Stop calling markets expensive. They've just gotten better

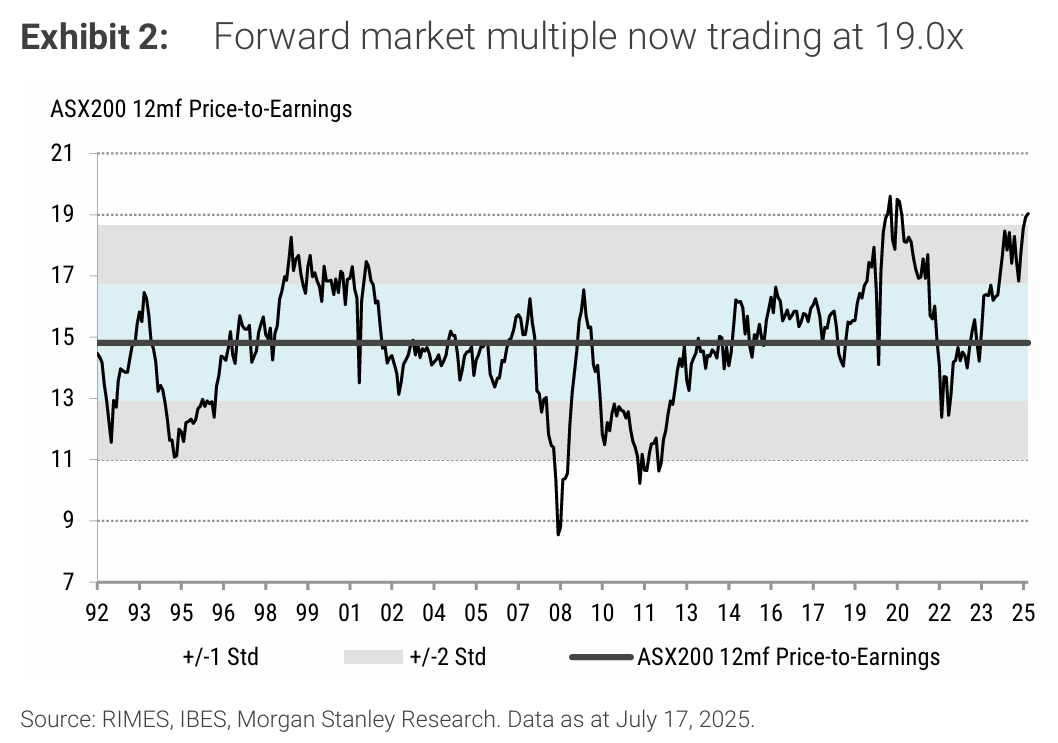

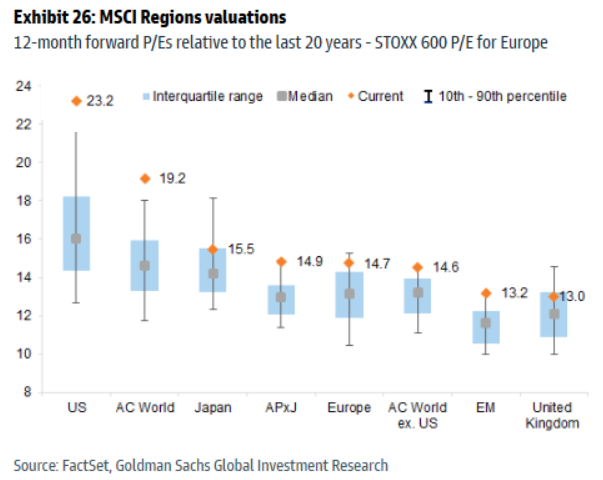

The ASX 200 trades at a forward multiple of 19x, the highest in over thirty years outside of COVID. Meanwhile, the S&P 500's forward multiple sits around 23.2x, the highest in over twenty years, according to Goldman Sachs.

These numbers appear to signal frothy valuations, if not outright bubble territory. But this narrative rests on a flawed assumption: that markets haven't fundamentally evolved over the past two decades. Comparing today's multiples to historical averages is like comparing modern life expectancy to figures from the 1990s – you're measuring entirely different realities.

The ASX Transformation

The Australian market has undergone a dramatic evolution that most investors have failed to grasp. UBS strategist Richard Schellbach identified this shift in a March 2025 report, arguing the ASX has reached a "tipping point" that challenges its reputation as a boring, resource-heavy market.

"In the early 1980s, Mining and Energy stocks held a combined weight of almost 80% of the Australian equity market's value," Schellbach noted. "Today their share is just 20%, as Healthcare, Tech, Online Classifieds, Insurance Brokers and Wealth platforms have grown."

The defining moment came in 2024 when growth stocks surpassed value stocks in the ASX 200 for the first time in the index's history. This wasn't a cyclical rotation, it marked the culmination of decades of structural transformation.

Higher quality earnings, better margins and stronger balance sheets

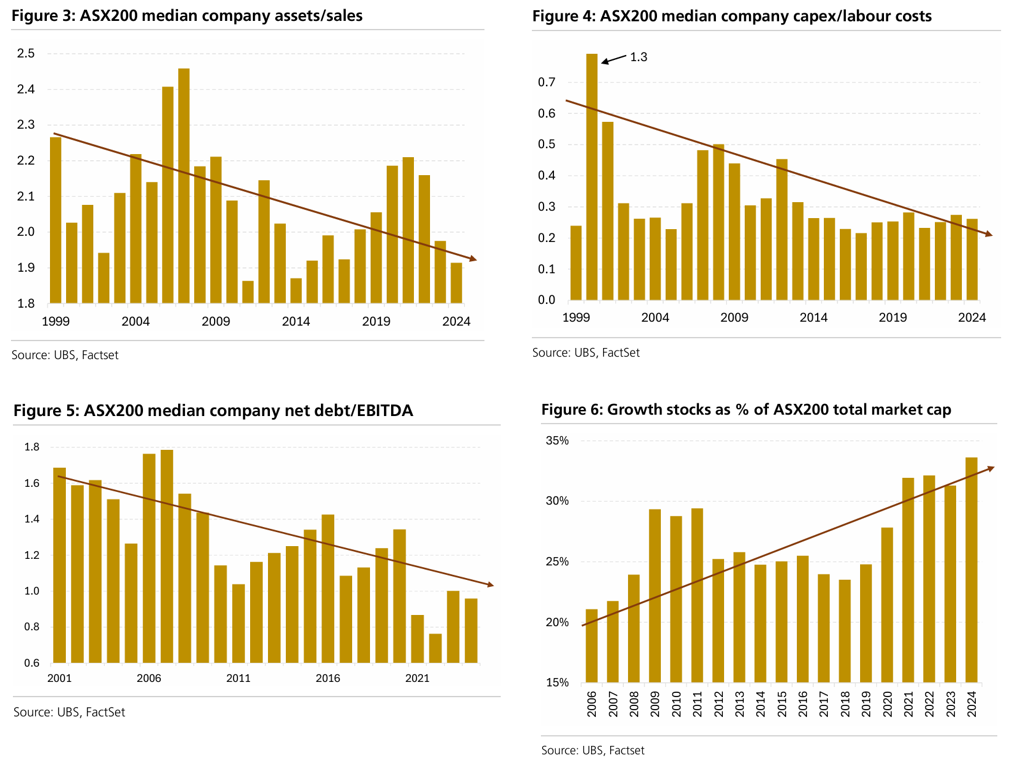

The below charts tell a compelling story about how far the market has come (from top left to bottom right).

- Asset Efficiency: Australian companies now generate more revenue from fewer assets, demonstrating improved capital allocation and operational discipline.

- Capital Discipline: The chronic capex blowouts that plagued Australian corporates in previous decades have largely disappeared, replaced by more measured and strategic spending.

- Balance Sheet Strength: The median ASX 200 company carries substantially less debt than historical norms. This deleveraging proved crucial during the RBA's recent hiking cycle, with Australian stocks proving far more resilient than predicted.

- Growth Ascendancy: Growth stocks now outweigh value stocks in the ASX 200, fundamentally altering the market's risk-return profile and justifying different valuation frameworks.

When companies generate better returns on capital, maintain stronger balance sheets, and operate in more attractive industries, they deserve higher multiples. The market isn't being irrational, it's recognising fundamental improvements in corporate quality.

This doesn't mean valuations are irrelevant or that markets can't become overextended. But it does mean that simplistic comparisons to historical averages miss the profound structural changes that justify different valuation levels.

While the ASX 200 is trading at more than two standard deviations above its long-term average of 14.8x, maybe an argument can be made here that the market hasn't become more expensive, it's become better.

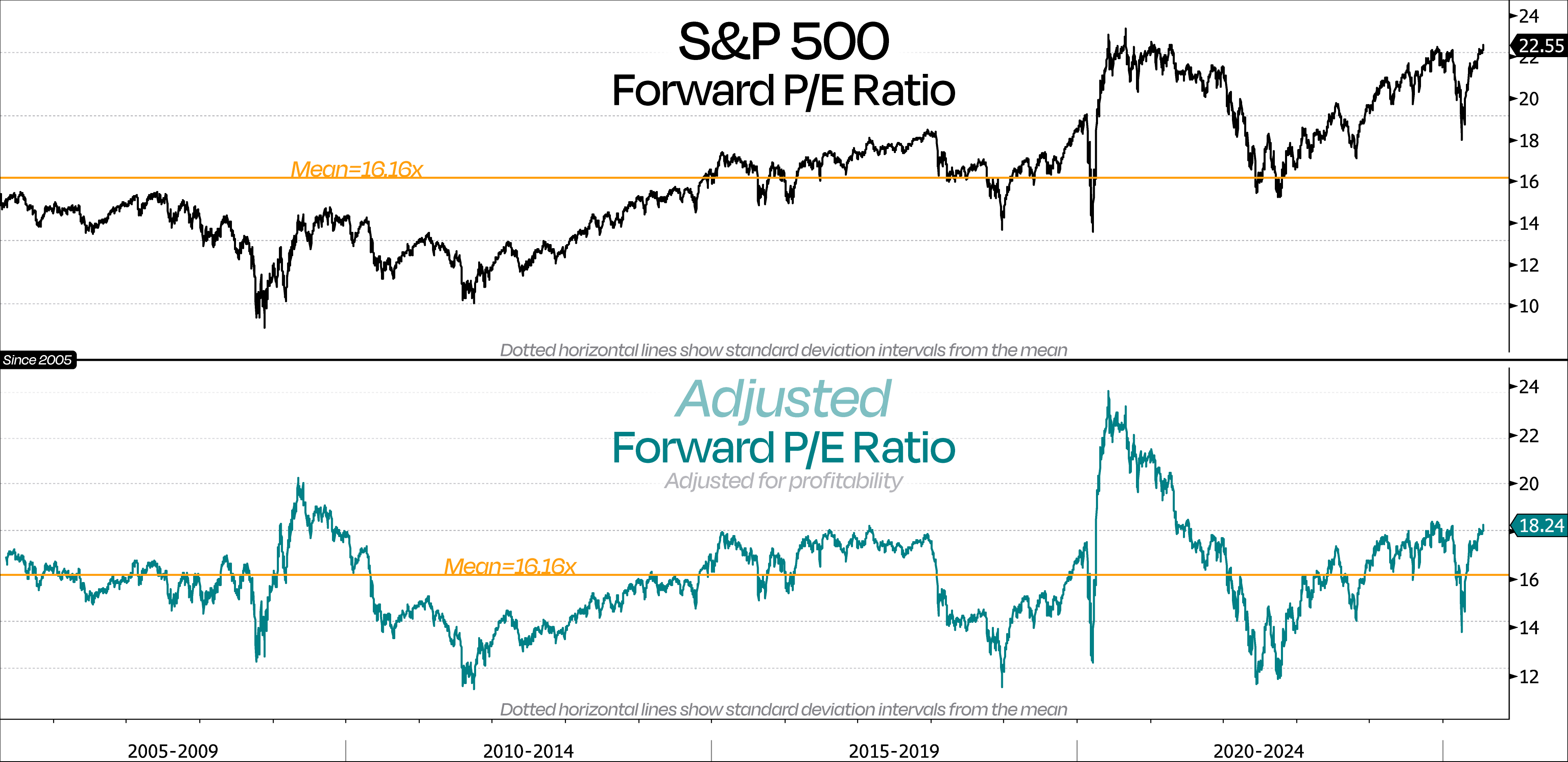

S&P 500 valuations

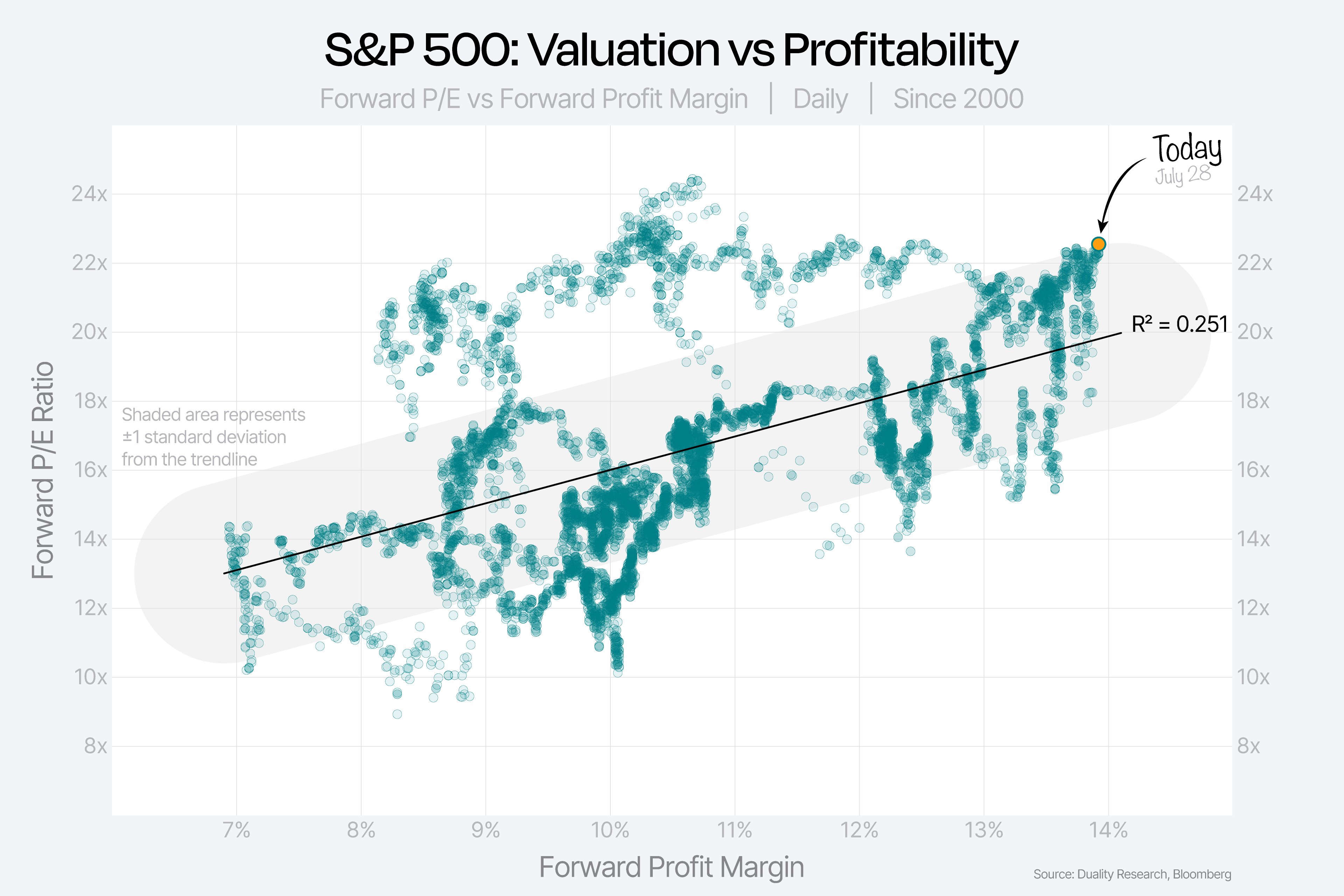

But when you plot historical PE ratios against profit margins, stronger margins typically command higher valuation multiples, according to Duality Research. However, the low R-squared value of 0.251 (a measure of how well the data fits the pattern) indicates this relationship isn't particularly strong.

But exclude the dot-com era anomaly, which pushed earnings multiples to unsustainable heights despite relatively weak profit margins, the R-squared improves to 0.601.

Under this revised framework, today's 23x earnings multiple, paired with roughly 14% profit margins, sits approximately one standard deviation above historical averages.

This suggests current valuations are elevated (around the 89th percentile) but not otherworldly as most charts imply.

While equity markets may look expensive by traditional standards, context matters. We may very well be witnessing a new era of higher valuations.

3 topics