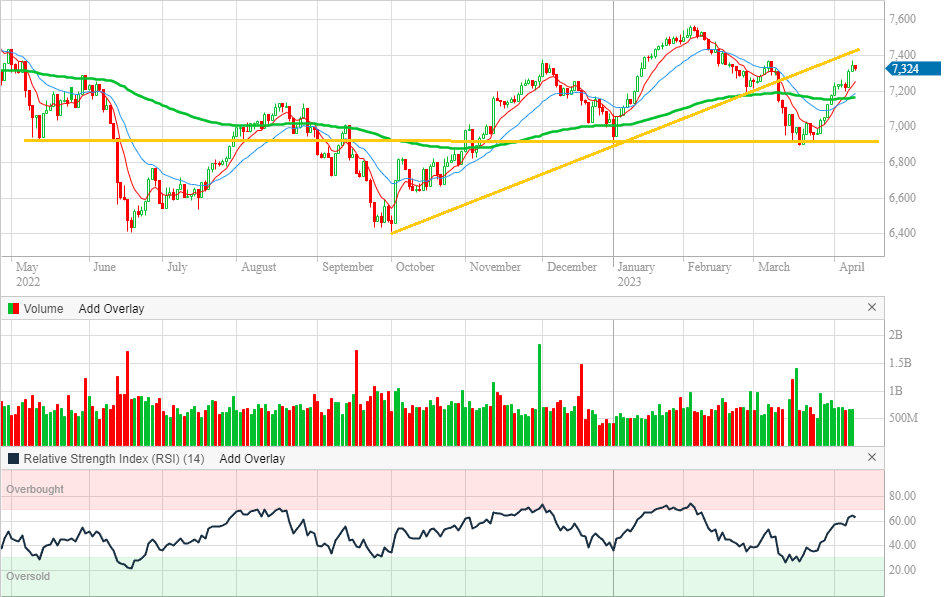

Chart of the Week

This segment of the morning wrap brings you weekly technical commentary on the ASX 200 and some of the more interesting charts in the market. These are not meant as recommendations. They are for illustrative purposes only. Any discussion of past performance is for educational purposes only. Past performance is not a reliable indicator of future return. Always do your own research.

ASX 200 – Big test at 7400

It has been a couple of weeks between drinks, given the Easter holiday last week, but last time out the comment was that things were looking more bullish than bearish and that the next test would be the underside of the uptrend support line, around 7400. Well, a couple of sessions back the index printed a high at 7370, before fading to close that session at 7344.

Yesterday there was some modest follow through to the downside with the index closing at 7324. So far, it seems that the bulls are failing the 7400 test. It has been a pretty strong run off the mid-March lows around 6980, so it would make sense for some consolidation before the next move higher. Let’s just all hope that the bulls don’t give up the ghost and all the hard work that has been done getting here.

Brambles (BXB) – The world gets moving again

We all know about the problems coming out of covid. Supply chains were all gummed up and goods were not making their way around the world as they typically would. Those pressures seem to have abated and the veins of capitalism are one again flowing freely. That’s good news for pallet maker Brambles, which seems to be reflected in the share price. The action over the past year shows a solid - if a little lumpy - bullish trend, the latter part of which has been supported by a healthy pickup in volumes. This one has momentum and, as we all know, momentum is hard to get and easy to lose.

Evolution Mining (EVN) – Gold stocks are ripping

Over the past couple of instalments, I’ve taken a look at NCM and RMS. Gold stocks continue to shine and the charts of BGL, NST, PRU, and RSG all look very strong. That said, the one I’m focused on today is Evolution (EVN). It hasn’t quite ripped higher like the others, but could it be about to? There is a significant resistance (supply) level at $3.50, which, if overcome, could open the floodgates for a rally. One for the watchlist, for sure.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Turners Automotive (TRA) – $0.056, Cadence Capital (CDM) – $0.04

- Dividends paid: Cash Converters (CCV) – $0.01, Fonterra (FSF) – $0.079, Regis Healthcare (REG) – $0.02, Vita Life Sciences (VLS) – $0.0325, Cochlear (COH) – $1.55, Lindsay Australia (LAU) – $0.019, Pepper Money (PPM) – $0.051, QBE Insurance (QBE) – $0.30, Corporate Travel (CTD) – $0.06, SRG Global (SRG) – $0.02

- Listing: None

Economic calendar (AEST):

- 4:00 pm: Germany Wholesale Prices

- 10:30 pm: US Retail Sales

- 12:00 am: US Consumer Sentiment

This Morning Wrap was first published for Market Index by Chris Conway and Kerry Sun.

2 contributors mentioned