Sidestepping the supply driven carnage

Investors and commentators who were enamoured with the long-term structural trends towards decarbonisation – and as a result have been heavily exposed to the battery minerals complex – have had a painful lesson.

Unpicking the longer term story, however, reveals what are in fact more a series of short-term drivers:

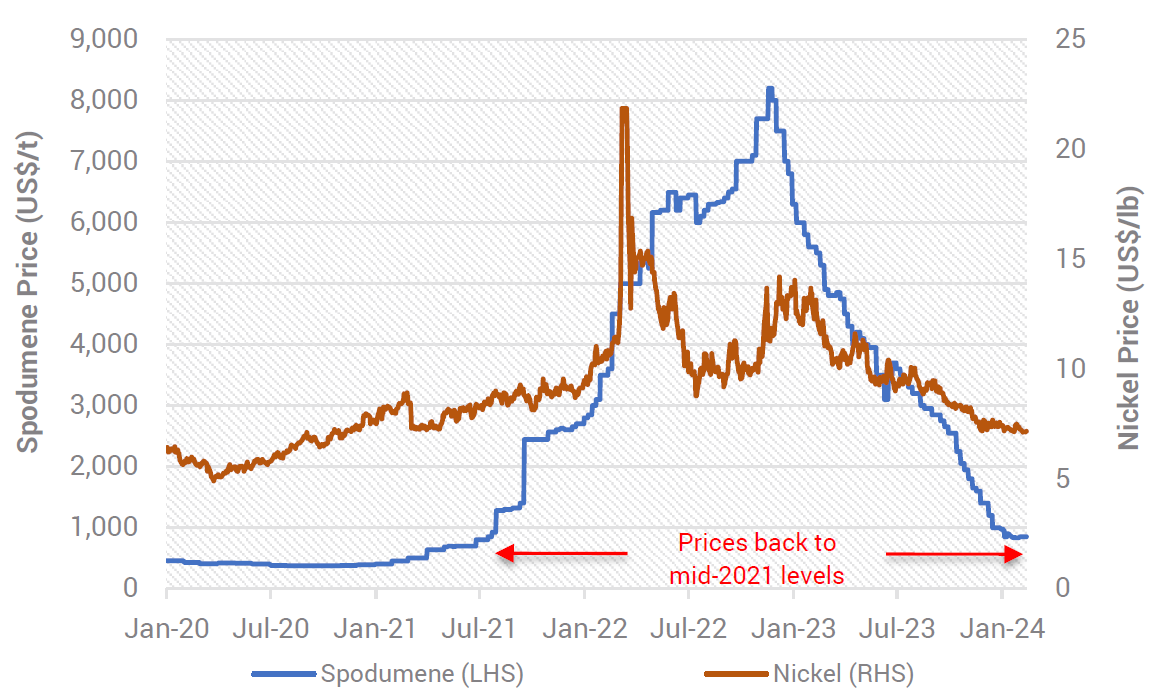

- Pricing in the lithium spodumene market crashed 85% in 2023 to finish the year at US$970/t, a price many thought was inconceivable but is actually where it was in mid-2021 prior to the speculative frenzy.

- Nickel has fallen by a more 'modest' 44% over that period, as surging Indonesian production (mostly funded by Chinese SOEs) flooded the market.

- This collapse in the pricing of both commodities (refer Chart 1) is despite strong EV demand, with sales up +34% globally in 2023 (slightly below expectations but representing more than 100% of the growth of the auto industry).

- The central issue with these two commodities is that supply has grown faster than demand, and when commodity prices move a mile away from their cost curves it typically ends in a blood bath. We have since observed lithium and nickel projects being deferred, mothballed, or curtailed. All of which is part of the natural business cycle.

Chart 1: The Lithium and Nickel Pricing Rollercoaster

Source: YCM, Bloomberg, Feb 2024.

Notwithstanding real time case studies being readily observable, there appears to be obvious complacency on Iron Ore which, inconveniently, is Australia's largest export ($144bn in 2023) and speaks for 17% of ASX 200 earnings (and 16% of dividends).

Demand for iron ore is stagnating. China – which represents 71% of the global seaborne market – has a housing sector which is in a deep funk and an economy showing clear signs of maturity and saturation.

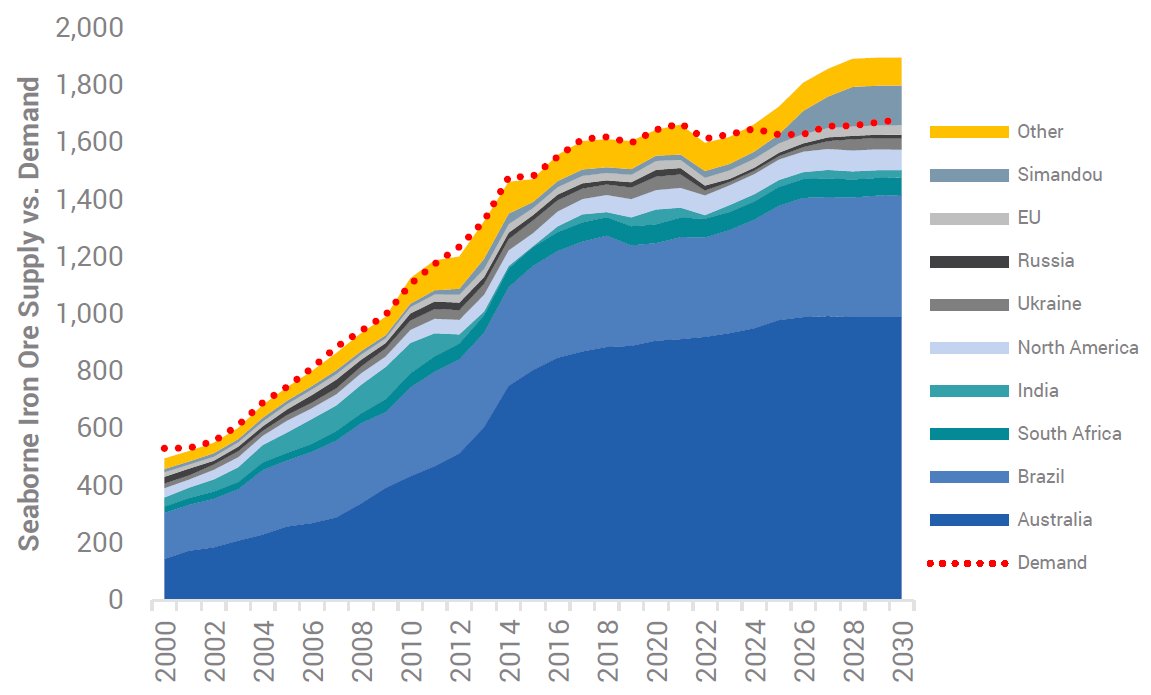

Yet despite this malaise, iron ore supply is set to surge from 2025, with Africa's Pilbara (the Simandou region) commencing production which – unless mitigated by supply cuts elsewhere – will push the market 5-10% into surplus (refer Chart 2). As with nickel, China has an incentive to over-invest in the commodity, flood the market and drive down prices for one of their largest imports.

Chart 2: Outlook for Iron Ore Supply is Concerning

Source: YCM, UBS, Wood Mackenzie, Feb 2024.

Logic would suggest this could result in a US$50/t plus drop in the iron price (to ~US$80/t, in line with the cost curve) which would slash earnings at BHP/RIO/FMG by 49%/49%/65% and ASX 200 earnings by 10%.

Rather than waiting for history to actually repeat, investors would be wise to look through the current temporary earnings strength in iron ore stocks and reposition to avoid what could potentially be carnage.

With trouble somewhere on the horizon, we remain significantly underweight iron ore stocks across all of our Australian equity portfolios.

Other Sources: Platts, ABS, Goldman Sachs, YCM. Data as at Feb 2024.

Access companies offering strong growth potential

The Yarra Ex-20 Australian Equities Fund seeks superior returns, providing investors with access to a diverse and balanced portfolio offering strong growth potential over the medium to long-term.

3 topics

1 fund mentioned