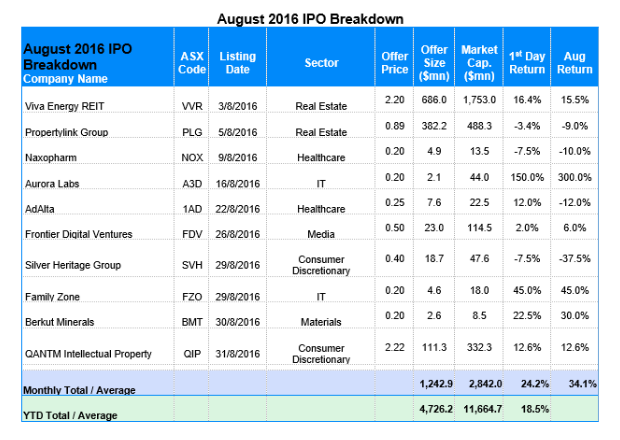

The average monthly return from the August IPOs compared to a 2.3% drop for the S&P/ASX 200

The average monthly return from the August IPOs compared to a 2.3% drop for the S&P/ASX 200. Year-to-date returns have been strong at 24.8% compared with 13% for the same period in 2015. The number of IPOs was up from seven listings in August 2015 which raised just $133.2 million.

Ben Bucknell, chief executive of OnMarket, said the report highlights the momentum IPOs have built during 2016.

“The IPO market has gained strength, with the OnMarket August IPO Report 2016 highlighting the average return on IPOs this year has easily outperformed the broader share market. Many IPO investors are better off than those people, for example, who invested in index funds.”

The IT sector continues to dominate the IPO count in 2016, with two new IPO listings in August. The 14 IPOs which have listed in 2016 have generated an average year-to-date return of 34.9%.

The five largest listings in August were the Viva Energy REIT, Propertylink, legal group QANTM Intellectual Property, Frontier Digital Ventures and gaming company and casino operator Silver Heritage. Those companies raised a combined $1.2 billion, approximately 98% of the total funds raised during August.

[OnMarket August IPO Report 2016.Final.pdf]

2 topics

At OnMarket, we are all former capital markets professionals who thought there was a better way for companies to raise capital, so we provided the know-how behind the technology that powers the world's first exchange-hosted capital raising...

Expertise

No areas of expertise

At OnMarket, we are all former capital markets professionals who thought there was a better way for companies to raise capital, so we provided the know-how behind the technology that powers the world's first exchange-hosted capital raising...

Expertise

No areas of expertise