S&P 500 turns positive, Treasury yields extend gains, ASX futures flat

ASX 200 futures are trading trading flat at 8:20 am AEDT.

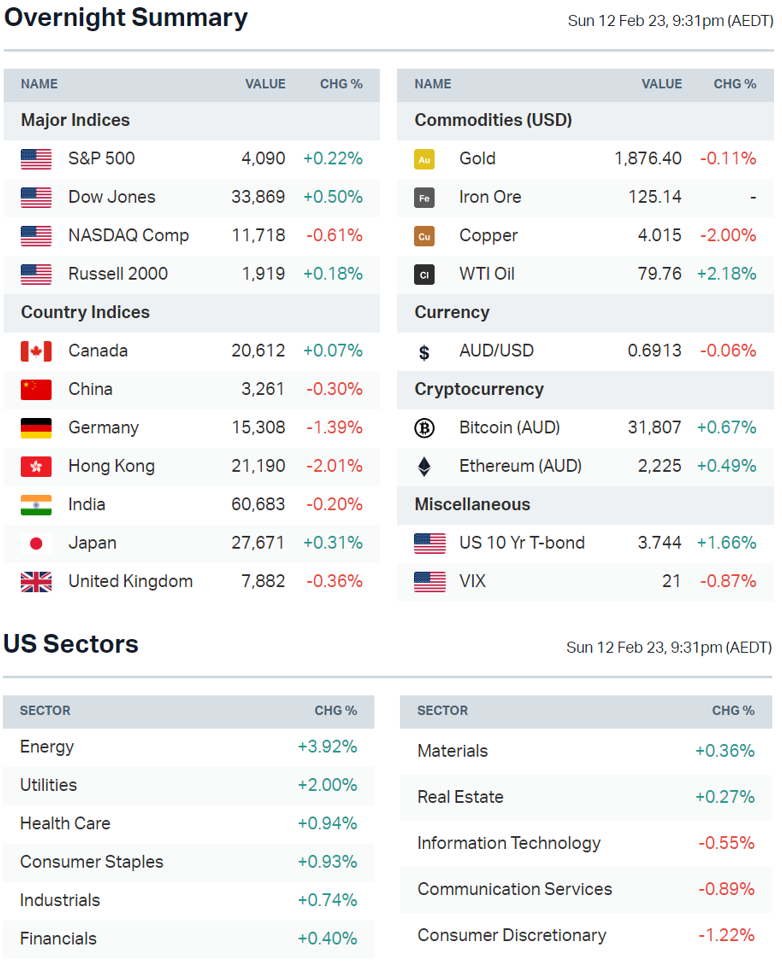

The S&P 500 bounced from session lows of -0.5% to close positive, the US 10-year Treasury yield rallies amid expectations of a higher Fed funds rate, PayPal tops earnings expectations but payment volumes were weaker-than-expected and all eyes on US inflation data on Wednesday.

Let's dive in.

S&P 500 Session Chart

MARKETS

- S&P 500 fell -1.1% last week, marking its first weekly decline in three weeks

- Peak Fed funds rate jumped to 5.15% from 4.9% a week ago

- Fed rate path repricing turned treasuries into a headwind, with the 10-year yield up 21 bps to 3.74% last week

- 2-and-10 year spread hit ~80 bps, its most inverted point since the early 1980s

- Market is now closest to neutral positioning since the second-half of 2022 after cutting over US$300bn of bearish bets (Bloomberg)

- Bond investors are increasingly accepting Fed's "higher for longer" messaging (FT)

- Investors positioning potential bond rout if Wednesday's CPI print hotter than expected (Bloomberg)

STOCKS

- Tesla closing the profit gap with Toyota (Nikkei)

- Samsung moving towards high-end of market amid declining phone sales (FT)

- Adidas may face "significant adverse impact" of unsold Yeezy inventory (CNBC)

EARNINGS

PayPal (+3.0%): EPS beat analyst expectations but payment volumes and revenues slightly missed, issued a strong guidance and repurchase plan (representing 75% of FCF or US$4bn per year) and CEO Shulman is set to retire.

Expedia Group (-8.6%): Missed earnings and revenue expectations, noted solid lodging demand but faced significant headwinds from Hurricane Ian in October and severe US weather in December, January bookings accelerated in 1H23 and set to outpace pre-Covid levels.

“... our most profitable year in 2022 … While our Q4 results were negatively impacted by severe weather, demand was otherwise strong and accelerating, and has been markedly stronger since the start of the year." - CEO Peter M Kern

Lyft (-36.4%): Q4 adjusted net loss of -US$271m, revenue and active riders was slightly ahead of expectations but guided towards a weaker 1Q23.

ECONOMY

- University of Michigan year-ahead inflation expectations jumped to 4.2% from 3.9% a month ago, five-year inflation expectations remained at 2.9%

- Canada added 150,000 jobs last month, 10 times what economists expected (CBC)

- Japan wholesale price inflation eases (Reuters)

- Declining excess savings fueling concerns about consumer spending outlook (FT)

These are all US-listed ETFs. You can check out our ETF table explainer here.

Deeper Dive: Charts, Macro & Sectors

Talking Technicals

S&P 500 manages to bounce on the 20-day (red). With CPI data due on Wednesday, will the market remain in 'wait-and-see' mode?

ASX 200 sold off rather heavily last week, down -1.65%. After such a powerful run, watch how the market behaves amid the pullback.

Macro: US CPI on Wednesday

US CPI is due on Wednesday at 12:30 am AEDT. Consensus expects:

- Inflation to fall to 6.2% in January from 6.5% in the previous month

- Core inflation to fall to 5.5% from 5.7%

Interestingly, the Cleveland Fed Inflation Nowcast is modelling a higher-than-expected reading of (for January):

- Inflation of 6.5%

- Core inflation of 5.59%

Every single CPI reading between February and July last year came in hotter-than-expected, with the S&P 500 down an average -1.27%. Towards the end of the year, we started to see some signs of hope, with (S&P 500 performance plus actual vs. consensus):

- Aug 10: +2.13% (cool)

- Sep 13: -4.32% (scorching hot)

- Oct 13: +2.60 (hot)

- Nov 10: +5.54% (cool)

- Dec 14: +1.28% (in-line)

Sectors to Watch

Oil: Energy was the best performing S&P 500 sector, up 3.9%. Oil prices finished last week up 8.4%. Interestingly, Woodside only closed up 0.65% last week. On Friday, Russia announced that it will cut its oil output but 500,000 barrels a day (around 5% of Jan production) from next month. This adds to the ~2m bpd of supply cuts announced by OPEC+ in 2022.

Defensives: The Dow is starting to outperform, down -0.2% last week compared to the Nasdaq's -1.9% decline. Taking note of Bloomberg's headline about the market approaching neutral positioning after cutting over US$300bn of bearish bets, does this mark the end of the recent resurgence in risk assets? And if so, is this a positive headwind for sectors like Staples, Utilities and Industrials?

Notable sector movers from our ETF list:

- Gainers: Uranium (+1.12%)

- Losers: Jets (-2.34%), Copper (-2.1%), Lithium (-1.92%), Cloud (-1.69%)

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Bailador Technology (BTI) – $0.035, Dicker Data (DDR) – $0.025

- Dividends paid: Transurban (TCL) – $0.265

- Listing: None

Economic calendar (AEDT):

No major economic announcements for Monday.