Tailwinds until 2050: How net-zero is fueling infrastructure investments

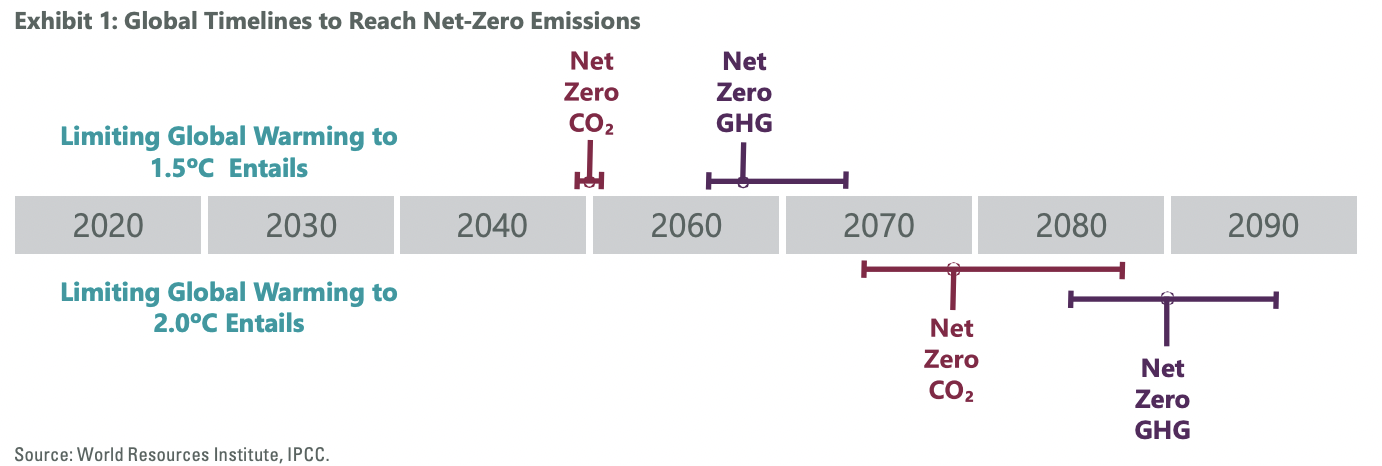

Working towards a net-zero emissions goal has become one of global finance's most important aspirations. The latest science suggests that to meet the Paris Agreement’s temperature goals, the world will need to reach net-zero emissions according to different timelines.

Governments need to get together. The major emitters (i.e. the U.S., the EU and China) should reach net zero emissions by 2050, and ideally much earlier, given the outsized role these economies play in determining the trajectory of global emissions.

Achieving these goals long term will require a lot of innovation.

.jpg)

At ClearBridge Investments, we view net zero as a huge positive for infrastructure investing and, in this piece, we will outline the next steps for four sectors.

- Electric utilities

- Ongoing transitions in energy infrastructure

- The shifting mentality in the rail sector

- The challenge of Scope 3 emissions at airports

#1 Electric utilities: A battery powered opportunity

Right now, it's all about building as many renewables as we can, building out poles and wires, building out EV charging infrastructure and the like. However, as we move forward into the 2030s, we should see a lot more innovation around things like green hydrogen.

In the electric utilities space, renewable power generation and transmission networks will gain the most from this push to net zero.

Conducive policies such as tariff subsidies, tax credits and renewable portfolio standards are also a major tailwind for these investments. However, the key challenge remains - how to accelerate a large buildout of renewables and maintain a stable grid at the same time.

#2 Energy Infrastructure: A $75 trillion investment challenge

About 60% of infrastructure-related emissions are energy or the transport and uses of that energy. The sector is going to need a phenomenal amount of investment to help move us along that path toward net-zero over the next 30 years.

How much?

Well, it's difficult to say but we are talking huge numbers in excess of US$75T in today's dollars over the next 30 years.

Core infrastructure names will be spending something in the order of $50T over the next 30 years alone. Already, they're spending something like US$700B a year.

There will be a significant step up, in the amount of infrastructure investment companies make towards reaching their net-zero emission targets by 2050. As such, we're going to see an increase in the trajectory of the growth of these underlying asset bases and with that, an increase in the earnings, dividends and cash flows.

Moving toward net-zero is difficult but several pathways exist for infrastructure to lead. Each of these will require substantial investment.

At ClearBridge, we want assets that are not volatile, have stable cash flows over time and have regulators or concession contracts backing revenue streams.

If you start investing in some of these technologies, innovations like green hydrogen, new types of batteries and carbon capture you potentially can make significant profits, but there's also a lot of risk associated with that; and that's not something we want for our portfolio.

.jpg)

While the adoption of electric vehicle will only accelerate, toll road owners, for example, don't care whether it's an internal combustion engine vehicle or an electric vehicle that travels on the road.

As we move forward into autonomous electric vehicles, that will potentially quadruple the capacity of today's toll roads. So that means that if we go forward ten years, we're not going to see a lot more toll roads built, but our existing toll roads are going to be worth a lot more because they'll have more traffic on them.

Assessing the pipeline for opportunity

.jpg)

Pipelines will pose an interesting challenge given the oil and

gas sectors face greater challenges than other

infrastructure sectors. Some pipes will be able to be re-sleeved while other pipes will become stranded assets and will have to be written off.

Generally, we think that the transmission pipelines, which are the high-pressure pipes that cross state boundaries, will likely survive.

However, as natural gas is used less and less, certain basins will essentially shut down, making those pipelines essentially stranded assets.

The majority of cash flows will still be sourced from

traditional means over the next decade meaning the execution

risk will come down to an inability to commercialise new

businesses or fail to compete effectively

with new players. While we are optimistic about

achieving net-zero, we remain skeptical that all

pipeline companies will benefit from the transition.

The good news for those companies which can execute well is that renewable energy prices are approaching parity with fossil fuels.

#3: Why railroads are on the right track

.jpg)

We think railroads will be one of the biggest winners in their industry due to their unique ability

to reduce emissions.

The sector still represents the cheapest and most efficient form of transportation and is an important business partner of the industrial sector. Today, rail is laser-focused on improving the reliability of service and becoming a viable alternative to trucks for shorter lengths of haul.

However, further improvement is also predicated on rail companies continuing to improve their technology in the form of trip optimisers and conversion of locomotives from diesel to natural gas.

Over the last two years, railroads have

begun committing to the CDP Science-Based

targets (SBT) initiative, which independently

assesses corporate emissions reduction targets

in line with what climate scientists say is needed

to meet the goals of the Paris Agreement. Rails

that have published targets are aiming for 30%

less GHG emissions, on average, by 2030. Provided technology continues to innovate at its current pace, we don't see these targets not being met.

#4: Why airports are in for an uncertain takeoff

.jpg)

In contrast, airports present a more uncertain future - especially around how passenger volumes will come back post-pandemic. Business travel is likely going to be down. Some governments (for example, in Europe) are trying to move people of planes and onto high-speed rail. That makes the outlook for growth in passenger traffic a little uncertain.

While airports are expected to achieve their Scope 1 and 2 emissions targets, Scope 3 reductions will be significantly more challenging given this requires aircraft technology development to achieve lower emissions.

The traditional main source of airports’ direct greenhouse gas emissions stems from electricity consumption. Historical efforts to reduce airport emissions have focused on energy efficiency. For example, installing LED lighting and improving the efficiency of heating, ventilation, and air conditioning systems as well as building thermal/lighting characteristics.

However, this time is different. The main source of emissions reduction in Scope 3 will now have to come from the airlines themselves. This includes reducing negative externalities in flights, waste and water management and even how passengers travel to airports.

For instance, Sydney Airport seeks to meet its Scope 3 targets by procuring renewable energy, electrifying its landside bus fleet and achieving a minimum 4-star Green Star Design and As-Built rating for new developments. As equipment costs fall, this target should become easier to achieve.

The path we take to achieve net-zero emissions by 2050 is critical, and infrastructure will play a pivotal role. Trillions of dollars need to be invested over the coming decades which will underpin infrastructure returns, providing a tailwind for investors of these assets for decades to come. However, liquidity and flexibility in portfolio construction will be crucial to capturing the opportunities and managing the risks as we navigate the path ahead.

ClearBridge Investments is a global equity manager committed to delivering superior risk-adjusted investment performance through authentic active management and ESG integration.

As at 31 March 2022, ClearBridge manage AU $254.8bn across a suite of equity strategies and solutions covering a range of asset classes and investment styles. The specialist infrastructure investment team in Australia are dedicated to identifying and investing in the best infrastructure assets in the listed equity market, with the goal of delivering strong risk adjusted returns over an investment cycle. Their investment process is founded on fundamental research undertaken within a rigorous analytical framework.

4 topics

1 fund mentioned