The best ASX micro-caps you’ve likely never heard of

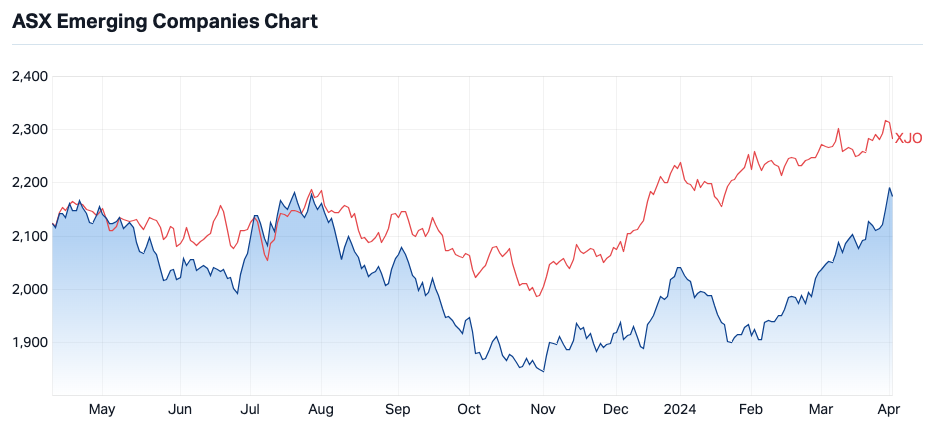

ASX micro caps have been on a tear lately, the ASX Emerging Companies index up almost 6% in the year so far – versus the 2.6% growth we’ve seen from the ASX 200 in the same period.

For investors able to live with the increased volatility that’s an inevitable part of investing in micro-caps, now might be a good time to consider the space. That’s the view of Merewether Capital founder and portfolio manager Luke Winchester. He believes confidence is coming back into the space, which is reflected in the higher volumes of trading we’re now seeing.

“And it’s not just moves on low liquidity. There's some decent buying coming in,” Winchester says.

But before we get to the detail, what is a micro-cap? There are different ways of defining micro-caps but for this wire, we’re looking at companies with market capitalisations of less than $300 million. Of the 2059 companies listed on the ASX as of the end of March 2024, some 1,470 of them met these criteria.

Source: Market Index

In the following, Merewether Capital’s Winchester discusses how he narrows this down to the 200 or 300 companies he considers investable. He also delves into his portfolio and discusses a couple of names, including one he believes is due to run harder – and that the market has largely missed – and another he regards as the most exciting stock in his portfolio currently.

How do you identify micro-cap opportunities?

Investors need to do a lot of legwork to identify micro-caps, with companies at this end of the market often under-researched by brokers and asset managers.

“You don't often have slick presentations or sell-side broker coverage. Sometimes you may not have any institutional funds who own the stocks and have done the write-up and covered the monthly reports,” Winchester says.

“Investing in large-caps, you're often driven by sell-side research or your macroeconomic views, whereas in micro caps there’s more digging into the companies themselves and figuring out what is moving them.”

Winchester also emphasises the importance of having a strong network, citing resources such as Livewire, Twitter, and LinkedIn as indicators of the types of companies people are watching.

What are the red flags?

Profit is a nice-to-have for companies in this space but isn’t essential, says Winchester. He looks for companies that have a clear runway toward profitability within the next two years and established revenue bases. Winchester also actively avoids companies that are at the very beginning of their lifecycle.

“I avoid companies that are pre-revenue or have very low revenue, where there's a long pathway to create a sustainable business,” he says.

“I own some businesses that are loss-making but have a substantial revenue base that is growing.”

Another red flag is listed firms that have previously been unsuccessful in securing venture capital funding.

“When those businesses list on the ASX, it's almost the source of capital of last resort for them. If they couldn’t attract VC funding and are on the ASX, it probably is a signal about the actual product,” Winchester says.

He considers many early-stage information technology and biotechnology names as largely off-limits for this reason.

Finally, he also keeps an eye out for individuals or management teams with poor track records: “Some investors keep a definitive list of management and boards who have previously blown-up companies or been involved with some wrongdoing.”

“When you're around these stocks long enough, you learn the names and the people. And whenever I see someone who's got a questionable background, I stay away.”

What is your most successful stock pick?

XRF Scientific (ASX: XRF)

Market cap: $167 million

Winchester nominates the mining services firm, a stock he has held since late 2015. XRF manufactures equipment and chemicals that are distributed to mines, construction companies, and commercial analytical laboratories in Australia and globally. One of its major clients is ALS Limited (ASX: ALQ).

His forecast for earnings growth of between 50% and 100% in the first couple of years played out, and XRF has continued to compound its earnings by 20-30% a year since then. The share price has also risen almost seven-fold in that time.

“The multiple has never gotten too far out of control, staying around 15- times PE the whole time. At no point have I thought I’m paying a high price for the future of the stock,” Winchester says.

For more information and market data on XRF, head to Market Index.

The advantages of being a boutique

Portfolio mandates at larger asset managers often rule out emerging companies for their investment teams, due to their higher funds under management and rigid investment processes.

As Winchester explains, some try to overcome this by spreading a high base of funds under management across 80 to 100 stocks.

“In micro-caps, I think you have to be high conviction and willing to own 10 to 20 names,” he says.

The advantage of smaller, more nimble asset managers is that they’re never forced to avoid investing in an otherwise quality company because it is too illiquid.

“I can buy a listed company, and have it form a meaningful part of the fund, and I'm never forced to exclude any just because they're illiquid,” Winchester says.

“If somebody looks at a company and says, ‘I really like that business. I want to invest but I can't because it's too small’ that doesn't make sense to me. It's a structural issue with the fund you're running, more than anything else.”

An under-the-radar stock due to run higher

On the back of a reader question, Winchester was asked to name a quality ASX micro-cap that’s so far been missed by the market, but which he believes will grow strongly from here.

Laserbond (ASX: LBL)

Market cap: $86 million

A family-run business, Laserbond provides surface engineering technology to the mining sector, servicing many large equipment manufacturers from Australia and overseas. Its products extend the wear life of components by between five and 10 times.

The company ticks Winchester’s boxes of revenue growth, EPS growth and strong margins. He notes it has had hiccups along the way, including the last half-year earnings: “But in terms of the longer-term trajectory, I have no doubt about the quality of the business.”

For more information and market data on Laserbond, head to Market Index.

What’s your most exciting stock currently?

AI Media Technologies (ASX: AIM)

Market cap: $78 million

Another small holding in the Merewether fund, Winchester recently took a small position in the provider of captioning services to media companies such as Channel 7, Channel 9, and Foxtel.

When AIM floated, the firm was a “human labour business” but that has changed in recent years on the back of a 2021 acquisition. The US-based firm, EEG Enterprises, owns an automated captioning business that has improved the accuracy by almost 10% - at a fraction of the cost. As an example, Winchester notes live captioning of an event such as the latest US Super Bowl would traditionally cost around US$80 an hour. “Whereas AI media sells their automated captioning at $8 an hour, they're 10 times cheaper, as that accuracy is now overtaking humans.”

For more information and market data on AI Media, head to Market Index.

What do you think?

Do you hold any of these companies or have other Aussie micro-caps on your watchlist? Let us know in the comments section below.

1 topic

3 stocks mentioned

1 contributor mentioned