The #1 risk for credit investors (and how to avoid it)

The lowering of interest rates to historical lows has driven investors to consider higher-yielding credit strategies simply to earn an ‘acceptable’ headline return. This flow of funds has seen the size of many credit managers increase materially and over a relatively short period. Such growth raises the very real risk that some credit managers may face capacity constraints which may in turn adversely impact the returns they can earn. Identifying these risks is problematic, but the following sets out a simplistic framework that may assist investors to identify potential ‘red flags’.

The first step in identifying potential distortions to returns is to establish a valuation framework that includes the major risk factors the investor views as driving returns. When considering credit risk there is a range of factors or characteristics to be considered. Some are quite easy for a client to monitor others less so. The most obvious risk factors for a client to monitor are :

- Spread duration

- Average credit rating

- The proportion of non-investment grade exposures

- Proportion private debt exposures

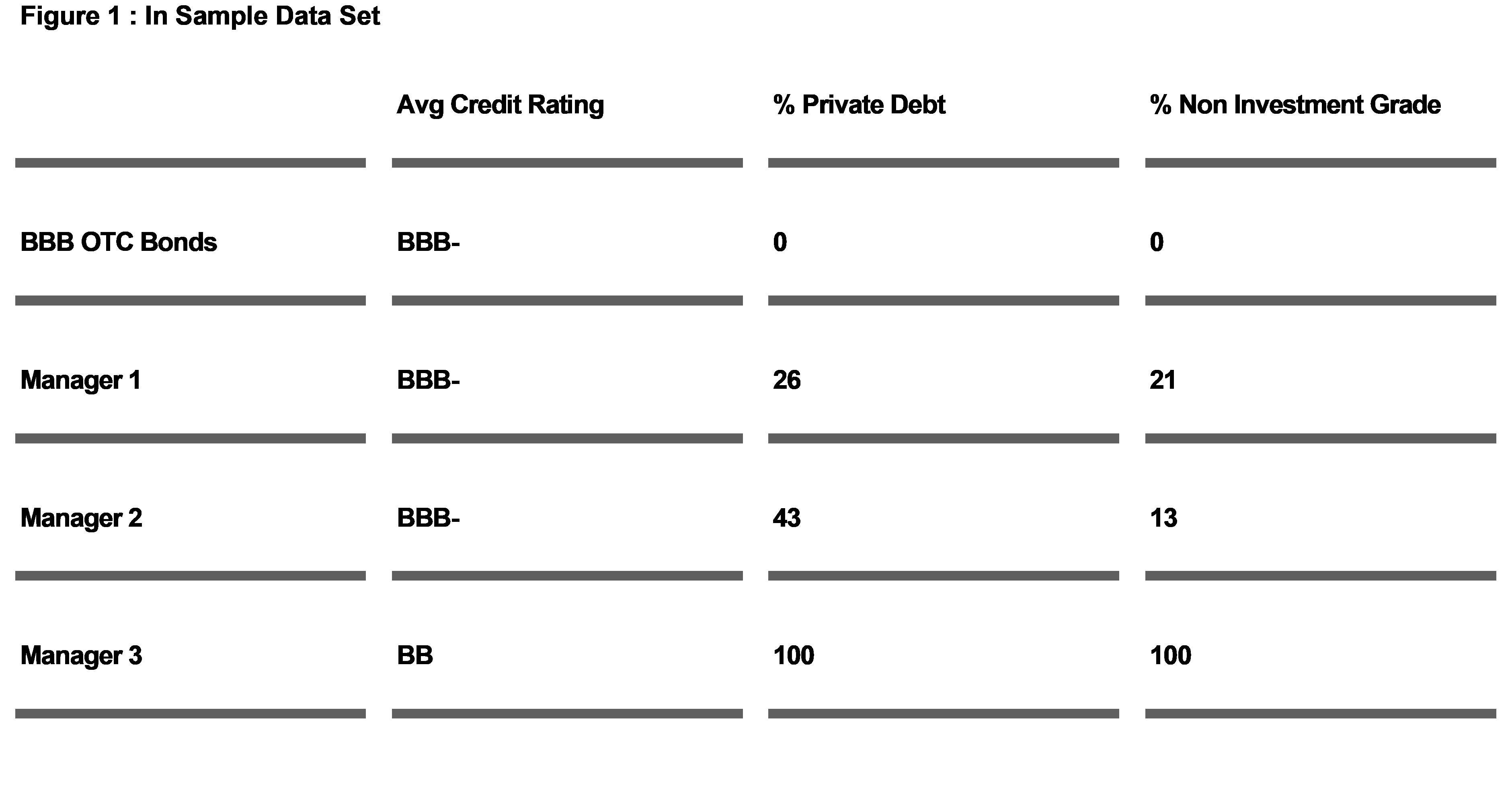

Though the list is not exhaustive it does highlight that even though the average rating of funds may be the same their characteristics can still vary in material ways. In particular for manager products with the same average credit ratings, the overall risk characteristics can vary materially due to differences in the proportion of non-investment grade and private debt exposures[i]. These two factors are important as they can have a material impact on the Default (Proportion Non-Investment Grade) and Liquidity (Proportion Private Debt) risks within a credit portfolio. In turn, investors should receive additional compensation for the assumption of higher levels of these risks.

Having identified the two risk factors of most relevance to an investor a simple framework can now be developed to determine the relationship between returns and the risk factors. The starting point is to utilise a sample of managers (referred to as our ‘in sample’ data set) capturing the spectrum of the risk characteristics the investor is interested in. To identify a more stable relationship the two extreme anchor points are :

- BBB Over the Counter (OTC) traded bond market which comprises zero exposure to private debt and non-investment grade credit.

- A non-investment grade private debt manager (Manager 3) that constitutes 100% non-investment grade private debt.

The characteristics of the ‘in sample’ data utilised are set out in Figure 1 :

The two risk factors identified can be utilised to calculate a Risk Score which can then be plotted against returns. To keep the concepts simple the risk scaling applied is simply to add the % Private Debt and Non-Investment Grade together. By doing so it is assumed that the contribution of each factor to both risk and excess margin is the same (admittedly a simplifying assumption but arguably not unreasonable).

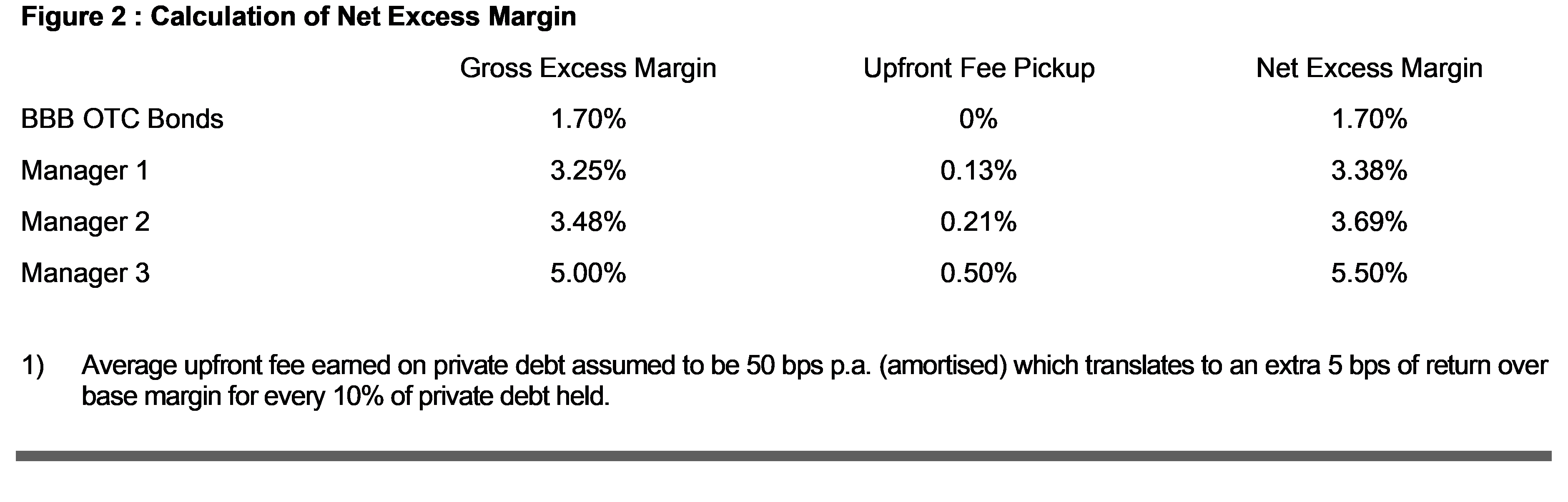

The other aspect of the framework is a measure of expected returns for which the excess margin over cash rates generated by the manager will be utilised. There are two main advantages to using excess margin over realised historical returns. Firstly, differences in valuation practices between managers, particularly concerning private debt, are more likely to distort realised historical returns rather than excess margins. Secondly, excess margins are more of a forward-looking/contemporaneous measure compared to historical realised returns. This makes excess margins a more relevant measure when compared with the current Risk Score, especially where those risk measures may be changing over time. When considering excess margins an important point to keep in mind is that a material amount of private debt returns can be earned from upfront fees. Given this, an average upfront fee needs to be applied to the excess margin to reflect differences in private debt holdings (see Figure 2).

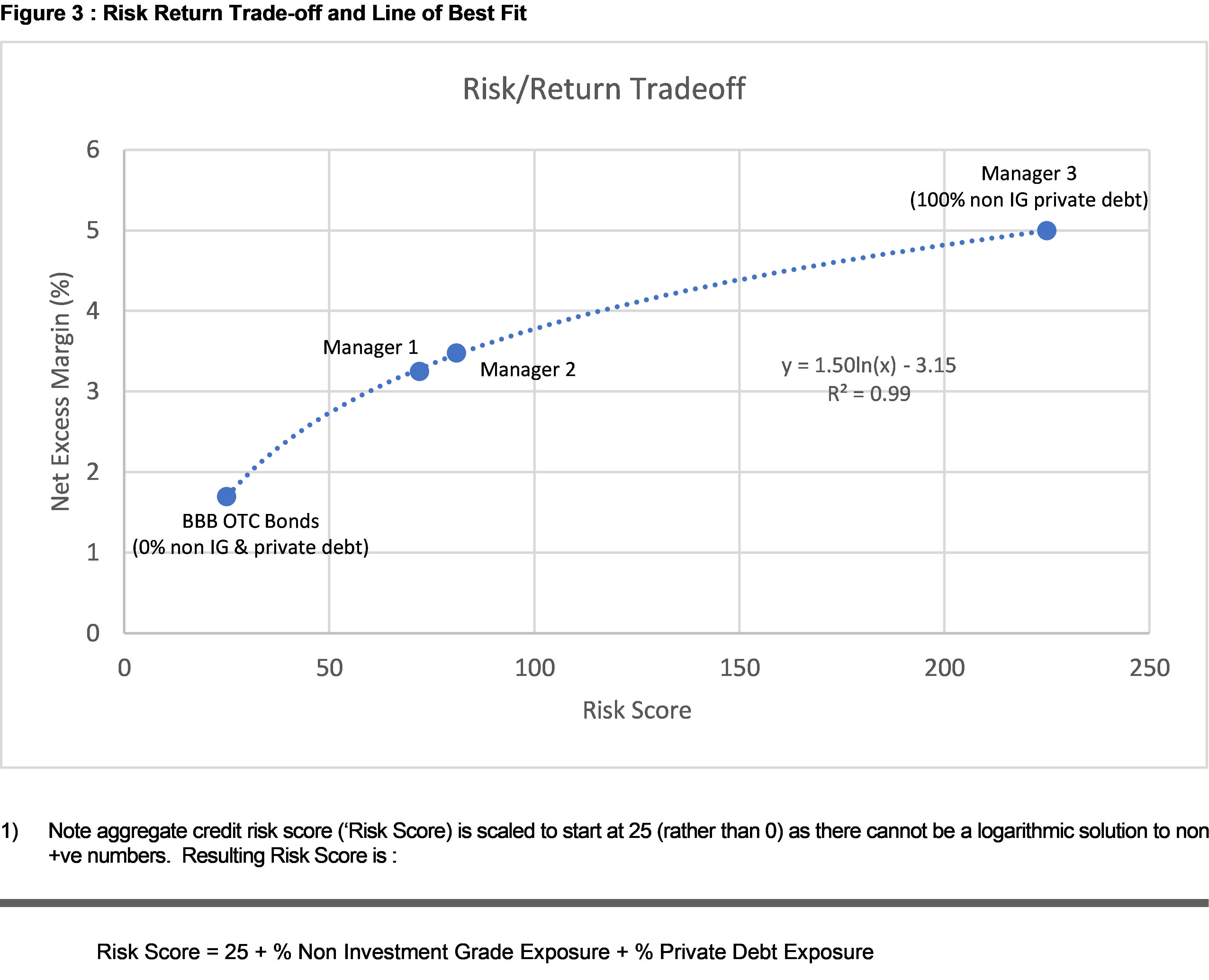

Bringing this together means that a framework for assessing ‘fair value’ can be developed by plotting each manager based on net excess margin and risk score with a line of best fit applied. Note that a logarithmic 'line of best fit' is applied to reflect the law of diminishing returns.

As Figure 3 highlights the ‘in-sample’ group of managers has allowed the investor to generate a reasonable assessment of the ‘fair value’ of risk. Importantly this relationship can now be utilised to check other managers and thereby assess ‘out of sample’ observations.

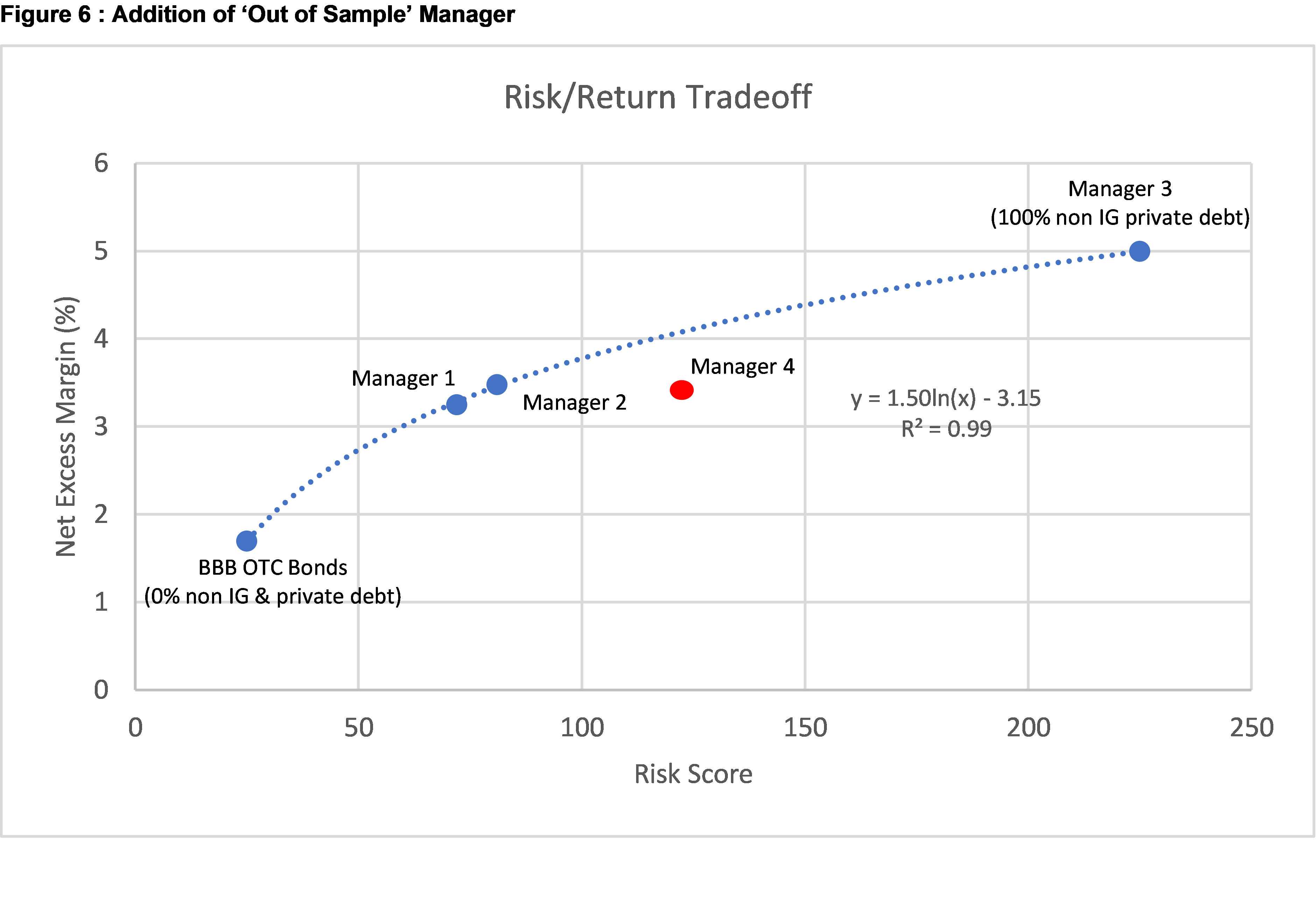

The ‘out of sample’ manager we will compare will be referred to as Manager 4.

This ‘out of sample’ manager can now be compared to the previously calculated relationship.

The simplified model raises an immediate ‘red flag’ in that the ‘out of sample’ manager (Manager 4) appears to be yielding around 50 bps p.a. less than would be expected given (a) their risk characteristics and (b) risk/return relationship for the ‘in sample’ group of managers.

Now there are two possible reasons why we may be observing this lower return from the ‘out of sample’ manager.

Firstly, the two factors being used may not be capturing all dimensions of risk; i.e. the investor may be overstating the Risk Score. While this is certainly possible, it must be remembered that any mismeasurement of risk must be disproportionately impacting the ‘out of sample’ manager for relativities to be materially impacted. While mismeasurement of risk is always a potential issue such analysis can still assist in directing further areas of research and focus when trying to understand the difference in risk/reward profiles between managers.

The potential ‘tyranny of size’

The second, and potentially more interesting, factor is that there may be material differences in size or rate of AUM growth between the managers. If the ‘out of sample’ manager was materially larger or experiencing much more rapid growth in AUM than the ‘in sample managers’ then the difference may be due to more aggressive bidding for deals to remain fully invested. Such a dynamic highlights the potential trade-off associated with size or rapid growth in AUM for all managers but more particularly ‘credit-oriented’ managers. On the one hand, there is the desire of a manager to remain selective in terms of exposure. But being selective when AUM is high or growing rapidly increases the risk that material amounts of AUM may be uninvested for extended periods. The trade-off becomes particularly relevant for higher-yielding credit strategies where uninvested funds may prove a material drag on performance.

The alternative facing the manager is to bid more aggressively for deals to ensure that they are always fully invested. But this is itself a cost as the manager is doing deals at lower margins than the risk of the loans justifies with the net loser being investors. This highlights the potential risk associated with the ‘tyranny of size’ where past a certain point, or above a certain growth trajectory, the AUM of a manager may start to adversely impact the returns earned by investors. Unfortunately for the manager, there is not much they can do about this other than cap AUM at a level that avoids this problem from arising in the first place. Though some managers do cap AUM levels there is always a temptation to continue growing AUM even when capacity constraints are being reached. Accordingly, investors need to remain wary of such risks and aim to identify potential ‘red flags’ where possible.

Identifying when capacity constraints are being faced by managers is always problematic. Yet by adopting a more consistent framework for assessing the risk/reward trade-off involved in credit management, potential ‘red flags’ can be more clearly identified. These ‘red flags’ do not necessarily prove that there is an issue with a manager but they can highlight where further research and investigation are warranted. In turn, this can assist investors to ensure that they are making the most of the opportunities to earn higher returns provided by the range of credit products available.

[i] One factor which will be eliminated from the following discussion is credit spread duration though this is not to say that they aren’t important and shouldn’t be monitored. Spread duration is an important measure of credit risk but it is difficult to monitor as it will tend to vary over time and based upon market conditions.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

You can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

3 topics

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...

Expertise

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...