SUDA - Faster, safer delivery for ex-blockbusters

Pitt Street Research and NDF Research

This week we've initiated coverage on SUDA, a Perth-based a drug delivery company focused on oral spray formulations of existing drugs. Imagine these five things:

First, a small pharmaceutical company with a unique platform for reformulating billion-dollar drugs for oral delivery.

Second, that such delivery is not only safer but also much faster-acting.

Third, that the target markets are large, including patients suffering migraine, anxiety, erectile dysfunction, nausea and malaria.

Fourth, that a reformulated approval potentially involves months (not years) and costs a few (not hundreds of) millions.

Fifth, that the small pharma already has its first licensing deal with a top-20 global pharma, as well as two other recent deals. Well, the small pharma is SUDA.

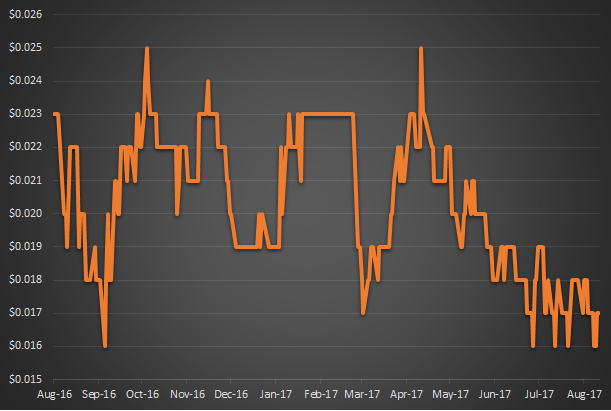

We value it at 9 cents per share base case and 25 cents per share optimistic case using a probability-weighted DCF approach. Our target price of 17 cents per share sits at around the mid-point of valuation range.

2 topics

1 stock mentioned

I am an equity research professional who worked in stockbroking from 2001 to 2015. After 15 months doing investor relations I returned to equity research with the founding of NDF Research. With Marc Kennis I founded Pitt Street Research in July 2018.

Expertise

I am an equity research professional who worked in stockbroking from 2001 to 2015. After 15 months doing investor relations I returned to equity research with the founding of NDF Research. With Marc Kennis I founded Pitt Street Research in July 2018.