The best performing market you’ve never looked at

Despite it being one of the most commonly quoted adages in investing, very few managers seem to adhere to Buffett’s logic that you should “be fearful when others are greedy, and greedy when others are fearful”.

When an area is unloved, or better yet, ‘uninvestable’, this is often the precise time that a prudent manager will look a little more closely to see if there is value to be found in an area where risk has already been priced in.

Which brings us to today’s subject: UK equities, or more specifically the FTSE 100.

UK equities have been an overweight in the Innova portfolios for over a year, a market which had seen little investor attention since the largely negative sentiment regarding Brexit had developed around the region. With compelling valuation, lessened geopolitical risk than Europe, an attractive sector composition and blue-chip global companies within the index, it was an exposure which ticked all boxes and ended up the best performing broad equity index in 2022. In fact, as of the 10th of March 2023 it is still the best performing broad equity index on a 1-year basis.

What were some of the characteristics which made this an opportunity worthy of further investigation?

Index Composition

One thing that made the FTSE 100 investment so compelling was the largely misguided idea that the index was largely representative of an admittedly sluggish UK economy.

However, the index composition means that the majority of firms listed on the FTSE 100 are multinational conglomerates with far more exposure to broader economic growth than simple domestic dynamics. These include:

- Shell (~9%)

- AstraZeneca (~8%)

- HSBC (~6%)

- Unilever (~5%)

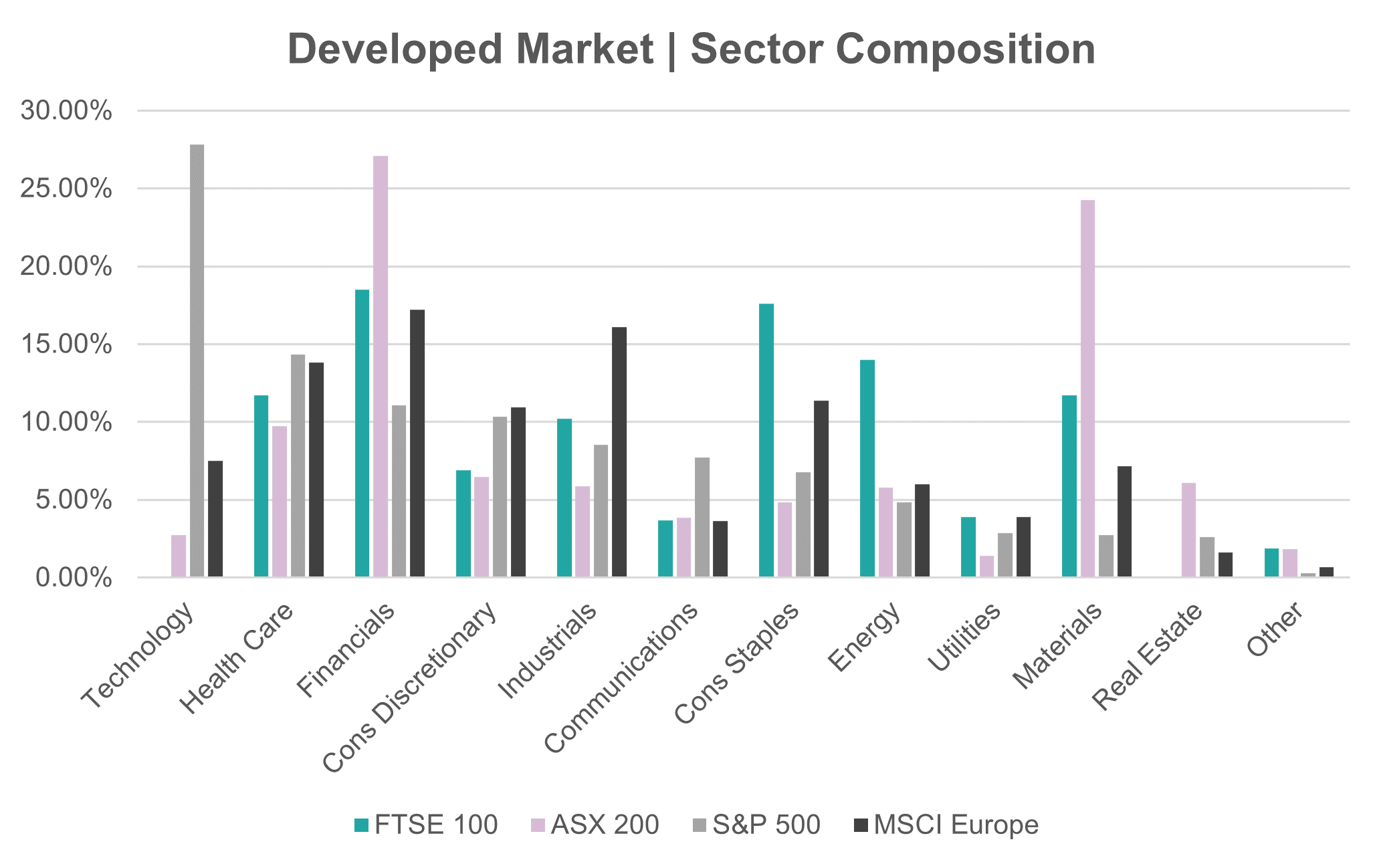

Furthermore, the sector composition of the FTSE 100 was overweight sectors which were trading cheaply and were of vastly different weightings to a typical global equity exposure; Consumer Staples, Financials and Energy particularly.

This composition gave us comfort to continue digging into the investment, seeing it was a true sector diversifier (not just geographic) in a total portfolio context, AND had sectors that had value-like qualities – a theme we will revisit throughout this note.

Valuation

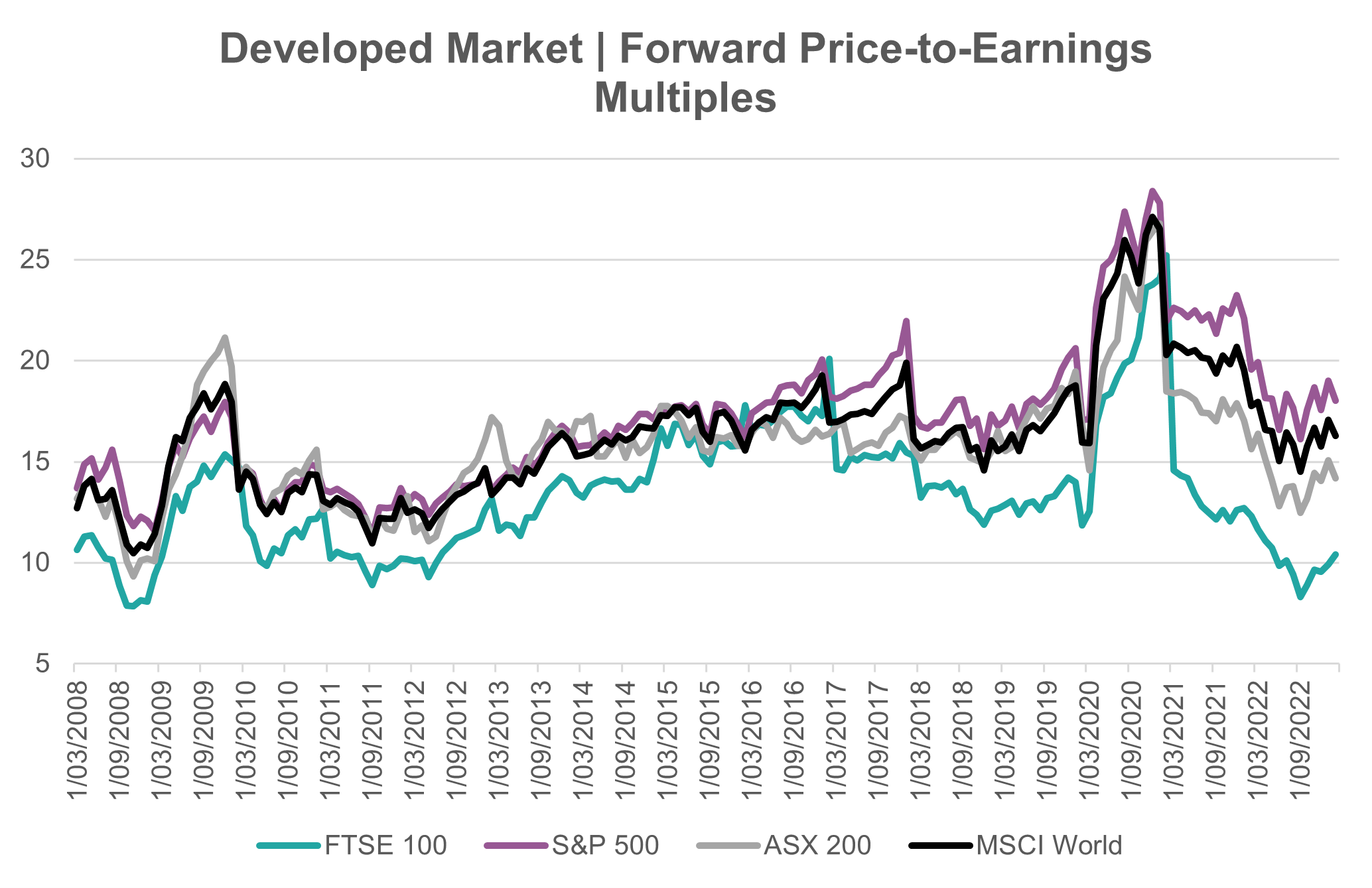

On the topic of sectors trading cheaply, as a whole, the FTSE 100 market has traded at a much more reasonable multiple than many other developed market indexes.

Consider the forward Price-to-Earning (P/E) ratio of some of the common global equity indexes, and notice the discount that the FTSE 100 has traded at historically (particularly since late 2020).

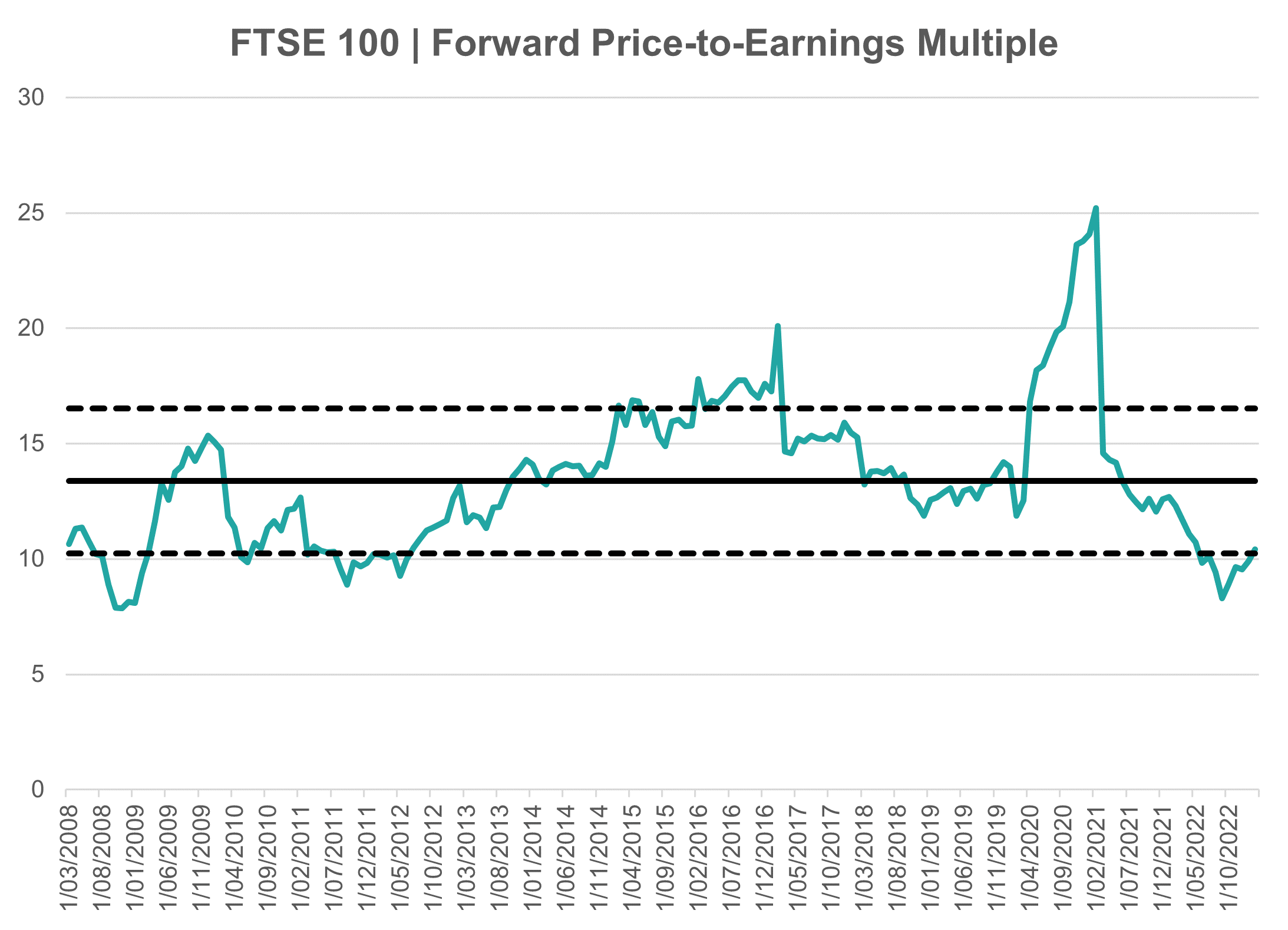

Another way to look at this is to consider the valuation of the index against its own history – after all, we just established the FTSE 100 has a very different sector composition to the S&P 500, so it may be reasonable that they trade at different multiples purely from a structural level.

In the above chart, the solid black line is the 15-year average of the FTSE 100’s P/E, and the two dotted lines are +1 / - 1 standard deviation respectively.

To consider something to be “cheap”, we’d like to see valuation around -1 standard deviation, an area that the FTSE 100 was indeed trading at when we first purchased and where it remains despite a solid increase in multiple (and subsequent rally in price) throughout last year.

Since an index’s valuation metrics tend to revert back to some long-term mean, buying an asset at cheap multiples offers investors a margin of safety (harder for a cheap index to lose valuation than an expensive index), and increases the odds of capital gain from expanding multiples.

Seeing the index trading at cheap multiples is not in itself a reason to buy – but it does offer a far better risk-adjusted return profile to investors, and in the context of early 2022, it was far more prudent for managers to be allocating client capital to indexes which were already pricing in risk (through low multiples) than to be buying tech-heavy indexes at double the P/E levels, such as the S&P 500.

Exposure to the Value Factor

Factor investing has a very important role to play in any multi-asset investment process. Every holding in an investor’s portfolio should have a purpose: this might be as a diversifier, as a well-researched alpha opportunity, or to gain exposure to a market factor that stands to benefit from the current environment.

Heading into 2022 (and incidentally, heading into 2023), uncertainty around markets and economic health meant that factors such as Value were better poised to outperform than Growth and even Quality – a factor that has historically served investors well but had become altogether far too expensive, and to an extent still is.

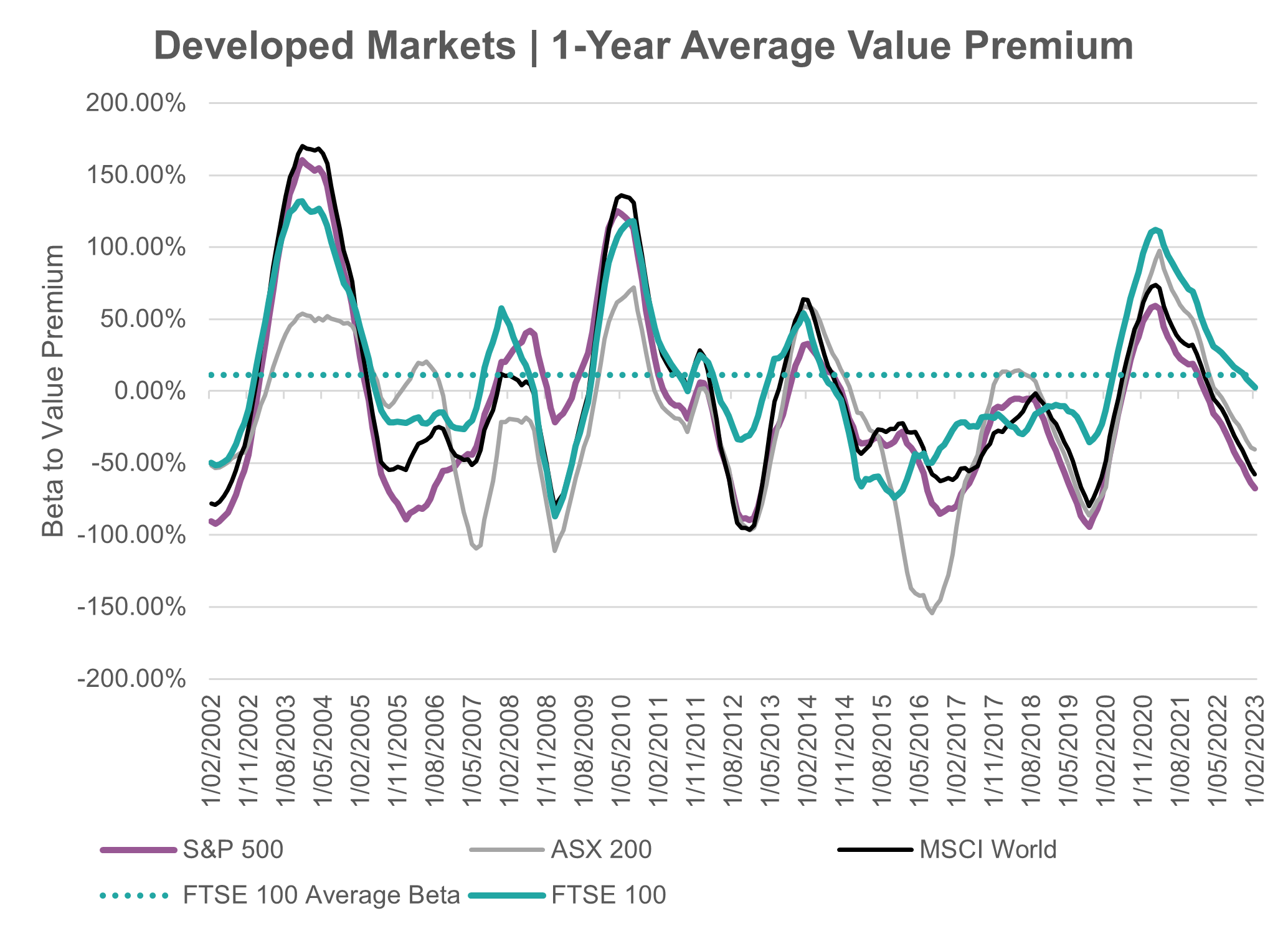

You can track and visualise the relationship that different indexes have to a global Value factor – this simply represents the difference between a global Value and global Growth index, where that difference represents the ‘value premium’ in the market.

Over a 15-year period, the FTSE 100 is the only index which has maintained a positive relationship (beta) to the global Value premium: this means that when Value as a factor is doing well, the FTSE 100 can reasonably be expected to perform as well. Since 2019 we can see that the beta to the Value premium has been higher than other developed market indexes, and is still positive even today, whilst other indexes are sharply negative.

Taking Stock

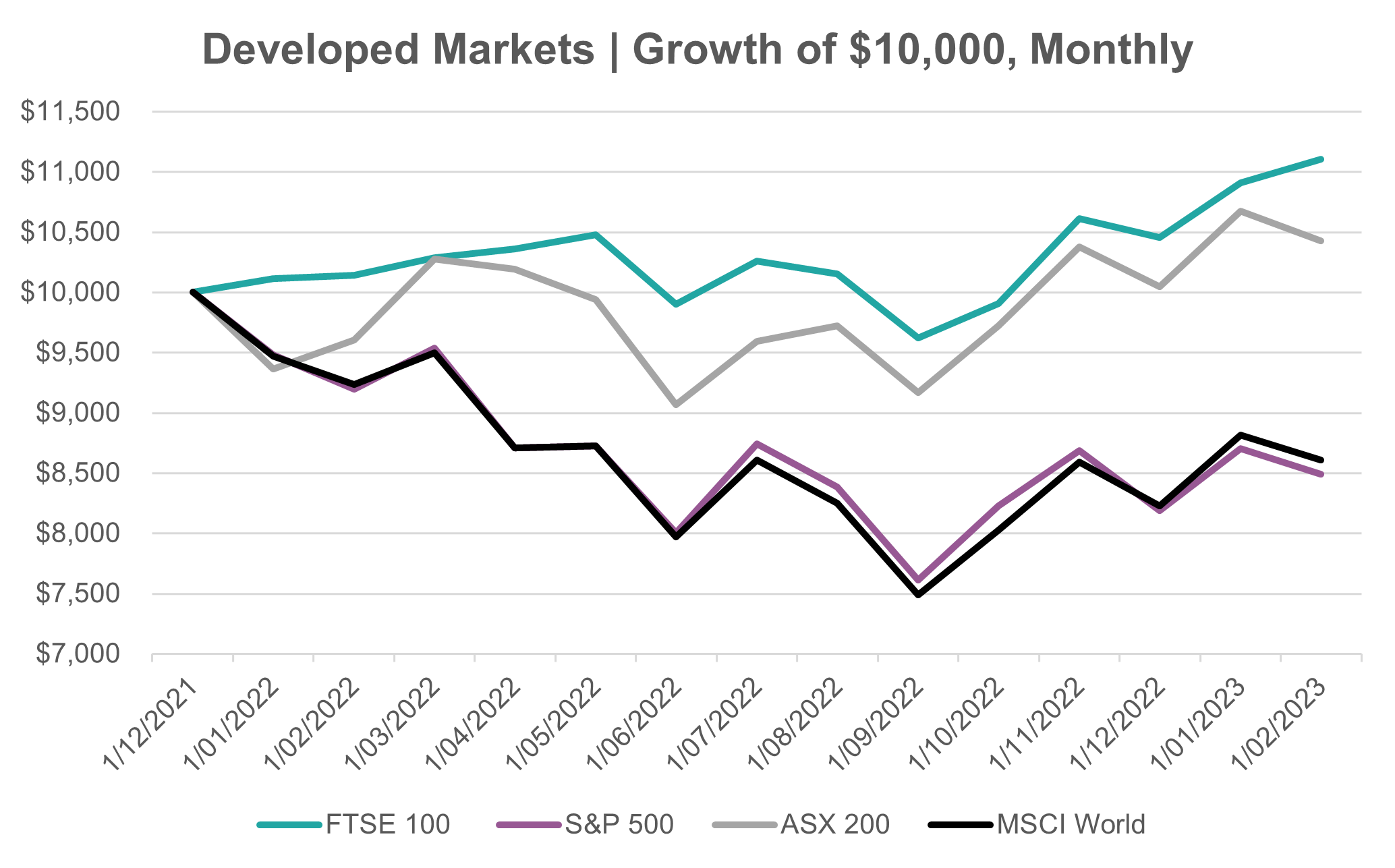

Since the start of 2022, what will likely become known as one of the most prolonged bear markets a new generation of investors has experienced to date, the FTSE 100 has been one of the best-performing investments any manager holding equity exposure could have held.

Over a 1-year period, indexes such as MSCI EM, MSCI ACWI, the S&P 500 and ASX Small Ordinaries are all still deeply negative, with some even double-digit negative in local currency terms.

The FTSE 100, on the other

hand, posted a 1-year return of 13.02% as of 10/03/2023. The chart below tells

the story since the start of 2022:

Whilst UK equities still certainly offer value, this is far more a lesson in prudent investigation, assessment of risk-adjusted return potential and recognising opportunities in areas which the broad market may not (yet) be looking at.

More investments like the FTSE 100 at the start of 2022 are doubtlessly waiting around the corner, and there’s a fair chance they’ll be screaming at investors to ‘be greedy’ when the crowd is too busy being fearful.

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

1 stock mentioned