Targeting 15% pa returns (with zero equities exposure)

Born of a Scandinavian industrialist family with roots in the late 19th century, EQT’s background is as unorthodox as it is uniquely effective. The heritage of the Wallenberg family stretches to the Industrial Revolution and is linked with some of the world’s biggest corporate names, including ABB, Ericsson and Electrolux.

EQT Nexus is our semi-liquid private equity fund, which has now launched in Australia and targets an annual return of between 12%-15%. We're part of the global investment organisation, EQT, which was formed in 1994 and whose more recent success is shaped by our industrial versus traditional financial approach to private equity.

The fund provides access to our global 216 billion Euro platform, which includes a 126 billion Euro mature buyout fund investing across Europe, North America and Asia, alongside a sleeve of early-stage opportunities and infrastructure across multiple markets and industries. The fund's greater liquidity than is typically on offer in this space is also a key part of EQT Nexus's appeal.

Why private equity?

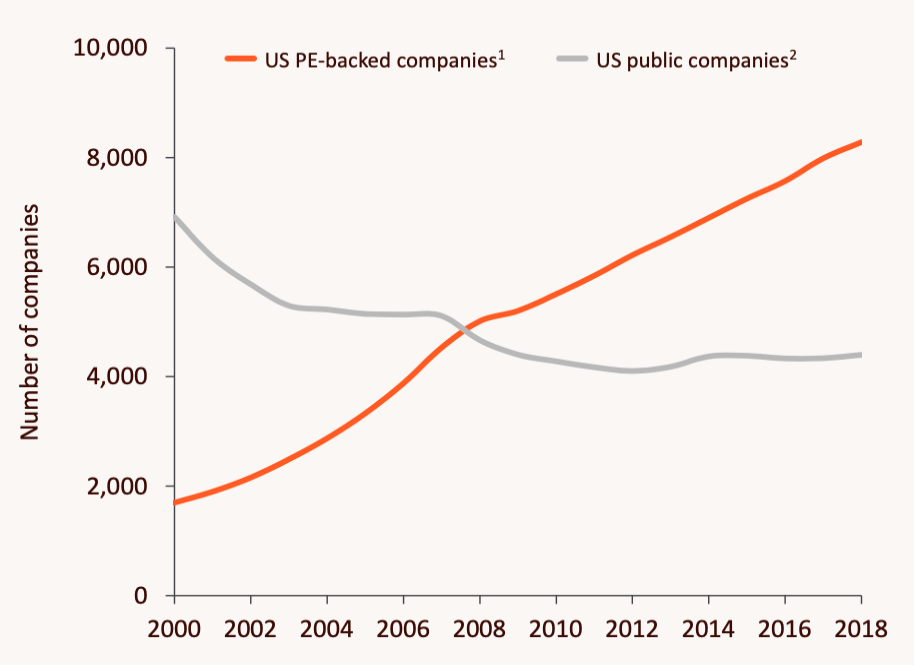

The PE universe captures a far broader range of companies than is possible using listed markets. Recent years have seen further growth in the asset class’s popularity as investors have sought its unique diversification attributes, the scale of the opportunity going only one way – upward.

Number of PE-backed companies versus public companies

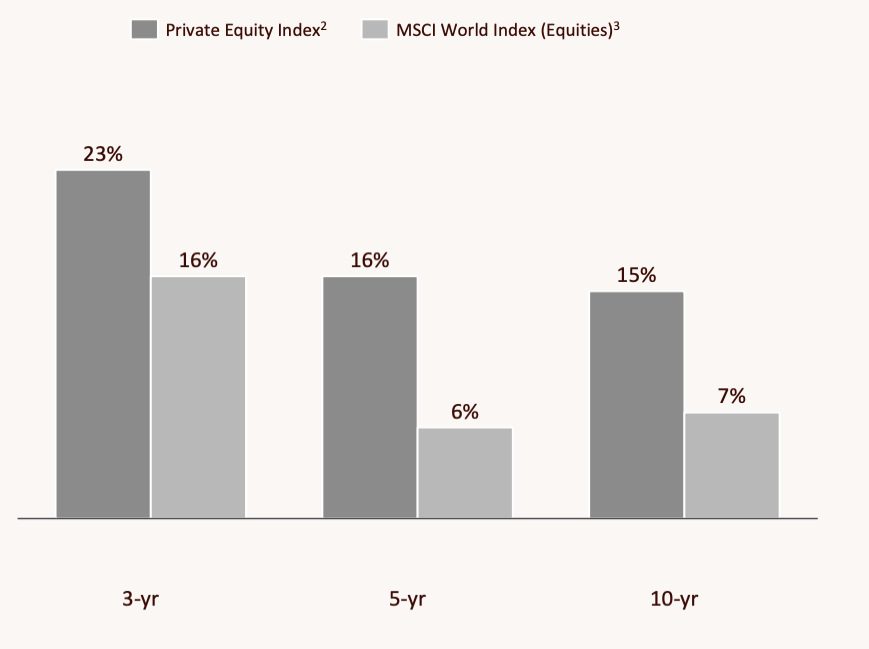

More importantly, the asset class's returns over both five- and 10-years are more than double that of global equities, though we emphasise past performance is no guarantee of future returns.

Performance of private versus public markets

In the following Fund In Focus video, I explain the appeal of PE more broadly, specifically our unique approach via EQT Nexus.

Time codes

- 1:10 – An industrial way of looking at private equity

- 2:40 – Why should an investor consider private markets?

- 5:18 – Making multi-billion-dollar global private markets accessible to investors

- 6:50 – A 226 billion euro opportunity

- 8:00 – How we target returns of between 12% and 15% per annum

- 9:20 – A simple way to allocate to PE, with liquidity when you need it

_logo.svg.png)

Europe's leading private equity firm

EQT Nexus provides wholesale investors with access to an institutional-grade portfolio of private assets with quarterly liquidity, a unique offering in the Australian market.

Wholesale and professional investors can discover more about EQT Nexus here.

5 topics

1 fund mentioned