Shopping, travel, offices set for a roaring return

2020 has been anything but normal. We have lived through a global pandemic; survived enforced lockdowns; learnt to teach our children by ourselves; and have all became super tech savvy as we learnt to conduct our daily lives online via e-commerce and tools like Zoom and Seesaw.

Collectively, we have demonstrated incredible resilience and optimism even as we experienced the worst global recession since the Second World War. But 2021 is going to be the year of the return to normalcy, and with it there will be adjustments as we revert to the old normal.

A return of retail

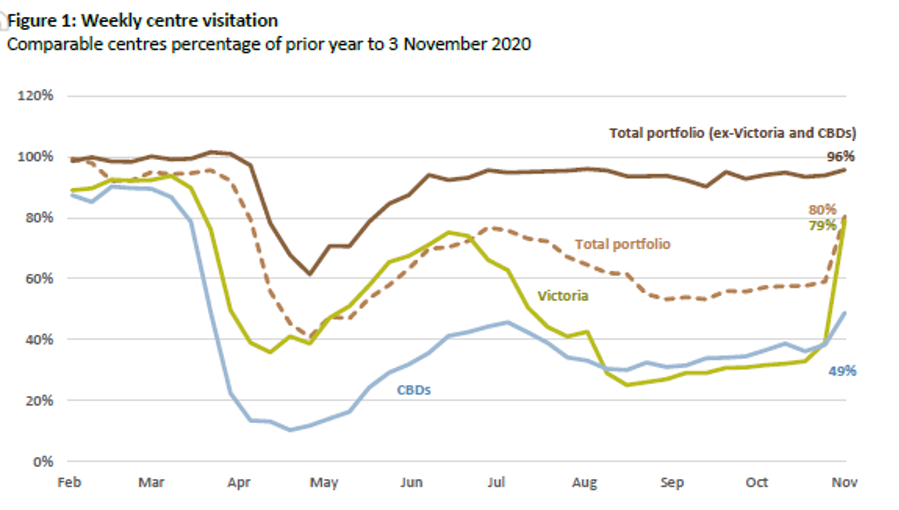

We can expect to see gradual easing of lockdown restrictions around the world as mass population vaccinations take place. Shops will be open again and shoppers will be back in droves. In fact, in Australia we have already seen sharp uplift in foot traffic in shopping centres as demonstrated in the following chart of the weekly centre visitation from Vicinity Centres (ASX: VCX) as online retail eases.

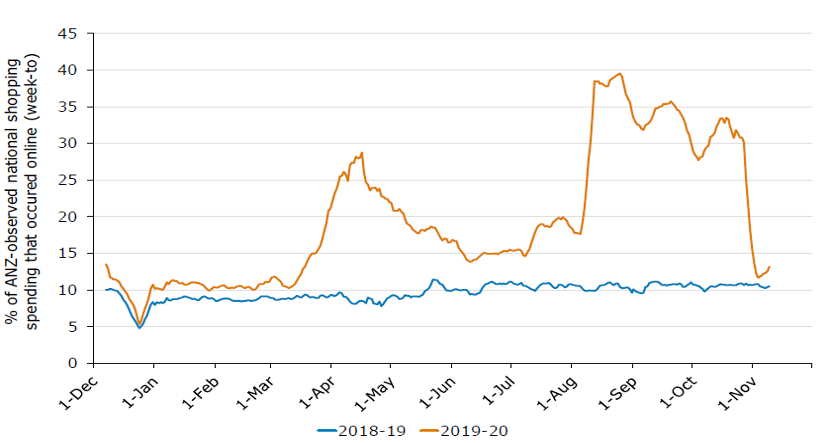

Figure 2: Share of ANZ observed Victorian shopping that occurred online

A return to the office

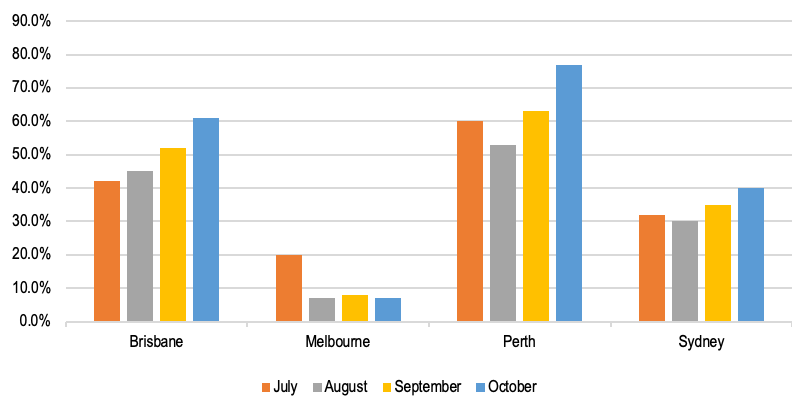

Offices will return to normal as workers leave their homes. Although there is some debate about whether working flexibility will continue to be offered, leading to less office space demand, current statistics across all major cities post lock down are showing promising trends.

Figure 3: Office utilisation compared to pre-COVID-19

A return of the housing investor

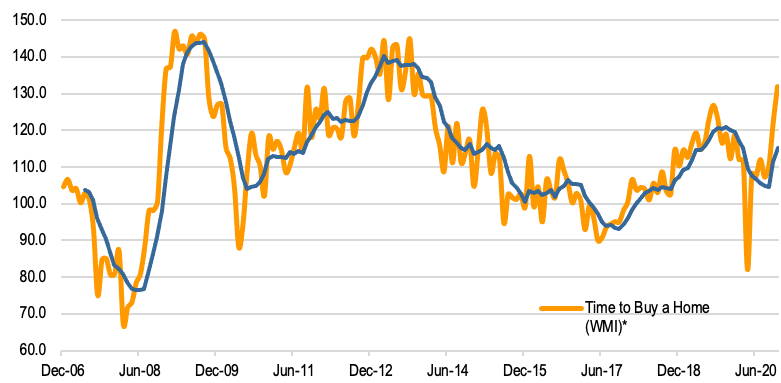

Fiscal stimulus and low interest rates have already started to move the housing market. House prices have increased meaningfully from their March trough, and transaction activities are also picking up. With an easing in the regulation on responsible lending and an improving economy, our banks are likely to start growing their mortgage lending again. The Reserve Bank of Australia’s assurance of near zero interest rates will absolutely drive property investors back into the market in 2021.

Figure 4: Housing sentiment: Time to buy a home

A return of the traveller

We will fly and travel again, and we will do so in a big way. Air travel has been the sector most impacted by the pandemic, but with the roll out of a vaccine, we expect a significant return of air travel and expect to experience multiple years of above trend growth due to pent up demand.

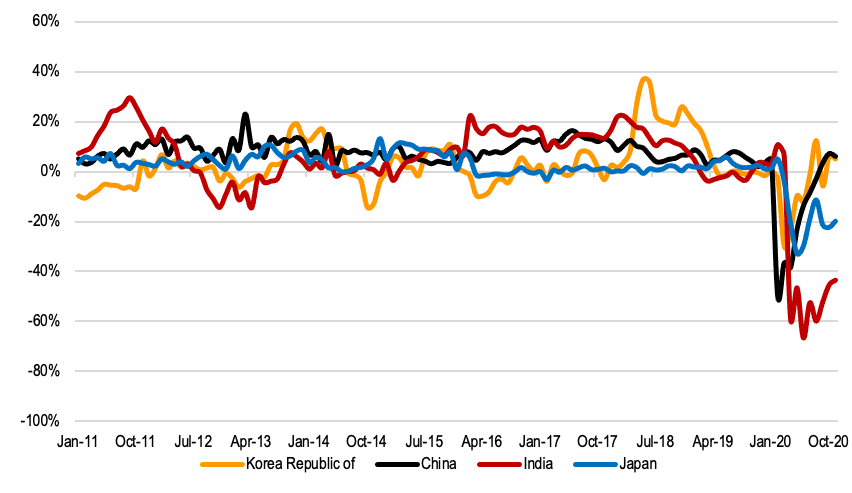

Around the world, we have already seen South Korea and China domestic air travel return to above pre-COVID-19 levels. This level of return has been seen in the past, following every localised health crisis - such as SARS or MERS.

Figure 5: Domestic YOY (%) No. flights

Finally, a return of diplomacy

A Biden presidency in the United States will see the return of a steadier hand in the White House, and we can expect a more multi-lateral approach towards foreign policy. As such, one can expect that 2021 will see an easing of political tension – and hopefully we can all be nice to strangers again.

One thing investors can't ignore in 2021

The above wire is part of Livewire's exclusive series titled "The one thing investors can't ignore in 2021." The series will culminate in the release of a dedicated eBook that will be sent to readers on Monday 21 December. You can stay up to date with all of my latest insights by hitting the follow button below.

1 topic

1 stock mentioned