The best places for income in the year ahead

The first half of 2022 has been challenging for investors across asset classes, and the uncertainties plaguing markets remain—particularly with regard to inflation, interest rates and the possibility of recession. As we look toward the second half of the year, our investment management teams gathered to discuss where income-seeking investors may find opportunities.

Casting a wide net for income

The financial landscape is changing dramatically. Inflation is at levels not seen in four decades, pandemic-driven supply and demand imbalances continue to batter global economies, and the Ukrainian war threatens geopolitical stability. Furthermore, central bank policymakers around the world—including the US Federal Reserve (Fed)—have taken a decidedly hawkish turn in their rhetoric and actions as they aim to dampen worrisome inflation. The Fed delivered a surprise 75 basis-point hike in June, and expectations of future rate increases have shifted up sharply, sparking worries about a potential recession.

The first half of 2022 has created another challenge as equities and fixed income have both shown similar downside volatility in lockstep with each other. Income-focused investors must be active and nimble against this shifting backdrop, casting a wider net as rising interest rates have led to a reduction in the principal value of fixed income and equities.

We believe the addition of alternative assets such as real estate and infrastructure to a portfolio can offer both a less correlated source of yield, while diversifying to better protect principal. If investors held any excess cash, this provided protection from the volatility of other assets and now provides liquidity to invest in income-producing assets at more attractive values and higher yields. It is a balance of accepting reasonable levels of risk to enhance the yield of their portfolios, while diversifying income sources to protect principal. Our independent investment managers have differing views on the best way to approach income investing in this environment.

Volatility provides opportunities for income investors

Ed Perks, manager of multi-asset income strategies, focuses on two challenges: the rise in interest rates and the broad based selloff across all assets. Ed thinks investors should be cognisant about diversifying their sources of income to manage for these risks.

This volatile environment has also uncovered opportunities.

One of these opportunities is in higher-quality fixed income securities, particularly those with longer duration or more exposure to interest-rate increases. The yields that investors can buy into now are significantly higher than they were just a few months ago.

Don’t reach for yield

Brian Giuliano from Brandywine Global offers a different view that although investors may be inclined to reach for yield to earn income, he thinks that’s a mistake. With little margin of safety relative to valuation and macro conditions, reaching for yield requires taking on too much risk.

Brian thinks opportunities exist in the corporate credit space with companies that have pricing power given the inflationary backdrop.

If market conditions continue to deteriorate, increasing exposure to high-quality government bonds would be wise and could offer return potential through appreciation if yields fall in reaction to a slowing economy, as well as a source of uncorrelated return relative to credit assets and equities.

Floating-rate loans can provide shelter from rising interest rates

Reema Agarwal from the Franklin Templeton Fixed Income team highlights that bank loans—also known as leveraged, floating-rate or senior secured loans—tend to act as a good hedge against rising interest rates given their higher nominal yields, lower duration and relatively lower volatility. Floating-rate loans do have credit risk.

In the current environment, loan selection remains critical and investors should focus on stable, income-generating, higher credit quality investments, rather than on more deeply discounted, lower credit quality loan issuers that may offer attractive yields, but also carry outsized credit risk amid uncertain macroeconomic conditions.

Dividend stocks and hybrids can be key sources of yield

Accepting some equity risk in the form of dividend-paying stocks may be attractive to enhance portfolio yield and protect against rising inflation. Michael Clarfeld from ClearBridge Investments and Matt Quinlan of Franklin Equity Group share their views on using effective dividend strategies to mitigate market volatility and hedge against inflation.

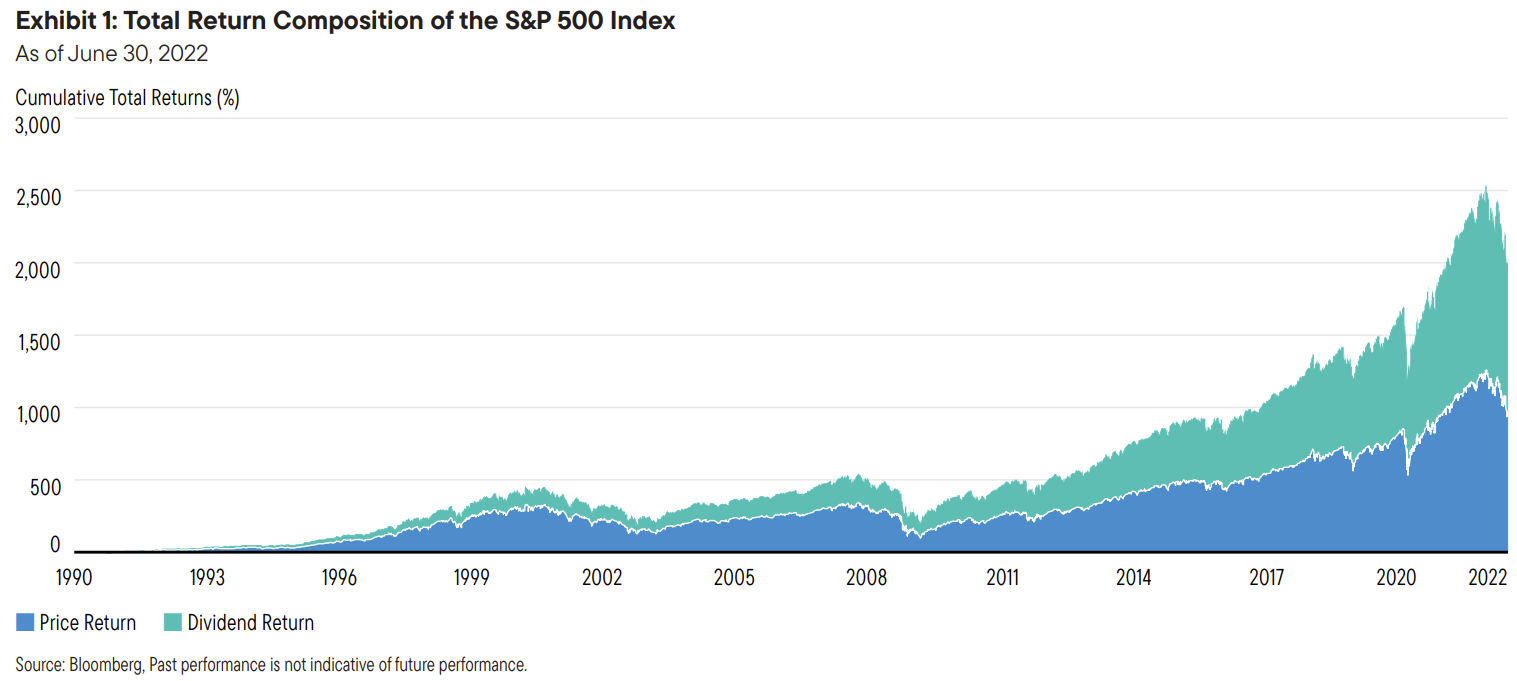

Of note, income gains from dividends that are reinvested are a significant contributor to total return over the long-term. Over the last 31 years, spanning January 1990 through June 2022, the compounding effect of reinvesting dividends accounted for close to 50% of the cumulative total return of the S&P 500 index (Exhibit 1).

There is also an opportunity to utilise the liquidity created by this income to re-allocate assets in volatile markets. This is an often-overlooked source of total return, as the income can be reinvested to optimise longer-term outcomes. In other words, when the market environment provides valuation opportunities due to temporary dislocations, dividends provide investors with additional capital to rebalance toward strategic asset allocations.

Dividends Can Drive Returns: Receipt and Reinvestment of Dividends Account for about 50% of Total Return Over the Long-term

Real estate as an inflation hedge

Some income investors may consider turning to traditionally private markets in search of yield. For example, commercial real estate (multi-family, industrial, office, retail, life sciences and warehousing) has become more accessible to retail investors as an instrument for portfolio diversification and income generation.

Moreover, commercial real estate has historically acted as a hedge against inflation.

As the team at Clarion Partners discusses, multi-family housing illustrates this as landlords generally can adjust rents more quickly (typically on an annual basis) during an economic expansion. For perspective, according to the CBRE, as of the fourth quarter last year, multi-family rents grew by 13.4% in 2021, much faster than US headline consumer price inflation of about 7.0% in the same year.

Infrastructure provides another option

Shane Hurst at ClearBridge reminds us that current income is important, but yield quality is also critical. As the economy re-thinks globalisation, it will need to invest in infrastructure, further supporting high visibility and predictability of earnings for assets such as toll roads, utilities and mid-stream energy infrastructure. These “user-pays” assets could benefit from continuing economic reopening and could dampen the effects of an otherwise slowing economy. There are idiosyncrasies that make this cycle unique and encourage differentiating between companies. We also expect the difference between real and nominal interest rates will require dynamic positioning, for example allocating between the United States and Europe.

Recognising income in all its forms

Ideally, being able to look at income opportunities across all asset classes widens the toolkit and should enhance diversification of income sources and improve portfolio yield. This is not a passive activity. We believe active management is key to continually uncover opportunities and build a resilient income portfolio.

Read our midyear outlook in full

This article is part of our midyear Global Investment Outlook. We hope it inspires you to think strategically as we navigate the rest of the year. If you would like to read the full paper, please visit our website.

1 topic

As Franklin Templeton’s Chief Market Strategist and Head of the Franklin Templeton Institute Stephen Dover leverages the knowledge of the firm’s autonomous investment teams to provide global capital market and long-term investment insights...

Expertise

As Franklin Templeton’s Chief Market Strategist and Head of the Franklin Templeton Institute Stephen Dover leverages the knowledge of the firm’s autonomous investment teams to provide global capital market and long-term investment insights...