The advantage of shopping globally for micro-caps

Spheria Asset Management

When British grocery executives were brought to Australia to shake up the local market, some dubbed Australia “Treasure Island”.

The far-flung small market lacked competition, and consumers had become accustomed to paying more for items than their overseas counterparts. Unfortunately, the Treasure Island tag can apply to stocks as well as baked beans.

As a global micro-cap fund manager, we have an enormous opportunity set to choose from. A brief Bloomberg screen identifies 15,121 equity securities between US$50 million and US$1 billion in developed markets alone.

With so much choice, it’s easy to notice disparities between markets.

A tale of two healthcare stocks

One of the most extreme examples we have come across is between the US-listed Lantheus (NASDAQ: LNTH) and Australian-listed Telix Pharmaceuticals (ASX: TLX).

The Spheria Global Microcap Fund purchased Lantheus in December 2020. It was evident during our due diligence that while the company was attractive in absolute terms, it was particularly attractive when compared to Telix.

Unlike Telix, Lantheus already has commercial products approved by the regulator and is profitable. The company generated US$58 million of free cash flow before COVID temporarily interrupted the diagnostics market.

Its existing products include Definity, the leading enhancement agent for echocardiograms of the left ventricle. This diagnostic agent continues to grow (ex-COVID), and the company has recently received approval for its RT version that requires no refrigeration, further cementing its dominance.

Lantheus’ product portfolio also includes a product called PYLARIFY, which is in direct competition with Telix’s Illuccix (TLX591).

PYLARIFY is a radiopharmaceutical that allows PET scans to detect the expression of a Prostate-Specific Membrane Antigen (PSMA), a diagnostic marker for prostate cancer. The diagnostic is used to investigate suspected metastasis or to further investigate elevated blood test levels for those with potential recurring prostate cancer.

PSMA PET scans will become the gold standard in detection, particularly for recurrent prostate cancer, allowing for earlier and more accurate detection. Good news for both Lantheus and Telix.

Recently, PYLARIFY has received regulatory approval from the FDA, while Telix is still waiting on a decision on Illuccix, due by the end of the year.

In addition to this head start on the market, Lantheus’ PYLARIFY has another advantage over the Telix product. PYLARIFY uses the Flourine-18 (18F) radioisotope to highlight the prostate-specific antigen in the patient. Telix uses Gallium68 (68Ga). The key difference is that 18F is produced in large-scale cyclotrons and has a significantly longer half-life than 68Ga produced by smaller generators.

This means that Telix’s product is at a significant scale and cost disadvantage to Lantheus’ product and will make winning market share difficult for Telix, especially as the second mover.

The valuation disparity

So we have established that Lantheus’ product is first to market, has a cost advantage over Telix’s product, and that Lantheus already has approved products that generated US$58 million of free cash flow pre-COVID.

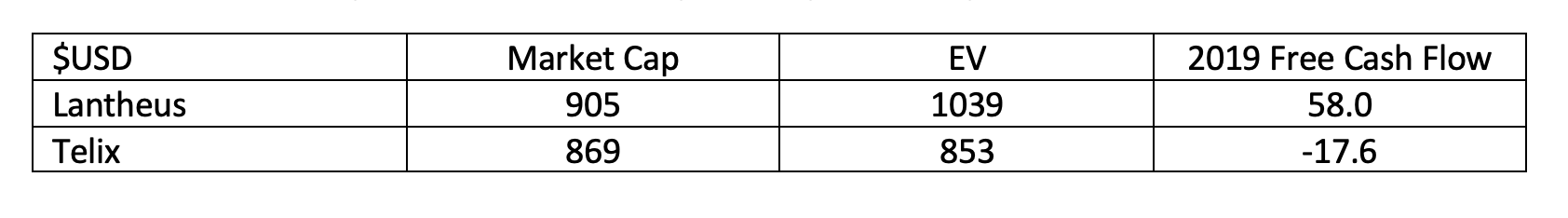

Yet, would it surprise you that Lantheus’ market cap and EV were only marginally higher than Telix when we opened the position in December 2020?

To be clear, we are not pessimistic about Telix, and expect Telix’s Illuccix will be well received once approved. However, the disparity in valuation between Lantheus and Telix highlights how growth companies in Australia, particularly in sectors such as Healthcare and IT, where options are limited, can be bid up well beyond their offshore peers.

Since our purchase, Lantheus stock has risen 85.5% in AUD compared to Telix’s 39.0% - in our view, confirmation that it pays to shop around globally.

Spheria Asset Management searches the world for innovative and growing microcaps, underpinned by strong fundamentals.

Visit the Spheria website to discover more about investing in global microcaps or keep up to date with the Spheria team on Linkedin.

2 topics

1 stock mentioned

Expertise